Claiming HVAC tax credits in 2025 is one of the smartest ways to lower the cost of upgrading your heating and cooling system. With credits worth up to $2,000, it’s a chance to reduce your out-of-pocket expenses while making your home more energy-efficient.

But here’s the reality: many homeowners miss out on some or all of their savings because of avoidable mistakes. From forgetting IRS paperwork to buying equipment that doesn’t qualify, these slip-ups can cost you hundreds or even thousands.

In this guide, I’ll walk through the most common mistakes when claiming HVAC tax credits — and how you can avoid them.

📘 Need a full overview of this year’s incentives? Start here: 2025 HVAC Tax Credits & Rebates Explained.

Forgetting to File IRS Form 5695

The most common mistake I see is homeowners assuming tax credits are automatic. They’re not.

To claim your 2025 HVAC credit, you must complete IRS Form 5695 and file it with your tax return. This form is specifically for residential energy credits, including HVAC upgrades. Without it, you won’t receive the credit — no matter how efficient your system is.

You can download the form and instructions directly from the IRS Energy Efficient Home Improvement Credit page.

👉 Tip: Keep your invoices, model numbers, and AHRI certificate handy when filling out the form to avoid mistakes.

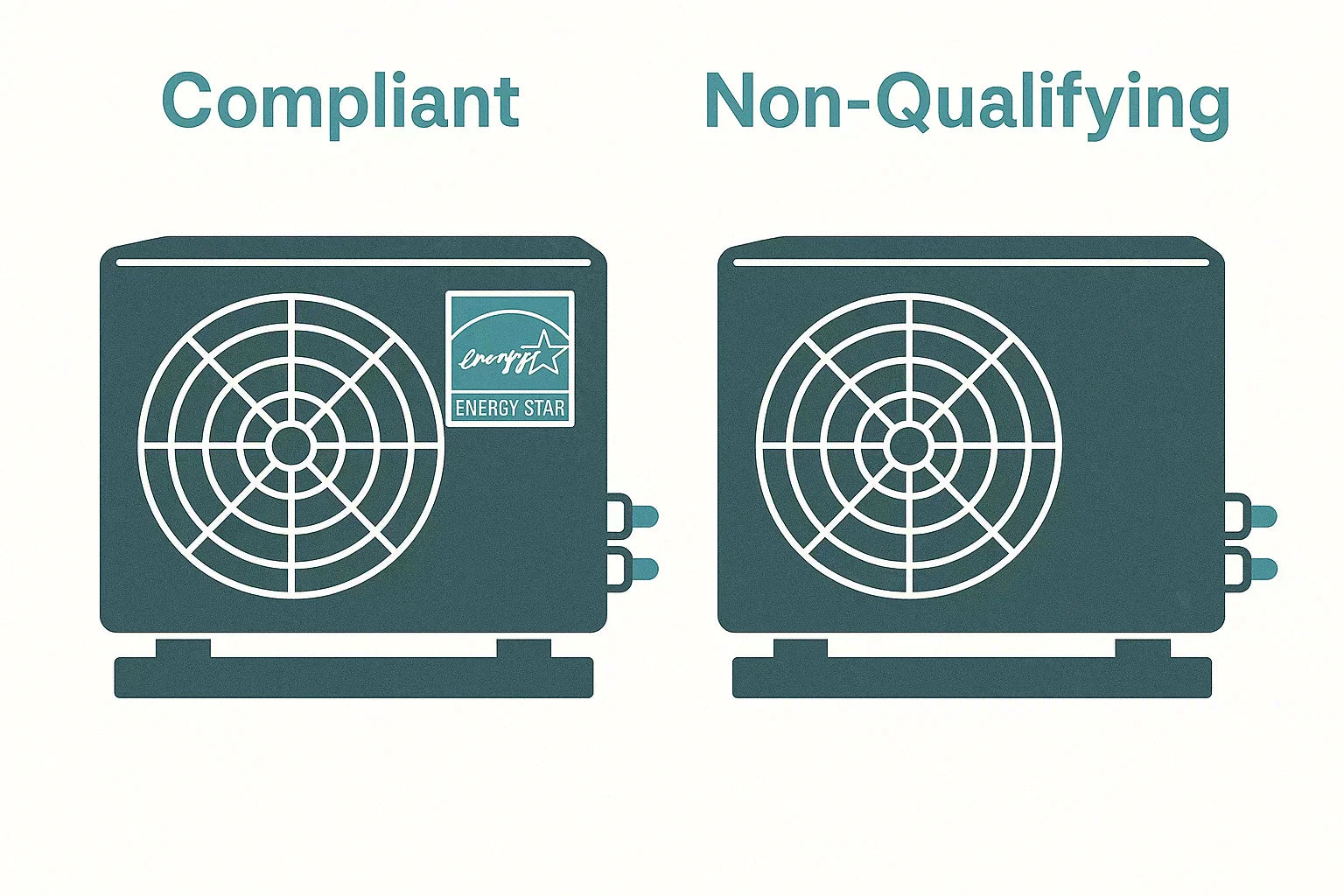

Buying Non-Qualifying Equipment

Not every “high-efficiency” system on the market qualifies for federal tax credits. To be eligible, your equipment must meet specific efficiency standards such as SEER2, AFUE, or ENERGY STAR® certification.

For example:

-

A central AC must be ENERGY STAR certified and meet minimum SEER2 efficiency.

-

A furnace must have an AFUE of at least 97% in some regions.

-

A heat pump must be ENERGY STAR certified and meet SEER2 and HSPF2 requirements.

To double-check, search the AHRI Directory or review the official ENERGY STAR federal tax credits page. These resources confirm whether your system qualifies before you buy.

Missing or Incomplete Documentation

The IRS doesn’t take your word for it — you need paperwork to back up your claim. Missing or incomplete documentation is another major reason credits get denied.

Make sure you have:

-

Itemized Invoice with installation date, cost, and model numbers.

-

AHRI Certificate showing efficiency ratings.

-

ENERGY STAR certification, if applicable.

-

Contractor details (license number, company name).

The best approach is to ask your HVAC installer for a “tax credit packet.” Many contractors prepare these for homeowners to simplify the filing process.

Confusing Rebates with Tax Credits

Another common mistake is assuming rebates and tax credits are the same thing. They’re not — and confusing the two can cause you to miss out.

-

Rebates: Offered by utilities or state programs, typically cash back or discounts soon after installation.

-

Tax Credits: Federal incentives claimed on your IRS tax return.

The good news is you can claim both, but they require different applications. For rebates, you’ll usually apply through your utility and submit paperwork within 30–90 days. For tax credits, you’ll file Form 5695 at tax time.

For a database of state and local rebates, visit the DSIRE incentives directory.

Waiting Too Long to Plan

Tax credits only apply to systems installed in the current tax year. If you wait until December to start shopping, you may not be able to schedule installation in time to qualify.

HVAC contractors get booked up fast — especially toward the end of the year when many homeowners rush to install before the deadline.

The U.S. Department of Energy’s Energy Saver site recommends planning upgrades early to make sure you don’t miss out.

Assuming Income Limits Apply

Here’s a myth that trips up homeowners: “I make too much to qualify.”

Unlike rebates, which sometimes have income-based tiers, federal HVAC tax credits are not income-restricted. Whether your household income is $40,000 or $400,000, you can still claim the credit as long as your system qualifies and you file correctly.

This is especially important for higher-income households who may be used to being excluded from state or utility incentives. Don’t assume you’re left out — the tax credit is available to all.

Example: How Mistakes Cost Homeowners

Let’s say a homeowner installs a $12,000 heat pump in 2025. Done right, they should receive:

-

$2,000 federal tax credit

-

$1,200 utility rebate

-

Total savings: $3,200

But if they buy a non-qualifying system and forget to file Form 5695, they’ll miss out on the $2,000 credit entirely. That’s a painful mistake that better planning could have prevented.

The Bottom Line

Most mistakes when claiming HVAC tax credits come down to poor planning or missing paperwork. The good news is, they’re easy to avoid.

-

File IRS Form 5695 with your return.

-

Confirm your system qualifies using the AHRI or ENERGY STAR databases.

-

Keep organized documentation.

-

Don’t confuse rebates with credits — claim both.

-

Plan ahead so your installation happens in the tax year.

-

Remember: tax credits are not income-limited.

By taking these steps, you can claim your full savings without stress and maximize the return on your HVAC investment.

📘 Next up: How to Plan Your HVAC Upgrades for Maximum Tax Credit Benefits.

Alex Lane

Your Home Comfort Advocate