If you’re planning HVAC upgrades in 2025, the timing and strategy matter just as much as the equipment you buy. Federal tax credits can save you up to $2,000 per year, but many homeowners leave money on the table because they don’t plan ahead.

The truth is, HVAC tax credits aren’t one-size-fits-all. They come with annual limits, qualifying requirements, and paperwork that can make or break your savings. With a little preparation, you can stretch those credits further — and when combined with rebates, you could cut 30–50% off your installation costs.

📘 New to incentives? Start with our full guide: 2025 HVAC Tax Credits & Rebates Explained.

Know the Tax Credit Limits for 2025

The Energy Efficient Home Improvement Credit (part of the Inflation Reduction Act) is the foundation for today’s HVAC tax savings. Here are the highlights for 2025:

-

Heat Pumps: Up to $2,000 credit

-

Central Air Conditioners: Up to $600 credit

-

Gas Furnaces or Boilers: Up to $600 credit (must be ENERGY STAR® certified)

-

Home Energy Audits: Up to $150 credit

Keep in mind that credits have annual caps. That means you can’t claim $2,000 for two different heat pumps in the same year. However, credits reset every year — which makes planning upgrades across multiple years a smart strategy.

👉 Reference: Check official details on the IRS Energy Efficient Home Improvement Credit page.

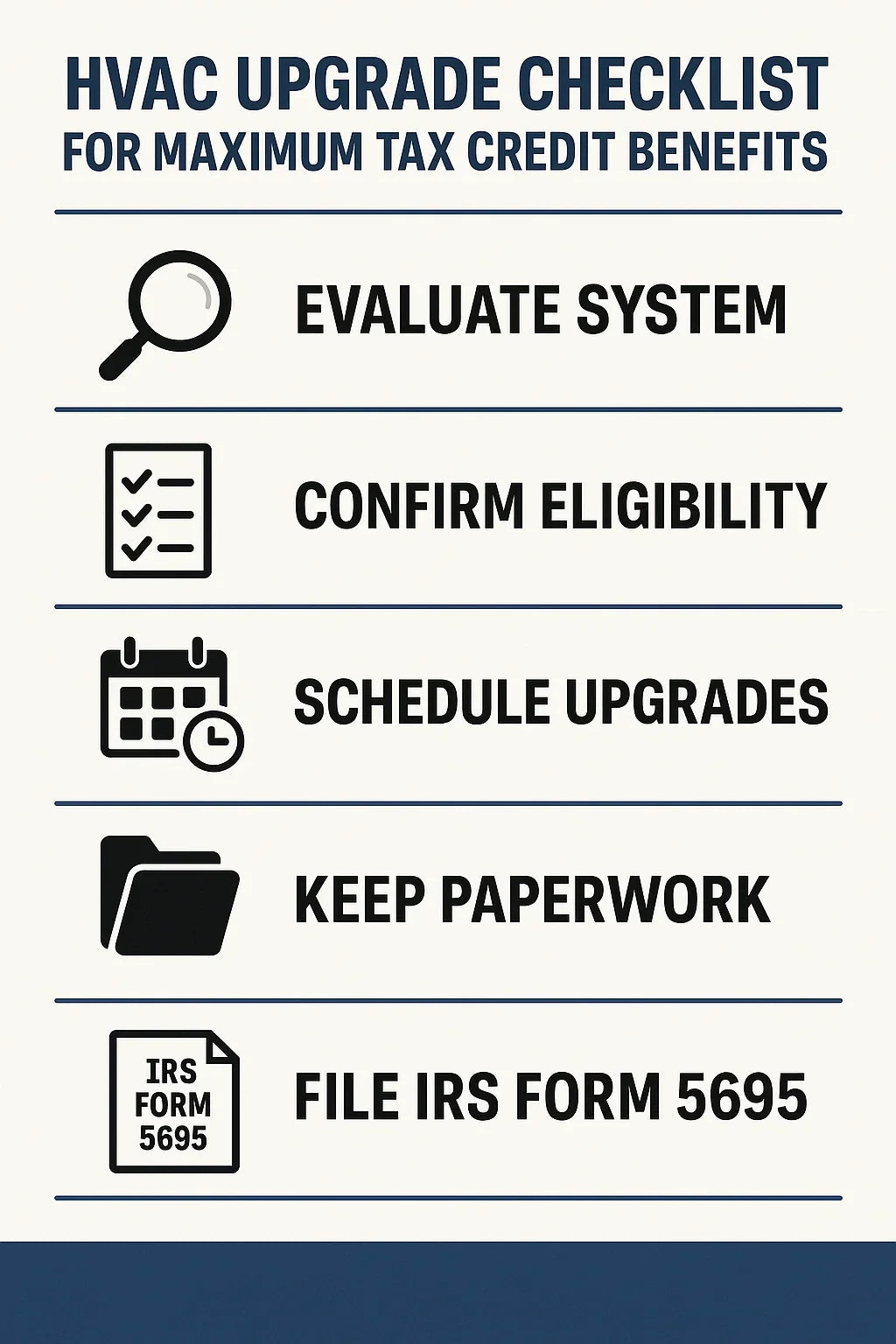

Step 1 – Evaluate Your Current System

Before scheduling any upgrades, take stock of what you have.

-

Age: Most systems last 10–15 years. If yours is older, you’re in the sweet spot for replacement.

-

Efficiency: Look for SEER2 or AFUE ratings. Older systems may be far below today’s standards.

-

Performance: Frequent repairs, uneven comfort, or high bills are red flags.

This evaluation doesn’t have to be guesswork. A professional home energy audit (which itself qualifies for a $150 tax credit) can identify which upgrades deliver the most savings.

👉 Resource: The U.S. Department of Energy’s Energy Saver site provides a helpful overview of audits and efficiency evaluations.

Step 2 – Prioritize the Biggest Credits First

Not all HVAC tax credits are equal. To maximize your return:

-

Start with heat pumps: They qualify for the largest credit ($2,000) and also unlock utility rebates.

-

Follow with furnaces or ACs: Smaller credits ($600), but worth it if your system is aging.

-

Include an audit: That $150 credit helps offset the cost of professional guidance.

If you’re planning multiple upgrades, focus on the highest-value credit first. This ensures you hit the maximum allowed savings in 2025.

Step 3 – Time Your Projects Across Multiple Years

One of the most overlooked strategies is phasing upgrades across different tax years. Because credits reset annually, spreading improvements out can significantly boost your total benefit.

Example Timeline

-

2025: Install a qualifying heat pump ($2,000 credit).

-

2026: Add attic insulation or high-efficiency windows (credits up to $1,200).

-

2027: Replace an aging central AC ($600 credit).

By spacing upgrades, you maximize credits each year instead of hitting the cap in a single year.

Step 4 – Combine Credits with Rebates

Rebates and tax credits are stackable, and combining them is one of the most powerful ways to save.

-

Example: A qualifying heat pump might earn you a $2,000 federal tax credit plus a $1,500 rebate from your utility.

-

That’s $3,500 in savings on one project.

To find rebate programs near you, search the ENERGY STAR rebate finder or the DSIRE database of state incentives.

Remember: rebates usually require paperwork within 30–90 days of installation, while tax credits are filed at tax time. Keep those timelines straight so you don’t miss either.

Step 5 – Keep Documentation Organized

Even if your upgrade qualifies, you can lose your credit if you don’t provide proof. Always keep:

-

Itemized invoice with installation date, cost, and model numbers.

-

AHRI Certificate confirming efficiency ratings (check the AHRI Directory if you need a copy).

-

ENERGY STAR certification, if applicable.

-

Contractor details including license information.

Keeping both digital and paper copies will make tax filing smooth and stress-free.

Common Planning Mistakes to Avoid

Even with the best intentions, many homeowners miss out on savings because of preventable mistakes. Watch out for these:

-

Waiting until year-end to start shopping — contractors book up, and you risk missing installation deadlines.

-

Assuming one upgrade per home qualifies — credits reset annually, so multiple projects can each qualify if spread across years.

-

Buying “efficient” equipment that doesn’t meet tax credit standards — always verify SEER2, AFUE, or ENERGY STAR requirements before purchase.

-

Mixing up rebates and credits — they’re separate processes, and missing paperwork can cause delays.

The Bottom Line

Planning your HVAC upgrades strategically is the key to maximizing tax credit savings. By prioritizing high-value projects, spacing upgrades across years, stacking rebates, and keeping documentation organized, you can dramatically reduce your installation costs in 2025 and beyond.

Remember: tax credits reset every year. With the right plan, you can unlock thousands of dollars in savings, while keeping your home comfortable and energy-efficient.

📘 Next up: Do Smart Thermostats Qualify for Rebates or Tax Credits in 2025?

Alex Lane

Your Home Comfort Advocate