Maximize Your Savings on Heating and Cooling Upgrades

If you’ve been putting off that HVAC upgrade, 2025 might just be the year to pull the trigger. Thanks to expanded tax credits, new federal rebate programs, and generous state and utility incentives, homeowners have more ways than ever to save big on energy-efficient heating and cooling systems.

As someone who’s worked in the field and now helps homeowners navigate their options, I’m here to break it all down—no jargon, just real-world tips on how to get money back in your pocket.

Why 2025 Is a Big Year for HVAC Incentives

Between the Inflation Reduction Act (IRA) and a growing push for home electrification, there’s a wave of funding aimed at helping Americans cut energy costs and reduce carbon emissions.

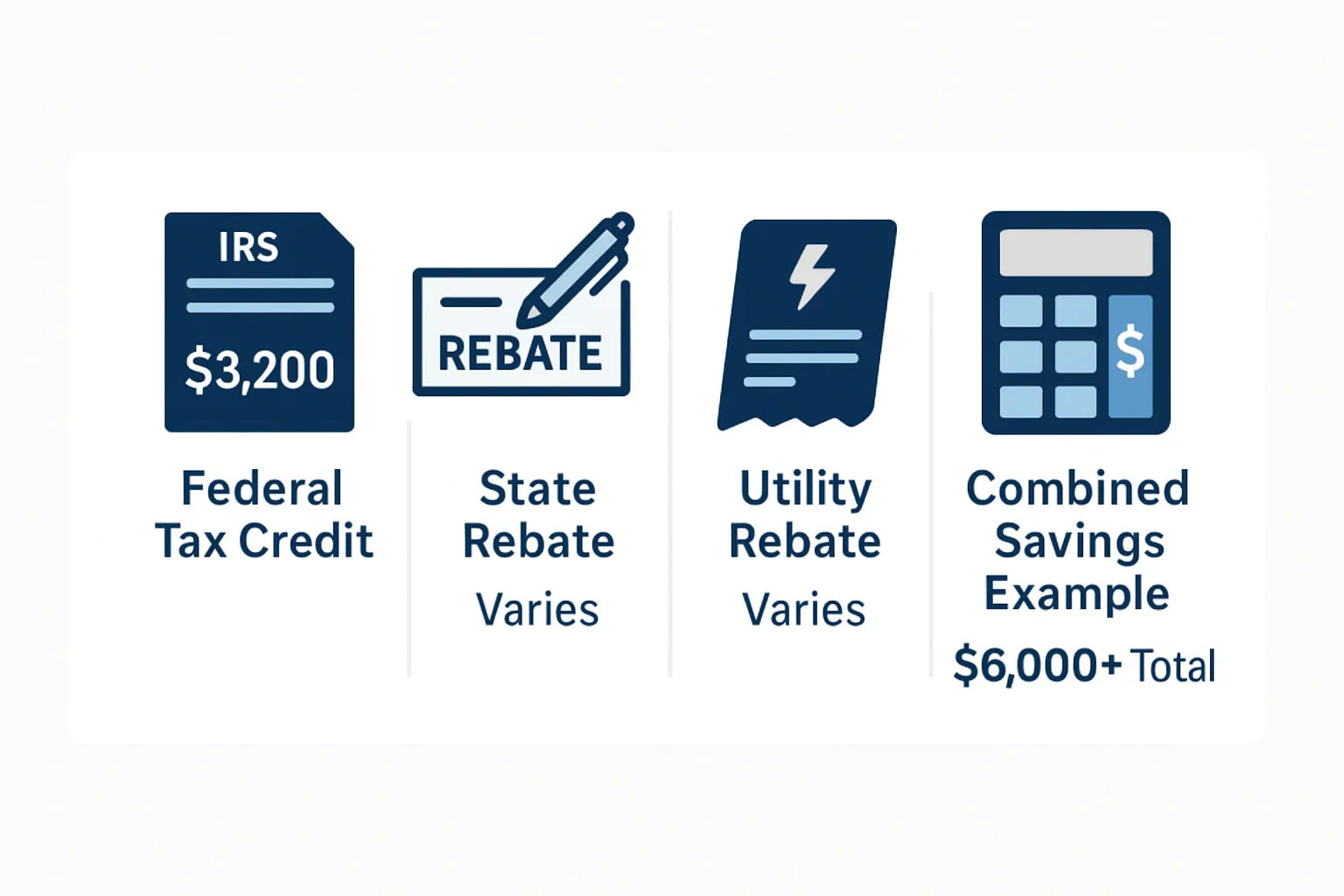

Here’s what’s on the table this year:

-

Federal tax credits up to $3,200 per household for qualifying upgrades

-

Rebates up to $14,000 through state-administered IRA programs

-

Local utility and manufacturer rebates that stack on top of federal savings

According to Energy Star, these incentives can dramatically reduce the upfront cost of replacing an old furnace, AC, or heat pump.

And if you want a quick idea of how much you could personally save, check out the IRA Savings Calculator by Rewiring America.

What HVAC Equipment Qualifies for 2025 Tax Credits

To qualify for 2025 tax credits, your system needs to meet specific efficiency standards—usually those set by ENERGY STAR® or the Consortium for Energy Efficiency (CEE). It must also be installed at your primary residence and placed in service during the 2025 tax year.

Eligible HVAC Upgrades:

-

Heat Pumps (air-source or geothermal) with high SEER2/HSPF2 ratings

-

Central Air Conditioners that meet ENERGY STAR Most Efficient criteria

-

Gas Furnaces with AFUE ≥ 97%

-

Boilers with AFUE ≥ 95%

-

Smart Thermostats (partial credits)

➡️ Want to explore qualifying equipment? Browse our R32 AC and Gas Furnaces collection to see models that meet the 2025 efficiency thresholds and are eligible for rebates or credits.

Make sure your contractor provides an AHRI certificate with your installation—that’s your official proof that the system meets federal efficiency standards.

Federal Tax Credits vs. HVAC Rebates: What’s the Difference?

Understanding the terminology can save you from leaving money on the table.

Federal Tax Credits

-

Available through 2032 (under the Energy Efficient Home Improvement Credit, Section 25C)

-

Cover up to 30% of qualified HVAC costs, capped at $3,200/year

-

Claimed via IRS Form 5695 when you file your tax return

IRA Home Rebates

-

Focused on low- to moderate-income households

-

Up to $8,000 for heat pumps under the High-Efficiency Electric Home Rebate Program

-

Rolled out state-by-state, starting in 2024 and expanding in 2025

📌 Check your state’s status at DSIRE

Utility & Manufacturer Rebates

-

Offered locally and vary by ZIP code

-

Often stackable with federal incentives

-

Require receipts, serial numbers, and installer info

Pro tip: Use the ENERGY.gov Home Energy Rebates hub to track both national and state-specific programs.

How Much Can You Really Save in 2025?

Here’s a sample breakdown of a heat pump upgrade:

| Item | Cost | Credit / Rebate | Net Cost |

|---|---|---|---|

| ENERGY STAR® Heat Pump | ₱350,000 | ₱50,000 (Tax Credit) + ₱40,000 (Utility Rebate) | ₱260,000 |

💡 Add in lower monthly energy bills, and your ROI starts to climb fast—especially in colder climates where high-efficiency systems shine.

Try the York Energy Savings Calculator to estimate long-term energy savings for your specific zip code and system type.

Avoid These Common Mistakes

A surprising number of homeowners miss out on savings due to small errors. Here’s what to watch out for:

🔴 Installed the wrong model

Even a small efficiency difference can disqualify your system. Always double-check eligibility against the current CEE directory.

🔴 Didn’t get documentation

Make sure your contractor gives you:

-

Model and serial number

-

AHRI certificate

-

Copy of itemized invoice

🔴 Missed the tax deadline

Tax credits must be claimed in the year the system is installed. Don’t wait until 2026 to gather paperwork.

Why Professional Installation Matters

Most rebate programs require the HVAC system to be:

-

Installed by a licensed contractor

-

Properly permitted

-

Compliant with local energy codes

Beyond that, a professional install ensures your unit runs at its rated efficiency. Poor installation can slash efficiency by 30% or more—even if the system itself is top-tier.

Plus, warranty claims and rebate audits are much smoother when everything is done by the book.

💬 Final Thoughts from Alex Lane

There’s never been a better time to invest in a high-efficiency HVAC system.

Between tax credits, rebates, and long-term energy savings, you could see thousands back in your pocket—but only if you choose the right equipment and file the right way.

If you're upgrading soon, work with a trusted HVAC pro, ask about rebate-eligible models, and start your paperwork early. You’ll thank yourself come tax season.

Alex Lane

Your Home Comfort Advocate