Looking to cash in on 2025’s federal HVAC tax credits? You’re not alone—and you’re smart to double-check what actually qualifies. These programs can put thousands back in your pocket, but only if you meet the right criteria.

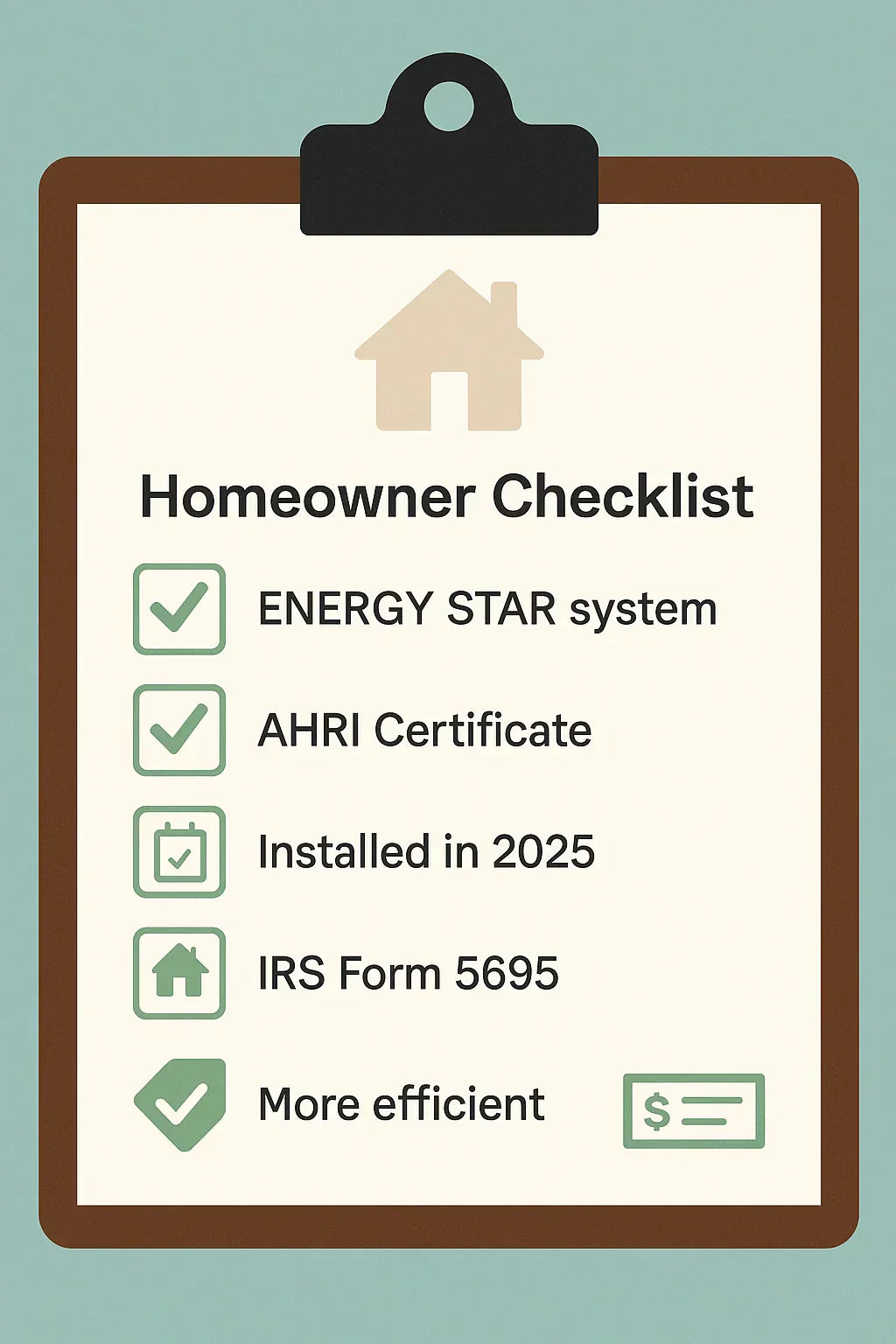

As someone who’s seen both the fieldwork and the fine print, I can tell you: small mistakes can cost you big savings. That’s why I put together this homeowner-friendly checklist. If you follow this step-by-step guide, you’ll know exactly what qualifies—and what to avoid.

Why This Checklist Matters

It’s tempting to assume that any new HVAC system will qualify for tax credits. But the IRS doesn’t hand out refunds just for buying something "energy-efficient." You need:

-

The right equipment

-

The right paperwork

-

The right timing

A recent ENERGY STAR report showed that thousands of homeowners were denied credits simply because their systems didn’t meet federal specs—or they failed to submit the right documents.

That’s where this checklist comes in.

📎 Need a deeper dive on rebates and incentives? Check out the full guide:

👉 2025 HVAC Tax Credits & Rebates Explained

✅ Step 1: Confirm Eligible HVAC Equipment

Let’s start with the heart of the matter—does your system qualify? In 2025, the Energy Efficient Home Improvement Credit (Section 25C) offers up to $3,200 in annual tax credits, but only for certain types of HVAC systems.

Qualifying Systems Include:

| System Type | Requirements |

|---|---|

| Heat Pumps | SEER2 ≥ 16 / HSPF2 ≥ 9 / ENERGY STAR Certified |

| Central Air Conditioners | SEER2 ≥ 16 / CEE Tier 1 or higher |

| Gas Furnaces | AFUE ≥ 97% |

| Boilers | AFUE ≥ 95% |

| Smart Thermostats | Partial credit (up to $150) |

These standards align with both ENERGY STAR requirements and the CEE efficiency tiers.

Pro Tip: If your equipment doesn’t show up on the AHRI directory, it doesn’t qualify—no exceptions.

✅ Step 2: Gather the Required Documentation

Buying the right system is only half the battle. To claim your 2025 tax credit, you’ll need to prove that it meets the standards—and that starts with your paperwork.

Required Documents:

-

✅ AHRI Certificate of Product Rating

Use the AHRI Directory to search your unit by model number. -

✅ Itemized Invoice

Should include installation date, system type, efficiency ratings, and installer details. -

✅ IRS Form 5695

This is how you claim the credit on your tax return. Find the latest version here. -

✅ Model & Serial Numbers

Write them down before installation. You’ll need them for warranty and rebate claims too.

✅ Step 3: Make Sure It’s Professionally Installed (and on Time)

Even if you choose the right equipment, bad installation can disqualify your claim.

What the IRS expects:

-

Installed at your primary U.S. residence

-

Operational by December 31, 2025

-

Installed by a licensed HVAC professional

-

Permitted and inspected if required by local codes

Remember: credits are only valid in the year the system is installed. If your install slides into 2026, you’ll need to wait another year—or worse, miss out if limits change.

🚫 What Can Disqualify You?

Here are some of the most common mistakes I’ve seen homeowners make:

| Mistake | Why It Disqualifies You |

|---|---|

| ❌ Buying a non-ENERGY STAR system | Doesn’t meet federal criteria |

| ❌ Missing AHRI Certificate | No proof of efficiency |

| ❌ DIY installation | No professional sign-off |

| ❌ Installing too late | Tax credit only applies to 2025 |

Double-check with your contractor and ask for documentation up front. If they can’t provide it, that’s a red flag.

✅ Ask These Questions Before You Commit

Before you sign on the dotted line, run these questions past your contractor or equipment supplier:

-

“Is this system listed in the AHRI database?”

-

“Can I see the AHRI certificate in advance?”

-

“Will this meet the 2025 federal tax credit thresholds?”

-

“Can I stack this with utility or manufacturer rebates?”

-

“Will I get a fully itemized invoice?”

A reputable installer will have no issue answering these. In fact, many already include tax-credit info in their sales process.

Final Thoughts from Alex Lane

Getting a tax credit shouldn’t feel like solving a puzzle—but the reality is, a little homework goes a long way.

If you use this checklist and stay on top of your documentation, you’ll have a much smoother path to claiming what you’re owed. Plus, you’ll have peace of mind knowing your HVAC system is efficient, compliant, and ready for the long haul.

📌 Up next: If you’re considering a heat pump, you’ll want to see what rebates are available.

👉 Heat Pump Rebates in 2025: How Much Can You Get Back?

Until then, keep this checklist handy—and don’t hesitate to ask your HVAC pro the tough questions. You’re the one writing the check, after all.

Alex Lane

Your Home Comfort Advocate