If you’re thinking about installing a heat pump in 2025, here’s some good news: you could get thousands back in rebates—and that’s on top of tax credits. Between federal programs, state incentives, and local utility rebates, homeowners have more opportunities than ever to lower the cost of a high-efficiency HVAC upgrade.

But how much can you really get back? And what hoops do you need to jump through to qualify? I’m breaking it all down for you here—clearly, simply, and with real numbers.

Why Heat Pumps Are Getting Big Rebates in 2025

Heat pumps are leading the charge when it comes to efficient, all-electric heating and cooling. They’re not just more energy efficient—they’re also key players in federal climate goals.

Here’s why rebates are bigger than ever this year:

-

The Inflation Reduction Act (IRA) created massive funding pools for high-efficiency upgrades.

-

Heat pumps are recognized by ENERGY STAR® as one of the most effective tools to reduce home emissions.

-

Utilities benefit from load-balancing and reduced fossil fuel reliance when more homes go electric.

Rewiring America estimates that heat pump rebates under the IRA could be worth $8,000 or more per household, depending on income.

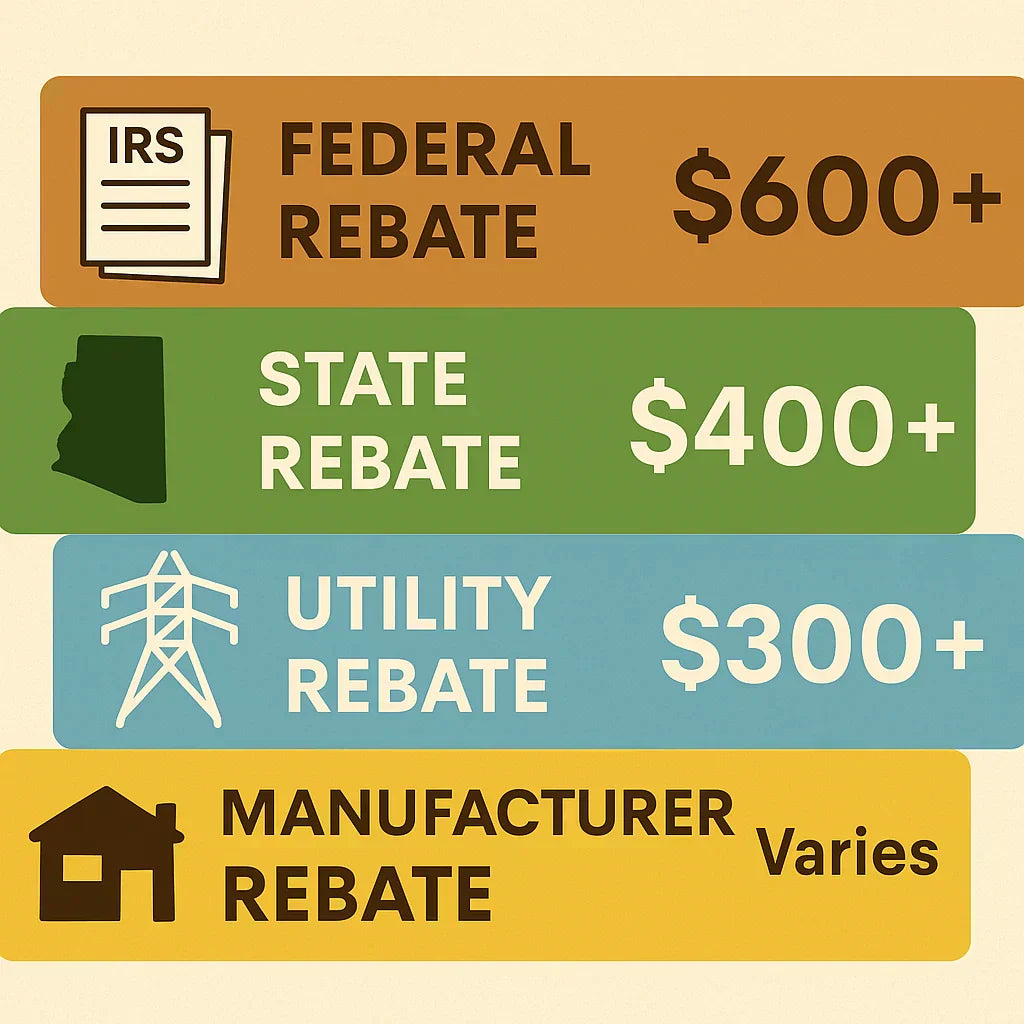

Types of Heat Pump Rebates Available in 2025

Not all rebates are created equal. Here’s a breakdown of the three major categories you should know about.

1. Federal Rebates – High-Efficiency Electric Home Rebate Act (HEEHRA)

This federal program is income-based and offers rebates up to:

-

$8,000 for eligible air-source heat pumps

-

$1,750 for heat pump water heaters

-

$4,000–$14,000 total per household (depending on upgrades)

📌 To qualify, your household income must be less than 150% of your area median income. You can check your status using the Rewiring America IRA Calculator.

To be eligible:

-

Your heat pump must be ENERGY STAR® certified

-

It must meet minimum SEER2 and HSPF2 ratings

-

It must be installed by a licensed contractor and meet local code

2. State-Level Heat Pump Rebates

Each state administers its own version of the IRA funding. Some already have robust programs in place, while others are rolling them out in 2025.

Examples:

-

California: Offers up to $3,000 through the TECH Clean California program

-

New York: The NYS Clean Heat Program provides up to $10,000 in total incentives

-

Massachusetts: Up to $10,000 through Mass Save

Eligibility and amounts vary by:

-

Your ZIP code

-

Your household income

-

The efficiency rating of your system

👉 Check your state’s programs on the DSIRE database, which lists updated incentives by location.

3. Utility and Manufacturer Rebates

These are often the most overlooked rebates—but they’re usually the easiest to claim.

-

Most utilities offer rebates from $300 to $2,000+ for qualifying heat pumps.

-

Some manufacturers (like Lennox, Carrier, and Mitsubishi) offer seasonal promotions or mail-in rebates.

-

To qualify, you typically need:

-

A licensed HVAC pro to install the unit

-

The rebate form submitted within 30–90 days

-

A copy of your itemized invoice and AHRI certificate

-

Don’t leave these on the table. Ask your installer to look up what’s available in your area or check your local utility’s rebate portal.

Sample Savings Breakdown (Real-World 2025 Scenario)

Let’s say you're a moderate-income homeowner in Pennsylvania replacing your old furnace with a ducted heat pump system:

| Rebate Source | Amount | Notes |

|---|---|---|

| Federal HEEHRA | $8,000 | Covers up to 100% of equipment cost |

| State Program (PA) | $1,000 | Through local clean energy fund |

| Utility Rebate | $1,200 | From your electric provider |

| Total Savings | $10,200 | Often paired with tax credit too |

💡 Use tools like the York Energy Savings Calculator to estimate your long-term return after factoring in rebates and lower energy bills.

Eligibility Checklist for Heat Pump Rebates

Before you start shopping or hiring, make sure you meet these common requirements:

-

✅ Installed in 2025

-

✅ Primary residence only

-

✅ Must meet ENERGY STAR and minimum SEER2/HSPF2 standards

-

✅ Installed by a licensed HVAC contractor

-

✅ Submit required documentation (invoice, AHRI cert, rebate forms)

Need help checking which models qualify? Start with the AHRI Directory and verify efficiency ratings through your installer.

How to Stack Rebates the Smart Way

Maximizing your rebates takes planning. Here’s how to line everything up:

H4: 1. Choose a Qualifying System First

Don’t assume it qualifies—verify the AHRI certificate and SEER2 rating before purchasing.

H4: 2. Work with a Certified Installer

Many rebate programs require contractors to be registered with the program (especially for state or utility rebates).

H4: 3. Keep All Documentation

-

Installation contract

-

Itemized invoice

-

AHRI certificate

-

Serial/model numbers

-

Rebate forms (utility/state/federal)

H4: 4. Apply in Order

-

Utility rebate (usually has the shortest deadline)

-

State-level rebate

-

Federal program if eligible

If you're also claiming a federal tax credit under Section 25C, check out the full breakdown:

👉 2025 HVAC Tax Credits & Rebates Explained

💬 Final Thoughts from Alex Lane

n 2025, heat pumps aren’t just a smart energy upgrade—they’re a golden ticket to serious savings.

If you meet the income qualifications for HEEHRA and live in a state with strong incentives, you could see over $10,000 in combined rebates and credits. Even if you don’t qualify for every program, utility and manufacturer rebates alone can still take a big bite out of your upfront cost.

Just remember:

-

✅ Do your homework before buying

-

✅ Get every document in writing

-

✅ Apply early—funding is limited and can run out mid-year

📌 Next up: Want to see what your state offers? Check out our next guide:

👉 State-by-State Guide to HVAC Rebates in 2025

Alex Lane

Your Home Comfort Advocate