Smart thermostats are one of the simplest upgrades homeowners can make to cut energy use. They learn your habits, adjust to your schedule, and even connect with your phone to make sure your system only runs when it needs to. It’s no surprise they’ve become a top choice for anyone looking to save money on heating and cooling.

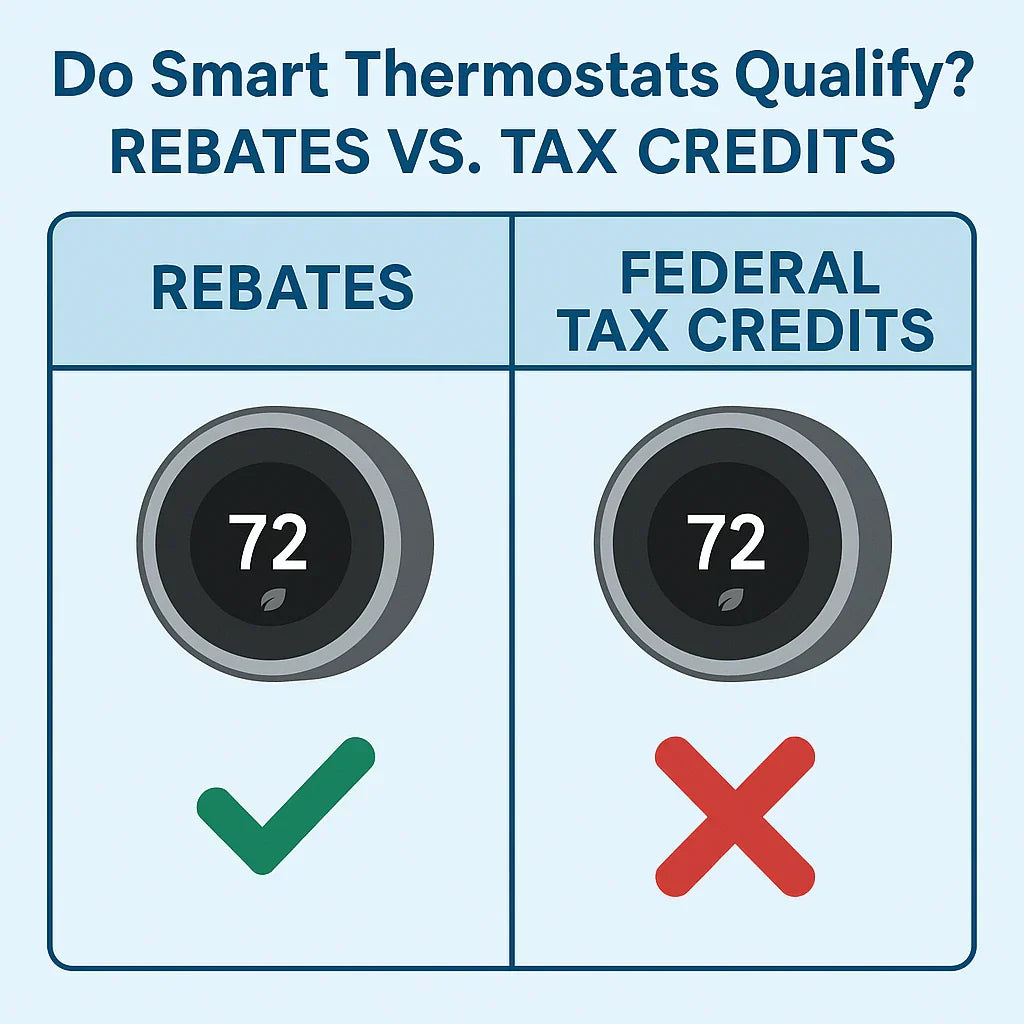

But if you’re planning HVAC upgrades in 2025, you may be wondering: Do smart thermostats qualify for rebates or federal tax credits? The short answer: they do qualify for many utility rebates, but not for federal tax credits.

That doesn’t mean they aren’t worth it. In this guide, I’ll break down where smart thermostats fit into today’s incentive programs, how much you can save, and why they’re still a smart investment for your home.

📘 Want the bigger picture on incentives? Start here: 2025 HVAC Tax Credits & Rebates Explained.

Federal Tax Credits and Smart Thermostats

As of 2025, smart thermostats do not qualify for federal HVAC tax credits. The Energy Efficient Home Improvement Credit focuses on larger projects like:

-

Heat pumps (up to $2,000 credit)

-

Central air conditioners and furnaces (up to $600 each)

-

Insulation, windows, doors, and home energy audits

While thermostats improve efficiency, the IRS has not included them in the list of covered improvements. If you’re looking strictly at federal credits, you’ll want to focus on high-efficiency HVAC equipment.

👉 Reference: See the official details on the IRS Energy Efficient Home Improvement Credit.

Utility Rebates for Smart Thermostats

Where smart thermostats shine is through utility rebate programs.

Many utilities partner with ENERGY STAR® to offer cash rebates for installing certified smart thermostats. These typically range from $25 to $100, though some utilities even provide them for free or at deep discounts when you enroll in a demand-response program.

Examples:

-

California utilities: $50–$100 rebates for ENERGY STAR models.

-

Northeast utilities: Rebates plus optional bill credits for participating in energy savings events.

-

Midwest utilities: Discounts when purchased through utility marketplaces.

You can quickly check available programs in your area using the ENERGY STAR Smart Thermostat Rebate Finder or the broader ENERGY STAR Rebate Finder.

State-Level Programs in 2025

Some state-run efficiency programs also include smart thermostat incentives. These often come through energy efficiency portfolios funded by public utilities.

-

California, New York, and Massachusetts: Widely support smart thermostat rebates.

-

Texas and Midwest states: Focus on utility-specific rebate offers.

-

Other states: May combine rebates with broader energy savings programs.

For state-by-state details, the DSIRE database is the most reliable source.

How Smart Thermostats Save Money Without Credits

Even without federal tax credits, smart thermostats still deliver strong value. According to the U.S. Department of Energy’s Energy Saver:

-

Homeowners save about 8–10% annually on heating and cooling.

-

Features like geofencing and learning algorithms ensure your system runs less when you’re away.

-

Many models integrate with heat pumps and high-efficiency HVAC systems for even greater savings.

So while the upfront rebate might only be $50–$100, the real payoff comes in lower monthly energy bills year after year.

Stacking Rebates with Larger HVAC Credits

Here’s where things get interesting: while smart thermostats don’t qualify for federal credits on their own, they can be combined with bigger upgrades.

Example:

-

Install a heat pump (qualifies for a $2,000 federal tax credit).

-

Add a smart thermostat (qualifies for a $75 utility rebate).

-

Result = Lower upfront cost + optimized energy use + ongoing savings.

This combination approach is one of the best ways to stretch your dollars when upgrading your home comfort system.

Common Misconceptions About Thermostat Incentives

There’s a lot of confusion around smart thermostat incentives. Let’s clear up a few myths:

-

Myth 1: All smart thermostats qualify for rebates.

Only ENERGY STAR-certified models are eligible. Always check the ENERGY STAR smart thermostat list. -

Myth 2: Smart thermostats qualify for the same tax credits as heat pumps.

False — they’re not included in the Energy Efficient Home Improvement Credit. -

Myth 3: Rebates are automatic.

You usually need to submit a rebate form with proof of purchase within 30–90 days.

The Bottom Line

In 2025, smart thermostats qualify for rebates, but not federal tax credits. That doesn’t make them any less valuable. Between utility rebates, lower energy bills, and better system control, a smart thermostat can pay for itself quickly.

If you’re planning bigger HVAC upgrades, pairing a thermostat with a new heat pump or furnace makes even more sense — stacking rebates with tax credits and long-term energy savings.

The takeaway? Don’t overlook small upgrades. Even without federal credits, a smart thermostat can be one of the smartest energy investments you make this year.

📘 Next up: Do You Need a Home Energy Audit to Qualify for Rebates?

Alex Lane

Your Home Comfort Advocate