When it comes to saving money on HVAC upgrades in 2025, rebates are a big part of the picture. But homeowners often ask me: “Do I need a home energy audit to qualify for rebates?”

The short answer: sometimes yes, sometimes no. Certain rebate programs require an energy audit before they’ll approve incentives, while others don’t. Even when it’s not required, an audit can still be one of the smartest first steps you take toward improving your home’s efficiency.

In this guide, I’ll explain when audits are required, when they’re optional, and why they may still be worth the investment.

📘 Want the complete breakdown of incentives? Start with our main guide: 2025 HVAC Tax Credits & Rebates Explained.

What Is a Home Energy Audit?

A home energy audit is a professional assessment that identifies how your home uses and loses energy. Think of it like a physical exam for your house.

During an audit, a contractor may:

-

Perform a blower door test to measure air leaks.

-

Use infrared cameras to spot insulation gaps.

-

Inspect ducts for leaks and restrictions.

-

Review HVAC performance and thermostat settings.

-

Recommend upgrades to improve comfort and efficiency.

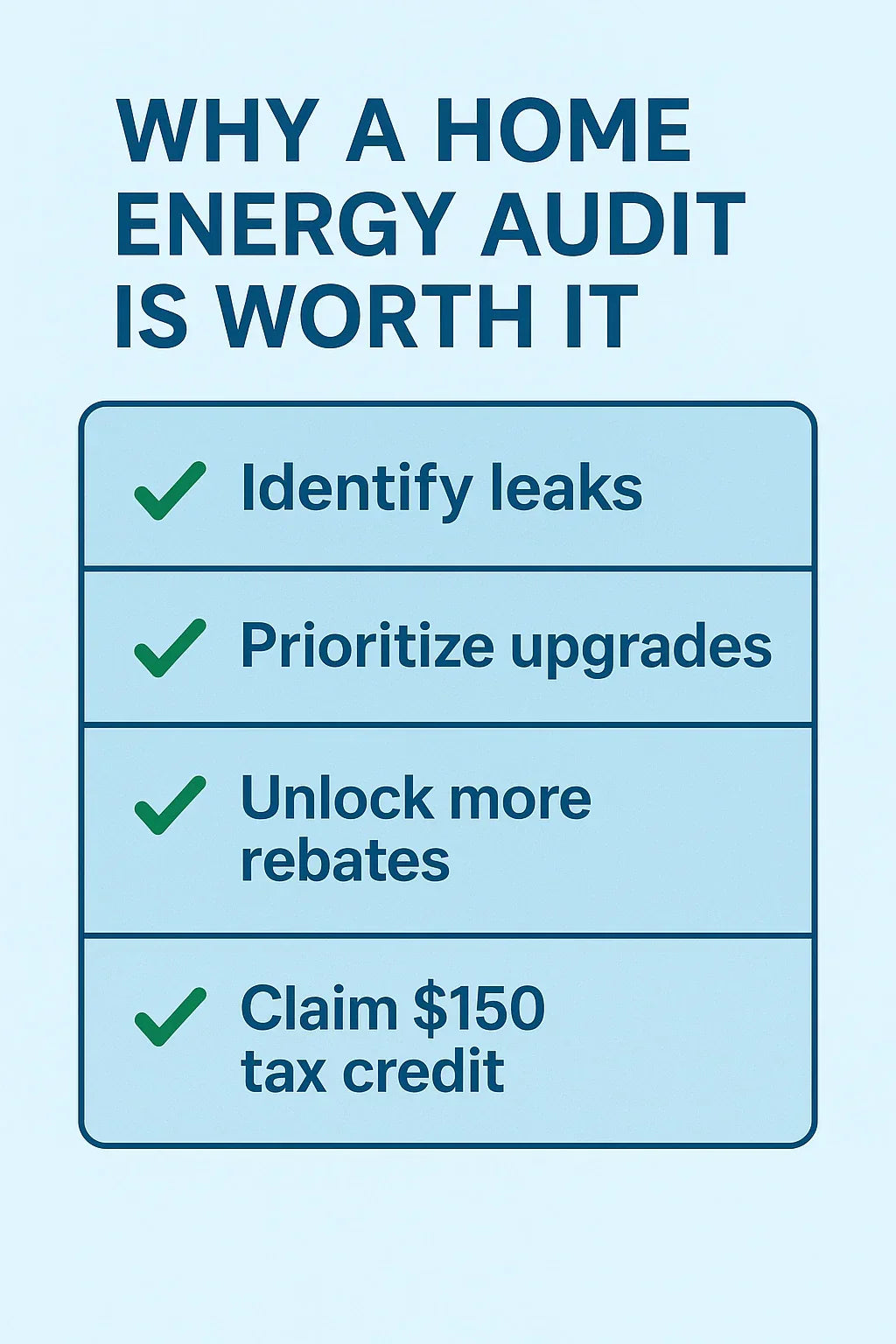

Costs usually range between $150–$400. The good news? In 2025, you can claim a $150 federal tax credit for a professional energy audit under the Energy Efficient Home Improvement Credit.

👉 Learn more at the U.S. Department of Energy’s Home Energy Audits guide.

Rebates That Require an Energy Audit

Some state and utility rebate programs require a home energy audit before you can qualify.

Why They Require Audits

-

Ensures rebate dollars fund the most effective improvements.

-

Helps homeowners prioritize upgrades (sometimes sealing ducts or adding insulation is smarter before replacing equipment).

-

Provides baseline energy use data to measure savings.

Examples

-

New York: The state’s “Home Performance with ENERGY STAR” program requires an audit before rebates are issued.

-

Massachusetts: The Mass Save® program often includes an energy audit as part of the rebate process.

-

Whole-home efficiency programs: These often require audits to coordinate multiple upgrades.

For state-specific rules, check the DSIRE incentives database.

Rebates That Do Not Require an Audit

Not all rebates require an audit. Many HVAC-specific programs focus only on the equipment itself.

Examples

-

Heat pump rebates: Usually require only an itemized invoice and AHRI certificate.

-

Central AC or furnace rebates: Typically require proof of ENERGY STAR® certification, but not an audit.

-

Smart thermostat rebates: Almost never require audits, just proof of purchase.

If your upgrade is straightforward, such as replacing an old AC with a high-efficiency unit, an audit probably won’t be necessary.

👉 You can confirm requirements with your local utility or by searching the ENERGY STAR Rebate Finder.

Why an Audit May Still Be Worth It

Even when not required, a home energy audit can be a game-changer.

Benefits of an Audit

-

Find hidden energy leaks: Audits often reveal issues like duct leakage or air gaps that waste money year-round.

-

Prioritize upgrades: You may find that sealing ducts or adding insulation delivers more savings than replacing equipment right away.

-

Unlock additional incentives: Some rebate programs offer bonus rebates if you complete an audit first.

-

Support bigger savings long-term: By addressing the “envelope” of your home, your HVAC system can run more efficiently and last longer.

For more details, check out ENERGY STAR’s Home Performance program, which combines audits with whole-home upgrades.

Federal Incentives for Energy Audits in 2025

While federal tax credits don’t cover HVAC rebates directly, they do cover audits themselves.

-

The Energy Efficient Home Improvement Credit allows you to claim up to $150 back on a qualifying home energy audit.

-

To qualify, the audit must be performed by a certified professional and must include written recommendations.

-

This credit is separate from HVAC credits (like $2,000 for heat pumps), which means you can stack them.

👉 Official details: IRS Energy Efficient Home Improvement Credit page.

Common Misconceptions About Energy Audits and Rebates

There’s a lot of confusion around energy audits. Here are some myths I hear regularly:

-

Myth 1: Every rebate requires an audit.

False — many HVAC rebates (like for heat pumps) only require invoices and model numbers. -

Myth 2: Audits are only for old homes.

Even new homes can have duct leaks or insulation gaps that audits can uncover. -

Myth 3: Audits are too expensive.

Many utilities subsidize or discount audits, and the $150 federal credit helps offset the cost. -

Myth 4: Audits delay rebates.

In reality, audits often speed things up by making sure your paperwork is complete and upgrades are prioritized correctly.

The Bottom Line

So, do you need a home energy audit to qualify for rebates?

-

For equipment-specific rebates (heat pumps, furnaces, ACs), usually not.

-

For whole-home or state-run programs, often yes.

-

Even when not required, audits can reveal hidden savings and qualify for a $150 tax credit.

If you want to maximize both comfort and savings, a home energy audit is often the smartest first step before investing in major HVAC upgrades.

📘 Next up: Tax Credits for Renters: Can You Get HVAC Incentives If You Don’t Own?

Alex Lane

Your Home Comfort Advocate