If you’re planning an HVAC upgrade in 2025, chances are you’ve heard about rebates and tax credits. Both can save you serious money, but they’re not the same thing — and mixing them up could cost you hundreds (or thousands) of dollars in missed incentives.

The good news? Rebates and tax credits can work together, giving you a chance to cut your installation costs by 30–50%. The trick is knowing how they differ, how to claim each one, and how to avoid the mistakes that leave savings on the table.

📘 Want the full breakdown of this year’s opportunities? Start with our guide: 2025 HVAC Tax Credits & Rebates Explained.

What Is an HVAC Rebate?

An HVAC rebate is essentially a refund or discount offered by utilities, state energy programs, or manufacturers. Instead of waiting until tax season, rebates give you money back soon after your purchase and installation.

How Rebates Work

-

Provided by your utility company, state agency, or equipment manufacturer.

-

Typically delivered as:

-

A mailed check

-

A prepaid card

-

An instant discount at the time of purchase

-

-

Usually requires submitting receipts, model numbers, and an application within 30–90 days of installation.

For example, a homeowner who installs a qualifying heat pump could receive a $1,200 rebate from their local utility. In some states, rebates for efficient heat pumps can reach $3,000 or more.

To see what’s available in your area, use the ENERGY STAR Rebate Finder.

What Is an HVAC Tax Credit?

An HVAC tax credit is a federal incentive that reduces what you owe on your income tax return. Instead of a check in the mail, the savings come when you file your taxes.

How Tax Credits Work

-

Available through the Energy Efficient Home Improvement Credit, part of the Inflation Reduction Act.

-

Claimed by filing IRS Form 5695 with your return.

-

Reduces your tax bill dollar-for-dollar (or increases your refund if you’ve already paid enough).

2025 HVAC Tax Credit Amounts

-

Up to $2,000 for qualifying heat pumps

-

Up to $600 for central air conditioners

-

Up to $600 for gas furnaces or boilers

-

Up to $150 for a professional energy audit

Eligibility requires your system to meet ENERGY STAR, SEER2, or AFUE standards. You can verify models on the ENERGY STAR federal tax credit page or through the AHRI Directory of Certified Product Performance.

For official filing details, visit the IRS Energy Efficient Home Improvement Credit page.

Key Differences Between Rebates and Tax Credits

Although both incentives save you money, the process and timing are different.

| Factor | Rebates | Tax Credits |

|---|---|---|

| Timing | Upfront or soon after installation | At tax filing (following spring) |

| Source | Utilities, state programs, manufacturers | Federal government (IRS) |

| Application | Submit invoices, AHRI certificate, application form | File IRS Form 5695 with tax return |

| Eligibility | May include income restrictions | Not income-limited |

| Savings Range | $300 – $3,000+ depending on program | $150 – $2,000 depending on system |

Put simply: rebates give you quicker cash, tax credits reward you later.

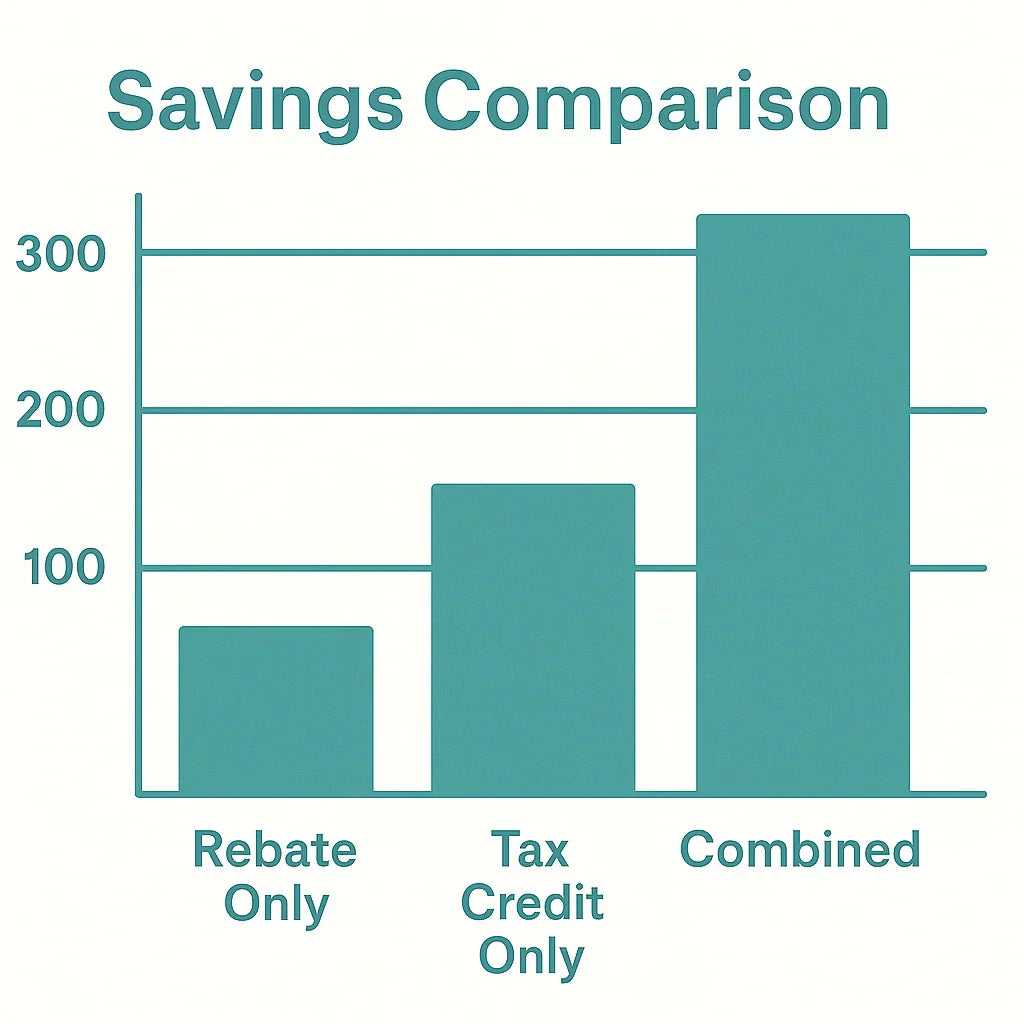

Can You Claim Both?

Yes — and this is where the real savings happen. Rebates and tax credits are stackable, which means you can claim them together as long as your system qualifies.

Example

-

Install a qualifying heat pump:

-

$1,500 rebate from your utility

-

$2,000 federal tax credit

-

-

Total savings: $3,500

The only catch is that you’ll need to complete two separate processes:

-

Apply for your rebate soon after installation (with paperwork like invoices and AHRI certificates).

-

File your tax credit with the IRS the following year.

For state-specific programs and how they interact with federal credits, check the DSIRE database.

Which One Saves You More?

It depends on where you live and what system you install.

-

Rebates vary widely by state and utility. In some regions, rebates for high-efficiency heat pumps can reach $3,000–$5,000, especially for low- and moderate-income households.

-

Tax Credits are capped at federal levels — $2,000 max for heat pumps, $600 for other HVAC systems.

The bottom line: while rebates often provide larger short-term savings, tax credits are guaranteed if you purchase qualifying equipment and file correctly. Together, they can reduce your installation cost by thousands.

For guidance on system efficiency standards, see U.S. Department of Energy – Energy Saver.

Common Homeowner Mistakes

Even with generous incentives available, many homeowners lose out due to small errors. Here are the most common pitfalls:

-

Assuming one cancels out the other — Rebates and tax credits are separate; you can claim both.

-

Missing rebate deadlines — Most programs require submission within 30–90 days.

-

Not filing Form 5695 — Without this, you can’t claim your credit.

-

Buying non-qualifying equipment — Always verify SEER2/AFUE ratings and ENERGY STAR certification before purchase.

The Bottom Line

Rebates and tax credits may sound similar, but the timing, source, and application process set them apart. Rebates provide fast, upfront savings, while tax credits reward you at tax time.

The smartest move for homeowners in 2025? Plan to claim both. That means buying qualifying equipment, keeping your paperwork organized, and submitting applications on time.

Do it right, and your HVAC upgrade won’t just keep you comfortable — it’ll put money back in your pocket.

📘 Next up: Common Mistakes When Claiming HVAC Tax Credits.

Alex Lane

Your Home Comfort Advocate