Hey folks—Mike Sanders here. I talk to a lot of homeowners who want to know, “Can I get a tax credit for this thing?” when they're eyeing a new water heater. And honestly, with the cost of utilities climbing and the government tossing out rebates like candy in 2025, it’s a smart question.

This guide answers:

-

What Energy Star means in 2025

-

Whether the State ProLine 50-Gallon Electric Water Heater qualifies

-

What tax credits and rebates are on the table

-

And how to actually claim them without losing your sanity

🌟 1. What Is Energy Star Certification?

Energy Star is a program run by the U.S. Environmental Protection Agency (EPA) and the Department of Energy (DOE). It helps consumers identify energy-efficient products that reduce utility bills and environmental impact.

For water heaters, Energy Star means:

-

Higher energy efficiency ratings (UEF above certain thresholds)

-

Lower operating costs over time

-

Eligibility for federal tax credits and rebates

-

Certification based on real-world testing

📚 Source: EnergyStar.gov – Water Heaters Overview

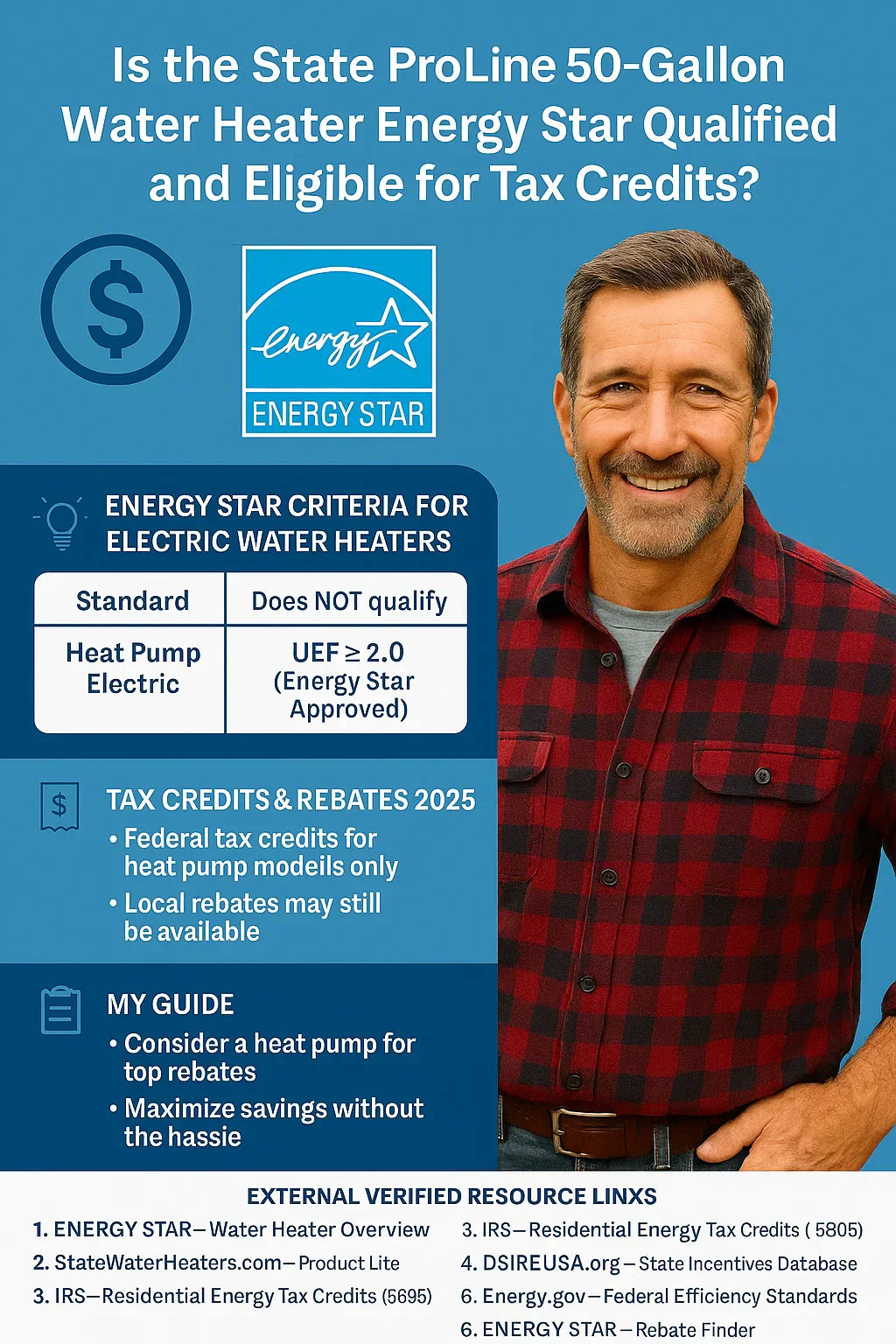

🧮 2. Energy Star Criteria for Electric Water Heaters (2025)

To earn the Energy Star label in 2025, electric water heaters must be heat pump models.

| Type | UEF Requirement | Energy Star Eligible? |

|---|---|---|

| Standard electric (resistance) | 0.93 or lower | ❌ No |

| Heat pump (hybrid) electric | ≥ 2.0 | ✅ Yes |

That means traditional tank-style electric heaters—even efficient ones like the State ProLine—do not qualify for Energy Star.

📎 Full criteria: DOE Heat Pump Water Heater Efficiency Guidelines

🔧 3. Does the State ProLine 50-Gallon Qualify?

Short answer: ❌ Not for Energy Star or federal tax credits.

The State ProLine 50-Gallon Tall Electric Water Heater:

-

Uses resistance heating elements (not a heat pump)

-

Has a Uniform Energy Factor (UEF) around 0.92–0.93

-

Does not meet Energy Star’s 2.0 UEF threshold for electric units

Even though it’s highly efficient and dependable—it’s not on the Energy Star Qualified Water Heaters List.

💵 4. What About Federal Tax Credits in 2025?

Under the Inflation Reduction Act (IRA), the 2025 tax credit program is called:

Energy Efficient Home Improvement Credit (IRS Form 5695)

This program covers:

-

30% of the cost (up to $600) for Energy Star-certified water heaters

-

Applies only to heat pump electric models

-

You must own the home, and it must be your primary residence

⚠️ State ProLine does not qualify for this credit.

✅ What does?

-

State ProLine heat pump models (if you upgrade to hybrid)

-

Certain models from Rheem, AO Smith, and Bradford White labeled "hybrid electric"

🔗 Official resource: IRS Energy Credits – Form 5695

🗺️ 5. Local & Utility Rebates — The Good News

Even if the ProLine doesn’t qualify for a federal credit, your local utility might still help out.

Examples:

-

NYSERDA (New York) – Offers rebates for energy-efficient water heaters, including electric resistance types in some cases

-

California TECH Initiative – Up to $3,100 for switching to a heat pump

-

Duke Energy, Georgia Power, PG&E, MidAmerican Energy – All have regional programs for water heaters

🎯 Use this search tool: DSIREUSA.org – Incentive Database

You can filter by:

-

Zip code

-

Utility provider

-

Type of water heater (electric, heat pump, gas)

📋 6. State-by-State Incentive Quick Guide

| State | Rebates for Electric Tanks? | Rebates for Heat Pumps? | Notes |

|---|---|---|---|

| CA | ❌ No | ✅ Yes – $3,100+ | TECH Clean CA |

| NY | ❌ Rare | ✅ Yes | NYSERDA |

| TX | ❌ No | ✅ Yes – varies | Reliant Energy |

| MN | ⚠️ Sometimes | ✅ Yes | Xcel Energy |

| FL | ❌ No | ✅ Yes – up to $500 | Florida Power & Light |

🔗 Source: Energy Star Rebate Finder

🧾 7. Mike’s Guide: Should You Upgrade to a Heat Pump Model?

The State ProLine resistance model is:

-

Affordable upfront

-

Easy to install

-

Reliable and low-maintenance

But if you're chasing tax credits and max rebates, a State ProLine heat pump or other Energy Star unit might be worth the upgrade.

Pros of Heat Pump Water Heaters:

-

2–3x more efficient (UEF ≥ 2.0)

-

Qualify for federal 30% tax credit up to $2,000

-

Lower monthly energy bills

-

Rebates in many areas

Cons:

-

Higher upfront cost ($1,300–$2,500)

-

Larger footprint and clearance space

-

Louder operation due to fan and compressor

-

Slower recovery rate vs. resistance heaters

🛠️ Mike’s Take: Stick with the State ProLine standard if your priority is simplicity, low cost, and long-term reliability. Go hybrid if you’re building new, need a rebate, or want extreme energy efficiency.

💡 8. How to Claim Rebates or Tax Credits

For federal tax credit:

-

Purchase an eligible Energy Star-certified model (not standard ProLine)

-

Keep all receipts and installation records

-

File IRS Form 5695 with your tax return

-

Claim 30% of purchase and install costs, up to $600 (standard) or $2,000 (heat pump)

For utility rebates:

-

Visit your utility company’s website

-

Search “water heater rebate”

-

Download claim form or apply online

-

Submit model/serial number, photo, invoice

📚 9. Verified External Resources

🏁 Final Word From Mike

If you’re buying a State ProLine 50-Gallon Electric Water Heater in 2025, you’re getting one of the most reliable, affordable, and field-tested electric tanks on the market. But:

❌ It does not qualify for Energy Star or the 25C federal tax credit.

✅ It might qualify for utility-level rebates, depending on your zip code.

💡 If you're upgrading to an Energy Star hybrid model, the tax benefits and long-term savings can be big—but so is the upfront cost.

In the next topic we will know more about: Is a 50-Gallon Water Heater Enough for Your Family? Sizing Tips from Mike