If you upgraded your HVAC system in 2025, you could be eligible for up to $3,200 in federal tax credits. That’s real money back in your pocket—but only if you file correctly.

The good news? Claiming your credit is easier than it sounds. All it takes is a qualified system, the right documents, and a few extra minutes with IRS Form 5695. In this guide, I’ll walk you through the process step by step, so you don’t leave any savings on the table.

First—Make Sure You Qualify

Before we jump into the paperwork, let’s confirm your system is eligible. The IRS has a few clear rules for what qualifies under the Energy Efficient Home Improvement Credit (Section 25C).

✅ You’re eligible if:

-

The upgrade was installed in your primary U.S. residence

-

The equipment was placed in service in 2025 (not just purchased)

-

The system meets or exceeds ENERGY STAR® efficiency standards

-

You have proper documentation (more on that shortly)

🛠️ Covered HVAC equipment includes:

-

Air-source heat pumps

-

High-efficiency central air conditioners

-

Natural gas, propane, or oil furnaces and boilers

-

Heat pump water heaters

-

Smart thermostats (partial credit)

📎 Not sure if your system qualifies? Double-check the requirements here:

👉 2025 HVAC Tax Credits & Rebates Explained

What You Can Claim in 2025 (Credit Breakdown)

The updated 25C tax credit allows homeowners to claim 30% of qualified HVAC expenses, up to certain annual limits:

| Upgrade Type | Maximum Credit | Notes |

|---|---|---|

| Air-source Heat Pumps | $2,000 | Must be ENERGY STAR certified |

| Central AC, Furnace, Boiler | $600 | Per category, per year |

| Smart Thermostats | $150 | Must meet connected requirements |

| Total Annual Cap | $3,200 | Per household, per year |

ENERGY STAR maintains a full list of eligible HVAC equipment and model-level details.

💡 Bonus: Labor costs do count toward the credit—as long as they relate directly to the installation of qualifying systems.

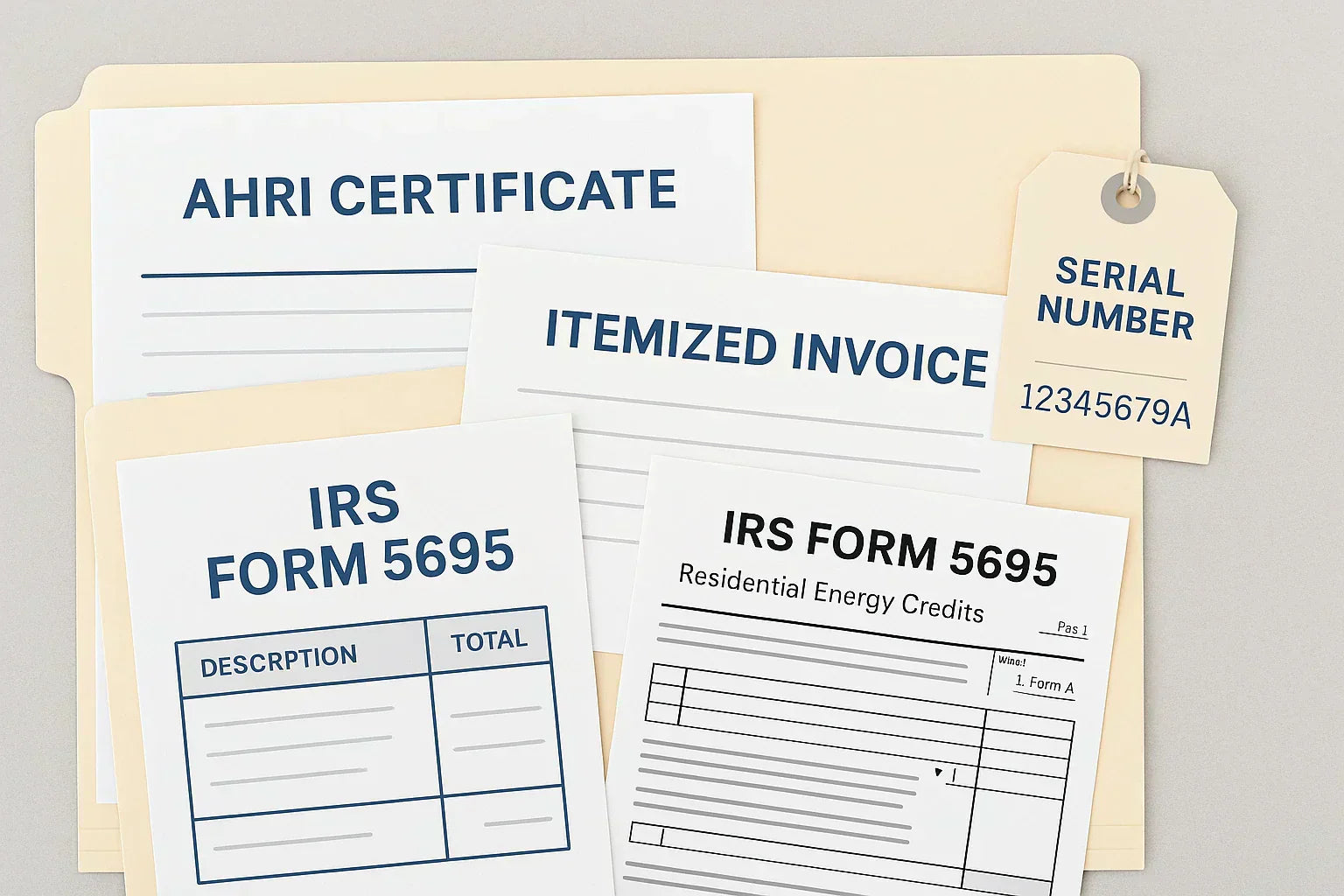

Documents You’ll Need to Claim Your Tax Credit

The IRS won’t give you a tax credit just for saying you installed a heat pump. You’ll need proof. Here’s what to gather:

🧾 Required Documentation:

-

AHRI Certificate of Product Rating

Confirms your equipment meets SEER2/HSPF2/AFUE requirements.

Search your unit here. -

Itemized Invoice from Licensed Installer

Must include product model numbers, serial numbers, labor breakdown, and installation date. -

Model & Serial Numbers

Needed for AHRI lookup and rebate validation. -

IRS Form 5695

This is the form you'll use to file the credit. Download it here with official instructions.

💬 Keep all paperwork for at least 3 years in case of an audit or rebate cross-check.

Step-by-Step: How to Fill Out IRS Form 5695 (2025)

Filing doesn’t require a tax pro—but it does require careful attention to details. Let’s walk through the steps.

Step 1: Download and Review IRS Form 5695

Start by visiting the IRS Form 5695 page and downloading both the form and the instructions PDF. You’ll be filling out Part II – Energy Efficient Home Improvement Credit.

Step 2: Enter Your HVAC Costs

In the section for HVAC upgrades:

-

Enter your total qualified costs (equipment + installation)

-

Calculate 30% of that total

-

Don’t exceed $2,000 for heat pumps or $600 for other HVAC categories

If you installed more than one system, list each separately.

Step 3: Apply the Credit to Your Tax Return

-

Transfer the final credit amount to Schedule 3 of Form 1040

-

Attach Form 5695 to your return

-

File electronically or with your tax preparer as usual

📝 Reminder: This is a non-refundable credit. That means it only reduces the tax you owe—you won’t receive a check if your tax bill is already zero.

Common Mistakes to Avoid When Filing

Even a small slip can delay or disqualify your credit. Here are some of the most common HVAC filing mistakes I’ve seen:

⚠️ Filing without documentation

Always keep copies of your invoice and AHRI certificate. If the IRS requests verification, you’ll need them.

⚠️ Claiming for an unqualified system

Not all systems—even new ones—meet ENERGY STAR or CEE efficiency thresholds. Verify before you buy.

⚠️ Missing the install year

The system must be installed (not just purchased) between January 1 and December 31, 2025.

⚠️ Filing the wrong year’s form

Use the 2025 version of Form 5695—not an older one. Instructions change each year.

💡 Bonus: Can You Claim a Rebate and a Tax Credit?

Yes! In most cases, you can combine:

-

Federal tax credits (like this one)

-

Utility rebates

-

State-level rebates and programs like HEEHRA

Just don’t double-dip on the same expense. If a rebate covered $1,500 of your install cost, subtract that amount before calculating your 30% tax credit.

📎 Want to see which HVAC upgrades qualify for both tax credits and rebates? That’s covered in our next article:

👉 HVAC Upgrades That Qualify for Both Tax Credits and Rebates

💬 Final Thoughts from Alex Lane

Filing for your 2025 HVAC tax credit doesn’t have to be a headache. With the right documents and a few extra steps, you can claim up to $3,200 in credits for improving your home’s energy efficiency.

Here’s the plan:

-

✅ Confirm your system qualifies

-

✅ Gather your paperwork before tax season

-

✅ Fill out IRS Form 5695 with real (not estimated) numbers

-

✅ Submit with your 2025 federal return

The result? More money in your pocket—and a more efficient, comfortable home.

Alex Lane

Your Home Comfort Advocate