If you’re looking to save big on your 2025 HVAC upgrade, here’s the golden rule: go for systems that qualify for both federal tax credits and local/state rebates.

With the right setup, you could offset 50% or more of your installation cost—and in some cases, nearly all of it. The key? Choosing equipment that checks all the boxes for Section 25C tax credits and also meets requirements for rebate programs like HEEHRA, utility rebates, and state-level incentives.

Let’s walk through which HVAC upgrades qualify for both, how to maximize your savings, and what paperwork you’ll need to claim it all.

Why Combining Credits and Rebates Matters in 2025

This year is one of the best in recent memory for HVAC savings, thanks to overlapping incentives from federal, state, and utility programs.

Here’s what’s available:

-

Federal tax credits up to $3,200 per year (via Section 25C)

-

HEEHRA rebates up to $8,000 for heat pumps

-

State and utility rebates that add another $300–$2,000+ depending on location

-

In total: Up to $10,000 or more in combined savings per household

According to ENERGY STAR, many common HVAC upgrades now qualify for both types of incentives. And thanks to the DSIRE database, you can easily find local programs that complement your federal credit.

But not all upgrades qualify. Let’s break down the ones that do.

Top HVAC Upgrades That Qualify for Both Incentives

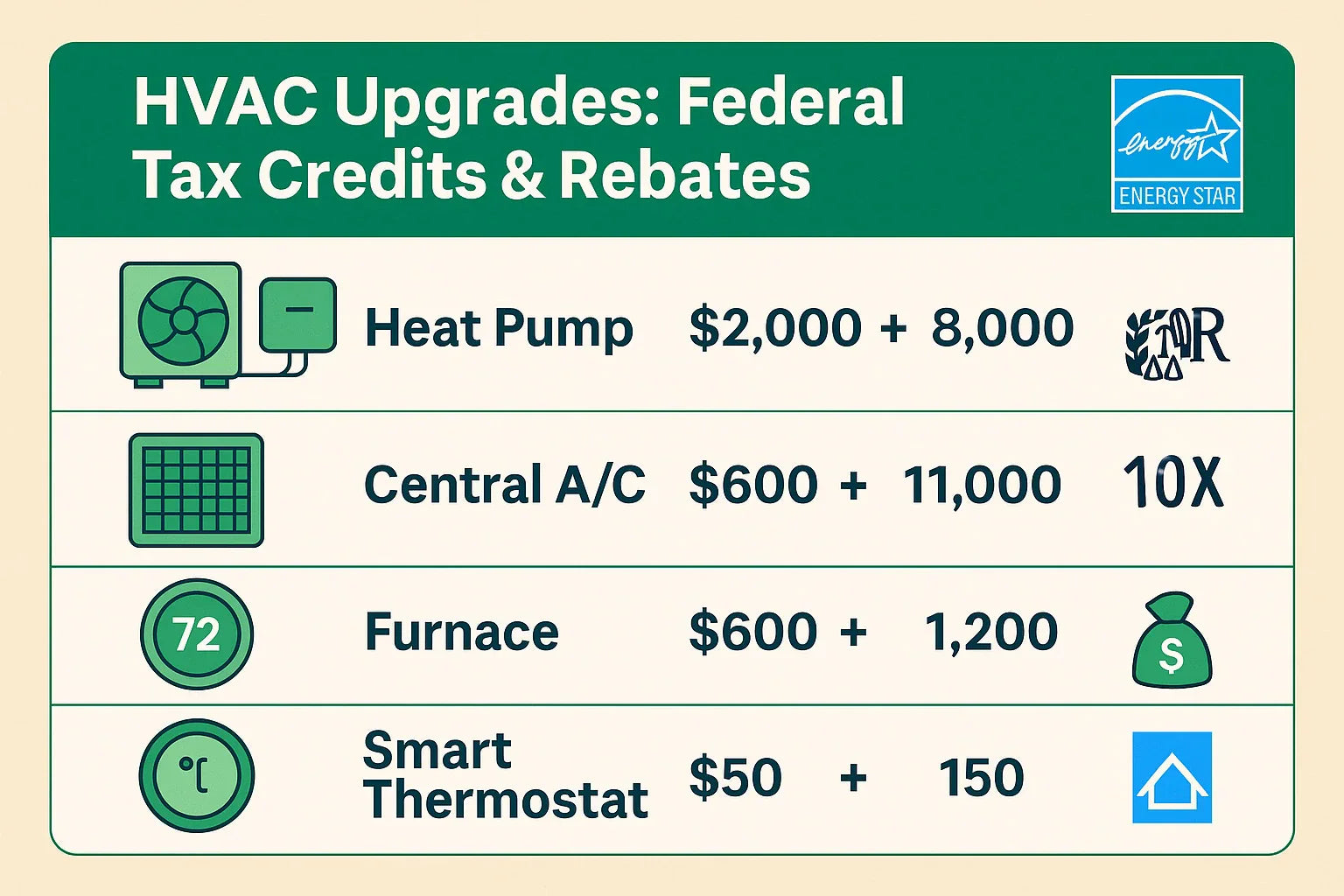

1. Air-Source Heat Pumps

This is the #1 upgrade when it comes to dual incentives. Here’s why:

-

Federal tax credit: Up to $2,000

-

HEEHRA rebate: Up to $8,000 (income-based)

-

Utility/state rebates: Often $500–$2,000 depending on your ZIP code

To qualify, your heat pump must:

-

Meet or exceed SEER2 and HSPF2 minimums

-

Be listed in the AHRI directory

📌 Pro tip: Rebates often require installation by a licensed contractor. DIY installs will likely disqualify you from both.

2. Central Air Conditioners

Central ACs are often included in rebate programs—even if you’re not fully electrifying.

-

Federal tax credit: Up to $600

-

Utility rebate: Ranges from $300–$1,500

Requirements:

-

Must meet ENERGY STAR Most Efficient levels

-

Check your local utility or state portal to confirm minimum SEER2 rating

-

AHRI certificate is a must

3. High-Efficiency Gas Furnaces

Gas furnaces are still eligible for incentives—especially if you live in a colder climate where a full switch to electric doesn’t make sense yet.

-

Federal tax credit: Up to $600

-

State/utility rebate: $300 to $2,000 depending on program and region

To qualify, your furnace should have:

-

An AFUE of 97% or higher

-

ENERGY STAR certification

-

Installed by a licensed HVAC contractor

Use tools like the York Energy Savings Calculator to estimate long-term cost savings.

4. Smart Thermostats (When Installed with HVAC)

Smart thermostats qualify for both incentives when bundled with a system upgrade.

-

Federal tax credit: Up to $150

-

Utility rebate: Usually $50–$100, depending on provider

Requirements:

-

Must be ENERGY STAR certified

-

Installed in conjunction with a qualifying HVAC system

-

May require connection to Wi-Fi or participation in demand-response programs

How to Maximize Your Dual Incentives

Stacking savings requires planning. Here’s how to make sure you get every dollar you’re entitled to.

1. Install by December 31, 2025

Your system must be installed and operational within the 2025 tax year to be eligible for this year’s credit.

2. Confirm Eligibility Before Buying

Use the AHRI Directory to verify that your specific model meets federal efficiency standards. Just because a system is "high-efficiency" doesn’t mean it qualifies.

3. Use a Licensed Contractor

Most rebate programs (especially utility and HEEHRA) require installation by a licensed, participating contractor. Always ask for documentation after the job is done.

4. File Your Rebate Forms Early

Rebate funds are often first-come, first-served. Submit within 30 to 90 days of installation. Keep digital copies of everything—itemized invoice, AHRI certificate, serial numbers, and contractor license number.

5. File IRS Form 5695 for the Federal Tax Credit

Use the official IRS Form 5695 when you file your 2025 return. You'll claim 30% of qualified costs, up to the maximum per category.

📎 Not sure you’ve met every requirement? Use this checklist to be sure:

👉 Income Limits and Eligibility Rules for 2025 HVAC Rebates

Avoid Double-Dipping

Here’s something important: you can claim both a rebate and a tax credit—but not for the same dollar.

If you received a rebate that covered part of your system cost, you need to subtract that amount before calculating your 30% tax credit.

Example:

-

Total cost of heat pump: $10,000

-

Rebate received: $4,000

-

Tax credit calculation = 30% of $6,000 = $1,800

💬 Final Thoughts from Alex Lane

Here’s the smart move for 2025: Don’t just upgrade—upgrade strategically.

By choosing HVAC systems that qualify for both tax credits and rebates, you can dramatically lower your installation costs while boosting long-term energy savings. But don’t wait—rebate funding can run out, and you only get one shot per tax year to file Form 5695 correctly.

✅ Choose certified equipment

✅ Work with a licensed contractor

✅ Save all your documents

✅ File on time

And remember: it’s not just about saving money—it’s about making your home more comfortable, efficient, and future-ready.

📎 For more on how to stack rebates and credits properly, revisit the full guide:

👉 2025 HVAC Tax Credits & Rebates Explained

Alex Lane

Your Home Comfort Advocate