🔎 Introduction: Mike’s Money-Saving Mission

Mike Sanders had just invested in a 1.5‑ton R‑32 air conditioner, a decision he felt good about for his family’s comfort and the environment. But with a total price tag of nearly $5,000 including installation, he had one big question:

“How can I bring down the upfront cost? I keep hearing about rebates and tax credits—can I get them?”

In 2025, the answer is a resounding yes. Thanks to new federal programs, state incentives, and utility rebates, many homeowners can save 20–40% off their installation cost.

This guide walks through exactly how Mike did it—and how you can too.

🏛️ 1. Federal Tax Credits for R‑32 Systems

Federal incentives are the backbone of savings for most homeowners.

🌍 Inflation Reduction Act (IRA) 25C Credits

-

Covers up to 30% of project cost for qualifying ENERGY STAR systems.

-

Maximum: $600 for central AC equipment.

-

Requirements:

-

Split systems must meet SEER2 16+

-

Must be installed by a licensed contractor

-

-

Claim using IRS Form 5695 (IRS.gov).

Mike’s system qualified:

-

SEER2 rating of 17.5

-

Professional install verified

Savings: $600 off his 2025 taxes.

🔌 High-Efficiency Electric Home Rebate Act (HEEHRA)

For households meeting income guidelines, HEEHRA provides point-of-sale rebates:

-

Up to $8,000 for heat pumps

-

Up to $4,000 for panel upgrades

-

Rebates applied instantly at purchase in many states

Mike’s income was above the HEEHRA threshold, but his neighbor qualified and saved $2,500 on a new system.

Check eligibility at Rewiring America.

📑 Mike’s Application Process

-

Saved receipts and AHRI certification number.

-

Confirmed his system was ENERGY STAR certified.

-

Submitted paperwork with his 2025 taxes.

-

Received confirmation of his $600 credit within 8 weeks.

🏠 2. State-Level Rebates & Programs

State programs vary, but many offer $200–$1,000 rebates for efficient systems.

🌐 Examples in 2025

-

California: Rebates up to $1,000 for SEER2 16+ units.

-

Texas: $300–$600 from major utilities for ENERGY STAR systems.

-

New York: Through NYSERDA, rebates up to $800 on new installs.

How Mike Checked His State:

-

Used the DSIRE database.

-

Found his state offered a $500 rebate for R‑32 systems installed after Jan 1, 2025.

⚡ 3. Utility Company Rebates

Most power companies offer direct rebates to encourage efficiency and reduce grid strain.

🔋 Typical Utility Rebates

-

$100–$500 per qualifying system

-

Extra incentives for replacing older, inefficient models

-

Usually require proof of professional installation

Mike’s Experience:

-

His local utility offered $350 for ENERGY STAR central ACs.

-

He submitted receipts online and had a check in 6 weeks.

Tip: Call your utility before buying—some programs require pre-approval.

🌱 4. Why R‑32 Helps You Qualify

Choosing R‑32 refrigerant wasn’t just an environmental decision—it also opened the door to incentives.

✅ Benefits of R‑32 vs. R‑410A

-

10% more efficient in many systems (Daikin)

-

Lower global warming potential (GWP): 675 vs. 2,088 for R‑410A

-

Preferred by ENERGY STAR and DOE for meeting 2025 efficiency targets

Mike’s takeaway:

“I realized R‑32 wasn’t just good for the planet—it made my AC qualify for rebates that R‑410A units couldn’t.”

🧾 5. Documentation You’ll Need

📋 Checklist for Rebates & Credits

-

Purchase receipt for the AC system

-

Proof of professional installation (invoices or contractor’s license)

-

AHRI Certificate of Product Ratings

-

IRS Form 5695 for tax credits (IRS.gov)

Mike’s Pro Tip:

“Scan everything into a PDF folder—rebate forms always ask for the same documents.”

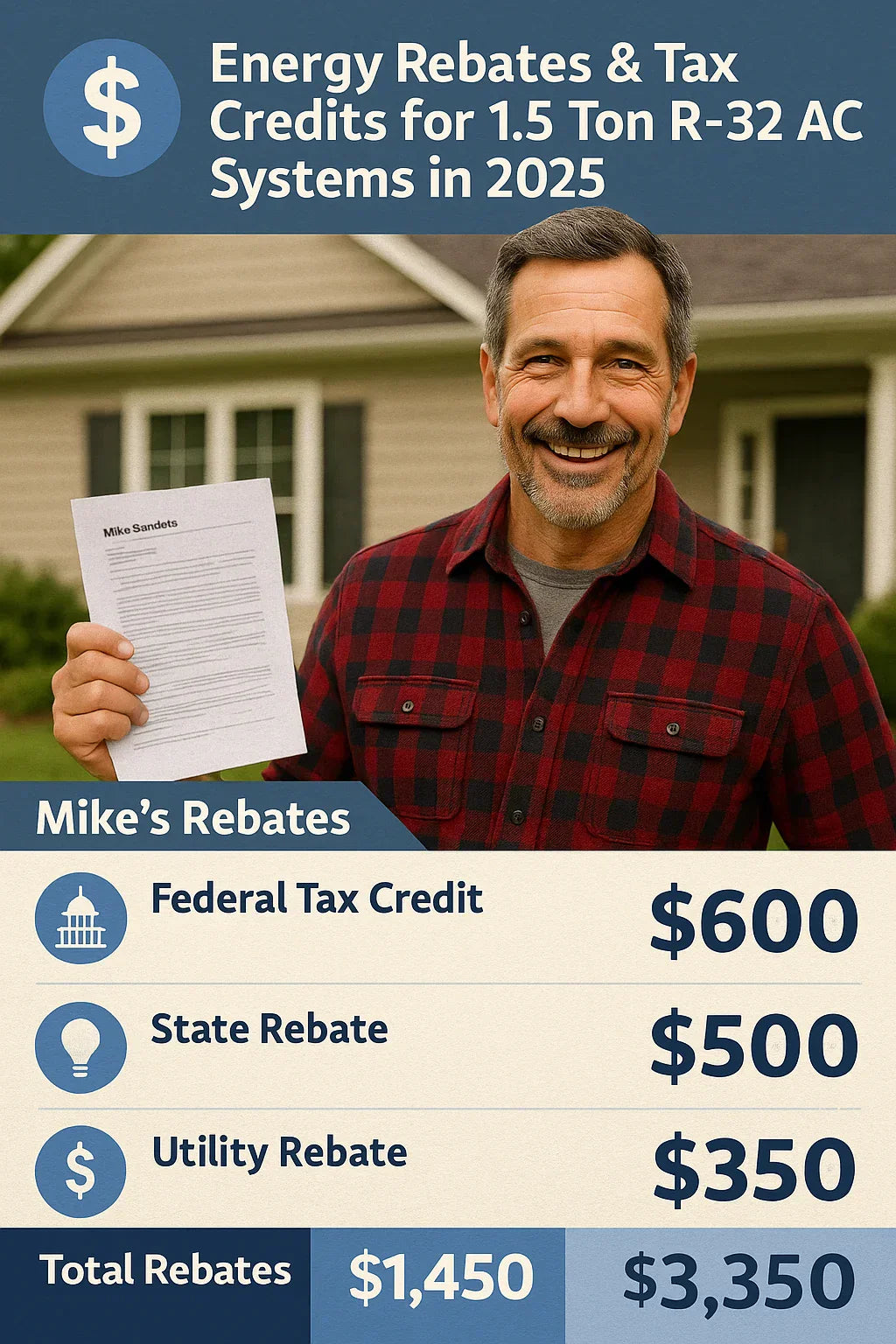

📊 6. Mike’s Real Numbers

Here’s how the math worked out for Mike:

| Item | Amount Saved |

|---|---|

| Federal Tax Credit (25C) | $600 |

| State Rebate | $500 |

| Utility Company Rebate | $350 |

| Total Rebates & Credits | $1,450 |

-

Original System Cost (unit + install): $4,800

-

Net Cost After Incentives: $3,350

That’s nearly 30% off—just for filling out paperwork.

📌 7. Mike’s Timeline to Rebates

-

Week 1: Installed system; saved receipts and AHRI number.

-

Week 2: Applied for state rebate and utility rebate.

-

Week 6: Received utility rebate check ($350).

-

Month 2: State rebate approved ($500).

-

Tax Season: Claimed $600 federal credit on Form 5695.

-

8 Weeks After Filing: IRS confirmed $600 refund.

🛠️ 8. Common Mistakes Homeowners Make

-

❌ Not checking eligibility before buying.

-

❌ Failing to hire a licensed installer (invalidates most programs).

-

❌ Losing receipts or AHRI certificate.

-

❌ Waiting too long—some rebates have limited funds.

Mike’s advice:

“Don’t assume you’ll figure it out later. Apply early, keep every scrap of paperwork, and ask your installer for help.”

✅ Conclusion: Mike’s Final Word

By choosing an R‑32 system in 2025, Mike turned a big upfront expense into a smarter investment. Between federal tax credits, state rebates, and his utility program, he slashed nearly $1,500 off the cost.

“Most people don’t realize how much free money is on the table. My advice? Grab it while you can. The paperwork is nothing compared to the savings.”

With efficiency standards rising and rebates favoring R‑32, now is the perfect time for homeowners to upgrade—and save big.

In the next topic we will know more about: Is a 1.5 Ton R-32 AC Big Enough for Your Home? Sizing Tips & Considerations