If you’re considering a through-the-wall AC or heat pump unit like the Amana PBH073J35AA, you may wonder whether it qualifies for energy efficiency rebates or federal and state tax credits. Mike Sanders explains what you need to know about potential savings and rebates when upgrading your home's cooling and heating with a wall unit.

⚡ Why Energy Efficiency Matters

✅ Lowers monthly energy bills ✅ Reduces your home's carbon footprint ✅ Improves comfort with advanced temperature and humidity control ✅ Qualifies for rebates and tax incentives

Further reading:

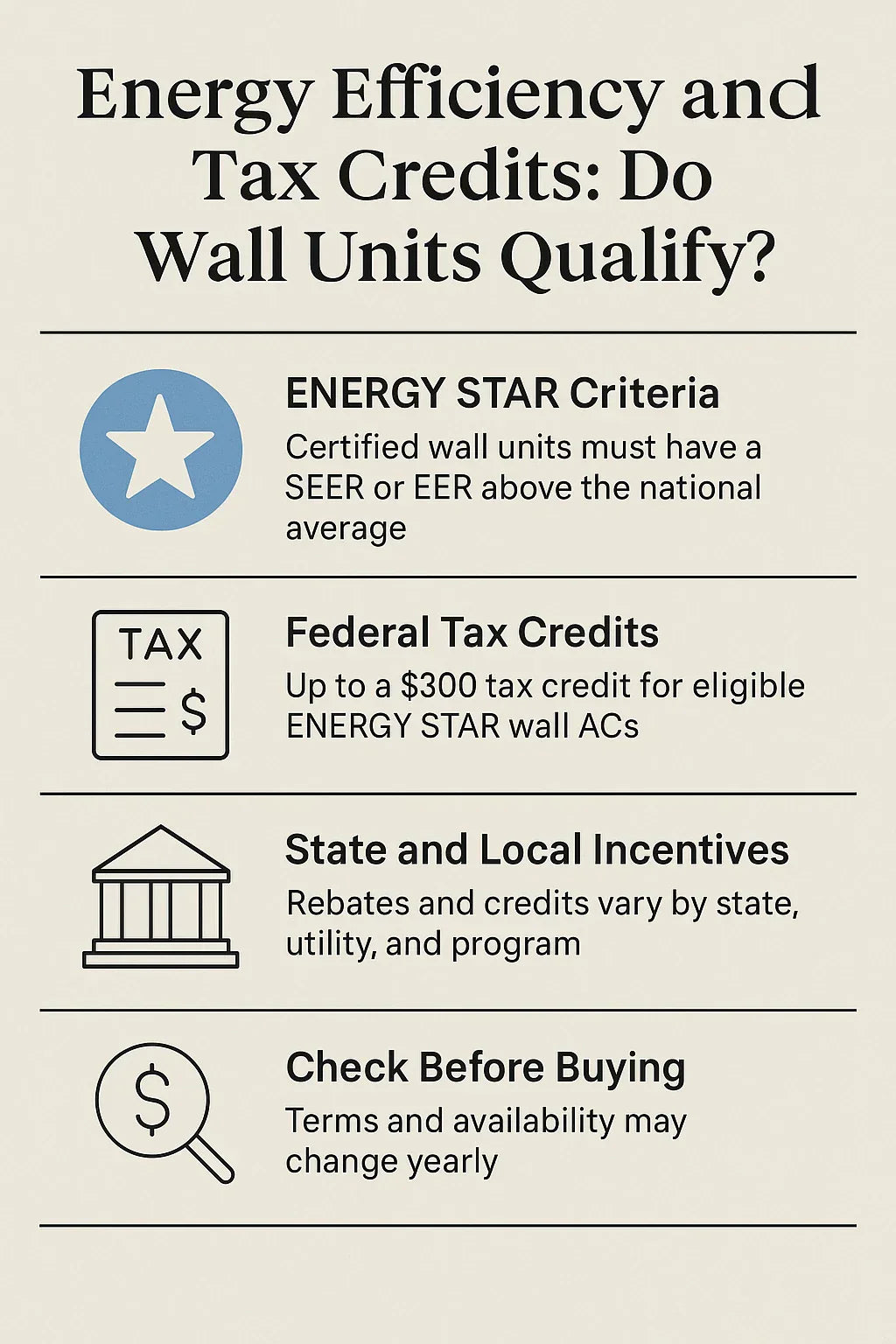

🪟 Do Through-the-Wall AC Units Qualify for Tax Credits?

Most through-the-wall AC units do not qualify for federal tax credits on their own unless they include heat pump technology with specific efficiency ratings.

Units with a heat pump and high SEER/EER ratings may qualify under:

-

Federal Energy Efficiency Tax Credits (Section 25C) for qualified residential energy property.

-

State-specific energy rebates and tax credits.

Always check current IRS guidelines or consult your tax professional to confirm eligibility for your specific model and region.

Further reading:

🌡️ Heat Pumps vs. AC Units: Tax Credit Eligibility

✅ Heat Pumps: Many ductless and through-the-wall heat pump units qualify if they meet minimum efficiency ratings (SEER2, EER2, and HSPF2 standards). ✅ AC Only Units: Typically do not qualify for federal tax credits but may qualify for local rebates.

If your through-the-wall unit includes a heat pump (like the Amana PBH073J35AA), it may qualify if it meets the required efficiency standards.

Further reading:

🏷️ Energy Rebates for Through-the-Wall Units

Many utility companies and state energy offices offer cash rebates for Energy Star-rated AC units and heat pumps.

✅ Rebates may range from $50-$300 depending on the utility and unit efficiency. ✅ Some programs require installation by a licensed contractor. ✅ Apply early, as rebate funds can run out during peak seasons.

Check with your local utility provider and state energy office for rebate eligibility for your specific model.

Further reading:

📊 What Efficiency Ratings Should You Look For?

✅ SEER2 (Seasonal Energy Efficiency Ratio 2): Higher is better; look for 15 SEER2 or above for heat pumps. ✅ EER2 (Energy Efficiency Ratio 2): Indicates efficiency at peak conditions; higher values save more energy. ✅ HSPF2 (Heating Seasonal Performance Factor 2): Relevant for heat pumps; higher ratings indicate better heating efficiency.

Units with high SEER2 and EER2 ratings are more likely to qualify for rebates and will save you money on operational costs.

🛠️ Installation Requirements for Incentives

✅ Some rebates and tax credits require professional installation. ✅ Keep all receipts and AHRI certificates from your contractor. ✅ Units must often be installed in your principal residence to qualify.

💡 Additional Savings Tips

✅ Combine rebates with off-season sales for maximum savings. ✅ Use programmable thermostats with your through-the-wall unit for additional energy savings. ✅ Maintain your unit regularly to preserve efficiency. ✅ Consider insulating your room to reduce load on your AC/heat pump.

✅ Conclusion: Can You Save with a Wall Unit?

You can save with a through-the-wall unit, especially if it includes a heat pump and meets high efficiency standards.

-

Check Energy Star certification for your unit.

-

Look for local utility rebates.

-

If your unit qualifies as a heat pump, explore federal tax credits under Section 25C.

-

Always keep documentation for tax and rebate filing.

With careful selection, you can enhance your home's comfort, lower your energy bills, and potentially reduce your upfront costs with incentives.