When I installed my Hotpoint PTAC (15,000 BTU with electric heat), I thought I was done once it was running smoothly. But then I started wondering:

👉 Could I get some money back through rebates or tax credits in 2025?

Turns out, rebates and tax credits for PTACs aren’t as straightforward as I thought. They depend on federal programs, state incentives, and whether the unit meets specific energy efficiency standards.

In this guide, I’ll walk you through everything I learned about PTAC rebates in 2025 — what qualifies, what doesn’t, and how I personally saved $150 with a local utility rebate on my Hotpoint.

🏷️ Why Rebates and Tax Credits Exist

Before we dive into PTACs specifically, it helps to understand why rebates exist at all.

-

Federal programs (like the Inflation Reduction Act) encourage homeowners to adopt energy-efficient heating and cooling.

-

State and local utilities often provide cash-back incentives to reduce peak electricity demand.

-

Energy Star certification is the usual benchmark for rebates.

📖 For a quick overview, check the ENERGY STAR rebate finder tool here: ENERGY STAR Rebate Finder

👉 In short: If your PTAC is energy efficient, someone out there wants to help you pay for it.

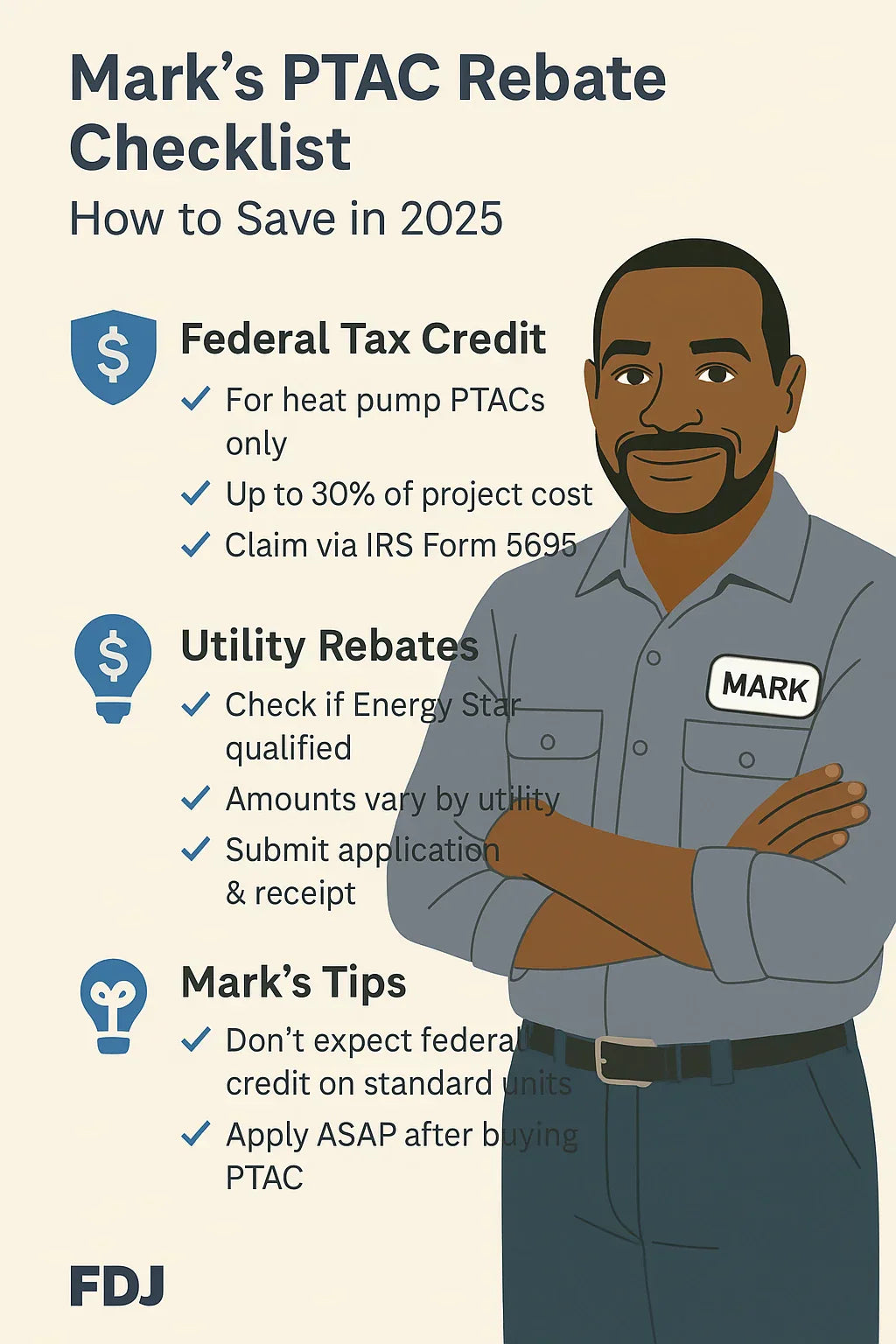

🌟 Federal Incentives in 2025

The Inflation Reduction Act (IRA) set aside billions in funding for energy-efficient home upgrades. But here’s the catch: not all PTACs qualify.

✅ What qualifies under federal rules:

-

Central heat pumps and mini-splits with high SEER2 ratings.

-

Some PTAC heat pump models that meet Energy Star guidelines.

-

Electric resistance PTACs (like my Hotpoint) usually don’t qualify for federal tax credits.

Tax credit details:

-

Up to 30% of cost or $2,000 maximum for qualified heat pump systems.

-

Filed using IRS Form 5695 (Residential Energy Credits).

👉 Lesson from me: My Hotpoint electric resistance PTAC wasn’t eligible for a federal tax credit. If you want federal money back, you’ll need a heat pump PTAC or a mini-split.

🏛️ State & Local Rebates

Here’s where things get interesting. Even if your PTAC doesn’t qualify for federal incentives, your local utility might offer rebates.

-

Many utilities offer $50–$250 rebates for Energy Star-certified PTACs.

-

Some programs include installation rebates if you hire a contractor.

-

Rebates often have deadlines (usually 90 days after purchase).

My example:

When I bought my Hotpoint PTAC, I checked my local power company’s website. They had a $150 rebate for Energy Star PTACs — all I had to do was submit the receipt online.

📖 To search your area, use the Database of State Incentives for Renewables & Efficiency (DSIRE)

👉 Tip: Don’t assume — always check your utility’s rebate list. Even if you think your unit doesn’t qualify, it might.

⚡ Energy Star Certification & PTACs

If there’s one thing I learned, it’s this: Energy Star is the key.

Why it matters:

-

Most rebates require Energy Star certification.

-

Energy Star PTACs are about 15–20% more efficient than standard models.

-

Certification depends on EER (Energy Efficiency Ratio).

Hotpoint PTACs:

-

Some Hotpoint PTACs carry Energy Star labels, especially at lower BTU levels.

-

My 15,000 BTU unit wasn’t Energy Star certified — but my utility still offered a rebate based on purchase date and BTU rating.

📖 Check current Energy Star PTAC listings: ENERGY STAR Certified PTACs

👉 Bottom line: If your unit has an Energy Star sticker, you’re in good shape for rebates.

💰 How Much Can You Actually Save?

Here’s what I found when I ran the numbers:

Federal tax credits (heat pumps only):

-

Up to $2,000 (30% of project cost).

-

Only if you install a heat pump PTAC or ductless mini-split.

State/utility rebates (any Energy Star PTAC):

-

Typical range: $50–$250 per unit.

-

Some utilities offer bigger rebates if you replace multiple units.

My savings:

-

Federal tax credit: ❌ None (my Hotpoint wasn’t a heat pump).

-

Local rebate: ✅ $150 cash back.

-

That covered the cost of my wall sleeve.

📖 Average rebate programs vary by state: Energy.gov Rebates & Incentives

👉 Even though I didn’t get a federal credit, that $150 rebate still made a difference.

📝 How to Apply for Rebates or Credits

The process isn’t complicated, but you need to follow the steps:

Federal (heat pumps only):

-

Install a qualified system.

-

Keep your receipts and manufacturer certification.

-

File IRS Form 5695 with your taxes.

State/Utility:

-

Go to your utility’s rebate page.

-

Verify your PTAC model number is on the approved list.

-

Submit an online or paper form with proof of purchase.

-

Wait 4–8 weeks for a check or bill credit.

👉 My mistake: I almost missed out because I waited too long. Always apply within the rebate deadline.

📖 Step-by-step rebate filing resources: ENERGY STAR: How to Apply for Rebates

❌ Common Misconceptions About PTAC Rebates

While researching, I ran into a lot of confusion online. Here are the top myths:

-

“All PTACs qualify for rebates.”

Not true — usually only Energy Star models do. -

“Federal tax credits apply to all PTACs.”

Wrong — only heat pump PTACs or high-efficiency systems qualify. -

“You’ll save thousands.”

In reality, most rebates are a few hundred dollars at most.

👉 My takeaway: Rebates are great, but they’re not a substitute for choosing the right PTAC size and efficiency in the first place.

📊 Example Savings Scenarios

Let’s run through three scenarios to show how rebates stack up:

1. Standard Electric PTAC (like my Hotpoint 15k)

-

Cost: $1,000

-

Federal tax credit: $0

-

Local rebate: $150

-

Final cost: $850

2. Energy Star-Certified PTAC

-

Cost: $1,100

-

Federal tax credit: $0

-

Local rebate: $200

-

Final cost: $900

3. Heat Pump PTAC or Mini-Split

-

Cost: $3,000

-

Federal tax credit: $900 (30%)

-

Local rebate: $250

-

Final cost: $1,850

👉 As you can see, heat pumps deliver the biggest rebates — but if you’re sticking with a standard electric PTAC, you’ll likely just get local incentives.

🎯 Mark’s Verdict: Can You Save with Hotpoint in 2025?

Here’s my honest conclusion after going through the rebate maze:

-

Hotpoint PTACs with electric resistance heat usually don’t qualify for federal tax credits.

-

Energy Star-certified Hotpoint models may qualify for state and utility rebates ($50–$250).

-

If you want the biggest incentives, you’ll need to consider a heat pump PTAC or mini-split system.

👉 For me, the $150 rebate from my utility was worth the 10 minutes it took to apply. It didn’t cover the whole system, but it paid for my grille and insulation supplies.

✅ Final Takeaway

If you’re considering a Hotpoint PTAC in 2025, here’s the bottom line:

-

Don’t count on federal tax credits unless you buy a heat pump PTAC.

-

Check your local utility — many offer $50–$250 rebates on Energy Star models.

-

Apply quickly after purchase so you don’t miss out.

And remember: Rebates are nice, but the real savings come from choosing a unit that’s properly sized, installed, and maintained.

In the next topic we will know more about: Wall Sleeve & Grille 101: What Accessories Do You Need for the Hotpoint PTAC?