When I was shopping for my MRCOOL Advantage 12k mini split, I wasn’t just thinking about comfort—I was thinking about my wallet. With all the buzz about rebates and tax credits for heat pumps, I thought, “Maybe I can get some of my money back on this thing.”

But after hours of digging (and calling my local utility), I found out the truth: not every mini split qualifies. And unfortunately, the MRCOOL Advantage doesn’t always make the cut.

Let’s break it all down so you know exactly what kind of savings to expect before you buy.

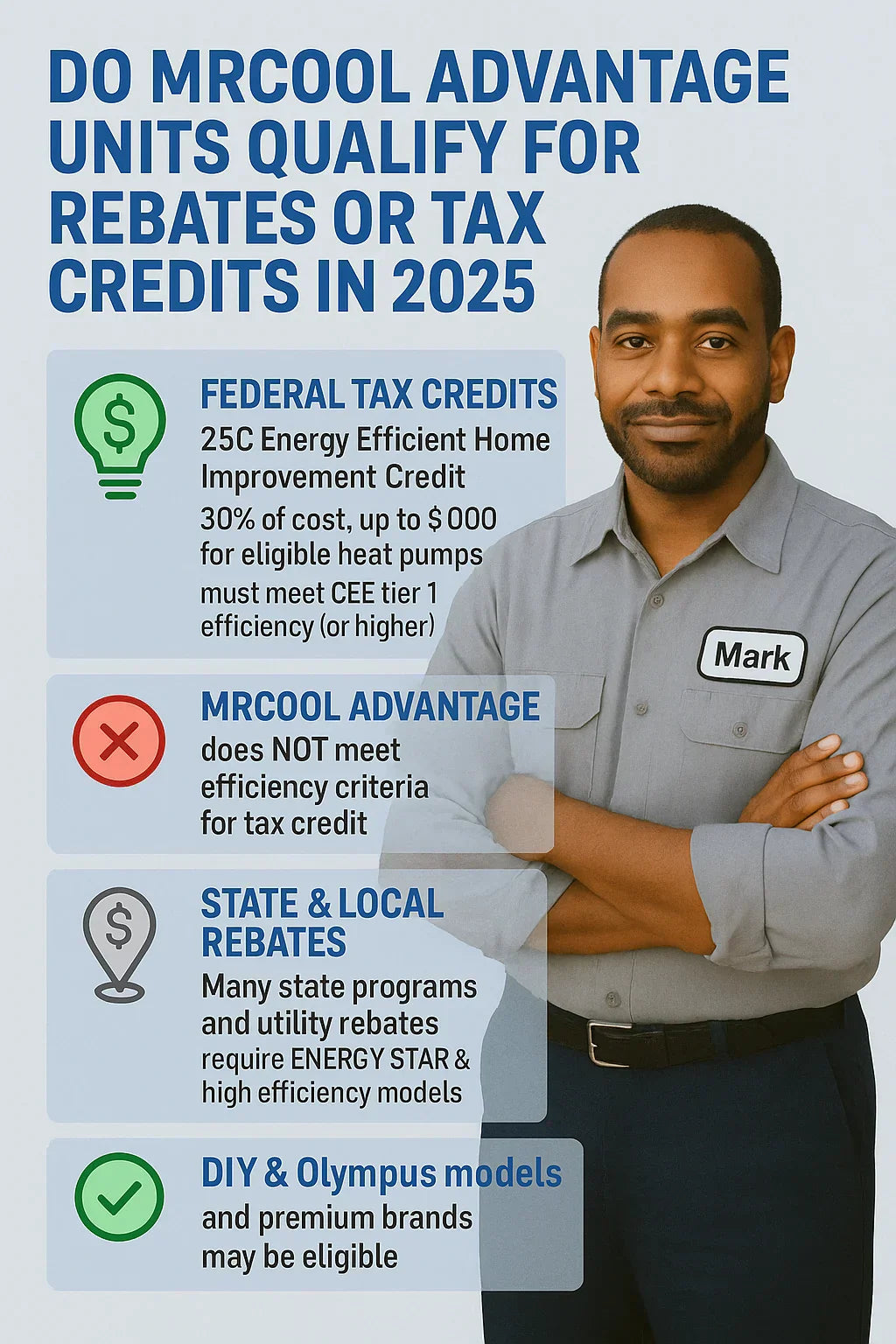

🏛️ Federal Tax Credits in 2025 (Inflation Reduction Act)

Thanks to the Inflation Reduction Act (IRA), homeowners can claim credits for certain high-efficiency HVAC systems through 2032.

The Key Program: 25C Energy Efficient Home Improvement Credit

-

Covers 30% of equipment + installation costs, up to $2,000 per year.

-

Applies to qualified heat pumps (mini splits are included).

-

Can be claimed each year (so multiple projects over time are eligible).

Eligibility Requirements:

-

System must meet CEE (Consortium for Energy Efficiency) Tier 1 or higher.

-

Must be installed in a primary residence in the U.S.

-

Must be Energy Star certified.

👉 Example: If you buy a $5,000 qualifying heat pump, you could get $1,500 back at tax time.

IRS – Energy Efficient Home Improvement Credit

📊 Does the MRCOOL Advantage Qualify?

Here’s the big question—and the answer isn’t what most buyers want to hear.

MRCOOL Advantage 12k Efficiency Ratings:

-

SEER2: ~18

-

HSPF2: ~8.5

-

EER: ~10.5

CEE Tier 1 Standards (for rebates/tax credits):

-

Typically require SEER2 ≥ 20 and HSPF2 ≥ 10 (varies by region).

Verdict:

-

The MRCOOL Advantage 12k usually does NOT meet Tier 1 requirements.

-

That means it typically does not qualify for the 25C tax credit.

-

MRCOOL DIY and Olympus models (with SEER2 ratings of 20+) often do.

👉 Mark’s Reality: “I was hoping to get a $2,000 tax credit, but my Advantage missed the cutoff. Still a good buy—but no help from Uncle Sam.”

Consortium for Energy Efficiency – Tier Standards

🏢 State & Utility Rebates

Even if the Advantage doesn’t meet federal requirements, you may still find local incentives.

Utility Rebates

-

Many utilities offer $200–$1,000+ rebates for high-efficiency mini splits.

-

Rebates are tied to Energy Star certification and higher efficiency models.

-

Advantage models may be excluded, while DIY or premium models qualify.

👉 Example:

-

Massachusetts Mass Save Program: up to $10,000 for whole-home heat pumps (Advantage doesn’t qualify; higher SEER2 models do).

-

California TECH Initiative: $1,000–$2,000 rebates for heat pump installs meeting Tier 1+ standards.

State Energy Offices

Some states provide additional credits or rebates stacked on top of federal programs. Always check your state energy office website.

💰 Real-World Cost Impact

So what does this mean for your wallet?

Without Rebates

-

MRCOOL Advantage 12k: $1,200–$2,800 installed.

-

No major federal rebate.

-

You pay full freight (still cheaper than premium systems).

With Rebates (Qualifying Systems)

-

MRCOOL DIY 12k: $1,600 installed (DIY).

-

Qualifies for up to $2,000 25C credit if installed by homeowner/properly documented.

-

Net cost could drop closer to $0–$1,000 after rebates.

👉 In other words: choosing the right model can mean thousands in savings.

📋 How to Check Eligibility in Your Area

If you’re not sure whether your Advantage or another MRCOOL model qualifies, here’s how to check:

-

Use the Energy Star Rebate Finder – enter your ZIP code.

Energy Star – Rebate Finder -

Check DSIRE (Database of State Incentives for Renewables & Efficiency).

DSIRE – State Incentives Database -

Call your utility company. Rebates often go through them.

-

Ask your installer. Many contractors know which models qualify and can file paperwork for you.

👉 Mark’s Tip: “I called my power company before buying. They confirmed the Advantage wasn’t on their list. Saved me the disappointment later.”

✅ Mark’s Final Verdict

So, do MRCOOL Advantage units qualify for rebates or tax credits in 2025?

-

Federal Tax Credit (25C): ❌ Usually no. Advantage doesn’t hit Tier 1 efficiency.

-

Utility Rebates: ⚠️ Sometimes, but usually not. DIY/premium MRCOOL units fare better.

-

State Incentives: ❌ Rarely for Advantage; check your local listings.

👉 My conclusion:

-

If you’re buying the Advantage, do it for the affordable price and solid performance—not for rebates.

-

If rebates/tax credits are important, spend more upfront on the MRCOOL DIY or a premium cold-climate model.

At the end of the day, the Advantage is still a solid choice for budget-conscious buyers. Just don’t expect the IRS or your utility to chip in.

In the next topic we will know more about: Is 12,000 BTUs Enough? Sizing Your Mini Split for Maximum Comfort