🏡 Why Rebates & Credits Matter

When I installed my 60,000 BTU furnace + AC system, I braced myself for the price tag. Between equipment, installation, and permits, the cost added up quickly. But then my contractor said something that changed everything:

“Don’t forget to apply for the rebates—you could save thousands.”

That’s when I realized that rebates and tax credits aren’t just nice perks—they’re essential to making HVAC upgrades affordable.

In 2025, thanks to federal programs like the Inflation Reduction Act (IRA), plus state and utility incentives, homeowners can cut costs by 20–30% or more—if they know how to qualify.

In this guide, I’ll break down:

-

Which 60,000 BTU systems qualify for rebates and credits.

-

The difference between federal, state, and utility incentives.

-

Eligibility requirements (and fine print).

-

How to apply step by step.

-

Real-world savings examples.

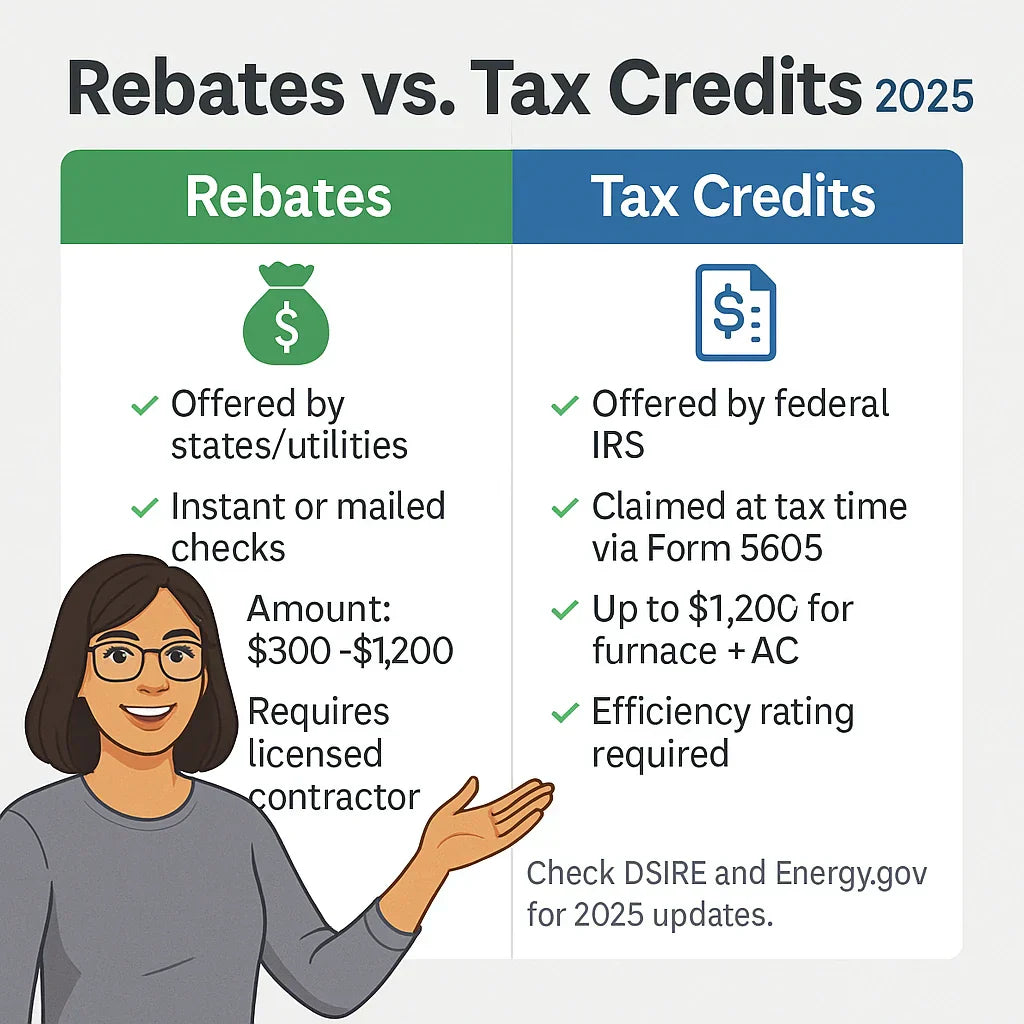

📜 Federal Tax Credits in 2025

The Inflation Reduction Act of 2022 revamped tax credits for energy-efficient home systems, and many provisions are still active in 2025.

🔑 Key Credits:

-

High-Efficiency Furnaces: Must have an AFUE ≥ 97% to qualify.

-

High-Efficiency Central AC Units: Must meet new SEER2 standards (usually SEER2 ≥ 16 depending on region).

-

Heat Pumps: Even more generous—up to $2,000 in credits.

💰 Credit Amounts:

-

Furnace credit: 30% of costs, up to $600.

-

Central AC credit: 30% of costs, up to $600.

-

Heat pump credit: 30% of costs, up to $2,000.

👉 Combined, a furnace + AC system can qualify for up to $1,200 in tax credits if both meet efficiency thresholds.

📎 Reference: Energy.gov – Tax Credits for Homeowners

🌎 State-Level Rebates

Federal credits are just the start. States often layer their own rebate programs on top.

Examples:

-

California: Rebates up to $1,000 for ENERGY STAR central air systems.

-

New York: Offers furnace rebates of $400–$600 for high-efficiency gas furnaces.

-

Minnesota: Rebates for both furnaces and AC systems through utilities like Xcel Energy.

💡 Samantha’s story: When I upgraded, I almost missed my $750 state rebate—until my contractor reminded me. It took two months to receive the check, but it was well worth it.

📎 Resource: DSIRE – Database of State Incentives for Renewables & Efficiency

⚡ Utility & Local Incentives

Your local utility may offer rebates for reducing energy demand. These can be some of the easiest savings to claim.

Typical Utility Rebates:

-

$300–$500 for ENERGY STAR central air conditioners.

-

$250–$600 for high-efficiency furnaces.

-

Bonus incentives for smart thermostat installation.

👉 Some utilities even offer instant rebates at checkout when you buy through approved contractors.

💡 Pro tip: Call your utility company before purchasing to confirm eligible models.

📎 See ENERGY STAR – Heating & Cooling Rebates

✅ Eligibility Requirements

Not every system qualifies. Here’s what you’ll need to check:

-

Efficiency Ratings

-

Furnace: 97% AFUE or higher.

-

AC: Meets SEER2 ≥ 16 (varies by region).

-

-

Certification

-

Must be ENERGY STAR certified.

-

-

Installation Rules

-

Installed in a primary residence (not rental property in some cases).

-

Often requires licensed contractor installation. DIY installs may disqualify you.

-

-

Documentation

-

Keep manufacturer’s certificate of efficiency.

-

Save all receipts and contracts.

-

📎 Reference: IRS – Form 5695 Instructions

🧾 How to Apply for Rebates & Credits

When I first applied, the paperwork felt overwhelming. Here’s the process simplified:

📝 Step 1: Save All Documentation

-

Contractor invoice.

-

Manufacturer’s certificate

-

Serial numbers of installed units.

📝 Step 2: Apply for Federal Credits

-

Complete IRS Form 5695 when filing taxes.

-

Enter the amount spent on qualifying equipment.

-

Attach supporting documents.

📝 Step 3: Apply for State/Utility Rebates

-

Visit your state’s energy office or DSIRE database.

-

Download the rebate application.

-

Submit proof of purchase and installation.

-

Expect checks or bill credits in 6–12 weeks.

💡 Samantha’s tip: I now keep a digital folder titled “HVAC Rebates 2025” with scanned receipts and forms. It makes tax time stress-free.

📊 Real-World Savings Example

Let’s put this into perspective with an example:

System Cost

-

60,000 BTU furnace + AC system: $10,500 installed.

Incentives

-

Federal tax credit: $1,200.

-

State rebate: $750.

-

Utility rebate: $500.

Total Savings

-

$2,450 in combined incentives.

👉 Net system cost: $8,050—a 23% savings just by filing the right paperwork.

💡 Samantha’s Lessons Learned

After going through this process myself, here’s what I tell friends:

-

Start early: Apply for state and utility rebates right after installation.

-

Double-check model numbers: Rebates only apply to listed models.

-

Don’t DIY if you want rebates: Most programs require pro installation.

-

Ask your contractor: Mine pre-filled my rebate forms, which saved hours.

-

Expect delays: Federal credits show up at tax time, and state rebates can take months.

📝 Conclusion: Rebates Are Worth the Effort

Yes, a 60,000 BTU furnace + AC system can qualify for rebates and tax credits in 2025—but only if it’s the right model, installed correctly, and documented properly.

The paperwork may feel tedious, but the savings are real. In my case, I shaved nearly $2,000 off my total cost—money I put right back into sealing ducts and upgrading my thermostat for even better efficiency.

So before you buy, ask:

-

Is this system ENERGY STAR certified?

-

Does it meet the IRA efficiency thresholds?

-

What rebates are available in my state and utility area?

Do that, and you’ll turn a big investment into a smart, budget-friendly upgrade.

In the next topic we will know more about: Noise, Space & Design: Will a 60,000 BTU System Fit in Your Utility Area?