👋 Introduction – Mike’s Story About Rebates

Hey folks, Mike here.

A couple of years back, I installed a new light commercial Daikin 3-ton system at a bakery. The owner was ready to stroke a check for $7,800, figuring that was the full cost. But I asked, “Did you check for rebates?”

Turns out she qualified for:

-

$600 federal tax credit

-

$400 state rebate

-

$250 utility rebate

That’s $1,250 back — nearly 20% of her total bill. She almost left that money on the table.

Here’s the thing: rebates and tax credits aren’t gimmicks. They’re real programs designed to encourage energy efficiency. But the rules change year to year, and in 2025, the incentives are some of the best I’ve seen in years.

In this guide, I’ll break down:

-

What federal credits apply in 2025.

-

How state and utility rebates stack.

-

What qualifies — and what doesn’t.

-

How to actually claim the money.

Because let’s face it: if you’re dropping thousands on a Daikin light commercial system, you deserve to get every bit of savings available.

💵 Federal Tax Credits for Commercial & Residential HVAC (2025)

1. The Inflation Reduction Act (IRA)

The big one. Passed in 2022, the Inflation Reduction Act extended and expanded federal energy credits through 2032.

For HVAC systems like Daikin light commercial units, here’s what applies in 2025:

-

25C Residential Energy Efficiency Tax Credit

-

Covers 30% of project cost, up to $600 for central AC systems.

-

System must meet Energy Star efficiency standards.

-

Applies to residential installations (homes, small rentals).

-

-

179D Commercial Deduction

-

For businesses installing efficient HVAC in commercial buildings.

-

Offers a tax deduction of up to $5.65 per square foot if efficiency standards are met.

-

AC must be part of a whole-building efficiency improvement.

-

👉 Mike’s Note: “If you’re putting a Daikin in your shop or office, the commercial deduction may be a better deal than the flat $600 credit.”

📚 Reference: Energy Star – Federal Tax Credits

🏛️ State and Local Rebates in 2025

Now here’s where it gets interesting. On top of federal programs, many states and municipalities run their own rebate programs.

Examples:

-

California (PG&E, SoCal Edison, LADWP)

-

Rebates up to $1,000 per system for high-SEER2 ACs.

-

-

Northeast (Mass Save, NYSERDA)

-

Incentives from $300–$600 for commercial HVAC replacements.

-

-

Texas (Oncor, Austin Energy)

-

Rebates up to $150 per ton for qualifying high-efficiency units.

-

👉 Mike’s Note: “Don’t assume there’s nothing in your state. I’ve seen programs in small towns that’ll give you $200 just for recycling the old unit.”

📚 Reference: DSIRE – Database of State Incentives

📈 Utility Rebates for Light Commercial Systems

Power companies like rebates because efficient units lower peak demand on hot days.

-

Typical Range: $150–$400 per ton.

-

For a 3-ton Daikin, that’s $450–$1,200 back.

-

Usually requires proof of AHRI certification.

Example Utility Rebates (2025):

-

Duke Energy (Midwest): $300 per ton.

-

Xcel Energy (Colorado/Minnesota): $250 per ton.

-

Florida Power & Light: $150–$500 depending on SEER2.

👉 Mike’s Note: “Utilities want to avoid brownouts. They’ll happily pay you to upgrade — it’s cheaper than building more power plants.”

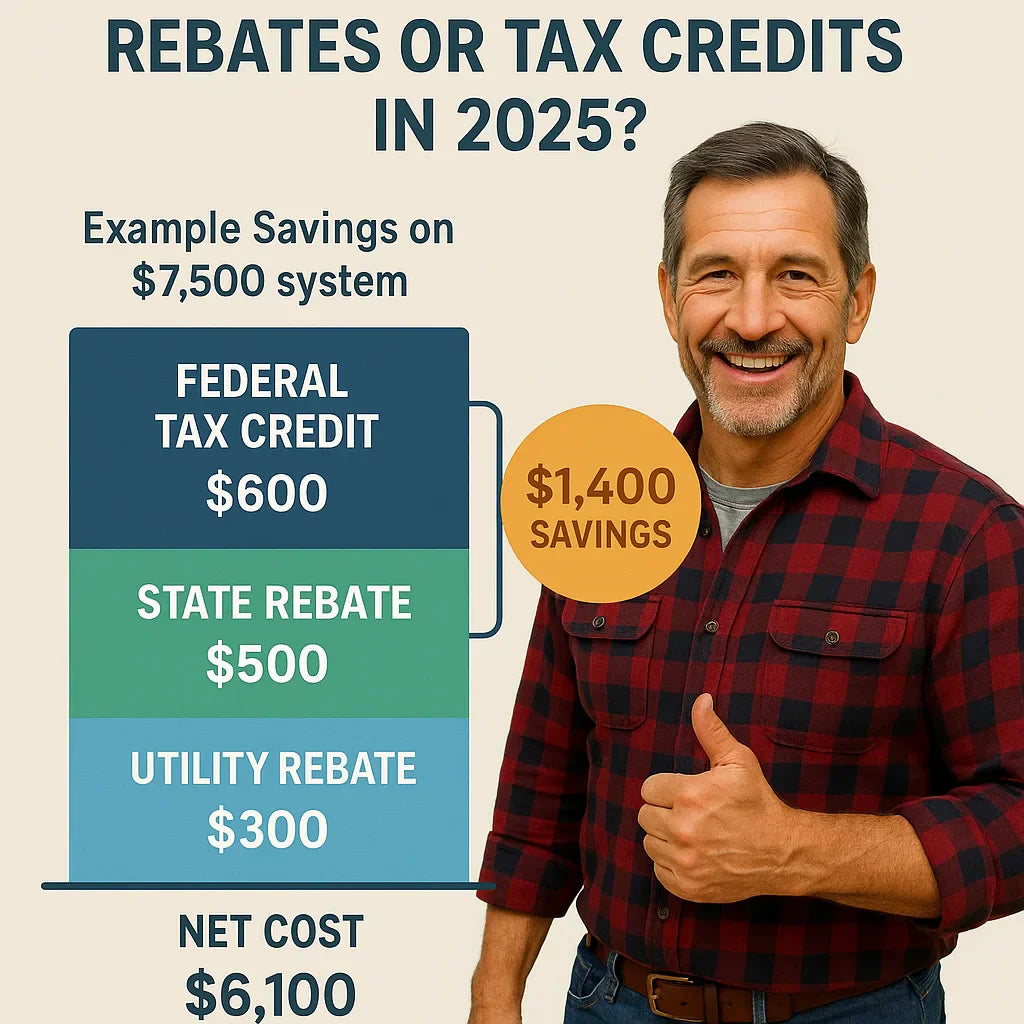

📊 Example Savings Breakdown – Daikin 3-Ton Install

Let’s run the numbers on a Daikin 3-ton, 13.8 SEER2 system installed in 2025:

-

System Cost (installed): $7,500

-

Federal Tax Credit (25C): $600

-

State Rebate (example CA/TX): $500

-

Utility Rebate (example): $300

Total Savings: $1,400

Net Cost: $6,100

That’s almost 20% off with paperwork alone.

👉 Mike’s Note: “Think of rebates like manufacturer coupons for your AC. The trick is knowing where to look.”

✅ Requirements for Eligibility

Not every unit qualifies. Here’s what matters:

-

Efficiency Ratings: Must meet SEER2/EER2/HSPF2 minimums (varies by region).

-

Install Date: Must be installed in 2025 to claim 2025 credits.

-

Certification: Equipment needs an AHRI certificate.

-

Paperwork: Keep receipts, invoices, and AHRI number.

📚 Reference: AHRI Directory

👉 Mike’s Note: “Paperwork is king. No AHRI number = no rebate. Don’t lose that sticker.”

🛠️ How to Claim Rebates & Credits

1. Federal (Residential)

-

File IRS Form 5695 with your taxes.

-

Enter system cost and credit amount.

-

Attach AHRI certificate if requested.

2. Commercial (Businesses)

-

Use Section 179D deduction with tax professional.

-

Must prove energy savings via certified modeling.

3. State & Utility Rebates

-

Submit forms to utility/state program.

-

Provide invoice, AHRI certificate, contractor license info.

-

Processing takes 6–12 weeks.

📚 Reference: IRS – Form 5695 Instructions

👉 Mike’s Note: “Don’t wait till tax season. Get your rebates in right after install — the check will come faster.”

⚖️ DIY vs. Contractor-Submitted Rebates

Some rebates require you to submit. Others let the contractor do it.

-

Contractor-submitted rebates: faster, less hassle.

-

Customer-submitted rebates: you need to track it yourself.

👉 Mike’s Rule: “Before signing the install contract, ask: ‘Who’s handling the rebates?’”

💡 Mike’s Pro Tips for Maximizing Rebates

-

Stack programs – federal + state + utility can all combine.

-

Go higher efficiency if rebates offset cost difference.

-

Example: Going from 13.8 SEER2 to 16 SEER2 may cost $600 more but earn an extra $500 rebate.

-

-

Ask about small rebates – recycling old equipment, smart thermostats, or duct sealing can add $100–$300.

-

Plan timing – rebates sometimes run out of funds mid-year.

👉 Mike’s Note: “The best deals usually hit in spring and fall, when utilities push upgrades hardest.”

🏁 Conclusion – Don’t Leave Money on the Table

Buying a new Daikin 3-ton light commercial system isn’t cheap. But in 2025, you can knock 10–20% off the price just by taking advantage of rebates and tax credits.

-

Federal programs: up to $600 (residential) or major deductions (commercial).

-

State programs: $200–$1,000.

-

Utility rebates: $150–$400 per ton.

👉 Mike’s Bottom Line: “If you’re not at least checking for rebates, you’re throwing away money. Always ask, always apply — because that rebate check spends just as good as cash.”

In the next topic we will know more about: Daikin’s Reputation in Light Commercial HVAC: What Mike Learned