When I upgraded to the Goodman 4.5 Ton Horizontal Cased Painted A-Coil with Built-In TXV (Model CHPTA6030D3, R-32 Ready), I assumed rebates and tax credits were only for complete systems—like when you buy a new air conditioner or heat pump. But I was wrong.

In 2025, thanks to the Inflation Reduction Act (IRA) and new refrigerant standards, even components like A-coils can help you qualify for financial incentives. The key is pairing your coil with the right condenser, furnace, or air handler so your entire system meets efficiency and refrigerant standards.

Let me walk you through everything I learned about whether this Goodman coil qualifies, how rebates and credits work, and how you can save money on your upgrade.

📜 Federal Incentives in 2025

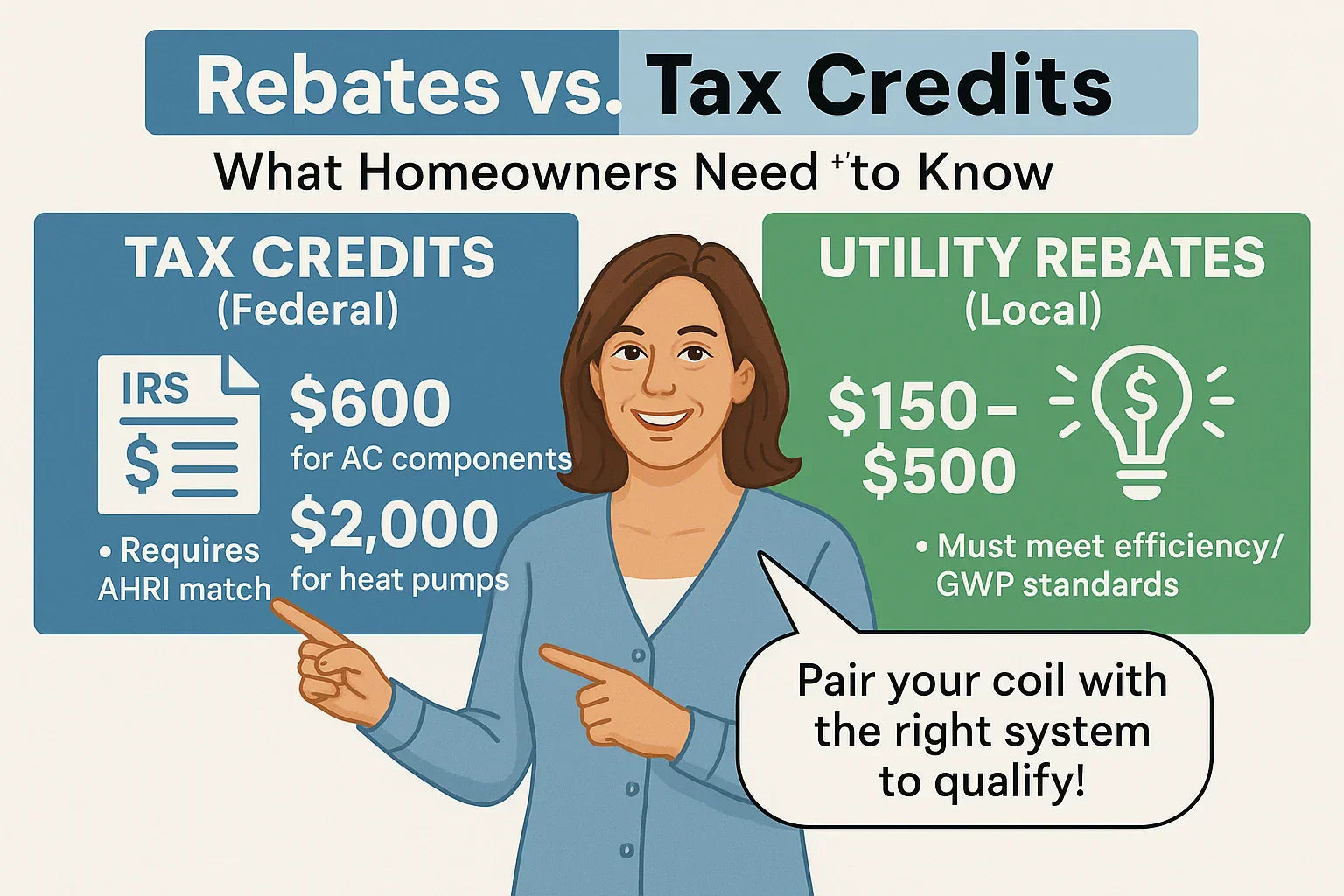

The Inflation Reduction Act of 2022 is still in full effect in 2025, and it provides tax credits for energy-efficient HVAC systems.

Here’s how it breaks down:

-

$600 Federal Tax Credit

-

Available for qualifying air conditioner components like coils, when installed as part of an AHRI-certified system.

-

Your coil alone won’t qualify—it must be matched with a condenser that meets SEER2 standards.

-

-

$2,000 Federal Tax Credit

-

For systems that include heat pumps (air-source, ducted, or mini-split).

-

If you pair your Goodman coil with a qualifying R-32 heat pump condenser, you could get this higher credit.

-

-

Form You’ll Need: IRS Form 5695 (Residential Energy Credits).

🔗 ENERGY STAR Rebate & Tax Credit Information is a great resource for checking eligibility.

👉 Translation: Your Goodman A-coil isn’t a standalone rebate winner, but when paired with a condenser in a certified match, it becomes part of a system that qualifies.

♻️ Why R-32 Compatibility Matters

The Goodman CHPTA6030D3 coil is R-32 ready, which is a big deal. Here’s why:

-

R-410A Phaseout: Starting in 2025, the EPA is phasing down R-410A due to its high global warming potential (GWP of 2,088).

-

R-32 Advantages: Lower GWP (675), higher efficiency, and already widely adopted worldwide.

-

Future-Proofing: Rebates and credits are increasingly tied to low-GWP refrigerants like R-32.

🔗 EPA Transitioning HFCs outlines the refrigerant shift happening now.

👉 In other words, by choosing this R-32 ready coil, you’re setting yourself up for eligibility in rebate programs that reward environmentally friendly choices.

🔗 AHRI Matchups: The Key to Rebates

The AHRI Directory of Certified Equipment is your best friend when it comes to rebates and credits.

-

Standalone coils don’t qualify.

-

But when your coil is paired with a Goodman R-32 condenser and furnace/air handler, it creates a certified system match.

-

This system match has an AHRI number, which is what you’ll use when applying for rebates or filing tax credits.

🔗 AHRI Directory lets you search by model numbers to confirm matchups.

👉 No AHRI number = no rebate. Always verify before purchase.

⚡ Utility Rebates

Beyond federal credits, many local utility companies offer rebates for energy-efficient HVAC systems.

-

Typical rebate amounts: $150–$500.

-

Requirements usually include:

-

High SEER2 rating (system efficiency).

-

Low-GWP refrigerant (like R-32).

-

Proof of installation by a licensed contractor.

-

Example: In hot-climate states like Texas and Arizona, utilities offer rebates for R-32 and SEER2 systems because they help reduce summer grid strain.

👉 Check your local utility’s website or the DSIRE database for available programs in your area.

🏡 State-Level Programs

Some states layer on additional rebates beyond federal and utility incentives.

-

California: Aggressive rebates for low-GWP HVAC equipment, often up to $1,000.

-

New York (NYSERDA): Offers enhanced rebates for efficient central AC systems.

-

Massachusetts (Mass Save): Rebates for high-efficiency systems, sometimes paired with 0% financing.

👉 Depending on your state, you could combine federal, state, and utility incentives for stacked savings.

💵 Real-World Cost Offsets

Here’s what costs look like in 2025 for the Goodman 4.5 Ton Horizontal A-Coil with TXV:

-

Equipment Price: $900–$1,200.

-

Installed with Condenser + Furnace: $3,000–$4,000 total.

-

Rebates/Credits Available:

-

Federal tax credit: $600–$2,000.

-

Utility rebate: $150–$500.

-

State rebate (if applicable): $200–$1,000.

-

👉 For my installation, I spent around $3,200 but got $900 back between federal and utility programs.

🛠️ Samantha’s Checklist for Claiming Rebates

Here’s the exact process I followed:

-

Confirm AHRI Match

-

Verify coil + condenser + furnace combo in the AHRI Directory.

-

-

Save Receipts

-

Keep invoices showing model numbers and installation date.

-

-

File IRS Form 5695

-

Claim federal credits on your tax return.

-

-

Apply Through Utility

-

Most require application within 90 days of installation.

-

Submit AHRI certificate and contractor invoice.

-

👉 Pro tip: Ask your contractor for the AHRI certificate at install—it saves time.

✅ Final Takeaway

So, does the Goodman 4.5 Ton R-32 Ready A-Coil qualify for rebates and tax credits in 2025?

-

On its own: No.

-

When paired in an AHRI-certified R-32 system: Yes, and it can unlock $600–$2,000 in federal tax credits plus local rebates.

For me, this made the investment in an R-32 coil an easy decision. I didn’t just get a future-proof system—I also saved nearly $1,000 upfront.

👉 My advice: Don’t just buy a coil—buy a system match. That’s the key to unlocking rebates, protecting your warranty, and future-proofing your home.

In the next topic we will know more about: Noise, Space & Design: Will a Horizontal A-Coil Fit Your Home Setup?