When I was shopping for my new Weil-McLain CGA-6 Series 3 166,000 BTU Cast Iron Natural Gas Boiler, I had one big question in the back of my mind: “Can I get money back for this?”

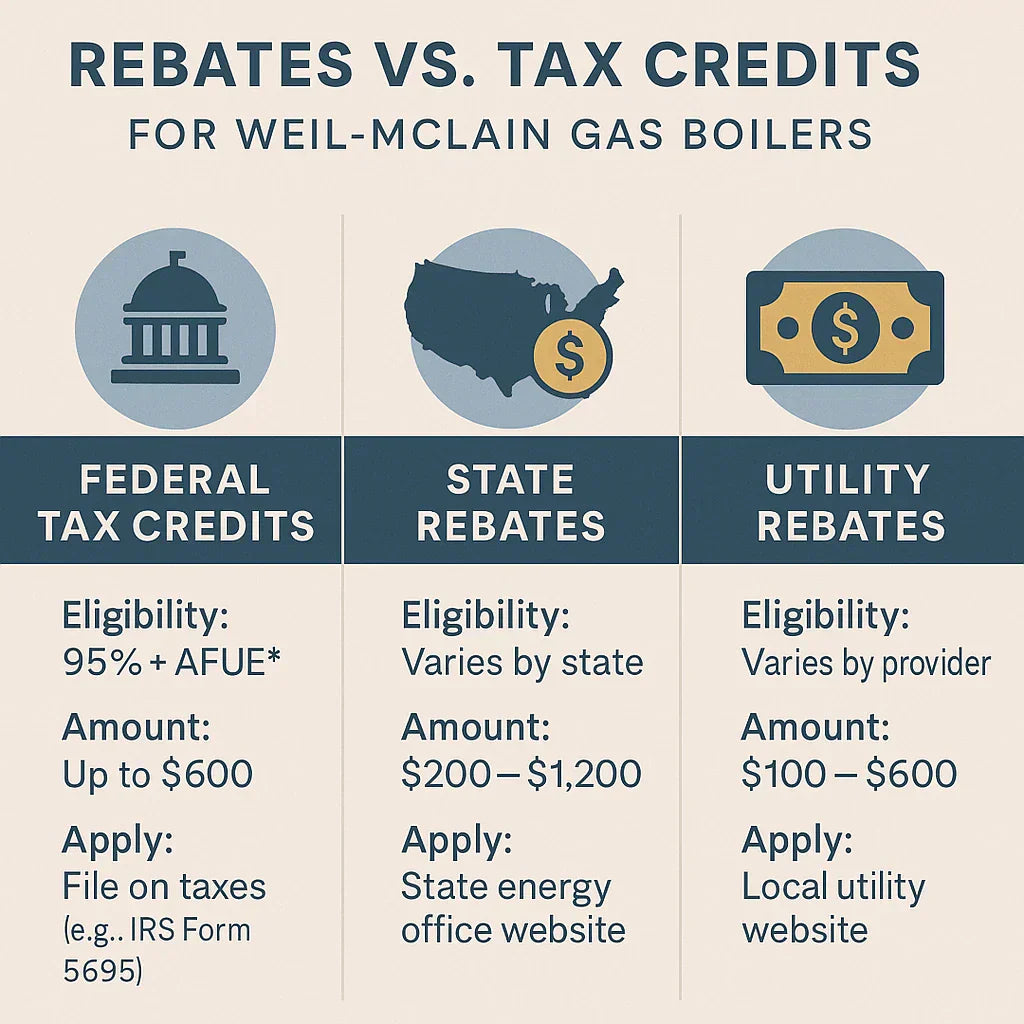

Between federal tax credits, state programs, and utility rebates, the savings can add up—if your boiler qualifies. The tricky part? Not all models are eligible.

In this guide, I’ll break down how rebates and credits work in 2025, which Weil-McLain boilers may qualify, and how I personally saved money on my install.

🏛️ Federal Tax Credits for Gas Boilers in 2025

Thanks to the Inflation Reduction Act (IRA), homeowners can still take advantage of Section 25C tax credits in 2025.

✅ The basics

-

Credit covers 30% of the cost, up to $600 for qualifying gas boilers.

-

Applies to ENERGY STAR® certified equipment that meets efficiency standards.

-

Must be installed in your primary residence (not rental or new construction).

🔗 ENERGY STAR Federal Tax Credits

⚠️ The catch with cast-iron boilers like the CGA-6

-

Most non-condensing gas boilers (around 80–85% AFUE) don’t meet the threshold for federal credits.

-

To qualify, boilers usually need 95%+ AFUE condensing technology.

-

Weil-McLain’s ECO Tec or GV90+ series condensing boilers are eligible, but the CGA-6 (82% AFUE) is not.

👉 In my case, I couldn’t use the $600 tax credit because the CGA-6 falls below the efficiency line.

🏙️ State-Level Rebates

Every state handles boiler incentives differently. Some offer generous rebates for both standard and condensing boilers, while others only reward ultra-high efficiency.

Examples of 2025 programs:

-

Massachusetts (Mass Save):

-

$2,000+ rebates for condensing gas boilers.

-

Limited incentives for standard-efficiency units.

-

-

New York (NYSERDA):

-

Rebates between $350–$1,500 depending on AFUE and capacity.

-

Focused on ENERGY STAR certified boilers.

-

-

Minnesota (CenterPoint Energy):

-

$200–$500 rebates for gas boilers 85%+ AFUE.

-

Additional credits for smart thermostats installed with system.

-

-

California (SoCalGas):

-

$300–$1,200 rebates depending on boiler type and efficiency.

-

Bonus incentives for low-income households.

-

💡 Samantha’s tip: Always start with your state energy office website, since many rebates are administered locally.

🔌 Utility Company Rebates

Even if your state doesn’t offer direct incentives, your local utility company often does.

How they work:

-

Apply directly through your gas or electric provider.

-

Usually requires:

-

Proof of purchase and installation.

-

Contractor’s license number.

-

Final inspection or invoice.

-

Typical rebate ranges (2025):

-

Standard boilers (82–85% AFUE): $200–$400.

-

High-efficiency condensing boilers: $600–$1,500.

👉 For my CGA-6 install, I received a $300 rebate from my local gas utility, even though it didn’t qualify for federal credits.

🔗 DSIREUSA – National Rebate Finder

📊 Efficiency Requirements Explained

Understanding AFUE (Annual Fuel Utilization Efficiency) is key:

-

82% AFUE (CGA-6): Standard efficiency cast-iron boiler. Reliable and durable but not rebate-friendly.

-

90–95% AFUE (condensing models): Required for most federal and high-value state incentives.

🧑🔧 Samantha’s Real-World Experience

When I bought my CGA-6, here’s how my rebate story unfolded:

-

Federal tax credit: ❌ Not eligible (82% AFUE).

-

Pennsylvania state rebate: ❌ None for standard boilers.

-

Local utility rebate: ✅ $300 rebate for any new gas boiler install.

Final savings: $300—not life-changing, but enough to cover the cost of my first year’s professional maintenance.

🧾 How to Apply for Credits & Rebates

Federal tax credits

-

File IRS Form 5695 (Residential Energy Credits).

-

Keep receipts, model numbers, and ENERGY STAR certification.

State & utility rebates

-

Submit forms online or by mail.

-

Attach proof of installation and contractor details.

-

Allow 4–12 weeks for processing.

💡 Samantha’s tip: File as soon as your installation is complete—rebate funds can run out mid-year.

💡 How to Maximize Your Savings

-

Pair upgrades: Add insulation, air sealing, or a smart thermostat to unlock bonus rebates.

-

Bundle rebates: You can often combine federal, state, and utility incentives.

-

Check eligibility before purchase: Don’t assume all Weil-McLain boilers qualify—verify AFUE ratings.

-

Use DSIREUSA: The most comprehensive database for incentives across the U.S.

📊 Cost Impact Example

Let’s compare two installs:

| Item | Weil-McLain CGA-6 (82% AFUE) | Weil-McLain ECO Tec (95% AFUE) |

|---|---|---|

| Equipment cost | $4,300 | $5,800 |

| Installation + accessories | $7,000 | $7,000 |

| Federal tax credit | ❌ Not eligible | ✅ $600 |

| State rebate (NY example) | ❌ Not eligible | ✅ $1,000 |

| Utility rebate | ✅ $300 | ✅ $500 |

| Net cost | $11,000 | $10,700 |

👉 Even though the condensing boiler costs more upfront, rebates actually make it the cheaper option in some cases.

✅ Key Takeaways

-

Not all Weil-McLain boilers qualify. Cast-iron models like the CGA-6 usually miss federal tax credits.

-

Condensing models are rebate winners. They meet the 95%+ AFUE threshold required for most incentives.

-

Utility rebates are your best fallback. Even standard boilers often earn $200–$400 from local providers.

-

Always research before you buy. Programs vary by state, utility, and year.

💡 Samantha’s advice: If rebates are a priority, lean toward a condensing model. But if you love the durability of cast iron like I do, check your utility company—you may still snag a few hundred dollars back.

In the next topic we will know more about: Cast Iron vs. Steel Boilers: Why Samantha Chose Weil-McLain