Upgrading your heating and cooling system is an exciting step, but let’s be honest — these systems can come with a big price tag. If you’re considering an Amana Distinctions PTAC unit, you might be wondering:

“Are there rebates, tax credits, or other energy incentives that can help offset the cost in 2025?”

The short answer is yes, but it depends on the unit’s efficiency, your location, and the specific program requirements.

In this guide, I’ll walk you through the latest rebates, tax credits, and incentives, explain what makes a PTAC eligible, and give practical tips to maximize your savings while keeping your apartment, studio, or rental property comfortable year-round.

🏠 1. Why Incentives Matter in 2025

Energy costs continue to rise, and governments and utilities want to encourage energy-efficient upgrades. PTAC units like the Amana Distinctions 14,700 BTU are designed to deliver efficient heating and cooling, which makes them eligible for a variety of rebates and tax credits.

Benefits of Rebates and Tax Credits

-

Reduce upfront cost: Rebate programs can cut hundreds of dollars from your purchase.

-

Lower ongoing energy bills: Energy-efficient units cost less to operate.

-

Increase property value: Energy-efficient upgrades are attractive to renters and buyers.

-

Environmental impact: Reduced energy consumption lowers your carbon footprint.

Samantha’s Tip: “Before buying, check both federal and local incentives — sometimes the savings can be enough to cover installation costs.”

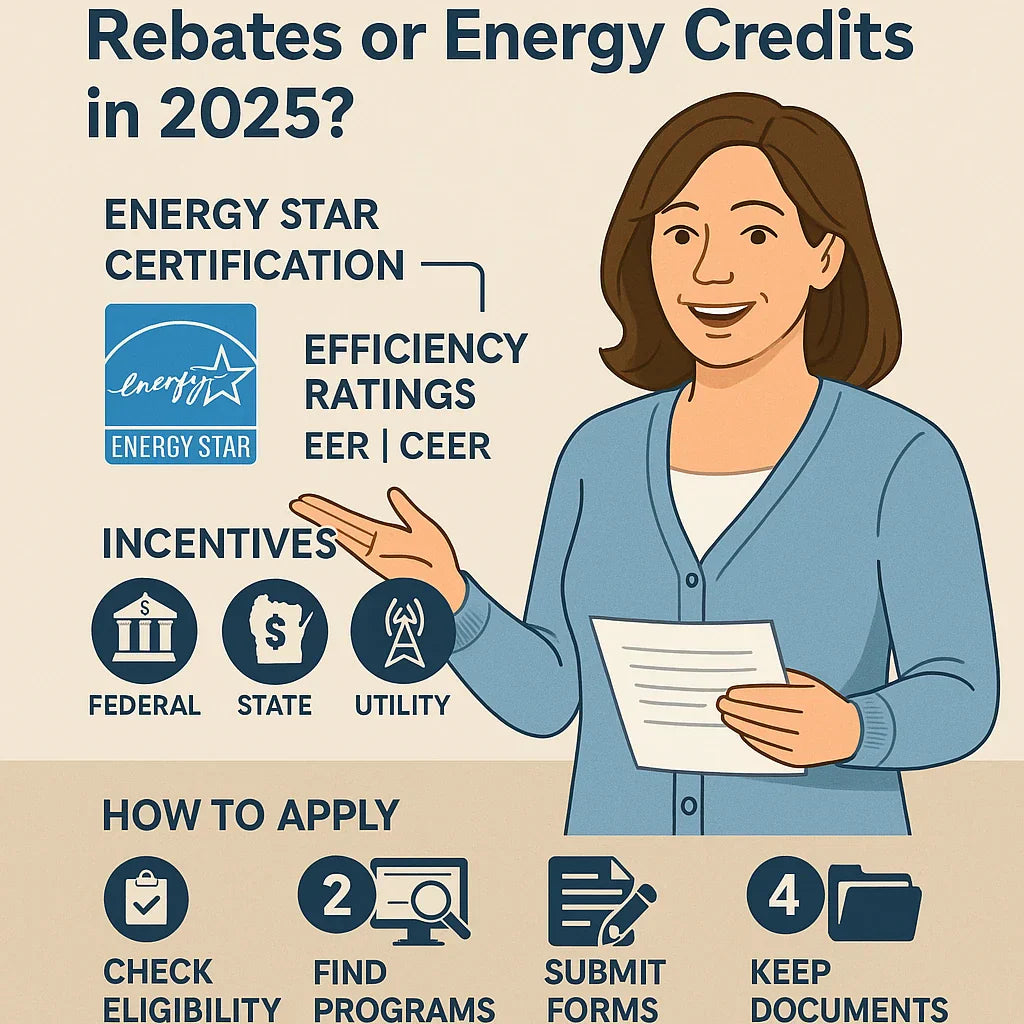

⚡ 2. Understanding Energy Efficiency Ratings

A PTAC’s eligibility for rebates or energy credits often depends on its efficiency ratings.

EER (Energy Efficiency Ratio)

-

Measures how effectively the unit cools per watt of electricity consumed.

-

Higher EER = more efficient.

-

Example: Amana Distinctions 14,700 BTU PTAC has an EER of 9.5, which qualifies for many incentive programs.

CEER (Combined Energy Efficiency Ratio)

-

Includes standby power and real-world operation.

-

Gives a more accurate picture of actual energy use.

-

Many utility and rebate programs require minimum CEER thresholds.

Why Ratings Matter

-

ENERGY STAR certification and high EER/CEER ratings make PTACs eligible for federal, state, and utility incentives.

-

Incentive programs often reference EER/CEER instead of just BTU output.

📘 Reference: ENERGY STAR – Room Air Conditioners Key Product Criteria

💵 3. Federal Tax Credits in 2025

The federal government offers tax incentives for energy-efficient home upgrades, including HVAC systems like PTAC units.

Federal Eligibility Criteria

-

Unit must be ENERGY STAR-certified.

-

Must meet or exceed minimum efficiency standards (EER/CEER thresholds).

-

Typically applies to residential properties, not commercial or rental units — though some exceptions exist.

How to Claim

-

Purchase an eligible PTAC unit.

-

Keep the receipt and manufacturer’s certification.

-

Complete the energy credit section of your federal tax return.

-

Submit the forms with your annual tax filing.

Samantha’s Tip: “Check with your accountant — some energy credits are non-refundable, so knowing how they apply to your taxes is key.”

📘 Reference: Energy.gov – Federal Tax Credits for Energy Efficiency

🏢 4. State and Utility Rebates

Many states and utility companies provide rebates for energy-efficient HVAC systems. These programs vary by state and even by city.

Examples:

-

California: Energy-efficient PTACs may qualify for rebates of $200–$500.

-

New York: NYSERDA rebates for replacement units that meet EER/CEER minimums.

-

Texas: Some municipal utilities offer incentives for ENERGY STAR-certified PTACs.

How to Check Eligibility

-

Search your state energy office website or local utility website.

-

Look for programs specific to residential HVAC upgrades.

-

Compare eligibility criteria: unit efficiency, installation date, and property type.

-

Submit proof of purchase, efficiency certifications, and installation documentation.

📘 Reference: DSIRE – Database of State Incentives for Renewables & Efficiency

🏷️ 5. ENERGY STAR Certification and Amana PTAC Units

ENERGY STAR is a trusted benchmark for energy efficiency. Incentive programs frequently require PTAC units to carry the ENERGY STAR logo.

Benefits of ENERGY STAR Certification

-

Rebate eligibility at both federal and state levels.

-

Reduced energy costs due to high EER/CEER performance.

-

Environmental recognition: helps reduce your carbon footprint.

-

Most Amana Distinctions PTACs meet or exceed ENERGY STAR efficiency requirements, making them strong candidates for rebates.

📘 Reference: ENERGY STAR Certified PTACs

📝 6. Step-by-Step Guide to Claiming Rebates or Credits

Step 1: Verify Your PTAC Eligibility

-

Check the unit’s model number, EER/CEER rating, and ENERGY STAR certification.

Step 2: Identify Programs

-

Federal incentives: claim on tax return.

-

State incentives: visit your energy office or utility website.

-

Utility rebates: apply directly with proof of purchase.

Step 3: Gather Documentation

-

Purchase receipt

-

Installation details (optional for some utility programs)

Step 4: Submit Application

-

Complete forms online or by mail.

-

Attach all supporting documentation.

-

Track application approval for rebate payment or tax credit application.

Step 5: Follow Up

-

Keep a copy of all submissions.

-

Check your utility or IRS account for processing status.

Samantha’s Tip: “Many utility programs are seasonal or have limited funding — apply early to secure your rebate.”

💡 7. Common Questions and Misconceptions

Can I claim rebates for older PTAC units?

-

Usually no; most programs require replacing old units with ENERGY STAR-certified models.

Do rebates cover installation costs?

-

Sometimes yes, sometimes no. Check program guidelines.

-

Many rebates cover equipment only; installation is often extra.

How long are incentives available?

-

Varies: federal tax credits have annual limits, state and utility rebates may run until funding is depleted.

🌟 8. Samantha’s Takeaway

“Investing in an Amana PTAC is smart for comfort and efficiency, but the real bonus is that 2025 offers multiple ways to save money on purchase through rebates and energy credits. Just make sure your unit meets ENERGY STAR and efficiency requirements, and don’t skip verifying your local programs — the savings can be substantial.”

By taking advantage of these programs, you can reduce upfront costs, lower monthly energy bills, and make an environmentally responsible choice for your home.

In the next topic we will know more about: Amana vs. GE vs. Hotpoint: Which PTAC Brand Offers the Best Value?