When your HVAC system breaks down, you’re often faced with a big decision: repair the part that failed or replace the entire system. And with tax credits and rebates available for energy-efficient HVAC upgrades in 2025, many homeowners wonder: do repairs or component replacements qualify for federal tax credits?

The short answer is: repairs don’t qualify, and most part replacements don’t either. Federal tax credits are designed to reward homeowners for upgrading to high-efficiency systems—not for keeping older ones running.

In this guide, I’ll break down what does and doesn’t qualify, why the IRS has strict rules, and how to make the most of available rebates and credits.

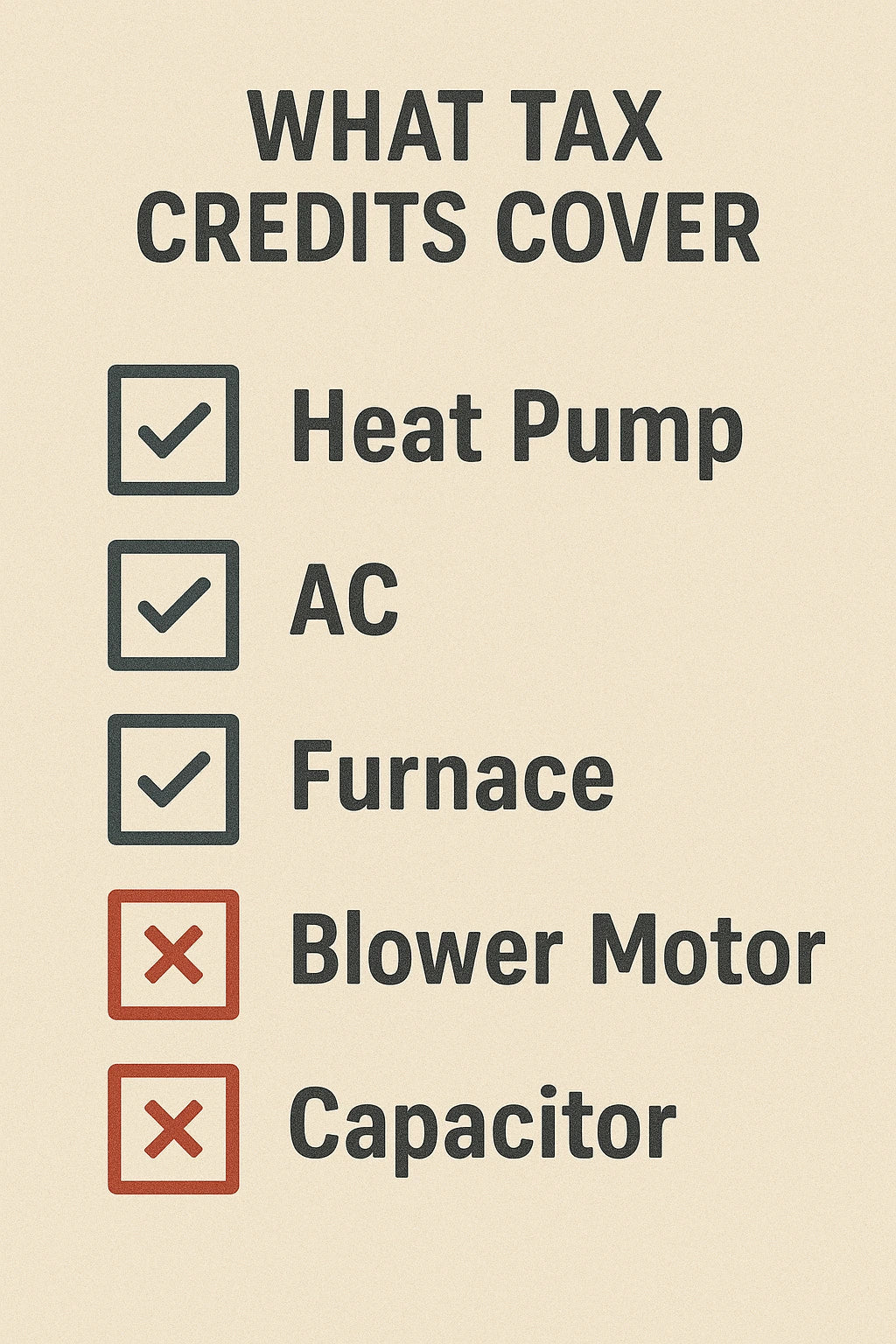

What HVAC Tax Credits Cover in 2025

Under the Inflation Reduction Act, homeowners can claim federal tax credits on qualifying HVAC systems through 2032. For 2025, the most relevant incentives include:

-

Heat pumps: Up to $2,000 if the system meets high-efficiency standards.

-

Air conditioners, furnaces, and boilers: Up to $600.

-

Home energy audits: $150 when performed by a qualified professional.

According to the IRS Form 5695 instructions, the credit is based on equipment that is “placed in service” during the tax year. That means the entire system must be installed and operational—not just a part swapped out.

The ENERGY STAR heating and cooling guide emphasizes that systems must meet minimum efficiency requirements (like SEER2 for air conditioners and HSPF2 for heat pumps) to qualify. Simply repairing or replacing one component does not bring an older system up to standard.

Do Repairs Qualify for Tax Credits?

Unfortunately, routine HVAC repairs do not qualify for federal tax credits. This includes:

-

Replacing capacitors or blower motors

-

Fixing refrigerant leaks

-

Swapping out compressors

-

Repairing electrical boards

These repairs keep your system working but don’t improve efficiency or reduce energy use—the core goals of the federal credit program.

The U.S. Department of Energy’s Energy Saver makes this clear: tax credits are meant for projects that reduce household energy consumption. Fixing an old unit doesn’t move the needle on efficiency.

What About Component Replacements?

This is where things get a little more nuanced.

Major Components

Replacing large parts like condensers, evaporator coils, or furnace heat exchangers may feel like an upgrade, but they typically don’t qualify for tax credits. The IRS requires that the system as a whole meets the efficiency threshold.

For example:

-

Installing a new outdoor AC unit but keeping an old indoor coil? → No tax credit.

-

Replacing just a furnace burner assembly? → No tax credit.

Smaller Components

Some components fall into a gray area:

-

Smart thermostats: These generally qualify for utility rebates but not federal tax credits. The ENERGY STAR rebate finder shows multiple local rebate options.

-

Ductwork repairs: Important for efficiency but not covered by federal credits. Some states and utilities may offer separate duct-sealing rebates.

Alternatives to Tax Credits for Repairs

Even though repairs don’t earn federal tax credits, you may still find financial help through:

-

Utility rebates: Some programs offer rebates for tune-ups, duct sealing, or installing smart thermostats.

-

State programs: The Database of State Incentives for Renewables & Efficiency (DSIRE) lists local rebates that can apply to smaller efficiency upgrades.

-

Manufacturer promotions: Brands sometimes provide seasonal incentives on replacement parts or accessories.

These programs may not be as large as federal tax credits, but they can help offset the cost of keeping your system efficient.

When It Makes Sense to Replace vs. Repair

Here’s the real decision point for many homeowners: should you keep repairing or replace the entire system?

Industry standards suggest replacement is worth considering if:

-

Your repair costs exceed 40–50% of the cost of replacement.

-

Your system is more than 12–15 years old.

-

Your equipment is no longer efficient enough to qualify for rebates or credits.

The Air Conditioning Contractors of America recommends weighing the age, efficiency, and repair history of your system when making the call. Replacing opens the door to tax credits and rebates, while repeated repairs often drain money without improving efficiency.

Final Thoughts

HVAC repairs and component replacements do not qualify for federal tax credits. The IRS only rewards whole-system upgrades that meet modern efficiency standards.

That doesn’t mean you’re out of options. Local rebates, state incentives, and manufacturer promotions can soften the cost of repairs or smaller upgrades. But if your system is aging and inefficient, a full replacement is the only way to tap into the larger federal tax credits and long-term energy savings.

📘 For a full breakdown of available incentives, visit 2025 HVAC Tax Credits & Rebates Explained

👉 Next in this series: Do You Have to File IRS Form 5695 for Every HVAC Upgrade?

Alex Lane

Your Home Comfort Advocate