Cash flow—not skill—is what kills most HVAC start-ups.

I’ve watched great installers shut their doors while mediocre ones stayed open for one reason: the mediocre ones managed cash better.

You can do perfect installs and still go broke if money doesn’t move when it needs to. This guide is about keeping cash flowing, covering surprises, and building breathing room while your business grows.

Goodman 68,240 BTU 20 kW Electric Furnace with 2,000 CFM Airflow - MBVK20DP1X00, HKTAD201

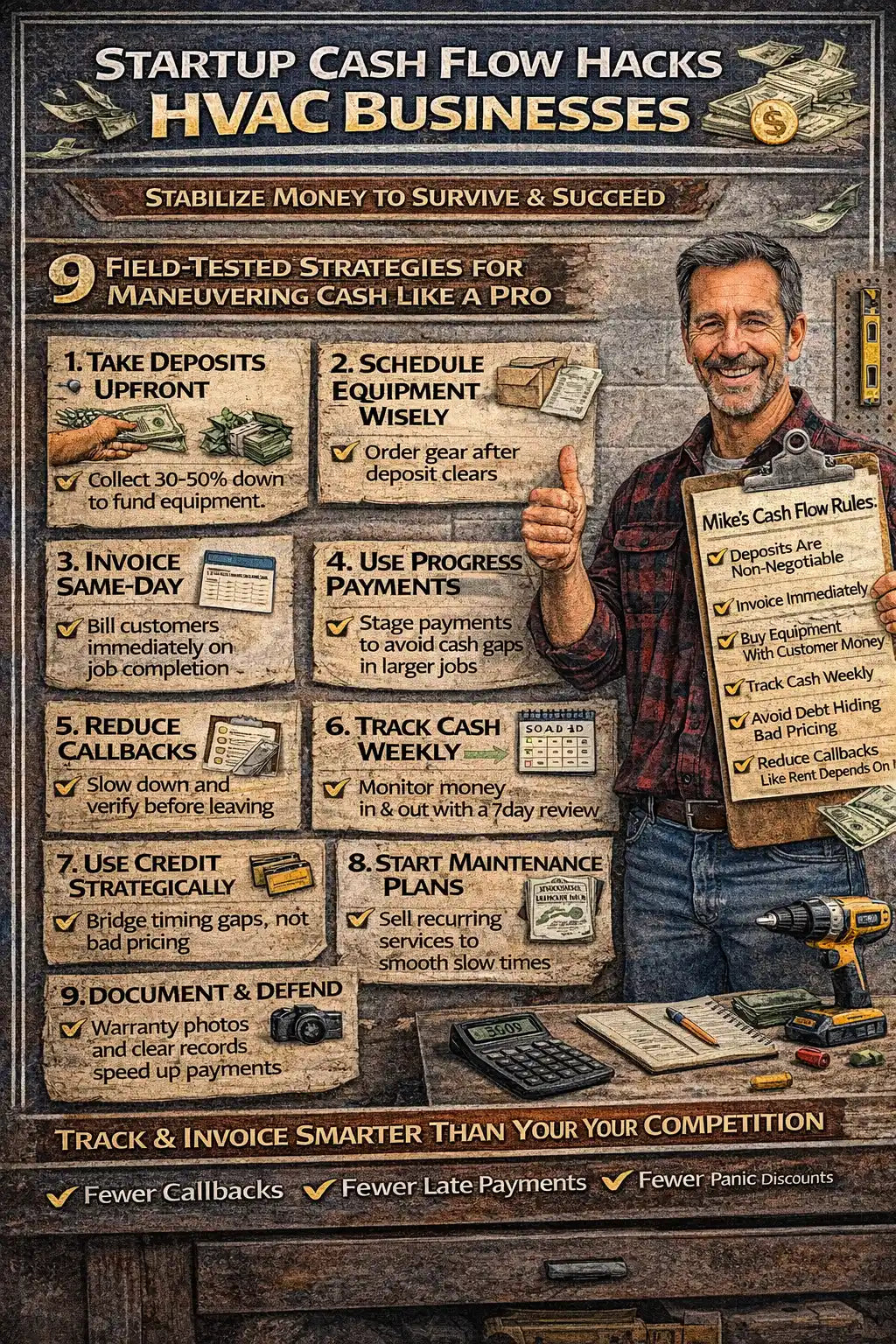

These aren’t theory hacks. These are field-tested survival strategies that work when you’re new, busy, and stretched thin.

🧠 Why Cash Flow Matters More Than Profit (At First)

Early on, profit is theoretical.

Cash is real.

You can be “profitable on paper” and still:

-

Miss payroll

-

Delay equipment orders

-

Rack up credit card debt

-

Panic during slow weeks

Your first goal isn’t maximum profit—it’s predictable cash movement.

🚨 The Biggest Cash Flow Traps HVAC Startups Fall Into

Before we fix cash flow, let’s call out what breaks it.

❌ Paying for Equipment Up Front

Buying equipment weeks before payment hits your account drains cash fast.

❌ Delaying Invoices

Every day you wait to invoice is a free loan to the customer.

❌ Underpricing Labor

Cheap jobs feel like work—but they don’t refill the tank.

❌ Ignoring Small Expenses

Fuel, fittings, tools, software—they add up quietly.

Fixing cash flow means fixing behavior first.

🧾 Hack #1: Get Paid Before You Touch the Job

This one change alone saves more startups than any marketing trick.

💰 Use Deposits—Always

For installs:

-

Collect 30–50% upfront

-

Balance due on completion

Deposits:

-

Fund equipment purchases

-

Filter out bad customers

-

Protect you from cancellations

This is standard practice—not aggressive.

The Small Business Administration confirms deposits are normal for service businesses:

📦 Hack #2: Time Equipment Purchases Strategically

Cash flow dies when money leaves too early.

✅ Best Practices:

-

Order equipment after deposit clears

-

Use suppliers with fast fulfillment

-

Avoid stockpiling inventory early

Large items like furnaces and air handlers tie up thousands of dollars. Buy them just-in-time, not “just in case.”

⏱️ Hack #3: Invoice the Same Day—No Exceptions

If the job is done, the invoice should already be sent.

📄 Same-Day Invoicing:

-

Shortens payment cycles

-

Reduces disputes

-

Improves cash predictability

Cloud invoicing tools make this easy, but even a simple PDF beats waiting.

The IRS emphasizes clean records and timely invoicing for small businesses:

👉 https://www.irs.gov/businesses/small-businesses-self-employed

🔁 Hack #4: Use Progress Payments for Bigger Jobs

For multi-day installs or larger projects:

-

Deposit upfront

-

Progress payment midway

-

Final payment at completion

This prevents:

-

You financing the job

-

Cash gaps during long installs

-

Stress when delays happen

Progress payments protect both sides.

🔧 Hack #5: Reduce Callbacks to Protect Cash

Callbacks don’t just cost time—they bleed money.

Every unpaid return trip means:

-

Lost labor hours

-

Lost opportunity

-

Increased stress

🛠️ Cash-Smart Prevention:

-

Slow down at startup

-

Document everything

-

Verify airflow, voltage, controls

Manufacturers emphasize proper installation and commissioning for system performance:

👉 https://www.goodmanmfg.com/resources

One avoided callback can equal the profit of an entire service call.

📊 Hack #6: Track Cash Weekly (Not Monthly)

Monthly reviews are too slow for startups.

📅 Weekly Cash Check:

-

Money in

-

Money out

-

Upcoming bills

-

Equipment orders

You don’t need fancy software—just visibility.

Knowing where you stand removes panic decisions.

💳 Hack #7: Use Credit Strategically (Not Emotionally)

Credit isn’t evil—but it’s dangerous if misused.

✅ Smart Uses of Credit:

-

Short-term gaps between deposit and payment

-

Equipment purchases with confirmed jobs

-

Emergencies

❌ Bad Uses:

-

Covering underpriced jobs

-

Funding lifestyle upgrades

-

Chasing slow-paying customers

Debt should support growth—not hide problems.

🔄 Hack #8: Create Maintenance Plans Early

Recurring revenue smooths cash flow better than anything else.

🔧 Maintenance Agreements:

-

Annual tune-ups

-

Priority scheduling

-

Small monthly or yearly fees

Even a handful of plans:

-

Creates predictable income

-

Keeps customers connected

-

Fills slow seasons

Energy.gov highlights maintenance as key to system efficiency and longevity:

👉 https://www.energy.gov/energysaver/energy-saver

📸 Hack #9: Document Everything to Protect Payment

Cash flow suffers when disputes delay payment.

Documentation helps you:

-

Prove work completed

-

Defend pricing

-

Support warranty claims

AHRI emphasizes installation quality and documentation as part of system performance:

👉 https://www.ahrinet.org

Photos, checklists, and signatures shorten payment delays.

🚫 Cash Flow Mistakes That Sink HVAC Startups Fast

❌ “I’ll Get Paid Later”

Later turns into never.

❌ Mixing Personal and Business Money

You lose clarity—and control.

❌ Chasing Revenue Instead of Cash

Busy doesn’t mean solvent.

🧠 How Cash Flow Stability Changes Everything

When cash flow is under control:

-

You price jobs calmly

-

You slow down on installs

-

You stop panic discounting

-

You sleep better

Cash flow doesn’t just protect your business—it protects your judgment.

🧱 Mike’s Cash Flow Rules for HVAC Startups

If you remember nothing else, remember this:

-

Deposits are non-negotiable

-

Invoice immediately

-

Buy equipment with customer money, not yours

-

Track cash weekly

-

Avoid debt used to hide bad pricing

-

Reduce callbacks like your rent depends on it—because it does

🧠 Mike’s Final Word

Cash flow isn’t glamorous—but it’s what keeps the lights on.

You don’t need massive sales volume to survive early on.

You need predictable money movement, discipline, and systems that protect you from yourself.

Do installs clean.

Get paid on time.

Keep cash visible.

That’s how HVAC start-ups become stable businesses instead of cautionary tales.