💵 Rebates, Tax Credits & Energy Savings: How Mike Claimed His 2025 HVAC Incentives

🔥 Introduction: When Efficiency Meets Opportunity

When Ohio homeowner Mike Sanders replaced his 20-year-old gas furnace, he wasn’t just looking for warmth. He wanted a system that made financial sense — one that would lower his bills and qualify for as many 2025 energy incentives as possible.

After weeks of research, Mike chose the Goodman GMVC96, a 96% AFUE (Annual Fuel Utilisation Efficiency) two-stage gas furnace paired with a smart thermostat and ComfortBridge™ controls.

The system promised high efficiency — but what really sealed the deal were the rebates and tax credits he could claim.

“I saved almost $850 between federal credits and local rebates,” Mike says. “It was like the government and my gas company helped pay for my upgrade.”

Now, Mike enjoys quieter operation, lower heating costs, and the satisfaction of knowing he’s doing something good for both his wallet and the planet.

This in-depth guide walks you through how Mike did it — and how you can maximise your own HVAC incentives in 2025.

🧭 1️⃣ Why HVAC Incentives Exist — and Why 2025 Is a Big Year

The U.S. government has made energy efficiency a national priority. The Inflation Reduction Act (IRA), passed in 2022, expanded and extended tax credits for homeowners who upgrade to high-efficiency heating, cooling, and water heating systems.

The goal:

✅ Cut household energy use

✅ Reduce carbon emissions

✅ Support the transition to cleaner technologies

In 2025, multiple programs — federal, state, and local — continue offering homeowners like Mike hundreds (or even thousands) in savings.

📘 Reference: Energy.gov – Federal Tax Credits, Rebates, and Savings Programs

🧮 2️⃣ The Three Main Types of HVAC Savings in 2025

Mike’s savings came from stacking three kinds of incentives — a powerful strategy any homeowner can use.

| Incentive Type | What It Is | Example | Typical Range |

|---|---|---|---|

| Federal Tax Credits | Money back when you file your IRS taxes | 25C Home Energy Improvement Credit | Up to $600 |

| State/Utility Rebates | Cash payments or bill credits | Dominion Energy Rebate | $100–$500 |

| Manufacturer Rebates | Brand-specific offers | Goodman Seasonal Promo | $25–$150 |

Each one works independently but can be combined to maximize total savings — as long as you file them correctly.

“It’s not just one program — it’s three buckets of savings,” Mike explains. “You just have to know where to look.”

🏠 3️⃣ Mike’s Starting Point: An Old, Inefficient Furnace

Mike’s previous system was an 80% AFUE furnace installed around 2005. That meant:

-

20 cents of every dollar in fuel went up the flue.

-

His home’s heating bills averaged $200/month.

-

The system produced unnecessary CO₂ and used outdated ignition technology.

He knew a high-efficiency replacement could slash utility bills by 20–25%.

But what sealed his decision was learning that furnaces over 95% AFUE qualify for ENERGY STAR® and federal tax incentives.

📗 Reference: ENERGY STAR – Gas Furnace Criteria (2025)

⚙️ 4️⃣ The Upgrade: Goodman GMVC96 96% AFUE Two-Stage Furnace

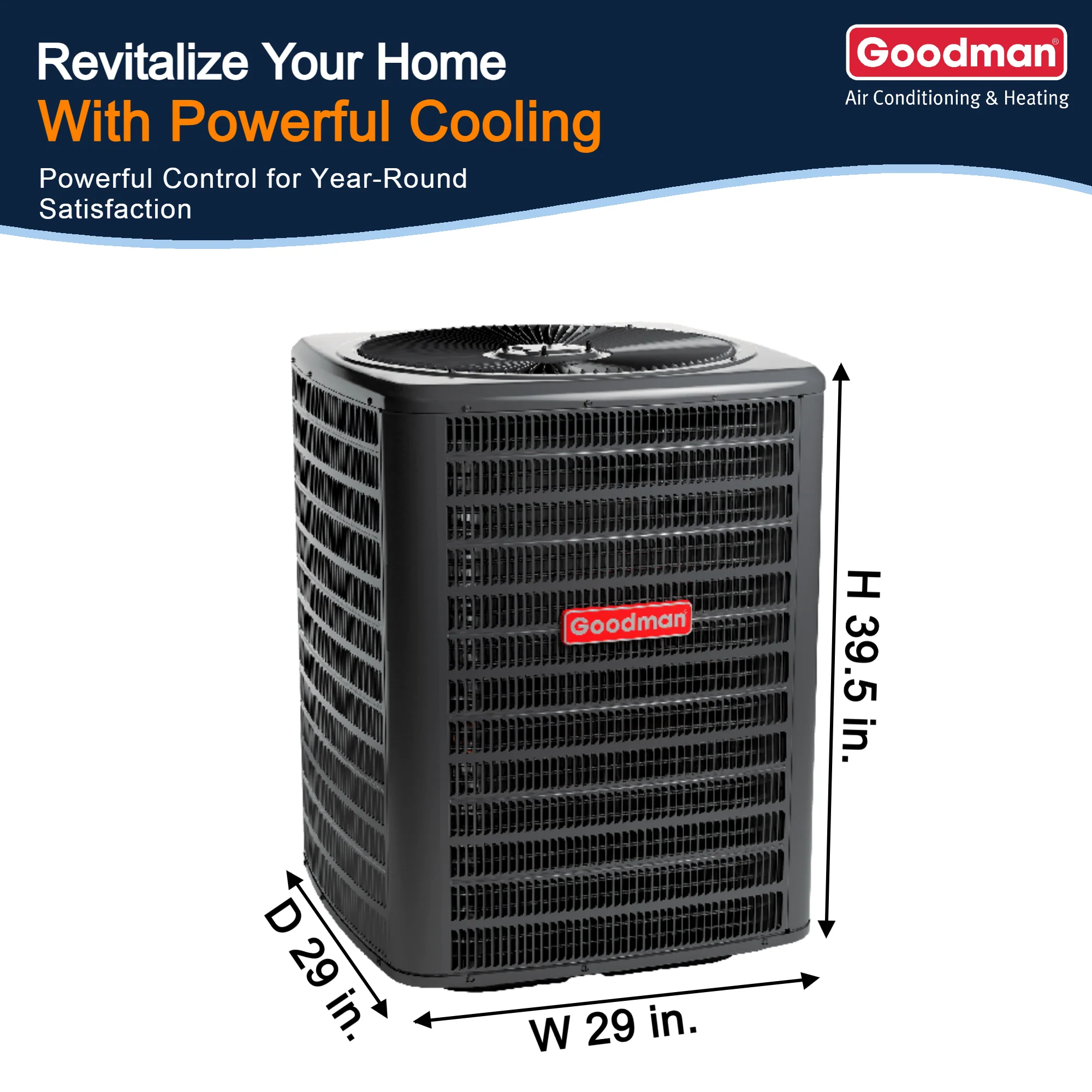

Mike’s contractor recommended the Goodman GMVC96, a top-rated, ENERGY STAR-certified furnace with:

-

Two-stage gas valve (for efficiency and comfort)

-

Variable-speed ECM blower motor (saves 60% more energy than PSC motors)

-

ComfortBridge™ smart control (for optimisation and diagnostics)

It cost about $4,800 installed, including a new thermostat and venting upgrades.

“It wasn’t the cheapest furnace on paper,” Mike says, “but the rebates made it the best value.”

📘 Reference: Goodman – GMVC96 Product Specifications

💰 5️⃣ Federal 25C Energy Efficient Home Improvement Credit

The cornerstone of Mike’s savings was the Section 25C Federal Energy Efficient Home Improvement Credit, renewed through 2032.

💵 What It Covers

-

30% of the total project cost (equipment + labour)

-

Capped at $600 per furnace or $1,200 total per year for combined HVAC upgrades

🧮 Mike’s Calculation

| Type Total“My accountant said it was one of the easiest credits to claim — just one extra form at tax time.” | |||

|---|---|---|---|

📘 Reference: Energy Efficient Home Improvement Credit (Form 5695)

🏦 6️⃣ State and Utility Rebates: Cash in Mike’s Mailbox

Next came local rebates. Mike’s utility company — Dominion Energy Ohio — offers a $150 rebate for high-efficiency furnaces rated 95% AFUE or higher.

He also qualified for an additional $75 through Columbia Gas’s Energy Efficiency Program.

These programs required:

-

Proof of purchase

-

Installation date

-

Model number verification

Mike applied online and received both checks within six weeks.

| Program | Type | Amount | Payout Time |

|---|---|---|---|

| Dominion Energy Rebate | Utility | $150 | 4 weeks |

| Columbia Gas Bonus | Utility | $75 | 6 weeks |

📗 Reference: ENERGY STAR – Local Rebate Finder Tool

🏭 7️⃣ Manufacturer Promotions: Goodman’s Seasonal Bonus

Goodman often partners with dealers to offer limited-time rebates for ENERGY STAR-certified installations.

Because Mike purchased through an authorised Goodman contractor, he received:

-

$25 instant rebate (applied at purchase)

-

Extended parts warranty (10 years with online registration)

These programs vary seasonally, so checking during spring or fall sales events can make a difference.

📊 8️⃣ Mike’s Total Savings Breakdown

Here’s how everything added up for Mike’s installation:

| Source | Incentive Type | Amount Saved |

|---|---|---|

| Federal 25C Tax Credit | IRS | $600 |

| Utility Rebates | Dominion + Columbia Gas | $225 |

| Manufacturer Rebate | Goodman Promo | $25 |

| Total Savings | — | $850 |

| Net Cost After Incentives | — | $3,950 |

“Between rebates and my first winter’s gas savings, I’ve already covered 25% of what I spent.”

🌡️ 9️⃣ Long-Term Energy Savings: The Real Financial Win

While rebates are great upfront, efficiency pays off year after year.

Mike’s old 80% furnace used 875 therms per year. His new one uses 700.

| Furnace Efficiency | Monthly Bill | Annual Cost | Annual Savings |

|---|---|---|---|

| 80% AFUE | $200 | $2,400 | — |

| 96% AFUE | $155 | $1,860 | $540/year |

That’s $8,100 saved over a 15-year lifespan — not including maintenance and repair savings from newer, smarter components.

📗 Reference: Energy.gov – Furnace Efficiency & Fuel Savings

🧰 🔟 Step-by-Step: How Mike Claimed His 2025 HVAC Incentives

Mike’s success wasn’t luck — it was process. Here’s exactly how he claimed each incentive.

🪜 Step 1: Confirm Eligibility

He used the AHRI directory to verify his furnace’s model number met ENERGY STAR® and rebate criteria.

📘 Reference: AHRI Directory – Certified Product Lookup

🪜 Step 2: Keep All Documentation

He saved:

-

Furnace purchase invoice

-

Installer license info

-

AHRI certificate

-

ENERGY STAR verification

-

Photos of the installed system

Most rebate applications require these attachments.

🪜 Step 3: Submit Utility Rebate Forms Online

He applied within 30 days of installation, which is critical because some programs close quarterly.

“Don’t wait — some utility budgets run out fast,” Mike warns.

🪜 Step 4: File IRS Form 5695

When tax season came, Mike’s accountant filed IRS Form 5695, claiming the $600 credit under Section 25C.

The credit applied directly to his federal tax bill — not just a deduction.

🪜 Step 5: Register for Manufacturer Warranty & Bonus Rebate

He registered his Goodman furnace serial number on the Goodman website within 60 days, locking in his 10-year parts warranty and rebate eligibility.

🧾 1️⃣1️⃣ Understanding Credits vs. Rebates: The Key Difference

Mike learned the hard way that a credit and a rebate are not the same thing.

| Type | Definition | When You Receive It |

|---|---|---|

| Tax Credit | Reduces taxes owed dollar-for-dollar | At tax filing time |

| Rebate | Cash or check from a utility or manufacturer | Within weeks of installation |

| Deduction | Lowers taxable income | During tax filing, smaller impact |

The beauty of 25C is that it’s a true credit — meaning if you owe $3,000 in taxes, your $600 HVAC credit reduces it to $2,400.

📘 Reference: ENERGY STAR – Understanding Energy Tax Credits

🌍 1️⃣2️⃣ The Environmental Impact: Smaller Bills, Smaller Footprint

Mike’s high-efficiency system doesn’t just save money — it reduces his household’s carbon emissions by nearly 1.6 tons per year.

| Furnace AFUE | Gas Use (Therms) | CO₂ Emissions (lbs/year) |

|---|---|---|

| 80% | 875 | 9,652 |

| 96% | 700 | 8,050 |

| Reduction | — | 1,602 lbs (≈0.8 tons) |

That’s the equivalent of:

-

Driving 1,800 fewer miles annually

-

Planting 25 trees

-

Powering one LED-lit home for six months

🏡 1️⃣3️⃣ Common Mistakes Homeowners Make When Filing

Even with all the right info, many homeowners miss out on rebates due to small errors. Here’s what Mike avoided:

-

❌ Forgetting to keep installation invoices.

-

❌ Missing submission deadlines (usually 90 days).

-

❌ Assuming all models qualify — always verify AFUE.

-

❌ Filing the wrong tax year (use year of installation).

-

❌ Not claiming the “installed cost” (labor included).

“If you treat it like free money, you might lose it. Treat it like paperwork, and you’ll get rewarded.”

🧱 1️⃣4️⃣ Regional Programs: Opportunities Across the U.S.

Mike’s Ohio rebates are part of a much larger nationwide trend.

Here are examples of 2025 HVAC rebate programs across different states:

| State | Program | Incentive |

|---|---|---|

| California | SoCalGas High Efficiency Program | $200–$600 for ≥95% AFUE |

| Texas | CenterPoint Energy | $150 per furnace |

| New York | NYSERDA Clean Heating Rebate | $300–$400 |

| Massachusetts | Mass Save Program | $500 for ENERGY STAR models |

| Florida | TECO Rebate | $200 for high-efficiency gas upgrades |

📘 Reference: DSIRE – Database of State Incentives for Renewables & Efficiency

🧩 1️⃣5️⃣ Can You Stack Rebates? Yes — But Follow the Rules

Most programs allow stacking, but you can’t double-claim the same system under different incentive categories.

Mike’s stack was legal because:

-

Federal credits apply nationwide

-

State and utility rebates apply regionally

-

Manufacturer promos apply at purchase

If you claim more than one incentive on the same line item (like “installation labor”), the IRS may reject it — so keep receipts itemized.

🧮 1️⃣6️⃣ Mike’s Full ROI: The Lifetime Payoff

When you factor in rebates, energy savings, and maintenance reductions, Mike’s total return is impressive.

| Source | Year 1 | 15-Year Lifetime |

|---|---|---|

| Federal + Local Incentives | $850 | — |

| Energy Savings | $540/year | $8,100 |

| Maintenance Savings | $50/year | $750 |

| Total Value | — | $9,700+ |

That’s double his original investment, paid back through efficiency alone.

“The furnace literally pays for itself twice over,” Mike laughs.

🌿 1️⃣7️⃣ Smart Thermostat Bonus: More Rebates Available

Mike’s Honeywell T9 Smart Thermostat qualified for an additional $50 utility rebate because it’s ENERGY STAR-certified and uses geofencing automation to reduce runtime.

Many utilities now offer separate thermostat rebates, even if you’re not replacing your furnace.

📗 Reference: ENERGY STAR – Smart Thermostat Incentives

💡 1️⃣8️⃣ Estimating Your Own Savings: The Simple Formula

Before buying, you can forecast your savings using this formula:

[

\text{Total Benefit} = (\text{Federal Credit}) + (\text{Utility Rebates}) + (\text{Manufacturer Promo}) + (\text{Annual Energy Savings} \times 15)

]

Example:

[

$600 + $200 + $50 + ($540 \times 15) = $9,950

]

Even modest upgrades can yield four-figure lifetime returns.

🧠 1️⃣9️⃣ Filing Tips for a Hassle-Free Experience

Mike offers these parting lessons from his 2025 rebate experience:

-

Start early: Rebate budgets run out midyear.

-

Document everything: Photos, serial numbers, invoices.

-

Read fine print: Some programs require pre-approval.

-

Combine smart controls: It improves both efficiency and eligibility.

-

Consult your tax preparer: Credits can carry forward if you exceed your annual limit.

“The paperwork was easier than I expected — and the payoff was worth every email and form.”

🏁 2️⃣0️⃣ The Takeaway: Efficiency That Pays You Back

Mike’s story proves that upgrading your furnace in 2025 isn’t just an expense — it’s an opportunity.

By leveraging federal tax credits, local rebates, and manufacturer incentives, he turned a $4,800 investment into $9,700 in lifetime returns — while enjoying better comfort, reliability, and sustainability.

If you’re planning an HVAC upgrade, 2025 is the year to do it.

Between new energy standards and generous federal funding, the rewards for choosing high efficiency have never been higher.

“My furnace keeps me warm,” Mike says. “But knowing it’s saving me money every month? That’s the best feeling of all.”

In the next blog we will learn about: Troubleshooting Guide: What to Do If Your R-32 System Isn’t Cooling Properly