As environmental regulations push industries toward cleaner technologies, A2L refrigerants are emerging as a frontrunner. These low-global-warming-potential (GWP) refrigerants offer promise—but they also carry mild flammability, creating new challenges for insurers and policyholders alike.

Insurance isn’t just about reacting to risk—it’s about understanding it. As HVAC systems transition to A2Ls, the insurance world is celebrating its models, premiums, and protocols to account for this evolving landscape. This article explores how A2Ls are driving innovation in underwriting, risk management, and regulatory compliance.

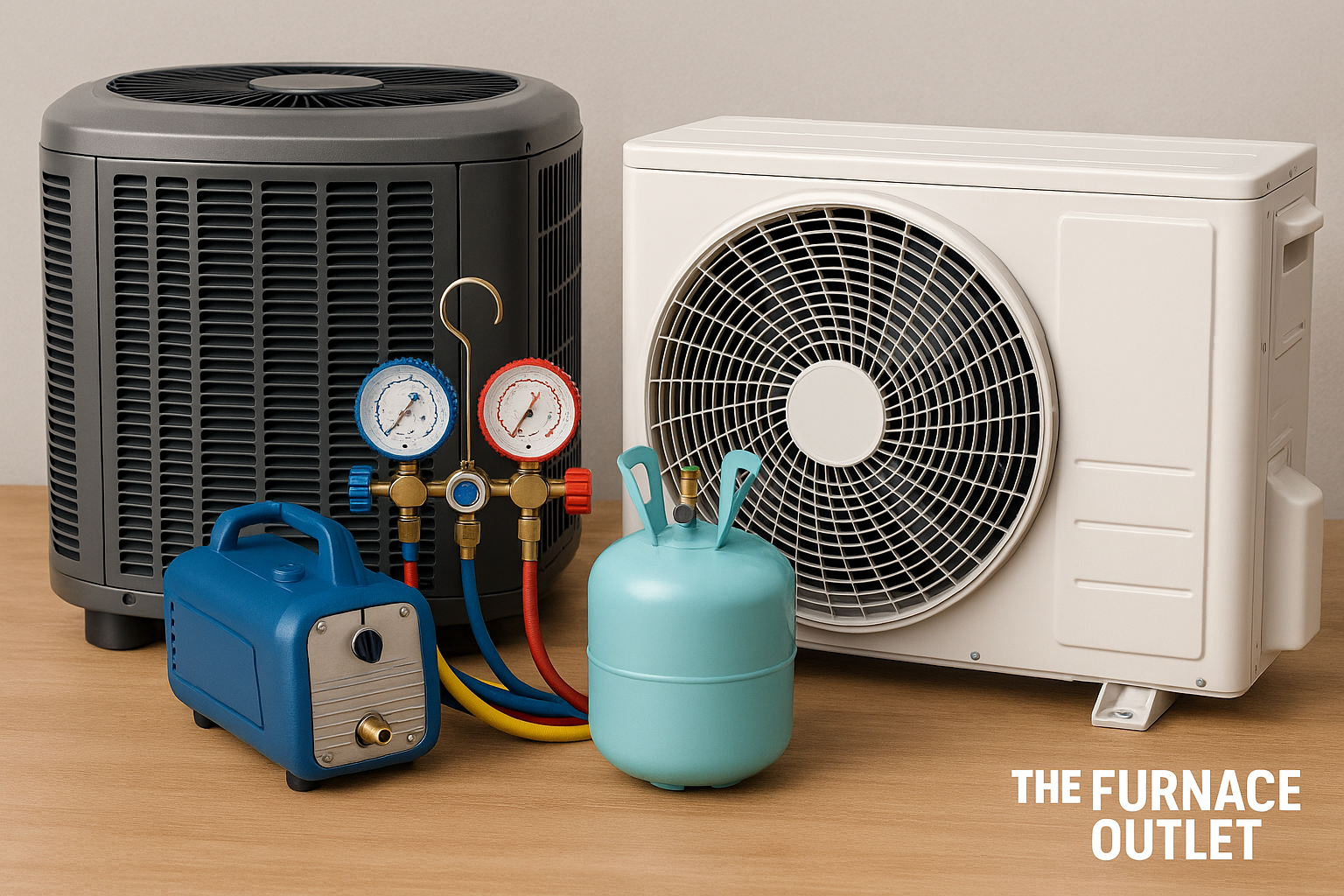

Explore R32 air conditioner and gas heater systems for optimized sustainability and system compatibility.

What Makes A2L Refrigerants Different—and Why It Matters

A2L refrigerants stand apart for two main reasons: their low environmental impact and their classification as "mildly flammable." Unlike older refrigerants like R-410A or R-134a, which have high GWP values, A2Ls like R-32 and R-454B offer a more sustainable path forward.

If you're comparing which A2L is best suited to your system, this guide on R-454B vs. R-32 outlines the key performance and safety differences.

But sustainability comes with complexity. These refrigerants require careful handling, specific installation standards, and system designs that mitigate ignition risks. From an insurance perspective, this translates to an entirely new category of operational and safety concerns that must be assessed and managed.

A Regulatory Web: Global Rules Guiding the A2L Shift

Governments are accelerating the adoption of low-GWP refrigerants through a mix of mandates and incentives. The Kigali Amendment to the Montreal Protocol, the EPA’s SNAP program, and the EU’s F-Gas Regulation are just a few examples shaping this shift.

For insurers, these evolving rules mean constant adaptation. Coverage must reflect not just current practices, but also anticipate future compliance demands. Businesses operating internationally face an additional burden—regulatory fragmentation—making policy customization essential.

Choose R32 dual-fuel packaged systems designed to help facilities meet efficiency targets and cross-jurisdictional code requirements.

Redefining Coverage: How A2Ls Are Changing Insurance Policies

When you introduce a mildly flammable substance into a building system, the risk profile changes. Traditional insurance policies built for non-flammable HFCs are no longer a one-size-fits-all solution.

Expect insurers to:

-

Adjust general liability and property coverage limits.

-

Create new endorsements for refrigerant-related fire risks.

-

Tie premiums to safety protocols and technician certifications.

Many insurers now require documentation that systems are not only installed properly, but that technicians are trained and certified in A2L refrigerant handling.

Rethinking Risk: Why Standard Models Fall Short with A2Ls

Underwriting A2L refrigerant risks isn’t as simple as checking a box for “flammable.” A2Ls exist in a middle ground—not as volatile as propane (A3), but far from inert.

The biggest challenge? A lack of long-term incident data. With limited historical claims to analyze, insurers must build models from predictive simulations, lab tests, and engineering studies. Variables like ignition temperature, concentration limits, and ventilation become critical factors.

Ensure proper component compatibility with R32 air handler systems for safe refrigerant distribution and leak prevention.

From Checklists to Customization: The New Rules of Underwriting

Insurers are beginning to overhaul underwriting strategies for A2L refrigerant systems. What’s changing?

-

Detailed system analysis: Type of A2L used, building layout, ventilation, and refrigerant charge size.

-

Operational safeguards: Maintenance schedules, technician training records, and emergency response protocols.

-

Dynamic risk scoring: Blending data from manufacturers, regulatory bodies, and claims analytics.

For HVAC engineers and facility managers, this shift underscores the importance of designing systems around A2L safety principles, not just meeting baseline compliance.

Lessons from the Field: Real Claims, Real Takeaways

Case #1: The Fire That Wasn’t Supposed to Happen

A commercial property using R-32 in a rooftop unit experienced a leak near an ignition source. The resulting fire led to extensive damage. While the system was compliant, post-incident analysis revealed insufficient ventilation—a gap in the safety strategy. Insurance covered the loss, but premiums rose significantly on renewal.

Takeaway: Meeting code isn't always enough—proactive ventilation and sensor systems matter.

Case #2: The Prepared Facility That Minimized Loss

A manufacturing plant using R-454B had a small accidental release. Because they had extensive training, automated leak detection, and a well-practiced evacuation plan, the situation was contained quickly, with minimal downtime. The insurance payout was modest, and the business earned a premium discount at renewal.

Browse accessories and leak detection systems to upgrade your facility’s safety and improve your risk profile.

Takeaway: Preparation pays—literally and operationally.

Insurers as Safety Partners: Shaping the Industry’s Response

The insurance industry is more than just a backstop; it can be a driver of safer practices. Here’s how insurers are supporting A2L adoption responsibly:

-

Premium incentives for best practices and third-party certifications.

-

Training and education programs co-developed with HVAC associations.

-

Custom risk assessments based on refrigerant type, building use, and equipment age.

Insurers are uniquely positioned to push for higher standards while helping policyholders control their costs.

Tomorrow’s Trends: What to Expect from A2L-Focused Insurance

As A2Ls become the norm, three major insurance trends are on the horizon:

-

Data-driven underwriting: IoT sensors, machine learning, and cloud-based monitoring tools will help insurers better predict incidents.

-

Sustainability-linked policies: Coverage offerings may be tied to a company’s environmental performance or refrigerant phase-down goals.

-

Multi-stakeholder collaboration: Expect deeper ties between insurers, OEMs, code developers, and regulators to shape unified safety protocols.

These trends will push the industry toward smarter, more resilient systems that balance cost, safety, and climate goals. For insurers and HVAC professionals alike, A2L refrigerants offer a chance to lead in both safety and sustainability.

Final Thoughts: Aligning Safety, Sustainability, and Smart Risk Management

A2L refrigerants are reshaping the landscape—not just for HVAC systems, but for how insurers view and manage risk. Businesses embracing A2Ls must go beyond regulatory checkboxes to implement robust safety strategies that align with evolving insurance expectations.

By partnering with insurers early, staying informed, and investing in the right technology and training, companies can protect both their operations and their premiums. For insurers, the rise of A2Ls offers an opportunity to lead—to not just insure against risk, but actively reduce it.

Ready to reduce risk and boost sustainability?

Start with UL-certified, A2L-compatible HVAC systems from The Furnace Outlet—built to meet tomorrow’s codes, safety expectations, and insurance standards.