Upgrading your HVAC system in 2025 doesn’t just mean better comfort — it could also mean serious savings. Thanks to federal tax credits and local utility rebates, homeowners can reduce their upfront costs by thousands of dollars.

The key is knowing how to combine both incentives without leaving money on the table. Many folks think it’s an either/or situation, but the truth is you can often stack them — as long as you follow the rules.

📘 New to HVAC incentives? Start with our guide: 2025 HVAC Tax Credits & Rebates Explained.

Rebates vs. Tax Credits — What’s the Difference?

Before you combine them, it’s important to understand how each works:

-

Utility Rebates

-

Offered by your utility company or state energy program.

-

Often come as a cash-back check, prepaid card, or instant discount on your installation.

-

Typically applied for within 30–90 days after installation.

-

-

Federal Tax Credits

-

Available under the Inflation Reduction Act and IRS energy efficiency programs.

-

Reduce your tax liability when you file your annual return.

-

Credits are worth up to $2,000 for qualifying heat pumps, plus smaller amounts for central ACs, furnaces, and other equipment.

-

In short: rebates save you money now, tax credits save you money at tax time.

For details on the federal side, check the ENERGY STAR tax credit guide and the IRS Energy Efficient Home Improvement Credit page.

Federal Tax Credits Available in 2025

The federal government’s biggest tool for HVAC savings comes from the Energy Efficient Home Improvement Credit. Highlights for 2025 include:

-

Heat Pumps: Up to $2,000 credit for qualifying models.

-

Central Air Conditioners: Up to $600 credit.

-

Gas Furnaces or Boilers: Up to $600 credit if ENERGY STAR-certified.

-

Home Energy Audits: Up to $150 credit.

Eligibility requires equipment that meets specific SEER2, AFUE, or ENERGY STAR standards. You can confirm your model through the ENERGY STAR product database.

How Utility Rebates Work

Utility rebates are usually designed to encourage local customers to switch to more efficient equipment. They vary widely by region but often include:

-

Cash-back rebates: $300–$1,500 for central ACs, $1,000–$3,000 for heat pumps.

-

Instant discounts: Applied directly at the time of purchase or installation.

-

Tiered incentives: Larger rebates for low- and moderate-income households.

Many utilities also require:

-

Installation by a licensed contractor.

-

Submission of receipts, AHRI certificate numbers, and energy audit results.

-

A completed application form, often within 90 days.

To find your local programs, use the DSIRE database, the most complete source of state and utility energy incentives.

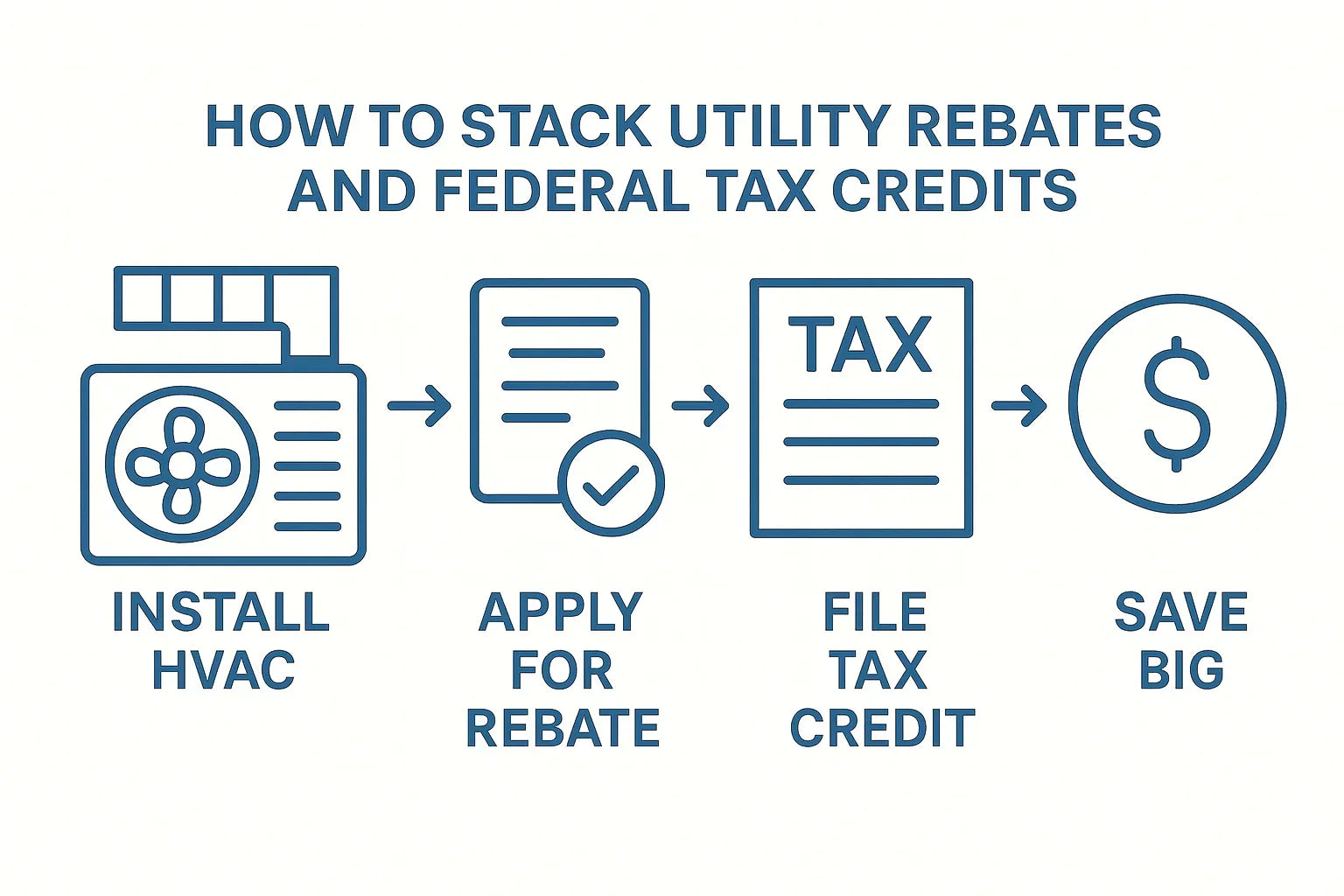

Can You Use Both Together? (Yes—Here’s How)

The good news: rebates and federal tax credits are stackable. In fact, combining them is one of the smartest ways to cut your HVAC upgrade costs.

Here’s how it typically works:

-

Install the qualifying HVAC system (make sure it meets efficiency requirements).

-

Apply for your utility rebate first. Many utilities require documentation soon after installation.

-

File your federal tax credit when you do your taxes in 2026 for your 2025 purchase.

Some state-level programs may reduce rebates if you also take the federal credit, so check the fine print. But in most cases, you can keep both without penalty.

Steps to Maximize Your Incentives

Follow these steps to make sure you capture every dollar of savings:

-

Check Your Income Eligibility

Some utility rebates are income-based, especially under IRA-funded programs. Verify your status using your area’s AMI (Area Median Income) on the HUD lookup tool. -

Confirm Equipment Certification

Look for ENERGY STAR® labels and verify the system meets SEER2 or AFUE thresholds. -

Hire a Qualified Contractor

Many rebates require installation by a utility-approved or certified contractor. -

Apply for the Rebate Promptly

Submit applications as soon as the system is installed — don’t wait, as funds can run out mid-year. -

Keep Documentation for Your Tax Credit

Save receipts, invoices, and model numbers. You’ll need these when filing your IRS Form 5695 for the credit.

Example Scenarios of Combined Savings

Let’s put the numbers into perspective:

-

Heat Pump Upgrade

-

$2,000 federal tax credit

-

$1,200 utility rebate

-

Total Savings: $3,200

-

-

High-Efficiency Furnace

-

$600 federal tax credit

-

$500 utility rebate

-

Total Savings: $1,100

-

-

Central AC Replacement

-

$600 federal tax credit

-

$800 utility rebate

-

Total Savings: $1,400

-

In some states, savings can reach 30–50% of the total installation cost, especially if income-based bonus rebates apply.

Common Mistakes to Avoid

Even with generous incentives, homeowners sometimes miss out because of avoidable errors:

-

Buying non-qualifying equipment — Always confirm ratings before purchase.

-

Missing rebate deadlines — Utilities often require applications within 30–90 days.

-

Forgetting tax paperwork — Keep documentation organized for your IRS filing.

-

Assuming you don’t qualify — Moderate- and even higher-income households may still qualify for partial rebates and full tax credits.

The Bottom Line

When you combine utility rebates with federal HVAC tax credits, you can cut thousands off your installation bill. The process requires a little paperwork, but the payoff is worth it.

My advice: plan ahead, verify your system qualifies, and apply promptly. By stacking both incentives, you’ll lower your out-of-pocket costs and enjoy efficient heating and cooling for years to come.

📘 Next up: What Paperwork You Need to Claim an HVAC Rebate Successfully.

Alex Lane

Your Home Comfort Advocate