1. 🏁 Introduction: Don’t Leave Money on the Table

Every time you buy a new SEER2 air conditioner, there’s a chance to slash thousands off your bill via federal tax credits, utility rebates, and local incentives. My job: to help you understand which ones apply, how to qualify, and where the paperwork lurks.

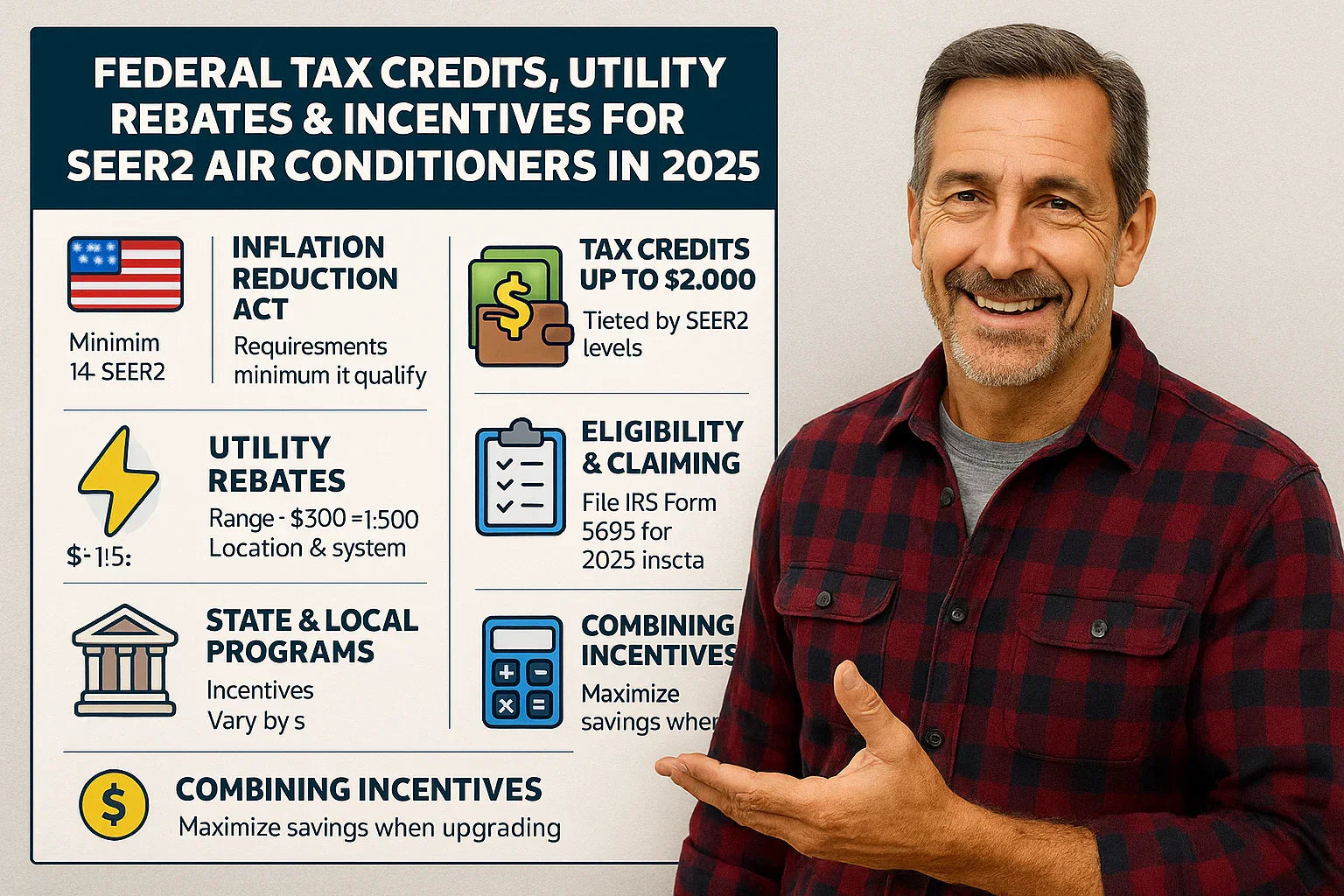

2. 🇺🇸 Federal Tax Credits Under Inflation Reduction Act

✅ Qualifying SEER2 Levels

-

Minimum: 14 SEER2 for split, single-stage systems.

-

Goodman GLXS3B2410 (13.4 SEER2) doesn’t qualify, but bumping up to 16 SEER2 does .

💵 Credit Amounts

-

Tier 1: 14–16 SEER2 = up to $600

-

Tier 2: >16–<20 = up to $1,200

-

Tier 3: ≥20 SEER2 = up to $2,000

🧾 How to Claim

-

Use IRS Form 5695, residential energy credits

-

Keep manufacturer specs showing SEER2 rating

-

Submit with your annual tax return

3. ⚡ Utility Company Rebates

-

Many offer $300–$1,500+ rebates, depending on the system’s efficiency and local climate

-

Example: TXU Energy (Texas) pays $1,000+ for 16 SEER2 systems

-

California’s SCE/SoCalGas provide $500–$1,200 for ≥16 SEER2

👉 Pro tip: Check your local utility’s website or ask your installer to bundle rebate paperwork.

4. 🏛️ State & Local Incentives

-

New York NYSERDA gives $500–$1,000

-

Massachusetts Mass Save rewards up to $1,200

-

State programs regularly morph—Mich., IL, CO, OR, and more are issuing similar offers

5. 🧮 Money in: Example Calculator

Assume a 16 SEER2 Goodman install at $10,500 total:

-

Federal credit: $600

-

Utility rebate: $800

-

State rebate: $500

➝ Total incentives: $1,900

➝ Net cost: $8,600

6. 📝 Eligibility & Common Gotchas

-

Install unit between Jan 1 and Dec 31, 2025

-

Unit must be installed and operating before claiming

-

Tax liability must exceed credit—no refund if it exceeds your total tax owed

-

Performance tiers matter—read fine print

-

Must provide AHRI certificate or manufacturer spec sheet

-

Some programs require pre‑approval

7. 🧭 Mike’s Step-by-Step Rebate Guide

-

Ask your installer: do you pre‑register systems with rebate programs?

-

Confirm installer will give you official documents: installation date, serial, SEER2 spec.

-

Submit paperwork ASAP—always before year-end cutoff

-

Hold for a check—rebates may come via check or on your utility bill

8. 🤝 Combining Strategies for Maximum Savings

| Upgrade Option | Installed Cost | Federal Tax Credit | Utility Rebate | Net Cost |

|---|---|---|---|---|

| 16 SEER2 | $10,500 | $600 | $800 | $9,100 |

| 18 SEER2 | $11,500 | $1,200 | $900 | $9,400 |

| 20 SEER2 | $13,000 | $2,000 | $1,200 | $9,800 |

9. ⏲️ Timing Is Everything

-

Tax season filing: gather documents and file in early 2026

-

Rebate windows: utility deadlines may end by Nov. 2025

-

Don’t delay install if you want 2025 credits

10. 📌 Keep Thorough Records

-

Invoice, model/serial number, date

-

Manufacturer SEER2 rating certificate

-

Tax form 5695

-

Rebate confirmations, utility bills

11. 🔗 Trusted External Resources

12. ✅ Bottom Line

-

Federal and state incentives can significantly reduce upfront cost

-

Maximum return comes from choosing ≥16 SEER2 systems

-

Diligent documentation and early submission = maximum money back

In the next article we will know about: Understanding 13.4 SEER2 — How Efficient Is the Goodman GLXS3B2410?