When you invest in a high-efficiency furnace, you expect to save money on your heating bills — but in 2025, you can go one step further.

With new and expanded programs under the Inflation Reduction Act (IRA) and dozens of state and utility rebates, homeowners can earn back up to $1,500 or more just by upgrading to a high-efficiency model like the Goodman 96% AFUE 120,000 BTU Two-Stage Variable-Speed Gas Furnace (Model GRVT961205DN).

I learned this firsthand when I replaced my old 80% furnace last year. Between the federal tax credit, my state rebate, and a utility discount, the savings were significant. And my gas bill? Down nearly 20% over the winter.

If you’re considering an upgrade in 2025, here’s your complete guide to rebates, tax credits, and smart savings opportunities for 96% AFUE furnaces — explained from a homeowner’s perspective.

💡 Why 2025 Is the Best Year Yet to Upgrade Your Furnace

The Inflation Reduction Act, passed in 2022, introduced billions in funding for home energy efficiency improvements. Those programs are now fully active — making 2025 the best time to modernize your HVAC system.

Here’s why:

-

Natural gas prices remain volatile, especially in cold-weather regions.

-

Energy-efficient homes are selling faster and at higher prices.

-

Federal and state incentives are at their peak through 2032.

💬 “When I upgraded to my Goodman 96% furnace, I didn’t just save on heating — I got hundreds back from the IRS and my utility company. It felt good to get rewarded for doing the right thing.” — Mark

According to the U.S. Department of Energy, homeowners who upgrade to qualifying ENERGY STAR equipment can save up to $1,200 annually through reduced energy bills and rebates combined.

🔍 Understanding AFUE and Why 96% Is the Magic Number

Before we dive into rebates, let’s break down what makes a 96% AFUE furnace special.

AFUE (Annual Fuel Utilization Efficiency) measures how efficiently your furnace converts fuel into heat.

-

80% AFUE furnace: 80 cents of every dollar go to heating your home; 20 cents are lost as exhaust.

-

96% AFUE furnace: 96 cents go to heating; only 4 cents are wasted.

That 16% difference adds up — and it’s why government programs reward high-efficiency upgrades.

✅ Goodman’s High-Efficiency Advantage

Goodman’s GRVT961205DN uses:

-

Dual heat exchangers to capture nearly all usable heat.

-

A two-stage gas valve that runs low most of the time, saving energy.

-

A variable-speed blower for consistent comfort and quiet operation.

These features make it ENERGY STAR® certified, automatically qualifying it for federal and state incentive

💰 Federal Tax Credits for High-Efficiency Furnaces (2025 Update)

Under the Inflation Reduction Act (IRA), the Energy Efficient Home Improvement Credit (25C) allows homeowners to claim up to 30% of project costs, capped at $600, for qualifying furnaces.

🧾 Key Details:

-

Applies to ENERGY STAR-certified furnaces with AFUE ≥ 95%.

-

Covers equipment and installation costs.

-

Credit available through December 31, 2032.

-

Claimable once per household per year.

That means Goodman’s 96% AFUE models like the GRVT961205DN fully qualify.

Example:

If your installed furnace cost is $3,000, your 30% credit = $600 off your federal tax bill.

Reference: IRS – Form 5695 Energy Credits Instructions

🧾 How to Claim the Federal Tax Credit

Claiming your furnace credit is easier than it sounds. Here’s the step-by-step guide I followed:

-

Save all paperwork: Your installer should give you the invoice and Goodman’s “Manufacturer’s Certification Statement.”

-

Complete IRS Form 5695 (“Residential Energy Credits”).

-

Submit with your tax return for the year the furnace was installed.

-

Keep records for five years in case of audit.

💬 “Filing my tax credit took 15 minutes. My accountant said Goodman’s paperwork was the clearest he’d seen.” — Mark

Pro Tip: You don’t need to attach receipts — just keep them for your records.

Reference: IRS – Home Energy Tax Credits

🏡 State and Local Rebate Programs for Goodman Furnaces

Beyond the federal credit, nearly every state now offers additional rebates for high-efficiency heating systems.

These are funded by state energy offices, local utilities, or environmental agencies, and they stack with federal incentives.

💵 Typical Rebates by State:

| State | Program | Rebate Amount | Notes |

|---|---|---|---|

| California | TECH Clean California | Up to $500 | Rebates for ENERGY STAR furnaces. |

| Illinois | Nicor Gas / ComEd | $300–$400 | Must be ≥95% AFUE. |

| New York | NYSERDA | $400–$600 | Available for condensing furnaces. |

| Massachusetts | Mass Save | Up to $600 | Requires professional installation. |

| Minnesota | CenterPoint Energy | $200–$450 | Income-based programs available. |

Each state program has its own application form and deadlines, so check DSIRE — the national incentive database — for the most accurate details.

💬 “I used DSIRE to find my Illinois rebate. It took five minutes to apply online and I got a check within six weeks.” — Mark

⚙️ Utility Company Rebates — Hidden Savings Most Homeowners Miss

Local energy providers often partner with HVAC manufacturers like Goodman to promote efficiency upgrades.

These rebates are usually instant — applied by your contractor at the time of sale.

🏦 Common Utility Rebates (2025):

| Utility | Region | Rebate Amount | Eligibility |

|---|---|---|---|

| Xcel Energy | Midwest | $400 | 95%+ AFUE, installed by registered contractor |

| Dominion Energy | Southeast | $300 | ENERGY STAR furnace |

| Consumers Energy | Michigan | $350 | Goodman 96%+ AFUE models |

| PG&E | California | $200 | Energy efficiency improvement program |

💬 “My contractor handled the Xcel rebate paperwork for me — it came straight off my invoice.” — Mark

Reference: EnergyStar – Rebate Finder Tool

🧠 Combining Rebates, Tax Credits, and Seasonal Promotions

Here’s where the magic happens: you can stack multiple incentives.

A typical Goodman upgrade qualifies for:

-

$600 federal tax credit

-

$300–$800 state rebate

-

$200–$500 utility rebate

-

$100–$300 manufacturer or dealer promotion

💡 Example:

| Incentive | Source | Amount |

|---|---|---|

| Federal Tax Credit | IRS | $600 |

| State Rebate | Illinois Nicor Gas | $300 |

| Utility Rebate | ComEd | $400 |

| Goodman Promotion | Local Dealer | $200 |

| Total Savings | $1,500 |

Your $4,500 furnace installation could cost just $3,000 after incentives — a 33% savings.

💬 “That’s like getting a high-end, high-efficiency system for the price of a mid-tier one.” — Mark

🧾 What Paperwork You’ll Need

| Document | Provided By | Purpose |

|---|---|---|

| Purchase Invoice | Installer | Proof of purchase and model verification |

| Manufacturer Certification Statement | Goodman | Confirms ENERGY STAR compliance |

| Utility Rebate Application | Local Provider | Claim rebate amount |

| IRS Form 5695 | IRS | File for federal tax credit |

| Local Permit | City/County | Confirms code-compliant installation |

Keep everything in a labeled folder — “HVAC Rebates 2025.” I did, and it made tax season stress-free.

🧰 How Goodman Makes Qualification Easy

One of the best parts about buying Goodman equipment is that it’s already ENERGY STAR-certified — no guesswork required.

The GRVT961205DN includes:

-

Manufacturer certification for tax credit eligibility.

-

Model-specific documentation (AFUE 96%, serial number, and ENERGY STAR listing).

-

Warranty registration form to protect your investment.

Goodman systems are built to meet or exceed 25C (IRA) and ENERGY STAR 2025 standards, which simplifies your rebate applications

🌍 Why Governments Offer Rebates for High-Efficiency Furnaces

These programs aren’t just about saving homeowners money — they’re part of a national strategy to reduce emissions and improve energy efficiency.

🌱 Environmental Benefits:

-

Reduced natural gas consumption.

-

Fewer greenhouse gas emissions.

-

More stable electrical grids.

-

Healthier indoor air from sealed combustion systems.

💬 “You’re not just saving cash — you’re helping the planet run cleaner. That’s a win-win.” — Mark

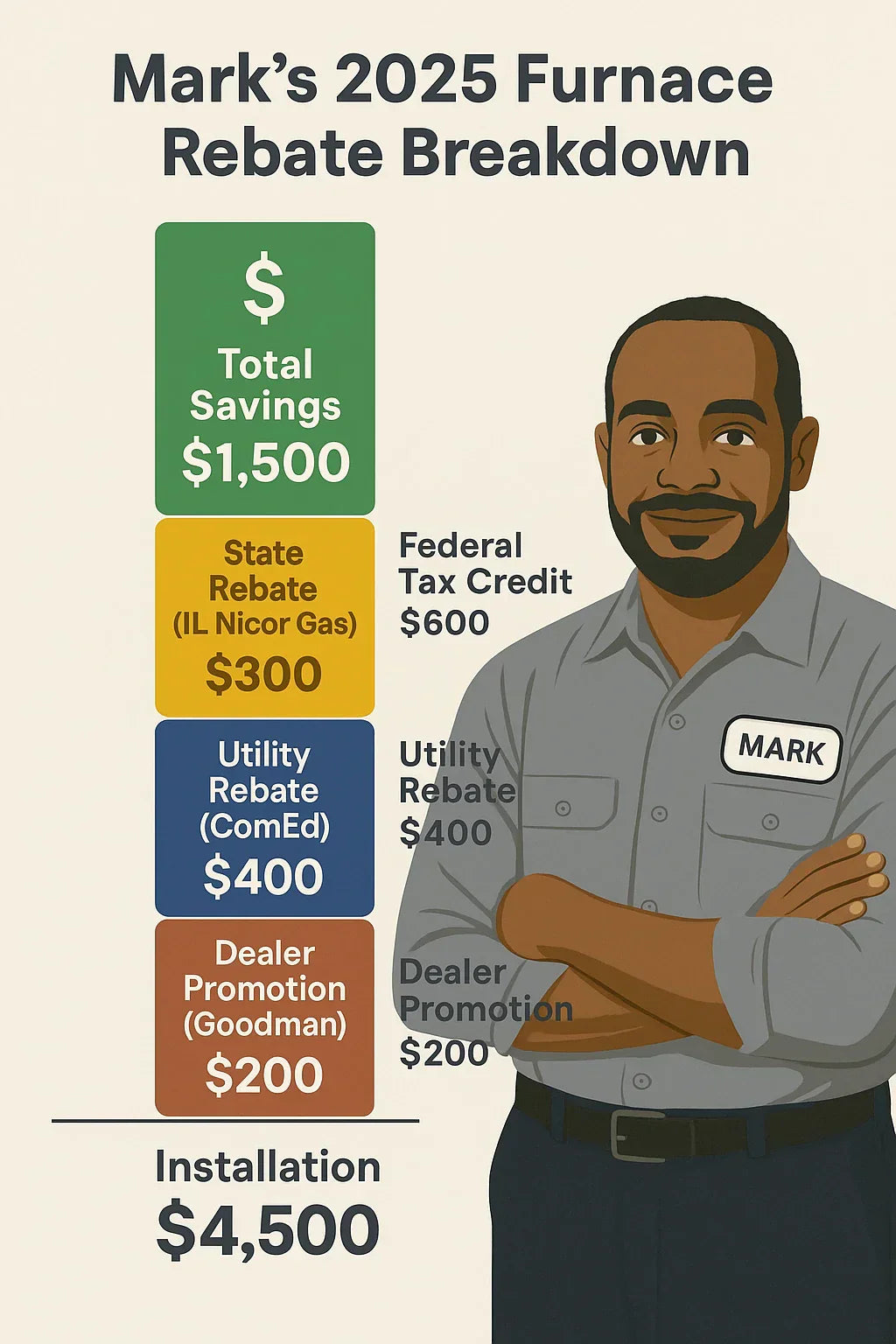

🧮 Real-World Example — Mark’s 2025 Rebate Breakdown

When I upgraded my furnace, here’s exactly what I earned back:

| Incentive Type | Source | Amount |

|---|---|---|

| Federal Tax Credit | IRS | $600 |

| State Rebate | Nicor Gas (IL) | $300 |

| Utility Rebate | ComEd | $400 |

| Dealer Promotion | Goodman Authorized Installer | $200 |

| Total Savings | $1,500 |

That’s not including the $400/year I now save on heating costs. Within 3 years, the furnace paid for itself — and it’s been whisper-quiet and perfectly reliable ever since.

💸 How to Check If You Qualify

To qualify for any combination of rebates and credits, your furnace must meet these criteria:

✅ 95% or higher AFUE

✅ ENERGY STAR certification

✅ Installed by a licensed HVAC contractor

✅ Primary residence (not a rental)

✅ Properly documented model number and serial number

Find state-specific programs at DSIRE USA.

📋 Step-by-Step: How to Apply for Multiple Rebates

-

Get a qualifying quote from an ENERGY STAR-certified installer.

-

Ask your installer which rebates apply — many handle them for you.

-

Save your Goodman documentation and contractor invoice.

-

Submit local/utility rebate forms within 90 days of installation.

-

Claim the federal tax credit during tax season via Form 5695.

💬 “My contractor submitted my utility rebate before he left the driveway. That was $400 off instantly.” — Mark

🏡 The Long-Term ROI of a 96% AFUE Furnace

Beyond rebates and credits, the Goodman GRVT961205DN delivers lasting savings every winter.

| Furnace Type | AFUE | Avg. Annual Gas Cost | 10-Year Energy Savings |

|---|---|---|---|

| 80% Standard | 80% | $1,800 | — |

| 96% Goodman | 96% | $1,500 | $3,000+ saved |

Combine that with $1,500 in upfront rebates, and your total lifetime savings exceed $4,500–$5,000.

Reference: EnergyStar – Furnace Savings Calculator

💬 Mark’s Final Take — Don’t Leave Free Money on the Table

“When I talk to neighbors about furnace upgrades, I always tell them the same thing: don’t wait until your old unit breaks down. Between rebates, tax credits, and lower gas bills, upgrading pays for itself faster than you think. And with Goodman, you’re getting proven reliability that lasts.”

A Goodman 96% AFUE furnace isn’t just a heating system — it’s an investment. One that cuts your carbon footprint, reduces your bills, and puts money back in your pocket.

In 2025, efficiency doesn’t just mean comfort — it means cash.

✅ Final Word

The 2025 rebate landscape is a rare opportunity for homeowners.

If your furnace is over 15 years old or running below 90% efficiency, now is the time to act. A new Goodman 96% AFUE model will keep you warmer, save you hundreds annually, and give you up to $1,500 in instant rebates and credits.

Don’t wait until next winter’s energy bills remind you. Take advantage of these incentives now — and enjoy the rewards every heating season that follows.

In the next topic we will know more about: How the Goodman GRVT961205DN Keeps Large Homes Warm — Performance, Airflow & Zone Control