When I bought my Amana 12,000 BTU through-the-wall air conditioner, I wondered if I could shave a little off the price with rebates or a tax credit. With energy costs climbing and incentives changing every year, it’s worth asking: Do these units qualify for rebates or tax credits in 2025?

The short answer is yes—but with conditions. Not every wall AC will qualify, and it depends on the brand, model, and efficiency rating. Plus, you’ll need to understand the difference between federal tax credits, state rebates, and utility incentives.

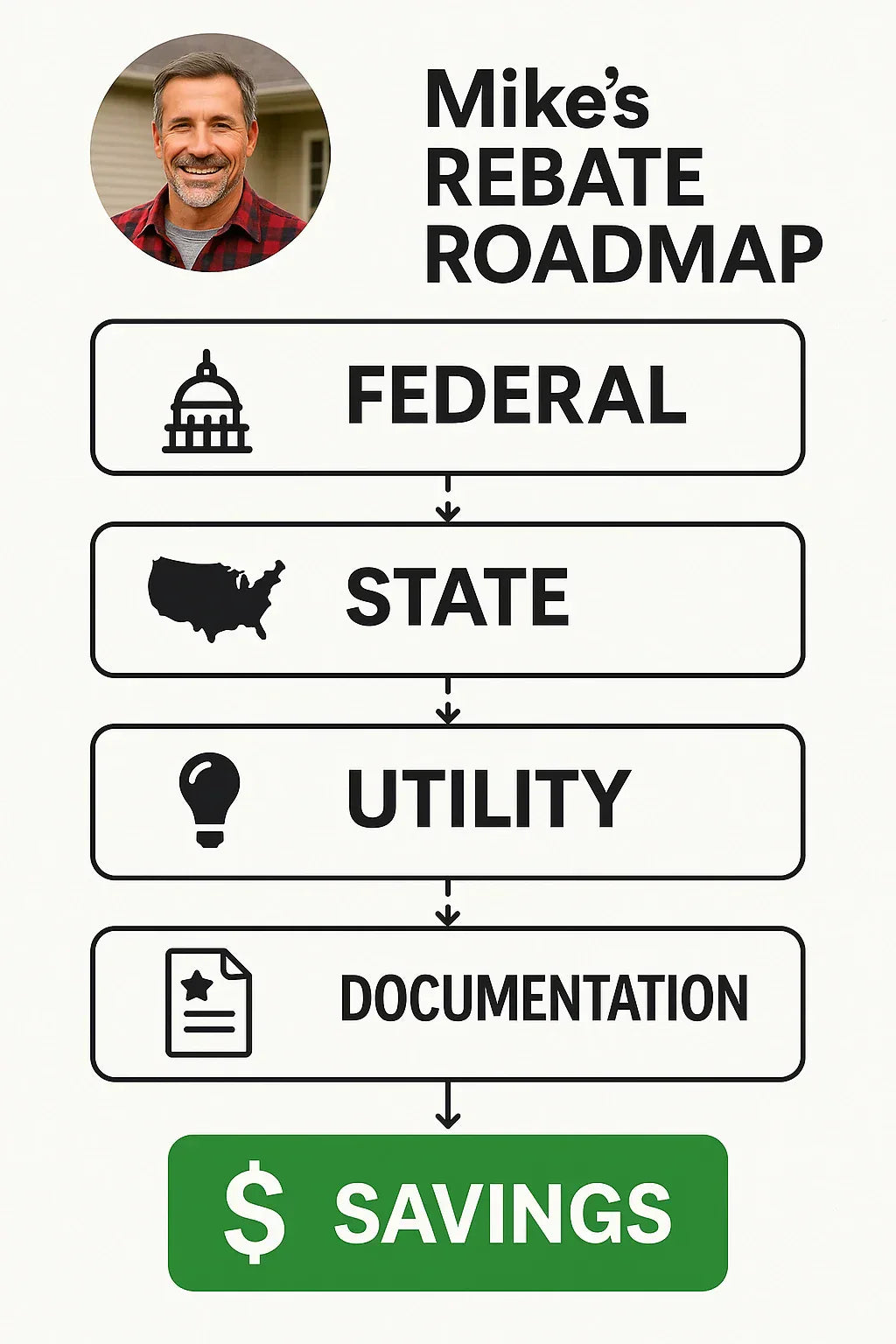

In this guide, I’ll walk you through everything I’ve learned as a homeowner navigating these programs. By the end, you’ll know how to check eligibility, how much money you can save, and what paperwork you’ll need to actually claim those rebates.

⚡ Federal Incentives in 2025

The Inflation Reduction Act (IRA) has been a game-changer for home energy efficiency incentives. As of 2025:

-

Federal tax credits are available for certain high-efficiency appliances, including some room and through-the-wall air conditioners.

-

The key requirement? Energy Star certification.

Federal Tax Credit Breakdown

-

Up to $300 tax credit for qualifying Energy Star-certified through-the-wall ACs.

-

Credit applies only to primary residences (not vacation homes or rentals).

-

You’ll need to file IRS Form 5695 when doing your taxes.

👉 Mike’s Tip: “Don’t assume your new AC automatically qualifies. Always check the Energy Star product finder before you buy.”

📖 Reference: Energy Star – Federal Tax Credits for Room ACs

🏛️ State & Local Rebates

Federal tax credits aren’t the only way to save. Many states and utility companies run their own rebate programs for energy-efficient ACs.

Examples of Local Incentives

-

California: Rebates through PG&E for Energy Star-certified room ACs, typically $50–$150.

-

New York: NYSERDA rebates for high-efficiency ACs, often around $75–$100.

-

Texas & Midwest Utilities: Many local providers offer $50–$100 rebates just for choosing Energy Star.

👉 Mike’s Story: When I replaced my old unit with an Energy Star-certified Amana, my local utility in the Midwest gave me a $75 rebate. The online form took 10 minutes, and I had the check in about six weeks.

📖 Reference: DSIRE USA – State Incentives Database

🏷️ Energy Star Qualification

Here’s the bottom line: if your wall AC isn’t Energy Star-certified, it won’t qualify for federal credits or most rebates.

What Makes a Wall AC Energy Star Certified?

-

Meets updated CEER (Combined Energy Efficiency Ratio) standards.

-

Uses less energy than standard models while delivering the same cooling.

-

Saves an average homeowner $75 per year in energy costs compared to non-certified models.

Brand Examples

-

Amana: Many through-the-wall models qualify.

-

Friedrich: Strong lineup of Energy Star-certified wall ACs.

-

GE: Some models qualify, but not all—always check the label.

👉 Mike’s Tip: “Look for the yellow EnergyGuide label in the store. If it has the Energy Star logo, you’re in good shape.”

📖 Reference: Energy Star – Certified Room Air Conditioners Product Finder

❌ When They Don’t Qualify

Not every wall AC purchase comes with rebate money. Here are the most common reasons they don’t qualify:

-

No Energy Star certification – Standard-efficiency models don’t make the cut.

-

Installed in a rental property – Federal credits are for primary residences only. (Some landlords may qualify under commercial programs, but it’s different paperwork.)

-

No proper documentation – If you lose the receipt or can’t show proof of Energy Star certification, your application may get denied.

-

Expired program windows – Some state and utility rebates have specific deadlines.

👉 Mike’s Story: A buddy of mine bought a wall AC from a clearance section. Great price—but no Energy Star certification. That “deal” cost him the $100 rebate he could’ve had with a certified unit.

🧾 How to Claim Rebates & Credits

So, how do you actually get the money? It’s not automatic—you’ll need to follow a process.

Federal Tax Credit Process

-

Save your receipt.

-

Download the Energy Star certificate for your specific model.

-

File IRS Form 5695 when doing your taxes.

-

Keep copies of all paperwork in case of an audit.

📖 Reference: IRS – Form 5695: Residential Energy Credits

State & Utility Rebate Process

-

Go to your utility provider’s website.

-

Find the Energy Star rebate section.

-

Upload your receipt and Energy Star documentation.

-

Submit your application online.

-

Wait 4–8 weeks for your rebate check or bill credit.

👉 Mike’s Experience: I snapped a photo of my receipt, uploaded it to my utility’s rebate portal, and got $75 back in the mail. Easy money for a unit I was already going to buy.

📖 Reference: Energy Star – Rebate Finder Tool

📊 Example Cost Savings in 2025

Let’s break down a real-world example.

-

Amana 12,000 BTU Through-the-Wall AC: ~$800

-

Federal Tax Credit: -$300

-

Utility Rebate: -$100

-

Net Cost: ~$400

👉 That’s 50% off just by choosing the right model and filling out some paperwork.

📖 Reference: Energy.gov – Room AC Efficiency Guide

🛡️ What to Watch Out For

Even though rebates and credits are real, there are pitfalls.

-

Don’t assume every Energy Star model is eligible—double-check the specific rebate rules.

-

Some programs require installation by a licensed contractor.

-

Deadlines matter. Don’t wait until tax season to start gathering documents.

👉 Mike’s Warning: I almost missed my rebate deadline once because I shoved the receipt in a drawer and forgot. Now I upload it to my phone right away.

🧾 Mike’s Bottom Line

👉 Mike’s Verdict:

-

“Yes—many through-the-wall ACs qualify for rebates and tax credits in 2025. But only if you buy an Energy Star model and keep your paperwork in order. Federal credits can save you up to $300, and local rebates often add another $50–$150. Put it together, and you’re looking at hundreds of dollars back.”

For most homeowners, the savings make it a no-brainer: always buy the Energy Star-certified model.

In the next topic we will know more about: Wall Sleeves & Grilles 101: Choosing the Right Accessories for Your Amana Unit