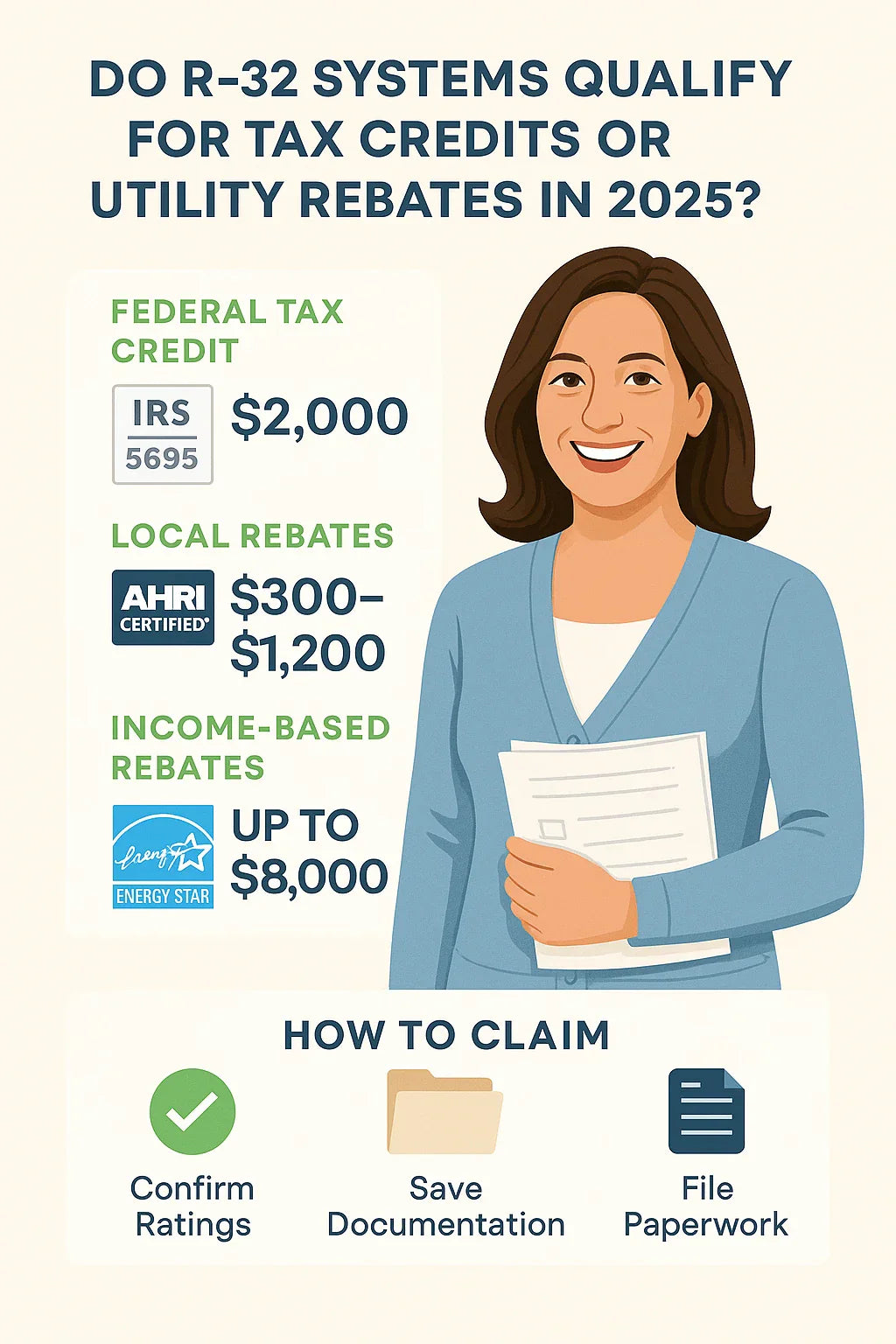

Unlock thousands in potential savings by understanding how energy-efficient R-32 AC systems qualify for rebates, incentives, and federal tax credits.

💰 Introduction: HVAC Upgrades That Pay You Back

Home upgrades don’t always come with a return—but switching to a high-efficiency air conditioner with R-32 refrigerant in 2025 absolutely can. If you’re like Samantha Reyes and want to make a smart, eco-conscious investment that pays off, you might be surprised how much money you can recoup.

Thanks to the Inflation Reduction Act (IRA), ENERGY STAR® rebates, and dozens of state/local programs, many R-32 AC systems qualify for incentives of $500–$3,200 or more.

Let’s explore how to unlock those savings.

📦 What Is an R-32 System?

R-32 systems use a low global warming potential (GWP) refrigerant called Difluoromethane (R-32) in place of R-410A. They are often:

-

More energy-efficient (up to 10–30%)

-

SEER2-compliant

-

Future-ready under 2025 refrigerant phase-down regulations

If you’re installing a 3-ton R-32 split system (outdoor condenser + indoor air handler), you’re likely eligible for multiple credits and rebates—if the system is properly matched, rated, and certified.

📋 2025 Federal Tax Credit: What You Need to Know

🧾 1. Inflation Reduction Act – 25C Energy Efficiency Home Improvement Credit

As of 2025, homeowners can claim a nonrefundable federal tax credit of:

-

Up to $2,000 for qualified central AC systems

-

Includes installation and labor

-

Renewed annually (you can reapply if you do phased upgrades)

✅ Eligibility Checklist

| Requirement | Criteria |

|---|---|

| Home type | Primary residence (owned) |

| Efficiency rating | Meets or exceeds 15.2 SEER2 |

| AHRI certificate | Must match indoor & outdoor units |

| Installation date | After January 1, 2023 |

| Installer paperwork | Keep invoice + AHRI cert on file |

💡 Samantha’s Tip: You must file IRS Form 5695 with your federal tax return to claim the credit.

🔌 2. High-Efficiency Electric Home Rebate Act (HEEHRA)

Part of the broader IRA, this program offers point-of-sale rebates for low- to moderate-income households upgrading to high-efficiency, electric HVAC systems—including those using R-32 refrigerants.

💸 Rebate Structure (Income-Based)

| Household Income (Area Median) | Rebate Amount |

|---|---|

| ≤ 80% AMI | 100% of cost, up to $8,000 |

| 81%–150% AMI | 50%, up to $4,000 |

| > 150% AMI | Not eligible |

These rebates are stackable with 25C federal credits and apply at checkout, so no waiting for a refund.

🔗 Rewiring America Rebate Calculator

🔎 3. ENERGY STAR® Certified Systems — Rebates by Manufacturer and Retailer

R-32 systems often carry the ENERGY STAR label due to their high SEER2 efficiency. This makes them eligible for:

-

Manufacturer rebates (e.g., Daikin, Carrier, Goodman)

-

Retailer promotions (via Lowe’s, The Furnace Outlet, etc.)

-

HVAC distributor incentives

📎 Use the ENERGY STAR Rebate Finder to search by product type and ZIP code.

🌎 4. State and Local Utility Rebates (Examples)

Hundreds of utilities across the U.S. offer local rebates to offset the cost of high-efficiency cooling systems.

🔦 Example: Duke Energy – North Carolina

-

$300–$600 for installing ENERGY STAR® central AC

-

R-32 systems qualify if SEER2 ≥ 15.2

-

Must use a participating contractor

🔗 Duke Energy Rebates Page

🔦 Example: LADWP – Los Angeles

-

Up to $1,200 back for split-system AC upgrades

-

Must meet Title 24 compliance + ENERGY STAR®

🔗 LADWP HVAC Incentive Portal

🔦 Example: Xcel Energy – Minnesota/Colorado

-

Up to $500 for SEER2 15+ systems

-

$75 bonus for Wi-Fi thermostat integration

🔗 Xcel Residential HVAC Rebates

💡 Tip: Use DSIRE USA to search rebates by ZIP and utility provider.

📂 How to Claim These Credits and Rebates

🛠️ Step-by-Step: Federal Tax Credit (25C)

-

Confirm SEER2 Rating + AHRI Certificate

-

Get a matched set AHRI certificate from your contractor or download from ahridirectory.org

-

-

Save Your Paperwork

-

Invoice, installer receipt, AHRI certificate

-

-

File IRS Form 5695

-

Attach to your annual tax return

-

-

Apply credit to your return

-

Can reduce taxes owed or increase refund

-

🧾 Step-by-Step: Utility Rebate

-

Visit your utility’s HVAC rebate page

-

Download and fill out rebate forms

-

Include:

-

Installer invoice

-

Copy of AHRI certificate

-

System serial/model numbers

-

-

Submit within 90–180 days of installation

-

Receive rebate as a check or utility bill credit

🏠 Samantha’s Real Example: R-32 Rebate Breakdown

Location: Louisville, KY

System: 3-ton R-32 split system (SEER2 16.2)

Air Handler: Variable-speed ECM blower

Installed Cost: $7,900

Incentives Received:

| Source | Amount |

|---|---|

| Federal Tax Credit (25C) | $2,000 |

| Local Utility (LG&E) | $500 |

| Manufacturer Promo | $250 |

| Total Savings: | $2,750 |

Net cost after incentives: $5,150

⚠️ Common Mistakes to Avoid

🚫 Don’t assume all R-32 systems qualify — check SEER2 ratings

🚫 Don’t mix/match unlisted indoor & outdoor units

🚫 Don’t skip the AHRI certificate — required for both rebates and IRS

🚫 Don’t wait too long — most rebate programs have deadlines (90–180 days)

📋 Final Takeaways: How to Maximize Your R-32 Savings

✅ Choose an R-32 system rated 15.2 SEER2 or higher

✅ Confirm it is AHRI-certified and ENERGY STAR® listed

✅ Work with a contractor who knows rebate paperwork and form 5695

✅ Stack savings using federal + utility + manufacturer + income-based rebates

✅ Claim before deadlines and keep all documentation

By planning wisely—like Samantha—you can cut 25–50% or more off your system’s cost in 2025.