🏠 Introduction: Why Incentives Matter in 2025

When homeowners ask me about upgrading to an R-32 gas furnace, the first thing they usually ask is:

👉 “How much will it cost?”

But the very next question is just as important:

👉 “Will I get any rebates or tax credits?”

Here’s the good news: 2025 is a great year to invest in high-efficiency heating. Thanks to the Inflation Reduction Act (IRA), ongoing ENERGY STAR® programs, and a nationwide push for low-GWP refrigerants, there are more rebates and credits available than ever before.

The switch from R-410A to R-32 isn’t just about environmental compliance — it positions homeowners to qualify for federal tax credits, state rebates, and even utility company incentives.

In this guide, I’ll walk you through everything you need to know about rebates and credits for R-32 gas furnaces in 2025.

💵 Federal Tax Credits (Inflation Reduction Act)

The Inflation Reduction Act (IRA), signed into law in 2022, expanded and extended energy efficiency tax credits through at least 2032.

What You Can Get in 2025

-

Up to $600 tax credit for qualifying gas furnaces.

-

Up to $2,000 tax credit for whole-home HVAC upgrades (including heat pumps and hybrid systems).

-

Credits are 30% of the project cost, capped at program limits.

Requirements for Furnaces

-

Must be ENERGY STAR® certified.

-

Must meet 95% AFUE or higher in the U.S. northern region.

-

Installed in your primary residence (not rentals).

-

Must be new equipment (not used or second-hand).

How to Claim

-

Save your manufacturer’s certificate (shows ENERGY STAR compliance).

-

File IRS Form 5695 (Residential Energy Credits) with your tax return.

📖 Reference: ENERGY STAR – Federal Tax Credits for Furnaces

👉 Mark’s Tip: Keep your receipts and AHRI certificate from your installer. If you don’t have documentation, you won’t get the credit.

🌍 State & Local Rebates

In addition to federal credits, many states, cities, and utility companies offer rebates for high-efficiency furnaces.

Typical Rebates in 2025

-

$300–$1,500 rebates from state energy offices.

-

Utility incentives for switching from lower-efficiency models.

-

Extra savings if you bundle your furnace upgrade with insulation or duct sealing projects.

How to Find Them

-

Search the DSIRE database for incentives in your ZIP code.

-

Check your utility company’s website — many offer rebates for customers upgrading to ENERGY STAR equipment.

👉 Mark’s Story: I recently installed a 40,000 BTU R-32 furnace for a homeowner in Ohio. Between the federal tax credit ($600) and a utility rebate ($350), they got nearly $1,000 back within the first year.

🏷️ ENERGY STAR® Certification

Here’s the key thing most homeowners don’t realize: rebates don’t care about refrigerant by itself — they care about efficiency ratings.

What That Means

-

An R-32 furnace is a big plus because it’s more efficient and future-proof.

-

But to qualify for rebates, the furnace must also be ENERGY STAR certified.

ENERGY STAR Furnace Standards (2025)

-

95% AFUE minimum in northern states.

-

90% AFUE minimum in southern states.

-

Must meet ENERGY STAR testing and certification standards.

📖 Reference: ENERGY STAR – Furnaces

👉 Mark’s Tip: Always ask your installer for the AHRI number of your furnace. That’s the industry standard reference that confirms your system is ENERGY STAR compliant.

🛠️ Installation Requirements

Here’s a detail that can make or break your rebate claim: how the furnace is installed.

Rules You Should Know

-

Professional installation is required. Most rebates and credits exclude DIY installs.

-

You’ll need invoices and paperwork proving the install date, AFUE rating, and model number.

-

Some programs require proof of old furnace disposal (to make sure you actually upgraded).

📖 Reference: Furnace Installation Costs & Guidelines

👉 Mark’s Tip: Don’t try to cut corners by self-installing if you want rebates. The paperwork almost always requires a licensed contractor’s invoice.

💡 Why R-32 Furnaces Are Future-Proof

Now let’s talk about why R-32 matters here.

R-410A Phase-Out

-

The EPA is phasing down high-GWP refrigerants like R-410A under the AIM Act.

-

By 2025, new HVAC systems must use low-GWP refrigerants like R-32.

Why That Matters for Rebates

-

Future rebates will likely exclude outdated refrigerant models.

-

R-32 units ensure compliance with new standards and incentives.

-

Choosing R-32 today means you won’t be stuck with equipment that can’t qualify later.

📖 EPA – Transitioning to Low-GWP Refrigerants

👉 Mark’s Take: If you’re buying a furnace in 2025, R-32 is the safe bet. Not just for efficiency, but for rebates, compliance, and long-term serviceability.

🏦 Real-World Example: Savings Breakdown

Let’s say you’re installing a 40,000 BTU R-32 furnace in a 1,500 sq. ft. home:

-

Furnace cost: $1,800

-

Installation & accessories: $3,200

-

Total installed: $5,000

Now let’s apply incentives:

-

Federal tax credit (30% up to $600): –$600

-

Utility rebate: –$400

-

State rebate: –$300

✅ Total out-of-pocket after incentives: $3,700

And that’s before you count the 15–25% lower energy bills you’ll see each winter with high efficiency.

🏆 Mark’s Take: Don’t Leave Money on the Table

Here’s the bottom line:

-

A 40,000 BTU R-32 furnace can absolutely qualify for tax credits and rebates in 2025.

-

You’ll need the right efficiency rating (95% AFUE+) and ENERGY STAR certification.

-

Installation must be done by a licensed contractor with proper paperwork.

-

Federal, state, and utility programs can combine to save you $1,000 or more upfront.

👉 My advice: “Ask about incentives before you buy — not after. That way, you pick a furnace that pays you back right away.”

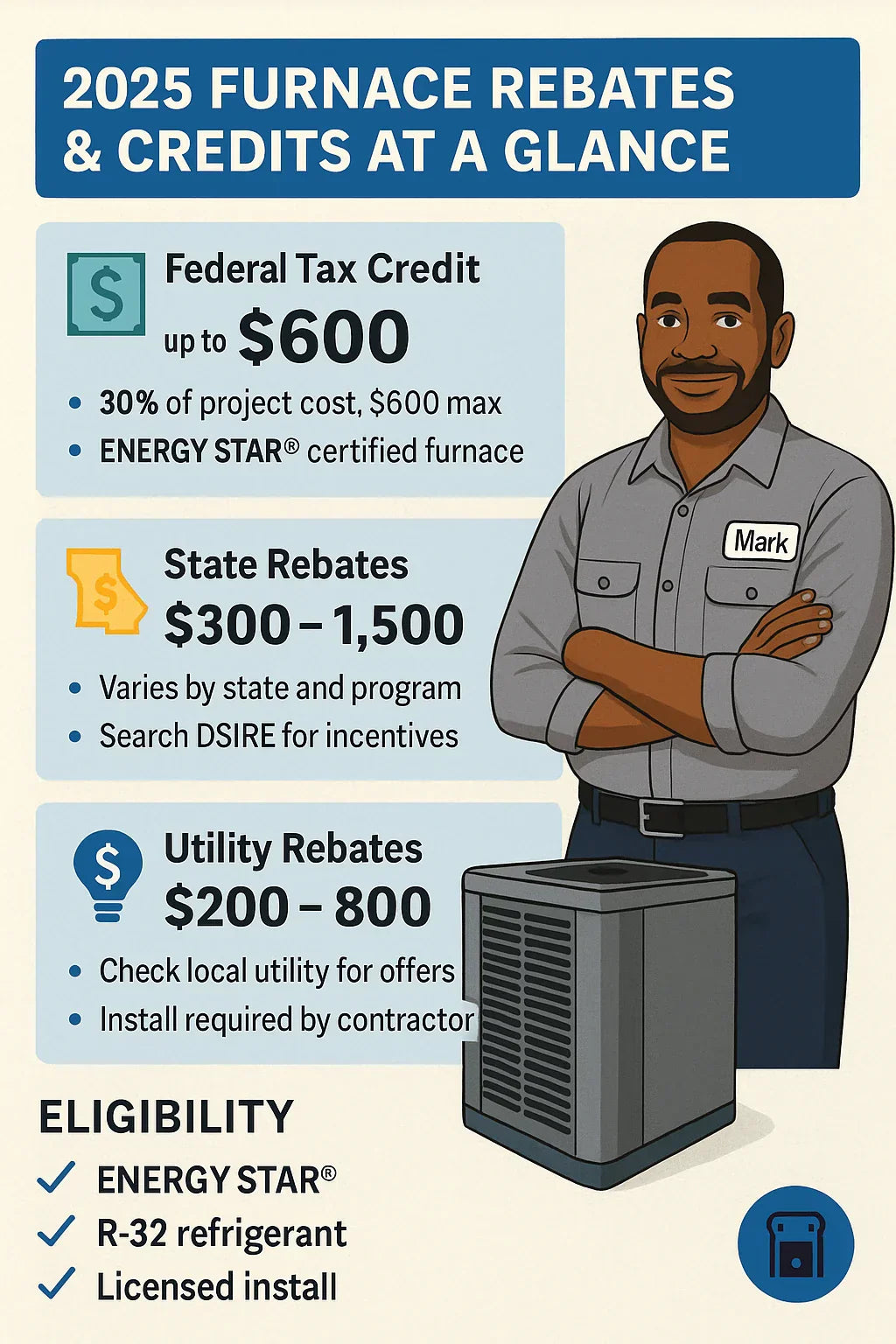

🎨 Infographic Idea: “2025 Furnace Rebates & Credits at a Glance”

-

Federal Tax Credit: Up to $600

-

State Rebates: $300–$1,500

-

Utility Rebates: $200–$800

-

Checklist for eligibility: ENERGY STAR ✅ / R-32 ✅ / Licensed install ✅

In the next topic we will know more about: Brand Comparison: Goodman vs. Amana vs. Carrier 40,000 BTU Furnaces