Thinking of upgrading to an R-32 air conditioner? You may be eligible for valuable energy tax credits and rebates in 2025. Here’s what you need to know to cash in while staying cool.

Introduction: Why Incentives Matter for Your Next AC Purchase

Replacing or upgrading your air conditioning system is a major investment. With R-32 refrigerant systems gaining popularity for their efficiency and environmental benefits, many homeowners are asking: Do these newer systems qualify for tax incentives? The short answer: yes—if you choose the right model.

This guide will walk you through:

-

How federal tax credits apply to R-32 AC systems

-

What ENERGY STAR® ratings have to do with it

-

How much you could save through local utility rebates

-

How to apply for 2025 energy tax credits with confidence

Let’s unpack the numbers, the eligibility rules, and the best strategies for maximizing your return.

What Is the 25C Energy Efficient Home Improvement Tax Credit?

Under the Inflation Reduction Act, the federal government reintroduced the Section 25C tax credit, also known as the Energy Efficient Home Improvement Credit.

Here’s how it works in 2025:

-

Up to 30% of the installation cost of qualified air conditioners is eligible

-

The annual credit cap is $1,200, with $600 max per qualified AC system

-

The equipment must meet ENERGY STAR® efficiency requirements at the time of installation

-

You must file IRS Form 5695 to claim the credit on your taxes

So, if you install an ENERGY STAR® certified R-32 system with a qualifying SEER2 rating, you could be eligible for up to $600 in federal tax credits.

Do R-32 AC Systems Qualify for the 25C Credit?

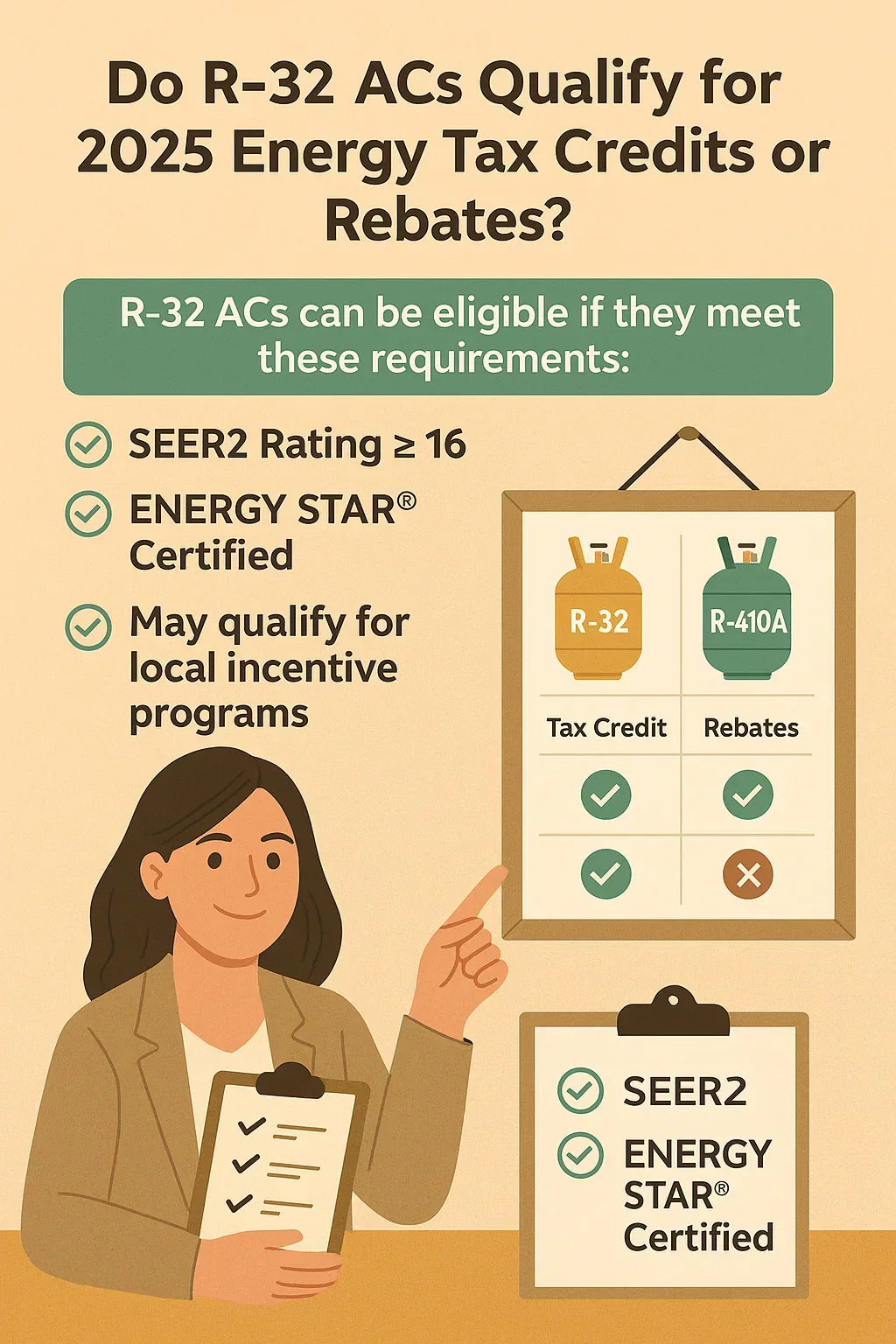

Yes—some R-32 AC units do qualify, but it depends on efficiency, not refrigerant alone.

✅ The qualifying factors:

-

SEER2 ratings must meet the minimum ENERGY STAR® standards for your region (typically 14.3 or higher)

-

The unit must be installed in your primary U.S. residence

-

The product must be listed in the ENERGY STAR® database at the time of installation

⚠️ The refrigerant type (like R-32 vs. R-410A) is not the only determining factor. However, most R-32 units are designed for high efficiency, so they are more likely to meet ENERGY STAR® requirements.

Check the AHRI Certificate or product specs to verify eligibility before buying.

How SEER2 Ratings Affect Your Tax Credit

The SEER2 (Seasonal Energy Efficiency Ratio 2) standard became official in 2023 and replaced traditional SEER ratings.

For a central split-system AC unit to qualify under ENERGY STAR® and the 25C program:

-

Split ACs must meet or exceed 15.2 SEER2

-

Packaged ACs must meet or exceed 14.3 SEER2

Many R-32 units, especially from major brands like Goodman, Amana, and Daikin, offer SEER2 ratings between 14.3–17+, making them strong candidates for incentives.

Are There Rebates from States or Utility Companies?

Yes—many states and local utilities offer rebates for installing high-efficiency AC systems, including those using R-32 refrigerant.

Examples:

-

California: Rebates through TECH Clean California or local power authorities (e.g., LADWP, PG&E)

-

Massachusetts: Mass Save® rebates of up to $500–$1,000 for ENERGY STAR® systems

-

Texas & Florida: Utility providers often offer cash-back programs for high-SEER2 systems

💡 Use the DSIRE database to look up your zip code and available energy incentives.

ENERGY STAR® Certification and R-32: What to Look For

To be eligible for both federal and local incentives, the R-32 AC system must be ENERGY STAR® certified.

Here’s what to check:

-

Look for the ENERGY STAR® label on the manufacturer’s website or product page

-

Review the AHRI Certificate or performance data sheet

-

Confirm the model's SEER2 and EER2 ratings

Bonus Tip:

Many ENERGY STAR® certified R-32 systems also qualify for:

-

Manufacturer rebates

-

Retail discounts

-

Extended warranties

These perks can reduce your total out-of-pocket cost by hundreds more.

What About Heat Pumps That Use R-32?

Great news: R-32 heat pumps (dual heating/cooling systems) often qualify for even higher tax credits.

Under the 25C rules:

-

Heat pumps can earn you up to $2,000 in credits, if they meet the higher ENERGY STAR® Cold Climate specs

-

This is separate from the $600 for central ACs

-

The system must be installed and operational in 2025

If you're deciding between a traditional R-32 AC system and an R-32 heat pump, run the numbers. You might get more in credits and enjoy year-round efficiency.

Step-by-Step: How to Claim Your Tax Credit

-

Choose an R-32 AC or heat pump with qualifying SEER2

-

Save your AHRI certificate and proof of ENERGY STAR® compliance

-

Have the system professionally installed (or DIY if local code allows)

-

Keep your receipts (labor + equipment costs are eligible)

-

File IRS Form 5695 with your 2025 tax return

-

Claim the 25C credit up to $600 for AC or $2,000 for heat pump

Key Takeaways for 2025 Shoppers

| Feature | R-32 System Benefit |

|---|---|

| ENERGY STAR® Eligibility | Most R-32 units qualify with SEER2 ≥ 14.3 |

| Federal Tax Credit | Up to $600 (AC) or $2,000 (heat pump) |

| Local Utility Rebates | May add $100–$1,000 depending on location |

| Efficiency | SEER2 ratings often 15.2–17+ |

| Environment | 3x lower GWP than R-410A |

Final Verdict: Is an R-32 AC Worth It in 2025?

Absolutely. If you’re planning to upgrade your AC this year, choosing a high-SEER2 R-32 system gives you:

-

Better efficiency and lower energy bills

-

Access to multiple incentives

-

A refrigerant future-proofed for environmental compliance

✅ Just make sure it’s ENERGY STAR® certified, keep your documentation, and check for local rebates before you install.

Savvy’s Advice: “Get Your Paperwork Ready Before Install Day”

“Don’t wait until tax time to figure this out. When I upgraded to my R-32 system, I printed the AHRI cert and the ENERGY STAR® sheet the day I ordered. That made tax filing super easy, and I got my rebate faster.”

— Savvy, R-32 DIYer and homeowner in Austin, TX

In the next topic we will know more about: What Tools and Accessories Do You Need to Install R-32 AC and Coils?