📌 Why This Matters

If you're considering a PTAC (Packaged Terminal Air Conditioner) upgrade or installation in 2025, you can access powerful federal tax credits and local rebates that significantly reduce costs. These savings can stretch your budget while boosting your home's energy efficiency.

This guide breaks down exactly what incentives apply to PTAC units, who’s eligible, and how to claim them—even covering the most impactful programs available through 2025.

🏛️ Federal Tax Credits Nearly 30% — Act Fast

✅ Energy Efficient Home Improvement Credit (IRC §25C)

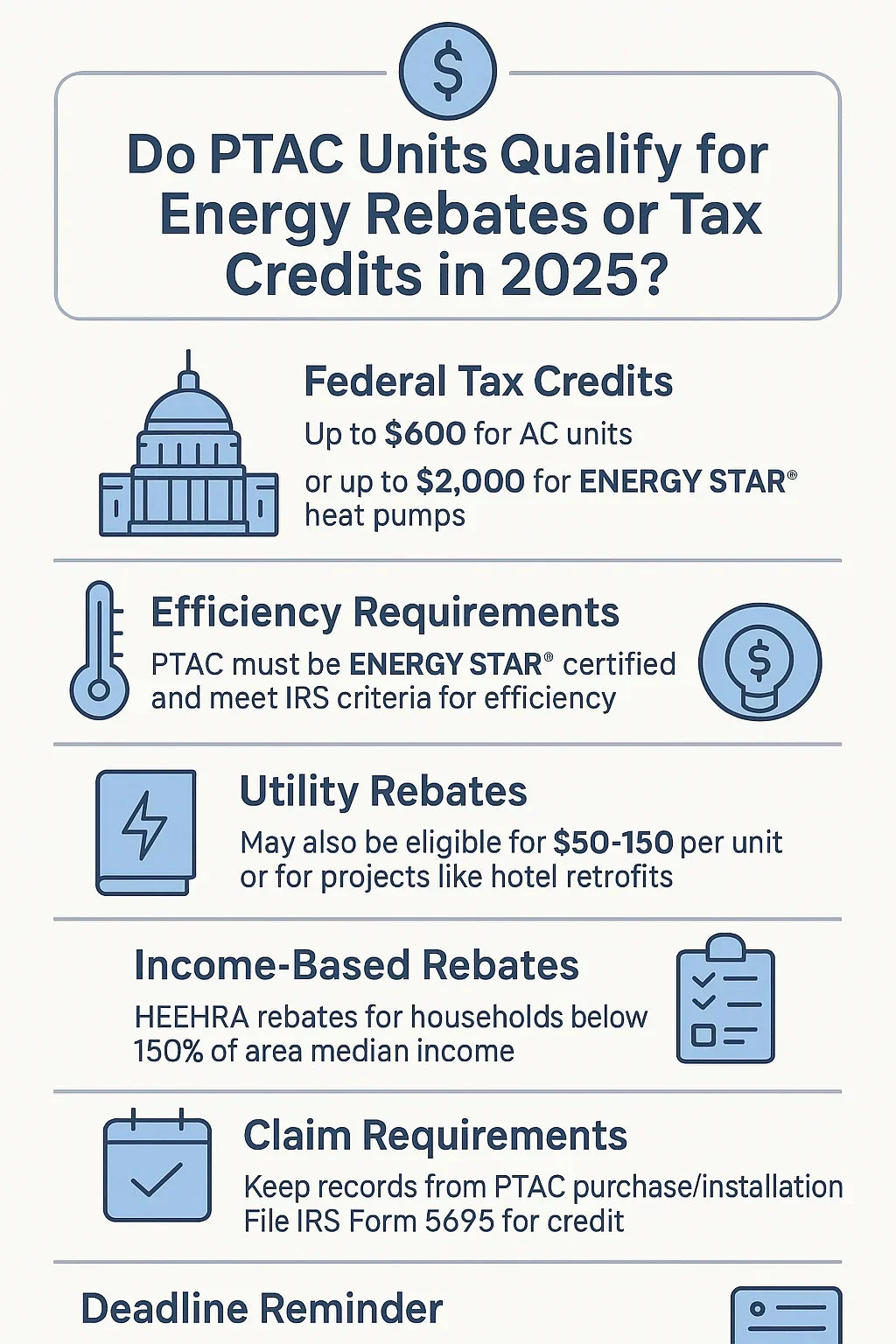

Under current tax laws, homeowners can claim 30% of qualifying costs (equipment + installation) up to:

-

$600 maximum for air conditioners or central HVAC systems, and

-

$2,000 maximum for heat pumps, biomass stoves, and other electric heating systems. (2025 HVAC federal tax credit: Eligible systems and savings)

For qualifying PTACs, if you install a heat pump model that meets ENERGY STAR® standards, you may be eligible for the larger $2,000 credit.

Install cooling-only or electric-resistance PTACs? You’ll fall under the $600 cap. (What HVAC System Qualifies for Tax Credit 2025?)

You must use IRS Form 5695 when filing to claim this credit. (Energy Efficient Home Improvement Credit)

🧊 How to Qualify: Efficiency Requirements

To qualify under these credits, your PTAC unit must:

-

Be ENERGY STAR certified, and

-

Meet efficiency standards (e.g. SEER2 ≥ 16.0 and EER2 ≥ 11.5 for packaged systems).

Many higher-end heat pump PTAC models meet or exceed these thresholds.

(Central Air Conditioners Tax Credit)

🏘️ Utility Rebates & Local Programs — Layer Your Incentives

Beyond federal credits, many utility and state programs offer additional rebates for installing high-efficiency PTACs.

Typical rebates include:

-

$50–$150 per PTAC unit from utilities in California, New York, Massachusetts, and Florida

-

Incentives for certified installation or larger projects—often used in hotels or multi-unit housing

Use ENERGY STAR’s Rebate Finder tool (enter your ZIP) to see local programs available for your area.

🪜 How Rebates and Credits Stack Together

These programs can stack to offer major savings:

🧾 Example for a Heat Pump PTAC Installation:

-

PTAC cost + install: $1,500

-

Federal tax credit (30%): − $450 (up to $2,000 cap)

-

Utility rebate: − $100

-

Net cost: $950

Check program rules carefully, but many homeowners can reduce net cost by 40–60% or more when incentives combine.

(Rebates, Tax Credits, and Incentives for PTACs in 2025)

🧠 Income-Based Rebates: HEEHRA & HOMES Program

If your household income is under 150% of your local median, you might qualify for the High-Efficiency Electric Home Rebate Act (HEEHRA) or the HOMES rebate program:

-

Up to $8,000 for heat pumps

-

Up to $4,000 for energy savings projects

(2024 & 2025 Energy Tax Credits & Energy Rebates Guide)

These rebates may be issued at point of sale through participating contractors—ask about them when shopping.

⏳ Act Before the Sunset: Deadline Approaching

As of July 2025, the federal Energy Efficient Home Improvement Credit is set to expire at year-end under legislation known as the “One Big Beautiful Bill (OBBB)

If you're considering a unit, be sure to purchase, install, and pay for it by December 31, 2025 or risk losing eligibility.

🧪 Claiming the Credit: What You Need

-

Purchase a qualifying ENERGY STAR® PTAC model.

-

Keep manufacturer certification statement and all receipts.

-

Submit IRS Form 5695 with your tax return.

-

Track any utility or state rebates applied.

-

Bonus: If you also install insulation, windows, or other qualifying upgrades in 2025, you can reach the $1,200 upper limit for non-heat-pump improvements.

(Programs and services guide for contractors 2025)

💡 Checklist Summary for Samantha

| Step | Action |

|---|---|

| 1️⃣ | Select an ENERGY STAR® certified PTAC (heat pump or electric) |

| 2️⃣ | Check your local utility rebate via ENERGY STAR rebate finder |

| 3️⃣ | Confirm manufacturer's efficiency ratings meet tax criteria |

| 4️⃣ | Save purchase, install, and efficiency documentation |

| 5️⃣ | File Form 5695 with tax return in year of installation |

| 6️⃣ | Combine with rebate/incentive programs where possible |

| 7️⃣ | Complete all steps before Dec 31, 2025 to qualify |

📌 Final Takeaways

-

✅ PTAC units can earn big tax savings. Heat pump PTACs qualify for a 30% credit up to $2,000; other units up to $600. (ENERGY STAR Rebate Finder)

-

✅ Utility and state rebates often stack, offering $50–$150 per unit or more. The Furnace Outlet

-

⚠️ Federal credits expire December 31, 2025. Act this year to secure savings. Kiplinger

-

✅ Low‑ and moderate‑income households may qualify for HEEHRA or HOMES rebates.

In the next topic we will know more about: Troubleshooting Guide: What to Do If Your PTAC Unit Isn’t Heating or Cooling