When I sit down with homeowners in the Northeast, one of the first questions they ask me—right after “How much will it cost?”—is:

👉 “Will I qualify for rebates or tax credits with this Goodman system?”

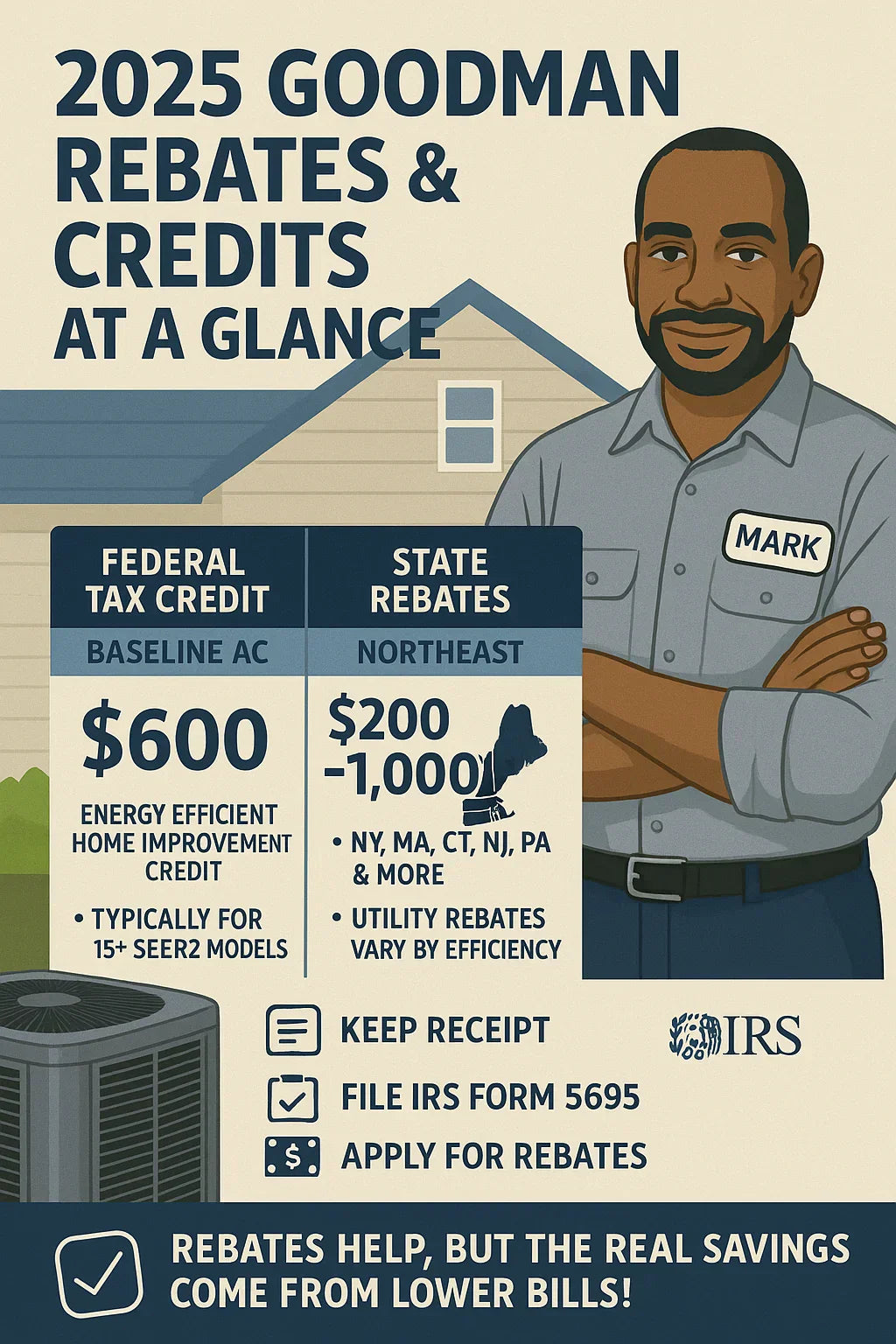

That’s a smart question. With the Inflation Reduction Act (IRA) and various state-level programs, there’s more incentive money on the table than ever in 2025. But here’s the catch: not every system qualifies, and not every rebate is worth chasing.

Let’s break down exactly how the Goodman 2.5 Ton 13.8 SEER2 Northeast System (GLXS3BN3010 condenser + AMST30BU1300 air handler) stacks up for federal credits, state rebates, and long-term savings.

🏛️ Federal Tax Credits in 2025

Under the Energy Efficient Home Improvement Credit (25C), homeowners can claim federal tax credits for upgrading HVAC systems.

✅ What’s Covered?

-

Up to $600 for central air conditioners that meet ENERGY STAR® efficiency criteria.

-

Up to $2,000 for qualifying heat pumps.

-

Credits apply to equipment + installation costs combined.

📊 Where Goodman Fits

-

The 2.5 Ton 13.8 SEER2 Goodman system meets DOE minimums for the Northeast.

-

But to qualify for the full $600 AC tax credit, the system typically needs to exceed baseline efficiency—often requiring ENERGY STAR certification (≈15 SEER2 or higher).

👉 Translation: The 13.8 SEER2 Goodman may not qualify for the $600 credit by itself. However, upgraded Goodman models (15+ SEER2) do.

🌎 State & Utility Rebates (Northeast Focus)

This is where many homeowners see real savings. Every Northeast state runs utility rebate programs to push higher efficiency.

🔑 Examples (2025)

-

New York (NYSERDA): $200–$500 for high-SEER2 ACs, larger for heat pumps.

-

Massachusetts (Mass Save): Up to $500 on central AC, $10,000+ on whole-home heat pumps.

-

Connecticut (Energize CT): $300–$600 rebates for ENERGY STAR AC installs.

-

New Jersey (NJ Clean Energy Program): $300–$500 rebates for AC upgrades.

-

Pennsylvania (PECO, PPL, etc.): $200–$400 rebates for central AC replacements.

👉 Rule of Thumb: Most utilities require ENERGY STAR-level efficiency (usually 15 SEER2+). Standard 13.8 SEER2 models typically don’t qualify.

DSIRE USA database of incentives

🔋 SEER2 Standards & Qualification

A lot of rebate eligibility boils down to one number: SEER2.

-

Goodman 13.8 SEER2: Meets DOE regional minimum for Northeast compliance.

-

ENERGY STAR AC (2025): Generally requires 15.2 SEER2 or higher.

-

Heat pumps: Qualify at higher SEER2/EER2/HSPF2 levels (depending on program).

👉 If you’re sticking with the base Goodman 13.8 SEER2, you may not hit most rebate thresholds. But step up one tier (15–16 SEER2), and doors open for both federal credits and state incentives.

ENERGY STAR Central AC criteria

❄️ Heat Pump Option: Bigger Rebates

Here’s where homeowners often shift their thinking.

-

A Goodman 2.5 Ton heat pump not only cools but also heats.

-

Under the IRA, heat pumps qualify for up to $2,000 in federal tax credits.

-

States like MA and NY offer massive heat pump rebates—sometimes $5,000–$10,000 for whole-home systems.

👉 If you’re considering long-term efficiency and bigger rebates, a Goodman heat pump may be a smarter investment than a straight AC.

🧾 How to Claim Credits & Rebates

Federal Credits

-

File IRS Form 5695 with your taxes.

-

Keep receipts for equipment + installation.

-

Make sure your installer provides an AHRI certificate (shows efficiency rating).

State/Utility Rebates

-

Apply online at your utility’s energy-efficiency portal.

-

Submit AHRI certificate + paid invoice.

-

Typical turnaround: 6–12 weeks.

👉 Pro Tip: Always confirm with your installer that the system qualifies before purchase.

📉 Example: Real-World Cost Impact

Let’s compare three scenarios for a Northeast homeowner replacing a 20-year-old 10 SEER unit.

Scenario 1: Goodman 13.8 SEER2 (no rebates)

-

Installed cost: $5,500

-

Annual cooling cost: ~$521

-

Federal credit: $0

-

State rebate: $0

-

Total net cost: $5,500

Scenario 2: Goodman 15.2 SEER2 (ENERGY STAR)

-

Installed cost: $6,200

-

Annual cooling cost: ~$473

-

Federal credit: $600

-

State rebate: $300

-

Total net cost: $5,300

Scenario 3: Goodman 2.5 Ton Heat Pump

-

Installed cost: $7,000

-

Annual cooling cost: ~$473

-

Annual heating savings vs. oil: $500+

-

Federal credit: $2,000

-

State rebate: $3,000+

-

Total net cost after incentives: $2,000–$2,500

👉 You can see why many Northeast homeowners are moving toward heat pumps—the incentives are just too good to ignore.

📊 Maintenance & Warranty Considerations

-

Goodman 2.5 Ton systems come with a 10-year parts warranty (registration required).

-

Rebates don’t affect warranty, but proper installation and documentation matter.

-

Keeping annual maintenance logs helps if you ever need to prove eligibility or claim warranty service.

🧰 Mark’s Pro Tips on Rebates & Credits

-

Don’t chase rebates blindly. Sometimes the jump in SEER2 cost isn’t worth the rebate if your cooling season is short.

-

Heat pumps = maximum incentive. If you’re considering heating upgrades, they’re almost always the smarter long-term play in 2025.

-

Always get an AHRI certificate. Rebates and credits won’t be approved without it.

-

Combine federal + state + utility. Stack programs for maximum savings.

-

Plan ahead. Incentive budgets run out—apply early in the year.

✅ Bottom Line: Do Goodman 2.5 Ton Systems Qualify?

-

Baseline Goodman 13.8 SEER2 AC: Compliant for Northeast, but unlikely to qualify for federal or state rebates.

-

Upgraded Goodman AC (15+ SEER2): Qualifies for $600 federal tax credit + $200–$500 state rebate.

-

Goodman Heat Pump: Qualifies for $2,000 federal tax credit + $3,000+ in state/utility rebates.

👉 My advice: If you’re investing in a new system in 2025, don’t just think about the box price. Think long-term comfort, energy savings, and stacked incentives.

In the next topic we will know more about: Can You DIY a 2.5 Ton Goodman Install or Should You Call a Pro?