When Mark invested in his GE 14,000 BTU 208/230 Volt Through-the-Wall Air Conditioner with Electric Heat (model AKEQ14DCJ), he was thrilled with its cooling power and convenient heating option. But he also had another question on his mind:

👉 “Are there rebates or tax credits I can claim in 2025 for installing this wall unit?”

Energy rebates and tax credits can make HVAC upgrades much more affordable. However, not every system qualifies—and wall units like GE’s AKEQ14DCJ sit in a gray area.

This guide explores:

-

How federal tax credits work in 2025

-

Whether GE wall units meet the requirements

-

Utility rebate opportunities

-

Alternatives that qualify for bigger incentives

-

Mark’s real-world experience comparing rebates to upfront costs

🏛️ A Quick Look at 2025 Energy Incentives

The Inflation Reduction Act (IRA) reshaped HVAC incentives starting in 2023, with expanded programs continuing in 2025. Two key types of incentives are available:

🔹 Federal Tax Credits (IRS 25C)

-

Up to 30% of installation cost, capped at $2,000/year.

-

Covers heat pumps, central ACs, furnaces, and efficient water heaters.

-

Requires Energy Star certification.

🔹 Rebates (varies by state & utility)

-

Some utilities give rebates ($25–$1,500+) for qualifying HVAC upgrades.

-

Focused on heat pumps, Energy Star ACs, and high-efficiency appliances.

-

Rebates are often instant discounts at purchase, unlike tax credits.

👉 Bottom line: Tax credits are nationwide, rebates are local.

⚡ Do GE Wall Units Qualify for Federal Tax Credits?

The short answer: generally no—at least not for the AKEQ14DCJ.

🔹 Why Not?

-

The GE AKEQ14DCJ uses electric resistance heat, not a heat pump.

-

Electric resistance systems do not qualify for the 25C credit.

-

The unit is not Energy Star-certified, so it misses the federal requirements.

🔹 Which Wall Units Might Qualify?

-

Only Energy Star-certified through-the-wall units are eligible for smaller utility rebates (not federal tax credits).

-

Most GE wall units, including the 14,000 BTU model, do not meet this bar.

👉 Mark learned the hard truth: “I wasn’t going to get a federal credit for my GE unit—but the lower upfront price still made it worth it.”

💡 Utility Rebates: A Smaller Possibility

Some utility companies offer rebates for installing Energy Star-certified room air conditioners, including through-the-wall models.

Typical Rebates

-

Range from $25–$100 per unit.

-

Require proof of purchase and Energy Star certification.

-

Some utilities limit rebates to one per household.

Example Programs

-

Con Edison (NY): Offers rebates on Energy Star room ACs.

-

PG&E (CA): Provides small incentives for efficient appliances.

-

Midwest Utilities: Often have $50 mail-in rebates for Energy Star ACs.

👉 But since the GE AKEQ14DCJ is not Energy Star-certified, Mark wasn’t eligible.

🔥 What About the Heating Function?

The AKEQ14DCJ includes electric resistance heating.

🔹 Efficiency Issue

-

Electric resistance = 100% efficient at point of use, but costly compared to heat pumps.

-

Federal and state programs do not incentivize resistance heating.

-

Heat pumps, which transfer heat instead of generating it, can reach 300% efficiency and qualify for credits.

👉 Mark’s verdict: “The heating worked great for chilly fall mornings, but it’s not the kind of efficiency Uncle Sam gives rebates for.”

⚖️ Alternatives That Do Qualify

If rebates and tax credits are a priority, here’s what to consider:

✅ Ductless Mini-Splits (Heat Pumps)

-

Qualify for federal 25C tax credit (up to $2,000).

-

Many qualify for local utility rebates ($500–$1,500).

-

Provide both cooling and highly efficient heating.

-

Higher upfront cost ($3,000–$6,000).

✅ Energy Star Wall Units

-

Smaller rebates ($25–$100) available.

-

Worth checking if you want a budget-friendly option.

👉 Mark compared his neighbor’s mini-split install:

-

Neighbor paid $5,500 upfront but got a $1,200 federal tax credit + $800 utility rebate.

-

Mark paid $850 for his GE wall unit, no rebates.

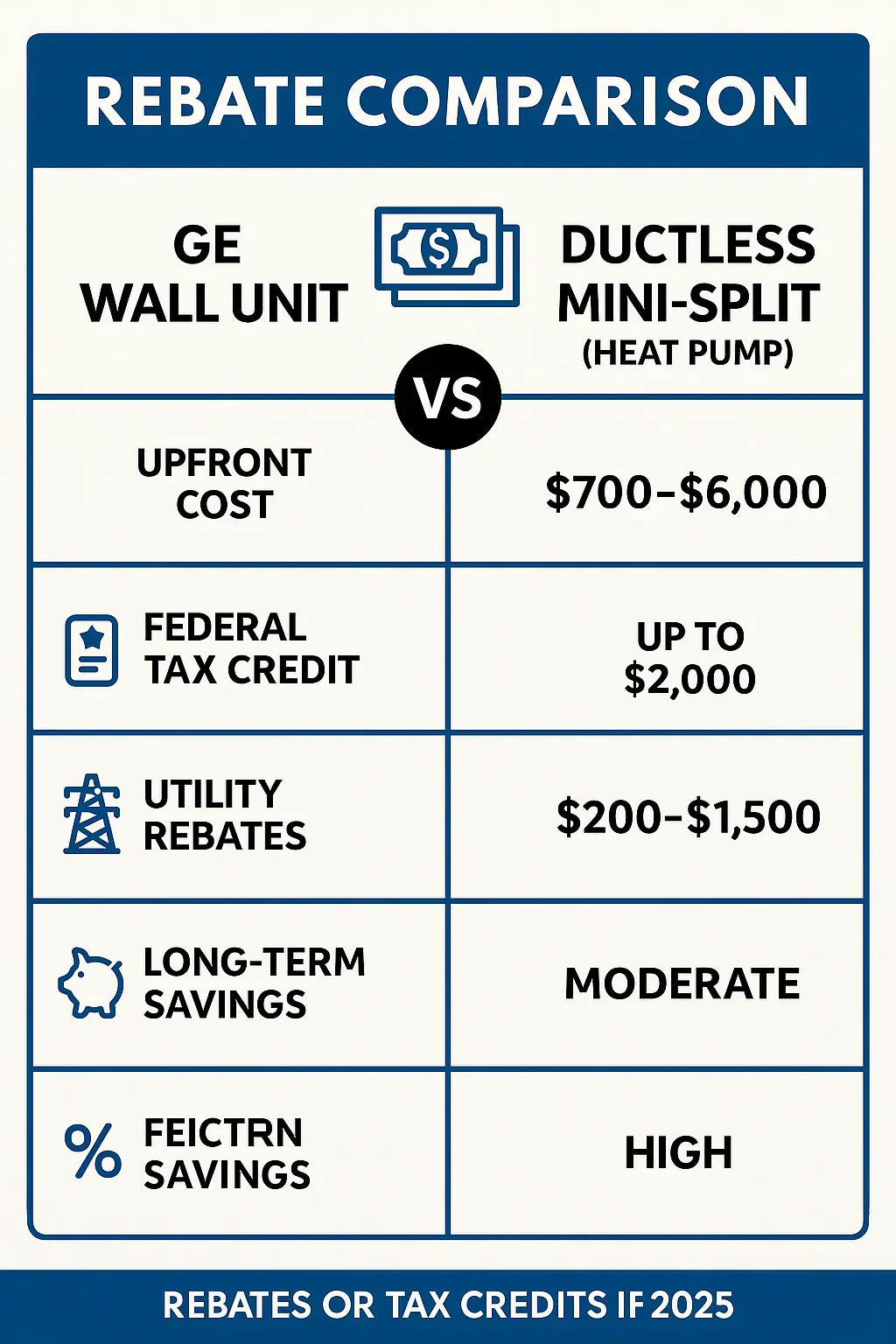

💵 Cost Comparison: GE Wall Unit vs. Mini-Split

| Feature | GE AKEQ14DCJ | Ductless Mini-Split (Heat Pump) |

|---|---|---|

| Upfront Cost | $700–$850 | $3,000–$6,000 |

| Federal Tax Credit | ❌ No | ✅ Up to $2,000 |

| Utility Rebates | ❌ Rare | ✅ $500–$1,500 |

| Heating Type | Electric Resistance | Heat Pump |

| Energy Efficiency | Moderate (CEER ~9.8) | High (SEER2 18–25) |

| Best For | Apartments, budget installs | Long-term savings, full-home comfort |

👉 Mark’s takeaway: “For me, the GE unit was affordable now. For long-term efficiency and rebates, the mini-split wins hands down.”

🧰 Mark’s Real-World Lesson

When Mark installed his GE wall unit:

-

He paid around $950 total with trim kit and sleeve.

-

He checked his state’s rebate portal—no rebates available.

-

He accepted the tradeoff: no credits, but a low upfront cost and reliable performance.

Meanwhile, his neighbor installed a mini-split:

-

Spent $5,500 upfront.

-

Got $2,000 federal credit + $800 rebate = $2,800 in incentives.

-

Still paid more than Mark, but enjoys lower utility bills year-round.

👉 Mark’s perspective: “If you want immediate comfort on a budget, GE works. If you want rebates and long-term savings, go mini-split.”

🔗 Verified References

✅ Final Thoughts

So, do GE wall units like the AKEQ14DCJ qualify for rebates or tax credits in 2025?

-

❌ No federal tax credits (not Energy Star and uses electric resistance heat).

-

⚠️ Local rebates possible only if the unit is Energy Star-certified—but the AKEQ14DCJ is not.

-

✅ Bigger incentives are available for mini-split heat pumps and other Energy Star systems.

👉 Mark’s advice: “Don’t buy a GE wall unit expecting rebates. Buy it for affordability, reliability, and convenience. If you want incentives, look at mini-splits or high-efficiency systems.”

In the next topic we will know more about: Is 14,000 BTUs Enough? Sizing Your GE Wall Unit for Rooms & Apartments