By Jake Lawson, The HVAC Specialist

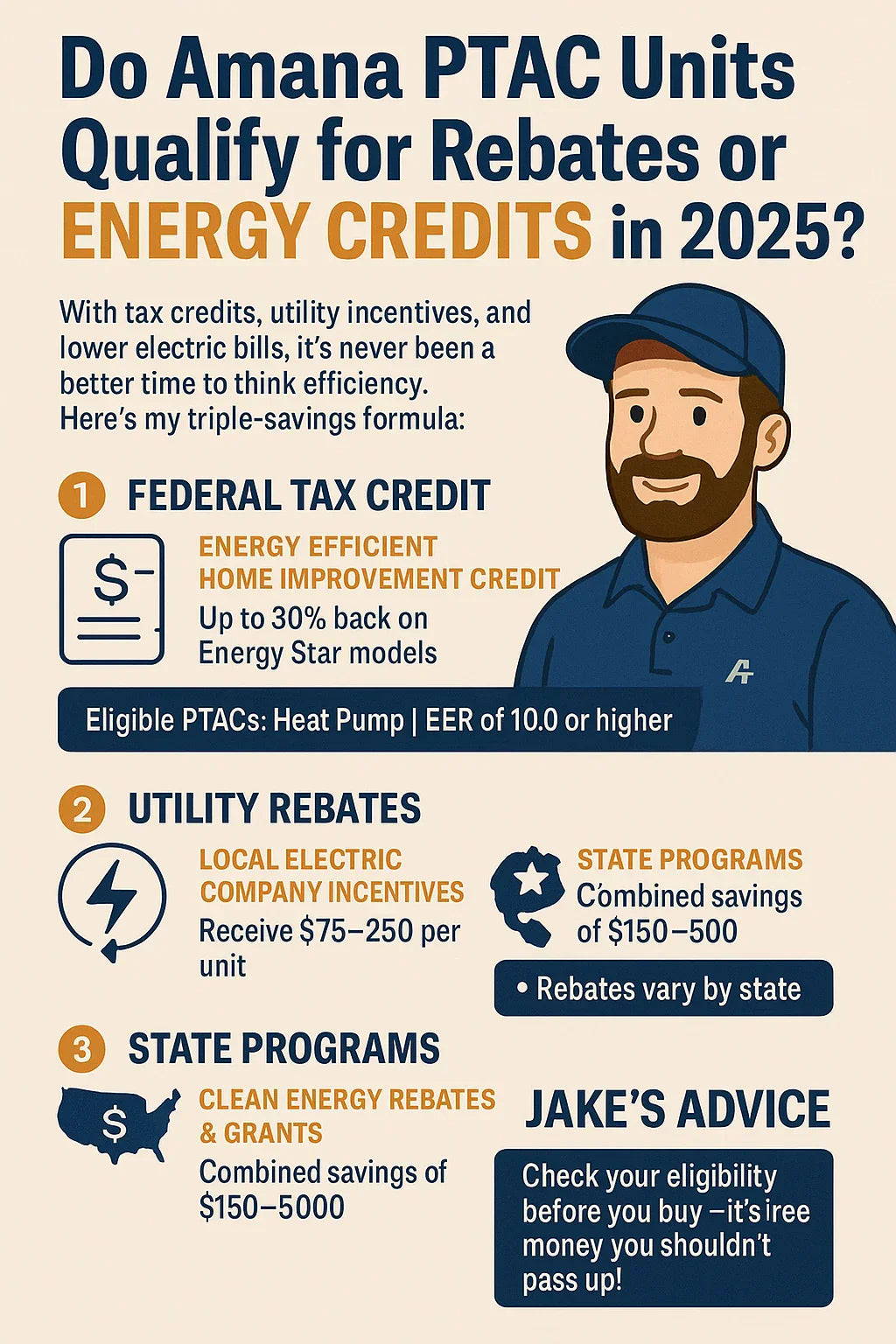

🏁 Why Energy Rebates Matter More Than Ever in 2025

Here’s something I tell every homeowner and property manager I work with:

“You’re already paying for efficiency — whether you use it or waste it.”

That’s especially true in 2025, with electricity costs still climbing, utility companies tightening their grids, and the federal government continuing to roll out programs to reward homeowners who upgrade to energy-efficient HVAC equipment.

If you’ve been considering an Amana PTAC (Packaged Terminal Air Conditioner) — especially a high-efficiency or heat pump model — this is the year to look seriously at rebates and tax credits.

Thanks to updates under the Inflation Reduction Act (IRA) and new Energy Star efficiency standards, certain PTAC systems now qualify for both federal tax credits and state or utility rebates — which can cut hundreds, even thousands, off your installation costs.

Let’s break it all down — what counts, how much you can get back, and which Amana models qualify in 2025.

⚙️ Understanding HVAC Rebates, Tax Credits & Incentives

When people hear “rebate,” they often think of confusing paperwork and fine print. But when it comes to HVAC, there are really three simple types of savings to know about:

🧾 1. Federal Tax Credits

You claim these when you file your taxes. They’re based on installing qualifying Energy Star equipment, and they reduce the taxes you owe (or increase your refund).

💸 2. Utility Rebates

These are offered by your local power company — often paid directly to you or deducted from your electric bill after installation.

🌎 3. State & Local Incentives

Many states offer extra rebates, often through energy-efficiency agencies like NYSERDA (New York), ComEd (Illinois), or PG&E (California).

Jake’s Take 💬

“Think of it like this — tax credits pay you later, rebates pay you sooner, and energy efficiency pays you every single month.”

🔗 Reference: Energy.gov – Rebates & Incentives Overview

💡 Federal Energy Tax Credits in 2025

The Inflation Reduction Act (IRA) extended and expanded the Energy Efficient Home Improvement Credit (25C) through 2032.

Here’s what that means for HVAC buyers in 2025:

-

You can claim 30% of the project cost, up to $600 per unit, for installing qualified Energy Star HVAC systems.

-

Qualifying systems include:

-

Energy Star–certified heat pumps

-

Energy-efficient air conditioners

-

Certain electric PTACs with EER (Energy Efficiency Ratio) ≥ 10

-

Jake’s Insight 💬

“Most folks think these credits only apply to big central units. But if your PTAC meets Energy Star standards, you’re eligible for the same savings.”

🧮 Example of a 2025 Federal Credit

Let’s say you buy an Amana PTH123H35AXXX 12,000 BTU Heat Pump PTAC for $1,000.

If it’s Energy Star certified:

$1,000 × 30% = $300 credit toward your federal tax bill.

Now imagine upgrading 5 units in a small motel — that’s $1,500 in tax credits come filing time.

🔗 Reference: Energy Star – Federal Tax Credits for HVAC

🌡 Which Amana PTAC Models May Qualify

Amana’s PTAC lineup is designed for both residential and light commercial use — and several models meet or exceed Energy Star and EER thresholds for 2025 incentive programs.

| Model | Type | Cooling (BTU) | EER | Energy Star | Likely Credit Eligible |

|---|---|---|---|---|---|

| PTH123H35AXXX | Heat Pump | 12,000 | 10.4 | ✅ | Yes (Federal + Utility) |

| PTH153H50AXXX | Heat Pump | 15,000 | 10.3 | ✅ | Yes |

| PTH093H35AXXX | Heat Pump | 9,000 | 9.8 | — | Possibly (Utility-level only) |

| PTH123G35AXXX | Electric Heat | 12,000 | 10.0 | ✅ | Likely Federal |

| PTH123G25AXXX | Electric Heat | 12,000 | 9.4 | — | No |

Jake’s Take 💬

“If the nameplate says 10.0 EER or higher, you’re already in the game. The Amana Distinctions line was built for this exact reason — strong cooling, lower power draw, and easy rebate eligibility.”

🔗 Reference: Amana PTAC Specifications

💵 Typical Savings from 2025 Incentives

So what can you realistically expect back from these programs?

| Incentive Type | Typical Range | Who Offers It | When You Receive It |

|---|---|---|---|

| Federal Tax Credit (25C) | $150–$600 per PTAC | U.S. Federal Government | Tax filing time |

| Utility Rebate | $75–$250 per PTAC | Local electric utilities | 4–8 weeks after application |

| State/Local Incentive | $150–$500 | State energy programs | Varies (mail-in or e-check) |

Jake’s Example 💬

“If you install five Amana heat pump PTACs in your property, your total incentive could hit $1,000–$1,500. That’s not marketing fluff — that’s cash back for doing the right thing.”

🏢 Utility and Local Rebates: The Hidden Goldmine

Here’s where a lot of homeowners and property managers leave money on the table — utility rebates.

In 2025, dozens of regional power companies are offering cash incentives for upgrading to Energy Star PTACs or heat pump wall systems.

📍 A Few Real-World Examples:

| Utility | Region | Rebate Amount | Eligible Units |

|---|---|---|---|

| Con Edison (NY) | Northeast | $150/unit | Energy Star PTACs |

| PG&E (CA) | West Coast | $200 | Heat pump PTACs |

| Austin Energy (TX) | South | 20% of project cost | High-EER wall systems |

| ComEd (IL) | Midwest | $100 | Electric or heat pump PTACs |

| Duke Energy (NC) | Southeast | $150 | Energy Star HVAC replacements |

Jake’s Tip 💬

“Most utility rebates take less than 10 minutes to apply for — you just upload your receipt and model info. It’s the easiest paycheck you’ll ever earn.”

🔗 Reference: DSIREUSA – State Incentive Database

🧰 How to Check If Your Amana PTAC Qualifies

If you’re not sure your unit qualifies, here’s my step-by-step guide to find out fast:

✅ Step 1: Locate Your Model Number

It’s printed on the Amana PTAC’s side label (starts with PTH, PTC, or PTE).

✅ Step 2: Check EER and Energy Star Status

Visit Amana PTAC Specs or The Furnace Outlet’s product page.

✅ Step 3: Use the Energy Star Rebate Finder

Head to Energy Star’s Rebate Finder Tool and enter your ZIP code.

✅ Step 4: Download the Energy Efficiency Certificate

This is often required for both tax and rebate claims (Amana provides one on their site).

✅ Step 5: Submit Your Claim

-

For tax credits, keep receipts and file IRS Form 5695 with your taxes.

-

For utility rebates, submit your purchase receipt and model info to your utility portal.

Jake’s Pro Tip 💬

“If you can order a PTAC online, you can apply for a rebate. It’s that easy — just don’t forget to do it.”

🌎 State-Level Rebates Worth Knowing in 2025

Here’s a breakdown of notable state programs currently offering PTAC-related energy incentives:

| State | Program | Rebate | Notes |

|---|---|---|---|

| California | Tech Clean California | Up to $250/unit | Covers Amana heat pump PTACs |

| New York | NYSERDA Efficient Buildings | 20% project rebate | Applies to multi-unit installs |

| Florida | FPL Energy Rewards | $150 per unit | For Energy Star wall units |

| Illinois | ComEd Efficiency Program | $100–$200 per system | Includes Amana electric PTACs |

| Texas | Oncor HVAC Rebate | $150 flat | Covers R-32 refrigerant units |

Jake’s Field Note 💬

“State programs are like coupons — they change yearly, but they’re worth checking. I’ve seen small hotels get thousands back in combined state and federal incentives.”

🔋 Why Energy Star Certification Matters

Most rebate and credit programs hinge on one thing — the Energy Star certification.

What It Means:

To earn the blue label, a PTAC must:

-

Have an EER ≥ 9.3

-

Maintain CEER ≥ 9.0 (standby efficiency)

-

For heat pumps, achieve HSPF ≥ 8.0

What It Gets You:

-

Federal tax credit eligibility

-

Utility rebates

-

Better resale and operating value

Jake’s Simplified Version 💬

“No sticker, no rebate — simple as that. If your PTAC has the blue star, you’re cashing in.”

🏨 Rebates for Commercial Properties and Hotels

If you manage a hotel, assisted living facility, or apartment complex, rebates multiply — because most programs pay per unit installed.

Example:

A 20-room motel upgrades to Amana PTH123H35AXXX heat pump PTACs:

-

$150 × 20 (Utility rebate) = $3,000

-

$600 × 20 (Federal credit cap) = $12,000

💰 Total possible incentive: $15,000

Jake’s Commercial Insight 💬

“Hotels are the biggest winners here. They get back thousands just for replacing outdated PTACs with efficient Amana units. That’s not theory — I’ve seen the checks.”

🧾 How to File Your 2025 Federal Tax Credit

The federal process sounds scarier than it is. Here’s how to handle it in under 10 minutes.

Step-by-Step:

-

Keep your purchase receipt and model number handy.

-

Download Amana’s Energy Efficiency Certificate (for your records).

-

Complete IRS Form 5695 — “Residential Energy Credits.”

-

Add your PTAC under “Qualified Energy Property.”

-

File as usual with your taxes in early 2026.

Jake’s Advice 💬

“If you’re filing with TurboTax or H&R Block, there’s literally a checkbox for this. It’s one of the easiest credits you’ll ever claim.”

🔗 Reference: IRS – Form 5695

🔧 Combining Rebates with Energy Savings

Rebates are the icing on the cake — the real long-term win comes from lower electric bills.

A 12,000 BTU Amana PTAC with a 10.0 EER uses about 10% less energy than older 9.0-rated models. Over a 10-year lifespan, that adds up to:

$15–$25/month in savings × 8 months/year × 10 years = $1,200–$2,000 saved in energy alone.

Combine that with rebates and credits, and your total lifetime benefit easily passes $2,500–$3,000 per unit.

Jake’s Field Math 💬

“When you buy efficient, you don’t just get a cooler room — you get a smaller bill every single month.”

🧠 Common Myths About HVAC Rebates

| Myth | Reality |

|---|---|

| “Only new homes qualify.” | Existing homes and commercial retrofits qualify, too. |

| “You must hire a contractor to apply.” | Homeowners can apply directly with receipts. |

| “Electric PTACs never qualify.” | High-EER Amana electric models can qualify. |

| “The paperwork takes forever.” | Most utilities use digital submissions now. |

Jake’s Take 💬

“I’ve applied for rebates in the time it takes to brew coffee. If you can click ‘checkout,’ you can claim a credit.”

💸 The Future of PTAC Rebates Beyond 2025

Here’s the good news: energy incentives aren’t going anywhere.

The Department of Energy (DOE) has set a target of reducing building energy use by 20% by 2030, and rebates are a big part of that plan.

Expect:

-

Expanded coverage for R-32 refrigerant systems (like Amana’s Distinctions line).

-

More heat pump incentives as fossil-fuel heating phases out.

-

Bonus rebates for all-electric or low-carbon retrofits.

Jake’s Forecast 💬

“We’re in the middle of an HVAC revolution. The next decade’s going to reward homeowners who go efficient early — and Amana’s already ready for it.”

🧾 Jake’s Quick Rebate Checklist

| Task | Details | Result |

|---|---|---|

| Check model number | Verify EER and Energy Star status | Confirms eligibility |

| Find local rebates | Visit Energy Star Rebate Finder | Instant savings lookup |

| File for utility rebate | Submit receipt and form | Cash or bill credit |

| File for federal credit | Use IRS Form 5695 | $150–$600 back |

| Keep efficiency docs | Save Amana certificate | Required for proof |

| Track savings | Compare energy bills | Measure long-term ROI |

Jake’s Tip 💬

“Print that certificate and staple it to your receipt — it’s your golden ticket come tax time.”

🏁 Jake’s Final Word: Don’t Leave Money on the Table

If you’ve been eyeing an Amana PTAC upgrade, 2025 is the year to make your move. Between federal tax credits, utility rebates, and lower monthly bills, you can get comfort that practically pays for itself.

Jake’s Closing Thought 💬

“You’re not just buying an air conditioner — you’re buying an investment. Rebates, credits, and savings are all just part of the return.”

In the next topic we will know more about: Is 12,000 BTUs Enough? How to Size Your Amana PTAC for Comfort and Efficiency