🧠 Introduction: Mike’s Perspective on Incentives

Mike Sanders still remembers when his neighbor saved nearly $2,000 on a new HVAC system just by filing the right paperwork.

“Most folks don’t realize that when you buy a high‑efficiency furnace and AC, Uncle Sam and your utility company might chip in,” Mike explains. “It’s like a hidden coupon for upgrading your comfort.”

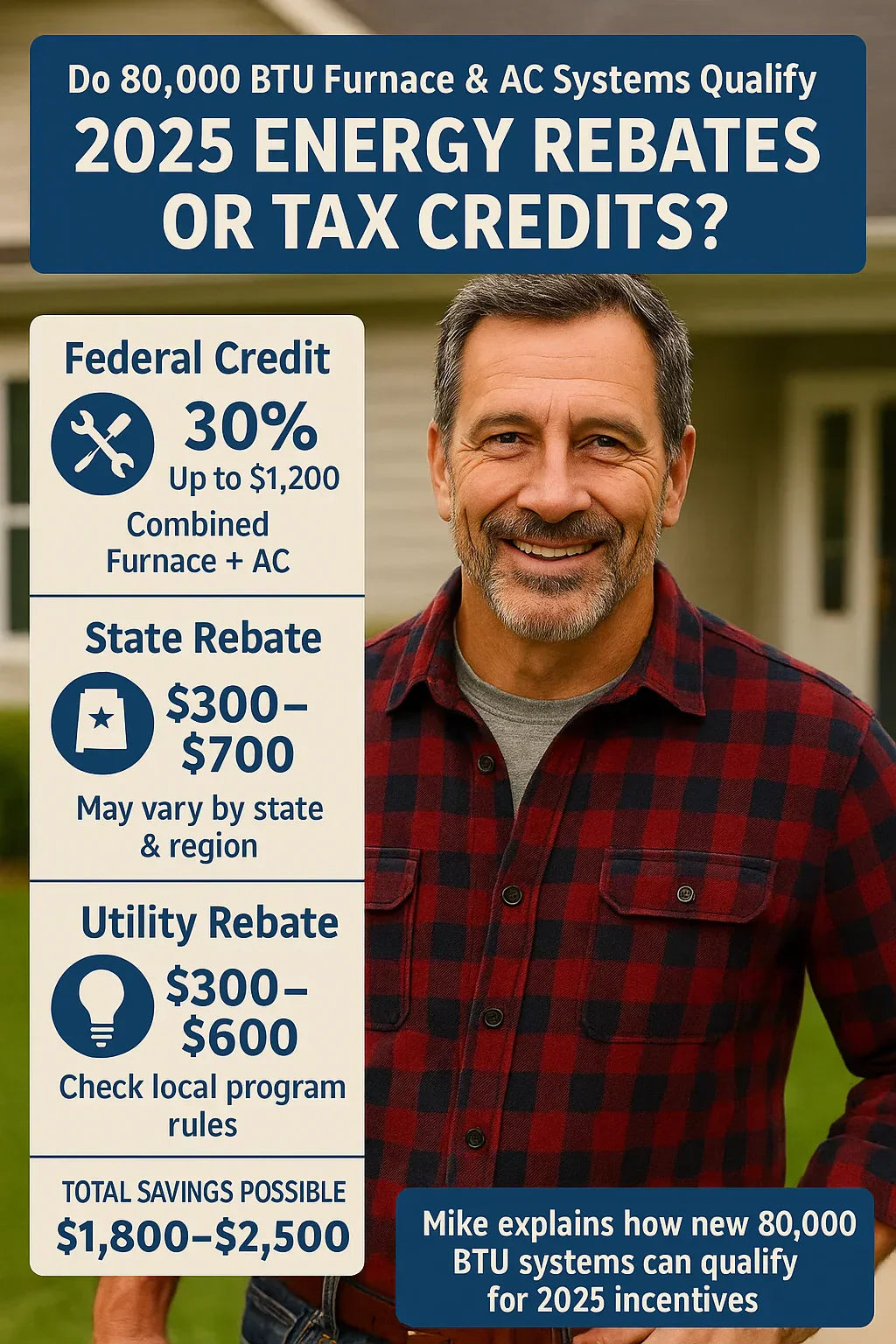

In 2025, rebates and tax credits are more generous than ever, especially if you’re installing an 80,000 BTU furnace & AC system that meets the latest efficiency standards. The key is knowing which systems qualify, how much you can get, and how to claim it.

🏷️ 1. Federal Tax Credits for 2025

Thanks to the Inflation Reduction Act (IRA), homeowners can save big on qualifying HVAC equipment.

🔧 Energy Efficient Home Improvement Credit (25C)

-

Covers 30% of total cost (equipment + installation)

-

Annual cap: $1,200 for most upgrades, $2,000 for heat pumps

-

Eligibility for 80,000 BTU systems:

-

Gas furnaces: ≥97% AFUE

-

Central AC: ≥16 SEER2

-

👉 Example:

-

New Amana 97% AFUE furnace + Rheem 16 SEER2 AC

-

Total cost: $12,000

-

30% credit = $3,600 (but capped at $1,200 for furnace + $600 for AC)

-

Final savings: $1,800

📖 Resource: ENERGY STAR – Tax Credits 2025

📈 2. State & Local Incentives

🌍 How They Work

-

States often stack their rebates on top of federal credits

-

Amounts vary by efficiency level and climate zone

🗺 Examples in 2025

-

Minnesota: $400 rebate for 95%+ AFUE furnaces

-

California: $1,000+ for ACs rated 16 SEER2 or higher

-

Texas: $600 rebate for high‑efficiency central AC systems

-

New York: Up to $1,200 back on qualifying furnace + AC bundles

📖 Find Local Programs: DSIREUSA – Incentives Database

👉 Mike’s Tip:

“Don’t assume your state doesn’t offer rebates. I’ve seen folks in small towns get $700 checks they didn’t know about.”

💡 3. Utility Company Rebates

Utilities often run their own promotions because efficient HVAC lowers grid strain.

-

Rebates usually range from $300–$800 per unit

-

Many utilities offer extra bonuses for dual‑system installs

-

Some programs only last until funds run out each year

📋 Example:

-

Local electric co‑op: $500 rebate for 16 SEER2 AC

-

Gas provider: $400 rebate for 97% AFUE furnace

-

Total = $900 in utility rebates

👉 Mike’s Tip:

“Check before you buy—rebates can change quarterly and sometimes run out of money fast.”

📖 Reference: Energy.gov – Utility Rebates

🏡 4. Which 80,000 BTU Systems Typically Qualify

✅ Gas Furnaces

-

Must meet or exceed 95–98% AFUE

-

Condensing models almost always qualify

✅ Central Air Conditioners

-

Must be 16+ SEER2

-

Higher SEER2 units may unlock extra bonuses in southern states

❌ Units That Don’t Qualify

-

Gas furnaces under 95% AFUE

-

ACs under 15.2 SEER2 (fail federal minimums)

🔎 5. How to Prove Eligibility

Documents You’ll Need:

-

Manufacturer’s Certification Statement

-

AHRI Certificate of Product Ratings

-

Proof of Purchase (invoice + paid receipt)

-

IRS Form 5695 for federal tax credits

👉 Pro Tip from Mike:

“Always ask your installer for the AHRI certificate. Without it, the IRS won’t approve your credit.”

📖 IRS Filing: IRS Form 5695 Instructions

🛠 6. Real‑World Example: Mike’s Neighbor

In early 2024, Mike’s neighbor installed:

-

Amana 96% AFUE furnace

-

Rheem 16 SEER2 AC

The Breakdown:

-

Install Cost: $12,500

-

Federal Tax Credit: $1,200

-

State Rebate (Ohio): $500

-

Utility Rebates: $300

-

Final Cost: $10,500

Savings: $2,000 total

“He told me the rebate checks covered his first six months of energy bills.”

📊 7. Rebates vs. Long‑Term Savings

💵 Upfront Math

-

High‑efficiency system: $1,500 more than baseline

-

Rebates + credits: $1,800 back

-

Net savings: $300 upfront

⚡ Energy Bill Savings

-

20% lower heating/cooling bills

-

Typical annual savings: $300–$500

-

Payback period: 3–5 years

👉 Mike’s Tip:

“Even if you just break even upfront, your utility bills will keep paying you back every single month.”

🧰 8. Mike’s Checklist for Claiming Rebates & Credits

✅ Confirm efficiency ratings before purchase (≥97% AFUE, ≥16 SEER2)

✅ Ask installer for AHRI certificate & manufacturer statement

✅ Save all invoices and receipts

✅ Submit IRS Form 5695 for tax credit

✅ Apply for state & utility rebates online (deadlines can be short)

✅ Keep digital copies for at least 3 years in case of audit

📊 Example Savings Table for 2025

| System Installed | Federal Credit | State Rebate | Utility Rebate | Total Savings |

|---|---|---|---|---|

| 96% AFUE Goodman + 16 SEER2 AC | $1,200 | $400 | $300 | $1,900 |

| 98% AFUE Amana + 18 SEER2 AC | $1,200 | $700 | $500 | $2,400 |

| 95% AFUE Rheem + 15.2 SEER2 AC | $800 | $300 | $300 | $1,400 |

🧭 Final Thoughts from Mike Sanders

“If you’re eyeing a new 80,000 BTU furnace & AC in 2025, you’d be crazy not to check rebates and credits first. The right paperwork can shave thousands off your install cost—and that’s before you even count the lower utility bills.”

In the next topic we will know more about: Is an 80,000 BTU Furnace & AC System Right for Your Home? Mike’s Sizing Tips