(Jake’s guide to finding and securing HVAC incentives without getting lost in the fine print)

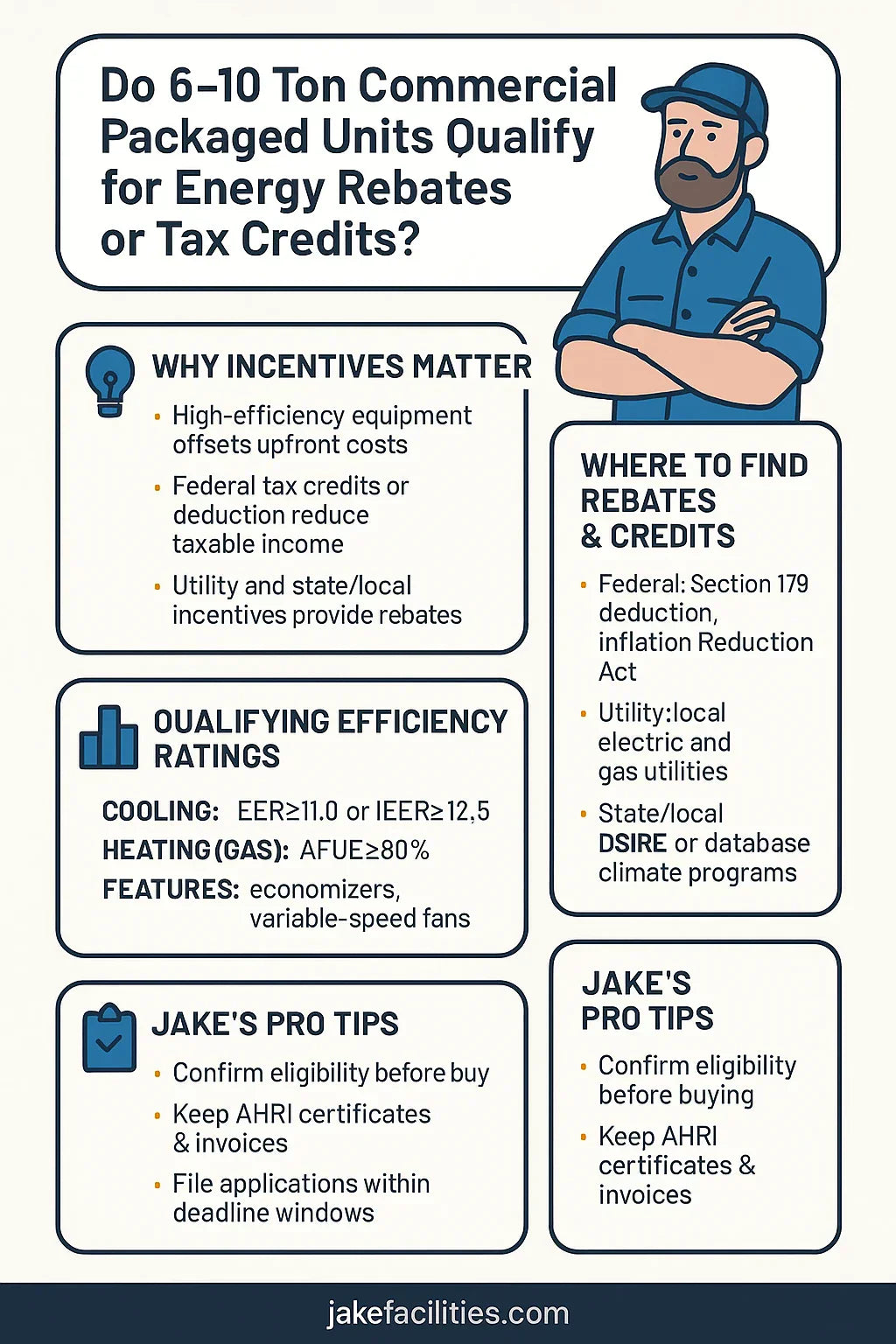

🏢 1. Introduction – Why Incentives Matter for Large HVAC Purchases

When you’re replacing a 6–10 ton commercial packaged AC & gas furnace unit, you’re not just buying a piece of equipment—you’re making a capital investment that can easily run $15,000–$25,000 or more installed.

The good news? Energy rebates and tax credits can significantly offset that cost.

-

Federal tax deductions can reduce your taxable income.

-

Utility rebates put cash back in your pocket.

-

State and local programs can stack on top of both.

Why do these programs exist?

-

To encourage businesses to upgrade to higher-efficiency equipment.

-

To reduce strain on the electrical grid during peak demand.

-

To lower overall carbon emissions from commercial buildings.

📜 2. Federal Tax Credits & Deductions

A. Section 179 Commercial HVAC Deduction (U.S.)

-

Allows businesses to deduct the full purchase price of qualifying HVAC equipment in the year it’s placed in service.

-

Applies to new commercial HVAC equipment, including 6–10 ton packaged units.

-

2025 limit for Section 179 deductions: $1.16 million (subject to phase-out).

Key Steps:

-

Ensure the unit is installed and operational within the tax year.

-

Keep all receipts and proof of installation.

B. Inflation Reduction Act (IRA) Incentives

-

Expanded incentives for energy-efficient commercial equipment.

-

Bonus deductions for projects that meet prevailing wage and apprenticeship requirements.

-

Higher savings for projects in energy communities or low-income areas.

C. Energy-Efficient Commercial Building Deduction (Section 179D)

-

Allows a tax deduction for energy-efficient building systems, including HVAC.

-

Efficiency improvements must meet ASHRAE 90.1 standards.

-

Deduction value varies based on kBtu/sq ft improvement.

💰 3. Utility Rebates & Regional Programs

Most major electric and gas utilities offer rebates for high-efficiency rooftop units—often tied to EER/IEER ratings and furnace AFUE.

Typical Examples for a 6–10 Ton Unit (2025 rates):

-

$150–$250 per ton for qualifying EER/IEER performance

-

$300–$600 bonus for advanced economizer integration

-

$150–$250 for demand-controlled ventilation features

Important:

-

Rebate eligibility is based on AHRI-certified performance data.

-

You’ll often need to submit the AHRI certificate with your application.

-

Programs are usually first-come, first-served—funding can run out before year-end.

🌎 4. State & Local Incentives

A. Where to Search

-

DSIRE (Database of State Incentives for Renewables & Efficiency) –

-

State energy offices often maintain their own lists of available programs.

-

Local climate action plans may include targeted funding for HVAC retrofits.

B. Examples

-

California: Commercial rebates for high-IEER rooftop units can reach $1,200+ per unit.

-

New York: NYSERDA offers performance-based incentives for high-efficiency packaged units.

-

Texas: Some utilities offer doubled incentives during grid reliability improvement periods.

📊 5. Qualifying Efficiency Ratings for Rebates

To qualify, most programs set minimum performance thresholds:

Cooling:

-

EER (Energy Efficiency Ratio): Often 11.0+ for rebates

-

IEER (Integrated EER): 14.0+ for tiered bonuses

Heating (Gas Furnace Section):

-

AFUE (Annual Fuel Utilization Efficiency): 80–90%+

Features That Boost Eligibility:

-

Variable-speed supply fans

-

Advanced economizers with fault detection

-

Demand-controlled ventilation sensors

🛠 6. Jake’s Steps to Securing Incentives

-

Check eligibility before you buy – Don’t assume any high-efficiency unit qualifies; requirements vary.

-

Work with an AHRI-certified match – Mismatched components can void rebate eligibility.

-

Gather documentation early – Model numbers, AHRI certificate, efficiency ratings, and invoices.

-

File promptly – Utility rebates often have a 60–90 day post-install window.

-

Track payments – Some rebates arrive as checks, others as bill credits.

📑 7. Case Study: Real-World Savings

Scenario:

-

Replacement of a 20-year-old 8-ton RTU in a 12,000 sq ft retail building.

-

Installed cost of new high-IEER unit: $18,500.

-

Utility rebate: $1,600.

-

Section 179 deduction tax savings: $3,885 (21% corporate tax rate).

-

Net effective cost: $13,015.

Payback:

-

Annual energy savings: $1,200/year.

-

Payback period: ~10 years including incentives.

📝 8. Jake’s Pro Tips

-

Stack programs when possible – Federal deduction + state rebate + utility rebate = maximum ROI.

-

Don’t skip economizers – They can push your unit into a higher rebate tier.

-

Ask about midstream incentives – Some rebates are built into the contractor’s invoice price.

-

Save your AHRI certs – They’re the #1 most requested rebate document.

-

Watch funding cycles – Many programs reset January 1, but some renew mid-year.

In the next topic we will know more about: Is a 6–10 Ton Packaged Unit Right for Your Building? Sizing, Load Calculations & Zoning Tips