When I installed my Daikin 20 Ton 14.2 IEER2 packaged rooftop unit, I knew it would be a serious investment — my project came in around $55,800 all-in. But here’s what saved me thousands: rebates and tax credits.

In 2025, businesses upgrading to high-efficiency commercial HVAC units can qualify for federal tax deductions, Inflation Reduction Act incentives, and utility rebates. This guide breaks down exactly how these programs work, what makes a 20 Ton Daikin eligible, and how much you can realistically save.

🏛️ The 2025 Incentive Landscape for Commercial HVAC

The Department of Energy (DOE) raised efficiency standards in 2023 for rooftop units and packaged commercial HVAC. By 2025, all new systems must meet higher IEER2 ratings.

Why does this matter?

-

Rebates and tax credits are tied to meeting or exceeding those efficiency standards.

-

A 20 Ton Daikin with 14.2 IEER2 qualifies under these new rules.

-

Incentives apply to new construction, system replacement, or retrofit projects.

📎 U.S. DOE – Commercial HVAC Efficiency Standards

👉 In short: If you’re upgrading your system in 2025, you’re in luck — there’s money on the table.

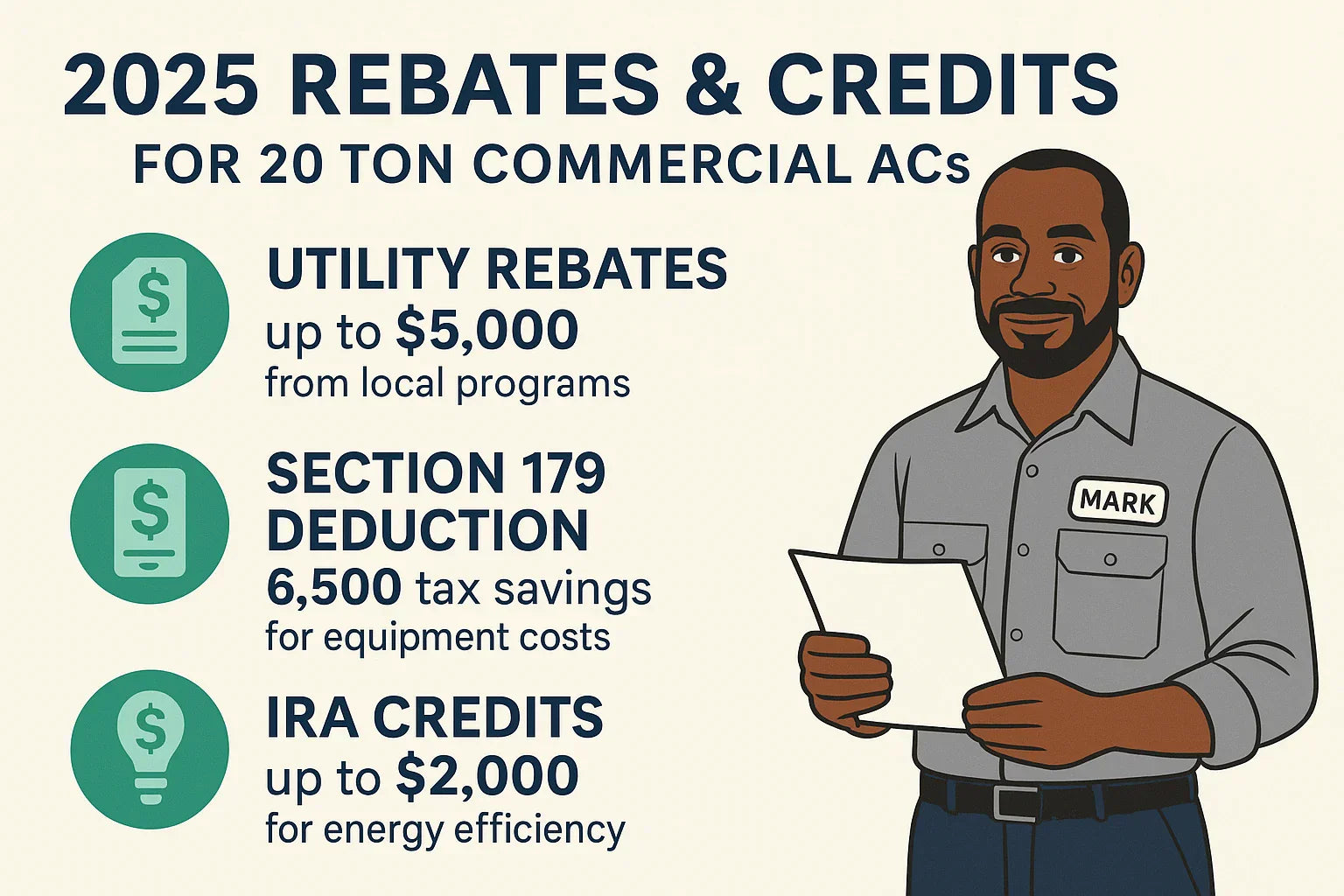

💵 Federal Incentives & Tax Credits

1. Section 179 Deduction

The IRS allows businesses to deduct the full purchase price of HVAC equipment in the year it’s placed into service.

-

Applies to equipment, installation, and labor.

-

Deduction limit for 2025: Up to $1.16 million.

-

No need to spread depreciation across years — you get the benefit upfront.

📎 IRS Section 179 HVAC Deduction

👉 My Section 179 deduction alone saved me ~$6,500 in taxes.

2. Inflation Reduction Act (IRA) Incentives

The IRA of 2022 included expanded credits for commercial buildings that improve energy efficiency.

-

Section 179D Deduction: Applies to commercial building upgrades that reduce energy use by 25% or more.

-

HVAC systems like Daikin’s packaged 20 Ton can contribute to that savings threshold.

-

Typical deduction: $2.50–$5.00 per square foot of upgraded building area.

📎 EPA – Inflation Reduction Act Programs

3. ENERGY STAR Commercial HVAC Credits

While more common in residential, some commercial programs offer additional incentives if your system is ENERGY STAR certified.

-

A 20 Ton Daikin packaged unit with 14.2 IEER2 typically meets or exceeds ENERGY STAR criteria.

-

Check specific model listings in the ENERGY STAR Commercial HVAC database.

⚡ Utility Rebates & Regional Programs

Utility companies across the U.S. are offering rebates for installing high-efficiency rooftop units (RTUs).

Typical Rebates

-

$2,000–$5,000 per qualifying unit (based on tonnage and efficiency).

-

Some utilities pay per ton of capacity — meaning a 20 Ton Daikin could qualify for $100–$250 per ton.

Example Programs

-

PG&E (California): Rebates for high-efficiency commercial RTUs.

-

Con Edison (New York): Offers per-ton rebates for packaged units meeting IEER2 standards.

-

Duke Energy (Southeast): Provides incentives for energy-efficient commercial HVAC retrofits.

📎 DSIRE Database – State Incentives for Renewables & Efficiency

👉 My local utility gave me a $2,500 rebate check within 60 days of submitting paperwork.

📊 What Makes a 20 Ton Daikin Eligible?

1. Efficiency Ratings

-

Daikin 20 Ton Packaged RTU: 14.2 IEER2.

-

Meets DOE 2023–2025 standards.

-

Often exceeds utility rebate minimums.

2. Documentation Required

-

AHRI Certificate of Product Ratings – proves efficiency.

-

Model/serial number of installed unit.

-

Installation invoice from licensed contractor.

📎 AHRI Directory of Certified Equipment

🧾 Paperwork & Application Process

Section 179 Deduction

-

Claim equipment on IRS Form 4562.

-

File in the same tax year you installed the unit.

Utility Rebates

-

Submit application through your utility provider.

-

Attach AHRI certificate and invoice.

-

Wait for utility inspection (if required).

Pro Tips from My Experience

-

File rebate paperwork immediately after install — utilities often have a 90-day deadline.

-

Keep digital copies of all documents for future audits.

-

Work with your contractor — many know exactly how to file.

📎 EnergyStar – Commercial HVAC Incentives

💡 Mark’s Real-World Example of Savings

Here’s how the math worked out for me:

-

Daikin 20 Ton System Installed Cost: $55,800

-

Utility Rebate: -$2,500

-

Section 179 Deduction: -$6,500 (tax savings)

-

Net Savings: ~$9,000

That’s nearly 16% off my total cost.

👉 Without rebates, I would’ve been over budget. These incentives made the project financially sustainable.

✅ Key Takeaways for 2025

-

Yes — 20 Ton Daikin packaged rooftop units qualify for rebates and tax credits in 2025.

-

Savings can range from 10–20% of project cost.

-

You’ll need:

-

Efficiency documentation (AHRI certificate)

-

Proof of purchase/installation

-

Properly filed applications (IRS + utility)

-

-

The combination of utility rebates + Section 179 deductions offers the biggest savings.

In the next topic we will know more about: Energy Efficiency Explained: What Does 14.2 IEER2 Really Mean for Your Utility Bills?