If you're in the market for a new air conditioning system, chances are you've heard about the shift to R-32 refrigerant—and the federal tax credits that could help cover your upgrade. But here's the real question:

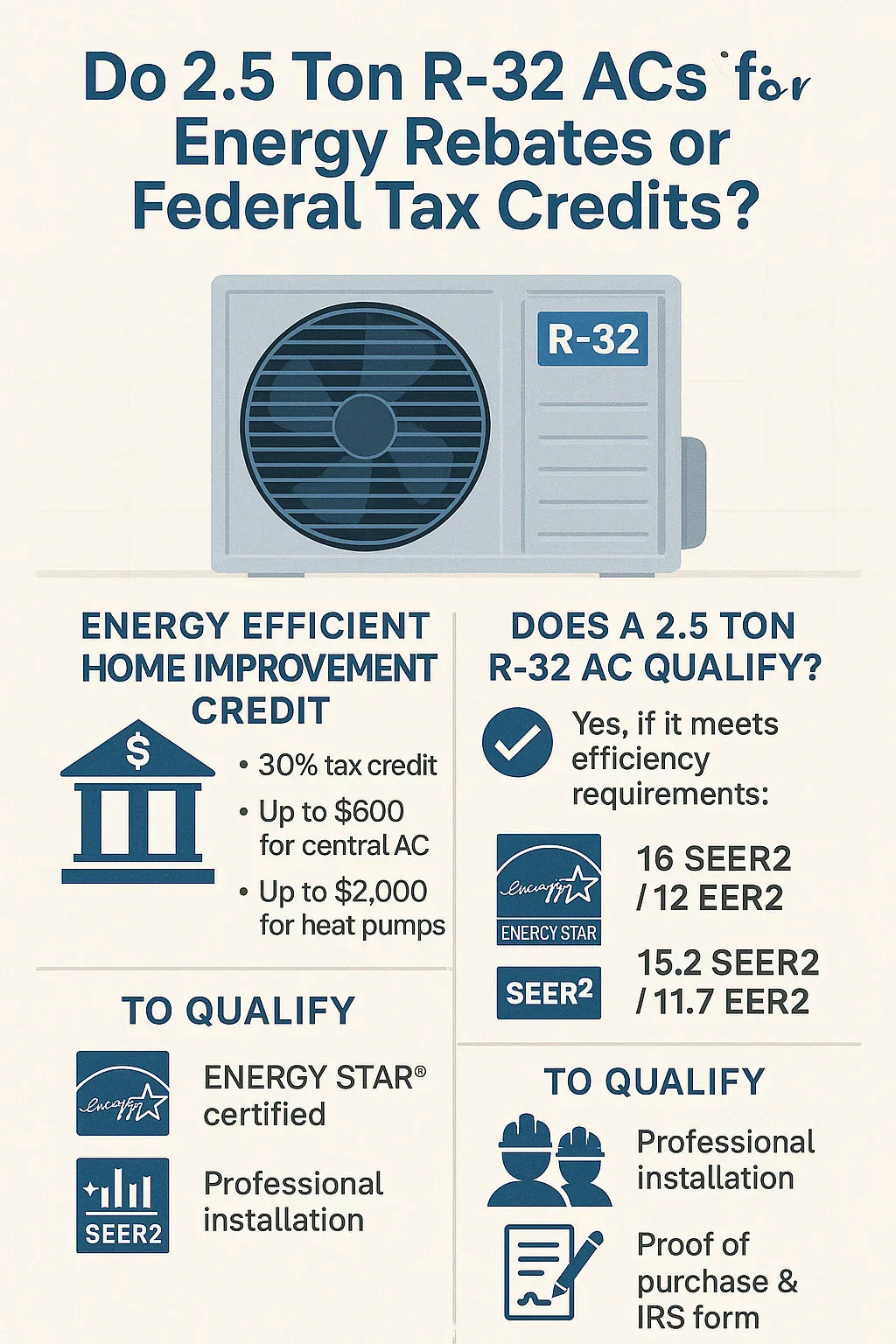

Does a 2.5 ton R-32 AC system qualify for energy rebates or the 2025 Energy Efficient Home Improvement Credit?

The short answer? Yes—but with a few key conditions. This guide breaks down what homeowners like you need to know about eligibility, how much you can save, and how to claim those rebates the right way.

🔍 What Is the Energy Efficient Home Improvement Credit?

In 2023, the Inflation Reduction Act (IRA) expanded federal incentives for high-efficiency HVAC systems. The updated Energy Efficient Home Improvement Credit (Section 25C) provides a 30% tax credit, up to $600 for qualifying air conditioners and $2,000 for heat pumps—each per year, not lifetime.

To qualify for these credits, your equipment must:

-

Meet minimum SEER2 and EER2 efficiency requirements

-

Be installed in a primary residence (not a rental or vacation home)

-

Be purchased and installed between Jan 1, 2023 – Dec 31, 2032

❄️ Do R-32 Systems Qualify for Rebates?

Yes. R-32 refrigerant systems can qualify for rebates and tax credits—if they meet the efficiency thresholds.

R-32 is a low-GWP (global warming potential) refrigerant designed to replace older, phased-out options like R-410A. That environmental friendliness can help boost a system’s Energy Star score, making it more likely to qualify.

✅ So if your 2.5-ton system uses R-32, that’s a plus—but not the only factor. Efficiency metrics matter more.

📊 Minimum Efficiency Ratings for 2025 Tax Credit Eligibility

According to the ENERGY STAR Version 6.1 specification for Central Air Conditioners (as of 2025):

For Split-System Central ACs (like most 2.5-ton R-32 units):

| Region | SEER2 Minimum | EER2 Minimum |

|---|---|---|

| North | 16.0 SEER2 | 12.0 EER2 |

| South/Southwest | 15.2 SEER2 | 11.7 EER2 (12.2 in SW region for systems < 45k BTU) |

📌 Note: A 2.5-ton system = 30,000 BTU, so it falls under the <45k rule for Southwest.

So your R-32 system must hit or exceed these SEER2 and EER2 thresholds to qualify.

✅ Does a 2.5 Ton R-32 System Typically Qualify?

Yes—many modern 2.5 ton R-32 systems do qualify, particularly from reputable brands like:

-

Goodman

-

Amana

-

Carrier

-

Lennox

-

Trane

Look for product specs showing:

-

15.2 SEER2 or higher

-

ENERGY STAR® certification

-

R-32 refrigerant

🔎 Tip: If your model isn’t ENERGY STAR certified, it will not qualify, even if it’s efficient.

💵 How Much Can You Save?

Federal Tax Credit Breakdown (2025):

-

Up to $600 for qualifying central AC

-

Up to $2,000 for qualifying heat pump (if you opt for a hybrid R-32 unit)

-

No lifetime limit (reset yearly through 2032)

-

Can be combined with state and utility rebates

Example:

If your 2.5 ton R-32 AC costs $3,500 for equipment and install, and qualifies under the program:

-

$600 federal tax credit

-

$200–$1,000 in possible utility rebates (varies by state)

-

Net savings: $800–$1,600+

🏡 Do You Need a Pro to Install It?

In most cases, yes—especially if you want the rebate.

IRS and ENERGY STAR rules require:

-

Installation by a qualified professional with proper documentation

-

A signed Manufacturer’s Certification Statement

-

A filled-out IRS Form 5695 at tax time

Even if you’re capable of DIY, you may lose eligibility for credits and rebates if the install isn’t certified. That’s why many homeowners like Tony choose to hire a licensed HVAC tech for final hookup and pressure test—even if they do the prep work themselves.

🔧 What Documentation Will You Need?

To successfully claim the federal tax credit:

-

Proof of purchase (invoice/receipt with make, model, and install date)

-

ENERGY STAR certification of your AC system

-

IRS Form 5695 attached to your annual tax return

-

(Optional but helpful): Installer license number and HVAC permit record

Keep this documentation in a folder labeled “IRA HVAC Credit 2025” just in case of audit.

🌎 State & Local Rebates: What Else Can You Stack?

Alongside the federal credit, your state or local utility may offer:

-

Instant rebates at point of sale (Home Depot, Lowe’s, HVAC distributors)

-

Post-purchase mail-in rebates

-

Efficiency program incentives via energy providers

Use the ENERGY STAR Rebate Finder and enter your zip code for the latest offers.

📦 Pro Tip: Use the Furnace Outlet’s Free “Quote by Photo” Tool

Want to see if your desired R-32 system qualifies before you buy?

✅ The Furnace Outlet’s Quote by Photo Tool makes it easy.

Just snap a picture of your current setup and a licensed HVAC expert will:

-

Recommend a compatible R-32 system

-

Confirm if it meets rebate/tax credit specs

-

Provide pricing on pro install or DIY support

📣 Final Word from Tony

“When I switched from my old R-410A unit to a 2.5 ton R-32 model, I was surprised how much I saved. Between the federal credit, a $750 local rebate, and better efficiency, I cut my cooling bill and made the system pay for itself faster.”

✅ Quick Checklist: Does Your System Qualify?

| Requirement | Needed for Credit? | Check |

|---|---|---|

| ENERGY STAR Certified | ✅ Yes | 🔲 |

| SEER2 ≥ 15.2 (or 16.0 North) | ✅ Yes | 🔲 |

| R-32 Refrigerant | ⚠️ Not required, but helps | 🔲 |

| Pro Installation | ✅ Yes (usually) | 🔲 |

| IRS Form 5695 | ✅ Yes | 🔲 |

| Installed in Primary Residence | ✅ Yes | 🔲 |

In the next topic we will know more about: Is a 2.5 Ton R-32 AC System Right for Your Home? Room Size, Layout & Climate Tips