🏢 Introduction: The Big Question

When I sit down with business owners about HVAC upgrades, one of the first things they ask is:

👉 “If I spend $20,000 on a new 10 ton system, will I get any money back?”

It’s a fair question. Commercial AC systems aren’t cheap. But here’s the good news: in 2025, high-efficiency systems like the Daikin 10 Ton Multi-Positional Split System not only cut your utility bills—they may also qualify for federal tax deductions, state and local rebates, and even utility incentives.

The catch? You need to know the rules. Eligibility depends on efficiency ratings, system type, and your location.

Let’s break it down so you know exactly what’s available.

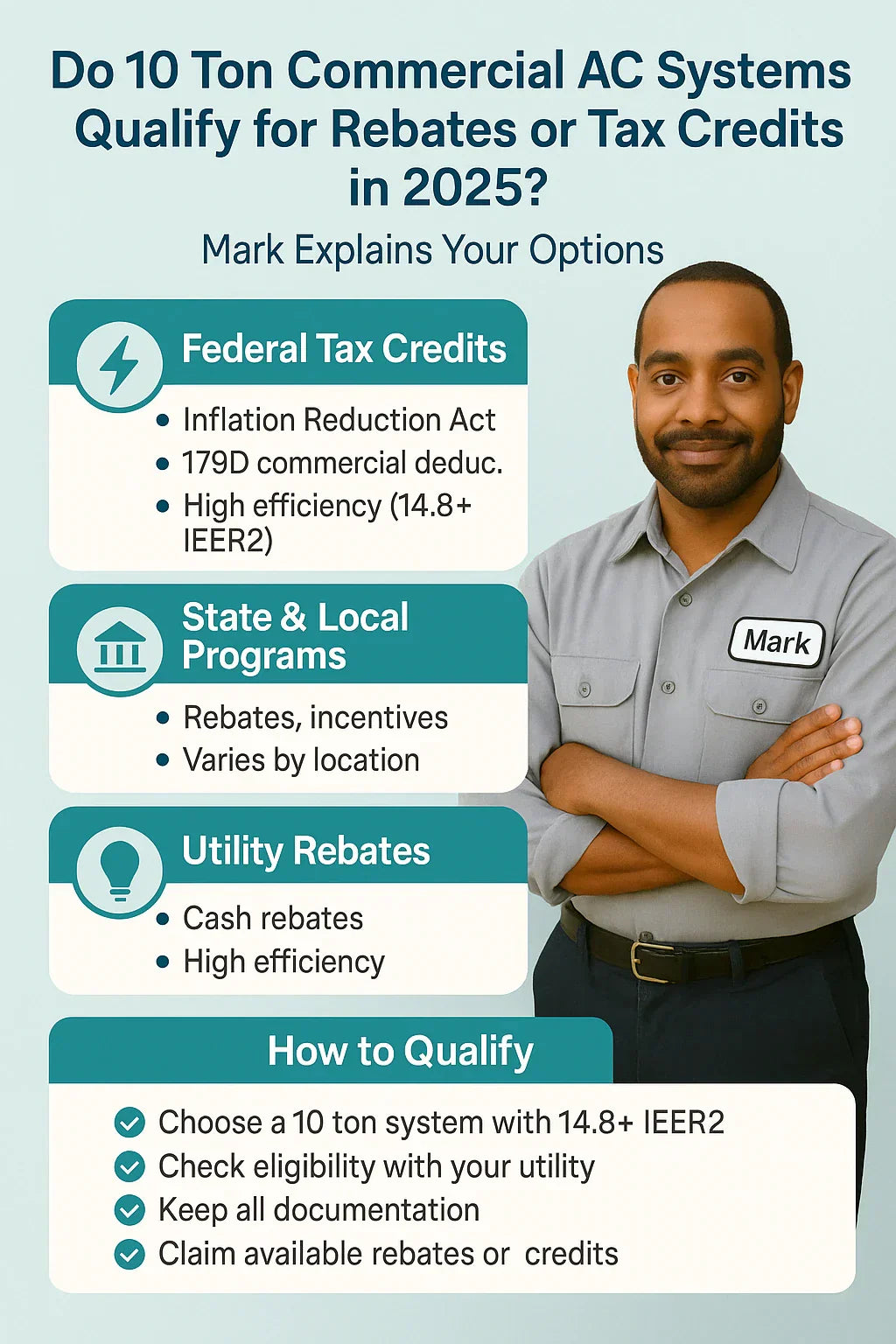

⚡ Federal Tax Credits & Deductions

Inflation Reduction Act (IRA) of 2022

The IRA extended and expanded energy incentives into 2025 and beyond. While most homeowners have heard about residential rebates, there’s also good news for commercial building owners.

Section 179D – Commercial Building Energy-Efficiency Deduction

-

Provides tax deductions for installing energy-efficient systems in commercial buildings.

-

Covers HVAC, lighting, and building envelope improvements.

-

For 2025, the deduction is up to $5.65 per square foot if your upgrades reduce building energy costs by 50% or more compared to ASHRAE standards .

For a 10 ton system in a 4,000 sq. ft. building, this could mean $15,000–$20,000 in deductions if paired with other efficiency improvements.

Business Energy Investment Tax Credit (ITC)

While primarily for solar, some integrated energy-efficiency upgrades tied to renewable projects may also qualify.

📖 IRS – Section 179D Commercial Buildings Deduction

💡 Utility Rebates

Utility companies across the U.S. offer cash rebates to encourage businesses to install energy-efficient systems.

Typical Rebate Ranges

-

$500–$2,500 per unit depending on tonnage and efficiency.

-

Some utilities pay per ton of installed capacity. For a 10 ton system, that can add up quickly.

Requirements

-

Must meet minimum IEER2 ratings (usually 14.0 or higher for light commercial).

-

Proof of installation and model number required.

Example

-

A Daikin 10 ton with 14.8 IEER2 typically qualifies.

-

Goodman units (13–14 IEER2) may not always meet thresholds.

-

Trane (15+ IEER2) often exceeds requirements, maximizing rebate potential.

🏛️ State & Local Incentives

Some states go beyond federal and utility programs, offering their own rebates or tax incentives.

Examples in 2025

-

California: Strong rebates for high-efficiency HVAC through the Self-Generation Incentive Program (SGIP).

-

New York (NYSERDA): Rebates for ENERGY STAR-certified light commercial HVAC.

-

Massachusetts (Mass Save): Rebates up to $1,000 per ton for qualifying systems.

Municipal Programs

-

Many cities and counties run energy-efficiency grants or financing programs.

-

Often stackable with state and federal rebates.

📖 DSIRE – Database of State Incentives

📊 How IEER2 Ratings Affect Eligibility

Here’s where system choice matters.

-

Daikin (14.8 IEER2): Eligible for most rebates and tax deductions.

-

Trane (15+ IEER2): Typically exceeds thresholds, making it rebate-friendly.

-

Goodman (13–14 IEER2): May fall below rebate cutoffs in some states/utilities.

In short: the higher the IEER2 rating, the more money you get back.

📖 DOE – Commercial HVAC Efficiency

🧾 Mark’s Real-World Example

Last year, I helped a client replace an outdated 8.5 ton system with a Daikin 10 ton, 14.8 IEER2 unit.

Here’s how the numbers worked:

-

Equipment & installation: $18,500.

-

Utility rebate: $1,200 back.

-

Federal Section 179D deduction: ~$5,000 (paired with LED lighting upgrade).

-

Net project cost: ~$12,300.

Annual energy savings: $1,500–$1,800. Payback period dropped from 12 years to 6 years thanks to rebates.

That’s why I tell business owners: “Don’t leave money on the table. Rebates and tax deductions are there to help you.”

✅ Steps to Claim Rebates & Credits

-

Check your model’s AHRI Certificate

-

Confirms efficiency ratings (IEER2, SEER2, etc.).

-

Most rebate programs require it.

-

-

Use ENERGY STAR Rebate Finder

-

Enter your zip code to see available rebates .

-

-

Contact your utility company

-

Verify program rules before installation.

-

-

Collect documentation

-

Save invoices, AHRI certificates, and contractor paperwork.

-

-

File rebate applications

-

Submit within 60–90 days of installation.

-

-

Consult your tax advisor

-

File Section 179D deduction with your federal return.

-

📖 Consortium for Energy Efficiency (CEE)

📈 Long-Term Benefits of Choosing Rebate-Eligible Systems

-

Lower upfront cost: Rebates and deductions can cut costs by 10–30%.

-

Higher efficiency = lower bills: Systems like Daikin’s 14.8 IEER2 unit save ~$1,500/year on energy.

-

Better ROI: Payback periods shrink dramatically.

-

Future-proofing: High IEER2 systems are more likely to meet future code and standard updates.

📊 Comparison: Rebates & Credits by Brand

| Brand | IEER2 Rating | Rebate Eligibility | Typical Rebate | Federal Deduction | Best Fit |

|---|---|---|---|---|---|

| Daikin | 14.8 | ✅ Yes | $1,000–$2,000 | Up to $5.65/sq. ft. with 179D | Balanced choice |

| Trane | 15+ | ✅ Yes (strong) | $1,500–$2,500 | Strong candidate | Premium projects |

| Goodman | 13–14 | ⚠️ Limited | $500–$1,000 | Less likely | Budget installs |

📈 Conclusion: Efficiency Pays Twice

Upgrading to a 10 ton commercial AC system is a big investment. But in 2025, the right system can pay you back twice:

-

Through lower utility bills.

-

Through rebates and tax deductions.

-

Daikin’s 14.8 IEER2 unit usually qualifies for rebates.

-

Trane often exceeds thresholds, maximizing incentives.

-

Goodman may miss out in some programs.

Mark’s takeaway: “Don’t just look at sticker price. Factor in rebates and credits—because the right system can practically pay for itself.”

In the next topic we will know more about: Is a 10 Ton AC System Right for Your Business? Mark’s Sizing Guide for Light Commercial Spaces