Timing matters when it comes to home upgrades. If you replaced your HVAC system at the end of 2024, you might be wondering: Do I qualify for the new 2025 tax credits, or am I stuck with last year’s rules?

It’s a fair question. With updated incentives under the Inflation Reduction Act (IRA) and the Energy Efficient Home Improvement Credit, homeowners want to make sure they’re not leaving money on the table. Let’s break down how retroactive tax credits work, what happens if you upgraded in late 2024, and how you can still maximize your savings.

📘 For the bigger picture, start here: 2025 HVAC Tax Credits & Rebates Explained.

What Does “Retroactive” Mean for Tax Credits?

When people ask if HVAC tax credits are “retroactive,” they’re really asking whether new tax laws apply to upgrades completed before those laws went into effect.

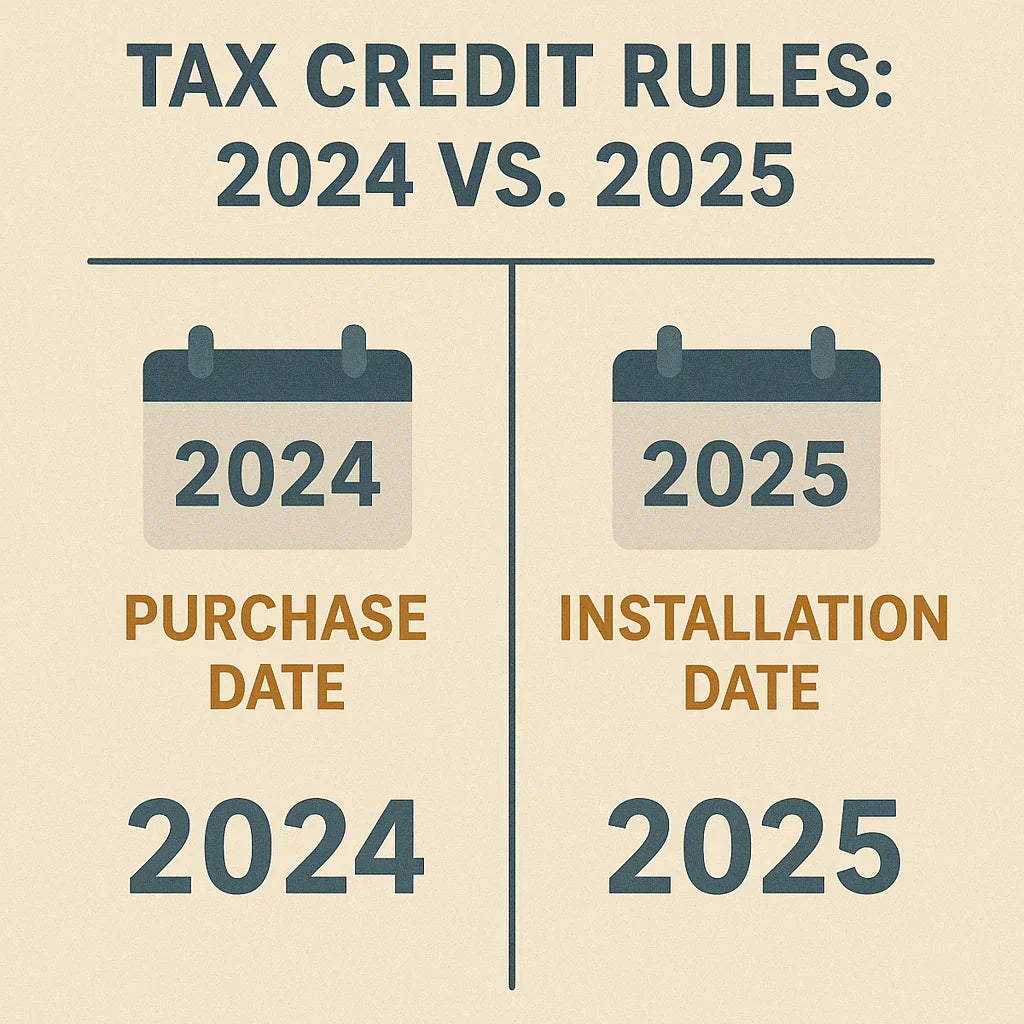

Here’s the rule of thumb: The IRS bases eligibility on the installation date, not the purchase date. That means if your new system was installed and operational in 2024, it typically falls under 2024’s tax credit rules—not the expanded credits that start in 2025.

In other words, you can’t go back and “retroactively” apply 2025 tax rules to a 2024 installation. This has been consistent across energy tax credits in past years, including the long-standing Energy Efficient Home Improvement Credit (25C).

Key Differences Between 2024 and 2025 Rules

The Inflation Reduction Act expanded incentives starting January 1, 2025. Here are the main differences that affect homeowners:

-

2024 credits – Capped at lower amounts for certain equipment. For example, central ACs and furnaces qualified for up to $300 in credits.

-

2025 credits – Increased caps and expanded coverage. Heat pumps now qualify for up to $2,000 annually, while central ACs and furnaces are capped at $600 .

-

Annual limits – In 2025, homeowners can claim up to $3,200 per year in combined credits, versus lower totals in 2024.

If your system was installed in December 2024, you’re tied to the 2024 caps. If the installation wrapped up in January 2025, you qualify under the new 2025 structure.

Installation Date vs. Purchase Date: Why It Matters

One of the most common points of confusion is whether the purchase date or the installation date determines eligibility. The IRS has made it clear: the installation date is what counts .

Example scenario:

-

You ordered a heat pump in November 2024.

-

Installation was completed on January 3, 2025.

-

Your project qualifies for the 2025 credit because the system wasn’t “placed in service” until the new year.

On the other hand, if that same heat pump was fully installed on December 20, 2024, it would fall under the 2024 rules—even if you paid for it in January 2025.

What If You Already Upgraded in Late 2024?

If your installation wrapped up before the end of 2024, you’re locked into last year’s credit structure. That’s not necessarily bad news—you can still claim credits, just at the 2024 levels.

Steps to take:

-

Gather your paperwork – Keep your receipts, AHRI certificate, and contractor invoice.

-

Check the IRS form – For 2024 installations, you’ll be filing IRS Form 5695 when you submit your taxes.

-

Confirm eligibility – Verify that your system meets the efficiency requirements listed on the ENERGY STAR® database.

-

Don’t double-claim – You can’t claim the same system in both years. If it was installed in 2024, it’s only eligible for that year’s credits.

Rebates and State Incentives as Alternatives

Even if your system doesn’t qualify under the new 2025 federal credits, you may still have other options:

-

Utility rebates – Many utilities offer rebates year-round, separate from federal credits. You can search by ZIP code using the ENERGY STAR Rebate Finder.

-

State-level programs – States like New York, Massachusetts, and California often run their own HVAC incentives .

-

DSIRE database – The Database of State Incentives for Renewables & Efficiency (DSIRE) is the most comprehensive source for local and state programs.

So, while your 2024 install may not qualify for 2025’s larger federal credits, you could still save hundreds—or even thousands—through local rebate programs.

Common Misconceptions About Retroactive Credits

Let’s clear up a few common myths:

-

Myth 1: If you file late, you can use the new year’s credits.

False. Credits are tied to the installation year, no matter when you file your taxes. -

Myth 2: Purchase date determines eligibility.

False. Only the installation/placed-in-service date counts. -

Myth 3: 2024 upgrades are automatically eligible for 2025 caps.

False. You can’t roll forward credits into a new year.

The Bottom Line

Are HVAC tax credits retroactive? The short answer: No. If you installed your system in late 2024, you’ll fall under that year’s rules—not the expanded 2025 incentives.

That said, you still have options. Between 2024 credits, state programs, and utility rebates, there are multiple ways to bring down your costs. And if you’re planning future upgrades, be strategic—timing your project can mean the difference between a $300 credit and a $2,000 one.

📘 Next up: Which HVAC Brands Make Claiming Rebates Easiest?

Alex Lane

Your Home Comfort Advocate