Whole-house standby generators are one of the smartest upgrades a homeowner can make for comfort and security. But with installed costs ranging from $10,000 to $20,000+, it’s no surprise that homeowners ask:

👉 “Can I get a rebate or tax credit to help offset the cost?”

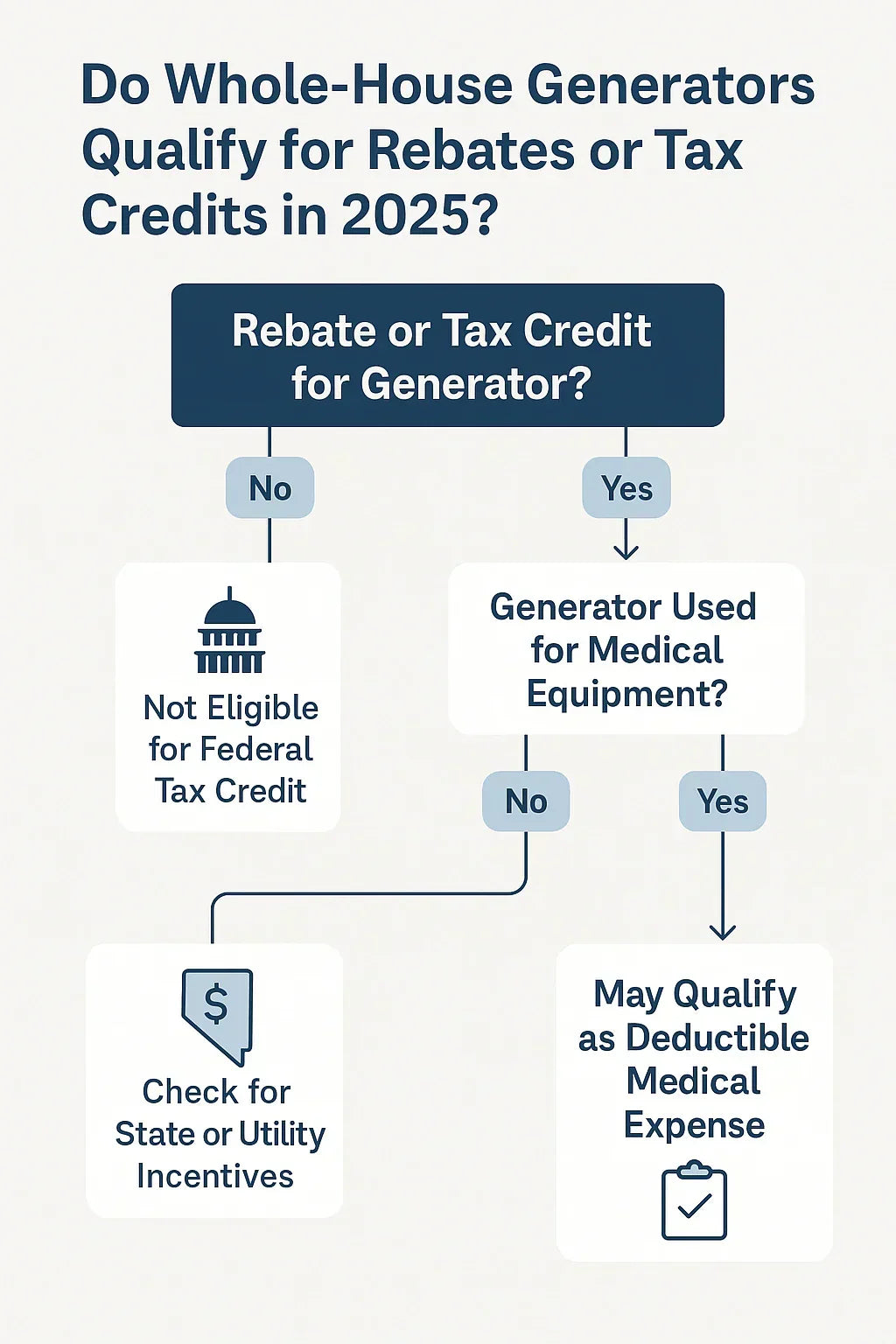

The short answer in 2025: standby generators rarely qualify for federal tax credits. However, some state, utility, and special-use incentives may apply. In certain cases—especially if you rely on medical equipment—a generator may even qualify as a deductible medical expense.

Generac Guardian® 70432 22kW Air-Cooled Standby Generator with Wi-Fi and Transfer Switch

This guide breaks down everything you need to know about rebates, tax credits, and cost-saving strategies for standby generators in 2025.

⚡ Why Homeowners Ask About Rebates & Tax Credits

Standby generators are expensive, but they solve real problems:

-

Power security: Keeps lights, HVAC, and appliances running during outages.

-

Safety: Protects sump pumps, security systems, and medical equipment.

-

Convenience: Automatic transfer switches kick in within seconds of an outage.

With so many other home upgrades (like solar panels, heat pumps, and energy-efficient appliances) qualifying for incentives, it’s natural to wonder if standby generators do too.

👉 Unfortunately, most generators don’t qualify for federal energy tax credits because they aren’t classified as renewable or efficiency-improving technologies. But that doesn’t mean all incentives are off the table.

🔗 EnergyStar.gov – Federal Tax Credits

💵 Federal Tax Credits (2025)

What You Can’t Claim

-

There is no federal tax credit for standard natural gas, propane, or diesel standby generators.

-

Generators are not Energy Star certified, so they don’t fall under appliance rebate programs.

-

They aren’t considered “renewable” under the Inflation Reduction Act (IRA) credits.

What You Might Qualify For

-

Medical Deduction (IRS)

-

If a generator is prescribed by a doctor for powering essential medical equipment (oxygen concentrators, CPAP machines, ventilators, etc.), the cost may qualify as a deductible medical expense.

-

IRS rules allow deductions for equipment needed to support health, but documentation is required.

-

-

Battery Systems Paired with Solar

-

If your generator is installed as part of a hybrid system with solar + storage, only the renewable/battery portion may qualify for a 30% federal credit under the Residential Clean Energy Credit.

-

The generator itself would not qualify, but batteries like Tesla Powerwall or Generac PWRcell do.

-

👉 For most homeowners, federal incentives are not available unless medical use or renewable integration applies.

🔗 IRS – Medical Expense Deductions

🔗 U.S. DOE – Inflation Reduction Act Tax Credits

🏛️ State & Local Incentives

While the federal government doesn’t cover standby generators, some states and municipalities do—especially in areas hit by frequent storms.

Examples of State/Utility Programs

-

Florida: Some utilities offer “storm-hardening” rebates for backup power systems.

-

Texas: Local utility co-ops sometimes offer $250–$500 rebates for propane standby units.

-

California: Certain wildfire-prone areas have programs for medically vulnerable residents.

-

Northeast (NY, NJ, CT): After Hurricane Sandy, several states offered temporary rebate programs for backup power.

👉 These programs change often, so homeowners should check DSIRE (Database of State Incentives for Renewables & Efficiency) for the latest listings.

🔗 DSIRE – Database of Incentives

🏥 Medical & Accessibility Exceptions

For homeowners with medical needs, a generator can be more than convenience—it’s a lifeline.

When Generators Qualify

-

If your doctor certifies that continuous power is medically necessary, you may:

-

Deduct part or all of the generator’s cost as a medical expense.

-

Qualify for utility rebates offered to “critical care customers.”

-

Gain priority service during outages from your utility.

-

Examples of Qualifying Medical Equipment

-

Oxygen concentrators.

-

Ventilators.

-

CPAP machines.

-

Electric wheelchairs or mobility lifts.

👉 Always keep documentation from your physician and receipts to substantiate claims.

📊 Utility Rebates in 2025

Some electric and gas utilities provide rebates for standby generators, especially when they’re installed with automatic load management or demand-response compatibility.

Why Utilities Offer Rebates

-

Helps stabilize the grid during storms.

-

Reduces emergency calls for customers who can self-supply power.

-

Supports medically vulnerable customers.

Typical Utility Rebates

-

$250–$1,000 rebate for eligible standby installations.

-

Extra credits for load-shedding or demand-response integration.

-

Free or discounted maintenance for qualifying customers.

👉 Call your local utility company to ask if they have generator-specific programs—many aren’t widely advertised.

🔗 National Grid – Emergency Preparedness Programs

❌ What Generators Don’t Qualify For

It’s just as important to know what doesn’t qualify:

-

Federal IRA credits (25C, 25D): Only cover renewable energy, energy efficiency, or electrification upgrades (not fossil-fueled generators).

-

Energy Star rebates: Generators aren’t Energy Star-certified.

-

Green energy incentives: Only apply if the generator integrates with renewable storage.

👉 Don’t count on big federal credits—focus on local and utility-level rebates instead.

✅ How to Save on Generator Costs Without Rebates

Even without direct credits, there are smart ways to lower your out-of-pocket costs.

Financing Options

-

Dealer financing with 0% APR for 12–24 months.

-

Personal loans or home equity lines of credit (HELOCs).

-

Bundled financing with HVAC or solar upgrades.

Contractor Discounts

-

Many installers offer bundle deals on equipment + installation.

-

Seasonal promotions (spring and fall) often include free maintenance packages.

Long-Term Savings

-

Generators can reduce home insurance claims (for food spoilage, frozen pipes, sump pump failures).

-

May qualify for lower premiums with some insurers.

-

Adds 3–5% resale value in outage-prone areas.

🔗 Forbes – Whole House Generator Cost & Financing

📈 Final Verdict: Rebates & Credits in 2025

So, do whole-house generators qualify for rebates or tax credits in 2025?

-

Federal level: ❌ No direct tax credits for standard NG/propane generators.

-

State/local level: ✅ Some rebates available in storm-prone or rural utility areas.

-

Medical necessity: ✅ Possible deductions and utility benefits with physician documentation.

-

Hybrid renewable setups: ✅ Only the renewable/battery portion qualifies, not the generator itself.

👉 If you’re a homeowner shopping for a standby generator, check:

-

DSIRE database for your state.

-

Local utility company programs.

-

Medical deduction eligibility if relevant.

That way, you’ll know whether you can reduce your upfront costs—or whether financing and insurance savings are your best bet.

In the next topic we will know more about: Wi-Fi Monitoring Explained: How the Generac Mobile Link App Keeps You in Control