🏠 Introduction: Efficiency That Pays You Back

When Samantha Reyes upgraded her old gas furnace to a new R-32 model, she expected lower energy bills. What she didn’t expect? A federal tax credit, a utility rebate, and a $400 check from her state energy program — all for choosing a cleaner, more efficient system.

“I knew it would save me money on heating,” Samantha explains. “But when I realized there were rebates available just for installing an R-32 furnace, it felt like the system paid me back.”

That’s the beauty of 2025’s energy incentives. Between the Inflation Reduction Act (IRA), ENERGY STAR tax credits, and state or utility rebate programs, homeowners are being rewarded for upgrading to eco-friendly systems — especially those using R-32 refrigerant, which meets the latest environmental standards.

If you’re considering an R-32 gas furnace, here’s everything you need to know about how to qualify for rebates and tax credits, how much you can expect to receive, and how to apply step-by-step.

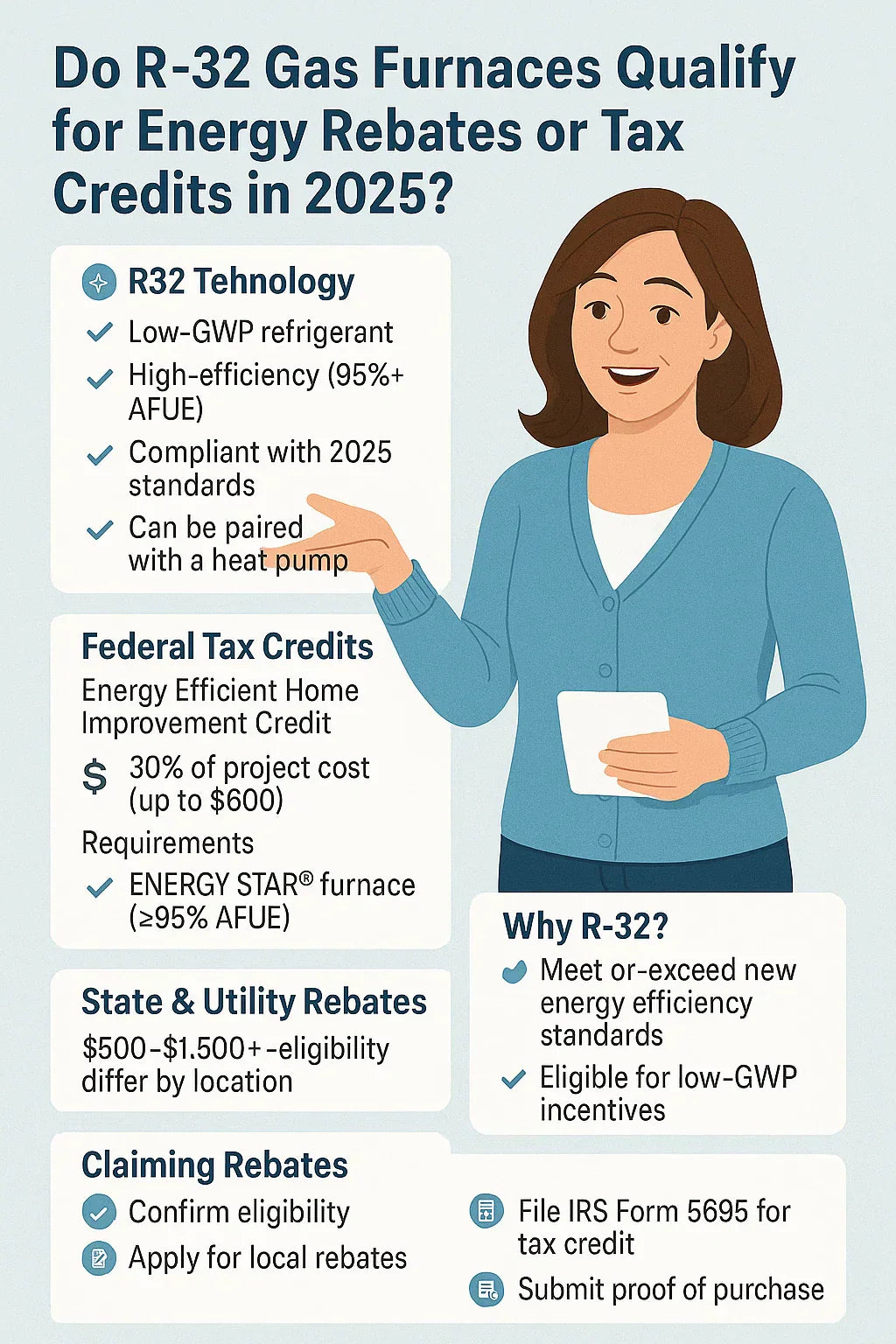

⚙️ 1. Why R-32 Gas Furnaces Qualify for Rebates in 2025

🔬 The Technology Behind R-32

R-32 is a low-GWP refrigerant (Global Warming Potential of 675 vs. 2,088 for R-410A). It’s more efficient at transferring heat and uses up to 30% less refrigerant for the same performance.

These systems are engineered for:

-

Higher AFUE ratings (95%+)

-

Lower emissions

-

Hybrid operation with heat pumps (dual-fuel systems)

-

Compliance with the EPA’s AIM Act refrigerant phase-down

All of those factors align with the U.S. government’s energy-efficiency goals — which is why R-32 furnaces often qualify for federal, state, and utility incentives.

According to Daikin Global, R-32 technology is now used in over 150 countries due to its energy efficiency and environmental benefits.

“It’s not just a better furnace — it’s a cleaner one,” Samantha says. “That’s why governments are encouraging people to make the switch.”

💰 2. The Federal Energy Efficient Home Improvement Credit (25C)

The Energy Efficient Home Improvement Credit, also known as the 25C credit, is part of the Inflation Reduction Act (IRA). It offers homeowners a 30% tax credit on eligible home energy upgrades, including furnaces that meet ENERGY STAR requirements.

🧾 Credit Details for Furnaces:

| Program | Credit Type | Max Amount | Eligibility |

|---|---|---|---|

| 25C Tax Credit | 30% of project cost | Up to $600 | ENERGY STAR-certified gas furnace (≥95% AFUE) |

| Hybrid Furnace/Heat Pump Combo | 30% of cost | Up to $2,000 | Dual-fuel systems (R-32 + electric) |

| Smart Thermostat Add-on | Included | Part of project | Must be ENERGY STAR-certified |

So if your R-32 gas furnace costs $7,500 installed, you can receive:

-

$600 off under 25C

-

$200–$400 more for a smart thermostat

-

Possibly more rebates from state or utility programs

📋 Requirements:

-

Must be installed after January 1, 2023 and before December 31, 2032

-

Must meet ENERGY STAR Version 6.1 criteria

-

Must be installed in your primary residence (not rental or vacation home)

Reference: ENERGY STAR – Tax Credits for HVAC Systems

“My furnace came with an ENERGY STAR label and 95% AFUE rating, so my installer confirmed I qualified automatically,” Samantha says.

🏢 3. The High-Efficiency Electric Home Rebate Act (HEEHRA)

If your home uses or plans to install a dual-fuel R-32 system (combining gas heating and a heat pump), you could qualify for even larger rebates under the High-Efficiency Electric Home Rebate Act (HEEHRA).

⚡ What Is HEEHRA?

A part of the Inflation Reduction Act, this program helps low- to middle-income households electrify their homes by covering upfront costs of energy-efficient equipment.

🏆 HEEHRA Benefits:

| Household Income | Rebate Coverage | Max Amount |

|---|---|---|

| <80% Area Median Income | 100% of cost | Up to $8,000 |

| 80–150% AMI | 50% of cost | Up to $4,000 |

Even if you don’t qualify for HEEHRA, the federal 25C tax credit can still apply.

Learn more: White House – IRA Rebate Programs

“Even middle-income homeowners can get thousands back,” Samantha notes. “It makes efficiency upgrades finally affordable.”

🏙️ 4. State-Level Rebates & Regional Incentives

Each state runs its own energy-efficiency rebate programs — and R-32 gas furnaces qualify for many of them because of their low emissions and high performance.

🌎 2025 State Rebate Examples:

| State | Program | Rebate Range | Eligibility |

|---|---|---|---|

| California | TECH Clean California | $500–$1,500 | Low-GWP HVAC systems |

| New York | NYSERDA Clean Heating | $500–$1,000 | ENERGY STAR-rated systems |

| Massachusetts | Mass Save | $600–$1,200 | ≥95% AFUE natural gas furnaces |

| Illinois | Nicor Gas Efficiency Program | $350–$600 | ENERGY STAR-certified furnaces |

| Texas | Oncor Electric Rebate | $200–$500 | Hybrid or dual-fuel systems |

Reference: Database of State Incentives for Renewables & Efficiency (DSIRE)

“I live in New York and got a $500 NYSERDA rebate,” Samantha says. “It showed up as a direct check within six weeks of my install.”

🧰 5. Utility Rebates: Check Your Local Power or Gas Provider

Local utilities are also encouraging low-emission heating through their own rebate programs.

🔧 Common Utility Rebates:

| Rebate Type | Amount | Requirement |

|---|---|---|

| High-Efficiency Furnace | $250–$800 | ≥95% AFUE |

| Dual-Fuel Furnace + Heat Pump | $500–$1,200 | ENERGY STAR hybrid |

| Smart Thermostat | $50–$200 | ENERGY STAR-certified device |

Use the ENERGY STAR Rebate Finder to check eligibility by ZIP code.

“My utility company handled everything digitally,” Samantha recalls. “All I had to do was upload my invoice — no mailing forms or waiting months.”

🌿 6. Why R-32 Systems Are “Future-Proof”

The EPA’s AIM Act is phasing down high-GWP refrigerants like R-410A by 85% by 2036. R-32 is already compliant with the new standards — meaning no costly retrofit later.

🧾 Benefits of Choosing R-32:

-

Eligible for current and future rebates

-

Compliant with 2025 efficiency rules (SEER2/AFUE)

-

Lower GWP = lower environmental fees in the future

Reference: EPA – HFC Phase-Down Regulations

“I didn’t want to install something I’d have to replace in a few years,” Samantha says. “R-32 is clearly built for the future.”

💸 7. Stacking Rebates: How to Maximize Your Return

Yes, you can combine multiple rebates and credits — and it’s often encouraged.

Example: Typical R-32 Furnace Installation (2025)

| Cost Category | Cost | Incentive | Net Cost |

|---|---|---|---|

| Equipment + Labor | $7,800 | — | $7,800 |

| Federal 25C Credit | -$600 | ✅ | $7,200 |

| State Rebate (e.g., Mass Save) | -$800 | ✅ | $6,400 |

| Utility Rebate | -$400 | ✅ | $6,000 |

| Total Savings | — | $1,800 | — |

Add the energy savings ($250–$300/year), and the payback period shortens even further.

“Once the rebates came in, I realized I’d saved almost 25% of the cost,” Samantha says. “And that doesn’t even count the lower gas bills.”

🧮 8. How to Apply for Rebates & Tax Credits

Here’s Samantha’s step-by-step guide to getting every dollar you deserve.

✅ Step-by-Step:

-

Confirm Eligibility

-

Look for the ENERGY STAR label and AFUE ≥95%.

-

Ask your installer for the AHRI certificate (proof of efficiency rating).

-

-

Keep Your Documentation

-

Save all invoices, receipts, and warranty info.

-

Record the model number and installation date.

-

-

Apply for Rebates

-

Go to ENERGY STAR Rebate Finder.

-

Check your state and local utility’s website.

-

Submit the online form and upload your proof of purchase.

-

-

Claim Federal Tax Credit

-

File IRS Form 5695 with your tax return.

-

Enter the cost and system details under the Energy Efficient Home Improvement Credit.

-

-

Track Your Rebate Timeline

-

Federal credits apply during tax season.

-

Utility and state rebates usually arrive within 4–8 weeks.

-

Reference: IRS Form 5695 Instructions

“My installer even filled out most of my rebate paperwork,” Samantha says. “It made the process stress-free.”

⚠️ 9. Common Mistakes That Disqualify Homeowners

Even efficient systems can be denied rebates if documentation is missing or eligibility isn’t met.

🚫 Mistakes to Avoid:

-

Purchasing a non-ENERGY STAR model (not eligible).

-

Hiring an unlicensed installer.

-

Forgetting to register your furnace with the manufacturer.

-

Missing rebate submission deadlines (often within 90 days).

-

Not saving your AHRI certificate.

“I almost forgot to register my warranty,” Samantha admits. “Luckily my installer reminded me before the rebate deadline.”

📈 10. How Much You Can Actually Save

Between rebates, tax credits, and energy efficiency, homeowners can recoup a significant portion of their investment.

💵 Typical Savings Over 15 Years:

| Source | Amount Saved |

|---|---|

| Federal Tax Credit | $600 |

| State + Utility Rebates | $1,000–$1,500 |

| Energy Efficiency | $3,000–$4,000 |

| Total Potential Savings | $4,500–$6,000 |

Even without rebates, R-32 systems often pay for themselves through lower operating costs and reduced maintenance.

“It’s one of those upgrades that keeps giving back every month,” Samantha says. “My furnace runs cleaner, my bills are lower, and I feel good about reducing my footprint.”

🌍 11. Environmental Impact Meets Financial Benefit

The rebates and tax credits aren’t just about money — they’re part of a nationwide effort to reduce greenhouse gas emissions.

🌿 Environmental Highlights:

-

R-32’s GWP (675) is 68% lower than R-410A.

-

Each upgrade contributes to the EPA’s 85% HFC phase-down goal.

-

The Kigali Amendment under the Montreal Protocol supports R-32’s global adoption.

Reference: UNEP – Kigali Amendment

“It feels great knowing my decision helps the planet too,” Samantha smiles. “It’s efficient comfort with a conscience.”

💬 12. Samantha’s Takeaway

“If you’re replacing your furnace in 2025, go with an R-32 model. You’ll get rebates, future compliance, and a system that pays you back — not just in energy savings, but in peace of mind.”

Her advice: Always check rebates before you buy. Sometimes choosing a slightly higher-efficiency model can unlock hundreds in incentives.

🌟 Conclusion: Efficiency Is an Investment, Not an Expense

R-32 gas furnaces are the smartest investment for 2025 homeowners — combining cutting-edge technology with real-world financial benefits.

✅ Recap:

-

Federal 25C Tax Credit: Up to $600 back

-

State & Utility Rebates: $500–$1,500 on average

-

Hybrid Systems (HEEHRA): Up to $8,000 for eligible households

-

Lifetime Energy Savings: $3,000–$4,000

-

Environmental Bonus: Fully compliant with 2036 refrigerant standards

In the next topic we will know more about: Goodman vs. Amana vs. Rheem: Which R-32 Gas Furnace Offers the Best Value?