When I installed my Weil-McLain CGI-4 Series 4 natural gas boiler, one of my first questions was: Am I going to get any money back for this?

Between all the talk of the Inflation Reduction Act, state rebates, and utility incentives, it’s easy to get lost. So I did the homework. Here’s the no-fluff guide to whether natural gas boilers qualify for rebates or tax credits in 2025, broken down so you can figure out what applies to your home.

🇺🇸 Federal Tax Credits in 2025

Let’s start with the big one: the federal energy efficiency tax credits.

✅ What qualifies

-

Under the Inflation Reduction Act (IRA), you can claim 30% of the cost of a qualified boiler installation, up to $600.

-

But — there’s a catch. The boiler has to meet high efficiency standards:

-

Gas boilers with AFUE ≥ 95% are required.

-

That usually means condensing boilers, not standard cast iron models.

-

❌ What doesn’t qualify

-

Boilers like the Weil-McLain CGI-4, with 82–84% AFUE, do not qualify for federal credits.

-

Standard efficiency gas boilers are excluded because they don’t meet the 95% threshold.

👉 Check Energy Star’s Federal Tax Credit Guide for up-to-date requirements.

💡 Mike’s Note: I was bummed my CGI-4 didn’t qualify, but when I compared installation costs, a high-efficiency condensing boiler would’ve run me an extra $3,000 upfront. Sometimes the credit doesn’t offset the higher cost.

🏛️ State-Level Rebates (Varies by Location)

Here’s where things get interesting: state rebate programs. Many states don’t require the 95% AFUE threshold for rebates. Instead, they give money back for upgrading from an older, less efficient boiler.

Examples:

-

Massachusetts (Mass Save): Rebates up to $2,750 for qualifying high-efficiency boilers. Lower rebates still exist for standard efficiency replacements in some cases.

-

New York (NYSERDA): Rebates vary, but upgrading to an efficient gas boiler can save hundreds of dollars.

-

Minnesota: Offers $200–$400 rebates for gas boiler upgrades through utilities.

🔗 Use the DSIRE database (Database of State Incentives for Renewables & Efficiency) to see what’s available in your state.

💡 Mike’s Note: In my state, I found a $300 rebate from the local energy efficiency fund — even though my CGI-4 wasn’t condensing. That was a nice surprise.

⚡ Utility Rebates (Don’t Overlook These)

Even if your state doesn’t offer much, your local utility company might.

What I found:

-

My gas utility gave $300 back for replacing an older boiler with a newer Energy Star-rated model.

-

Some utilities offer bonus rebates if you combine a boiler install with other upgrades (like insulation or a smart thermostat).

-

Others offer 0% financing or bill credits instead of a rebate.

👉 Always check your gas provider’s website. Rebates can change yearly, and they often run out of funds mid-season.

🔗 Example: Con Edison Rebates in New York.

💡 Mike’s Note: My rebate check showed up six weeks after submitting paperwork. Keep your invoice, model number, and contractor info handy — utilities love paperwork.

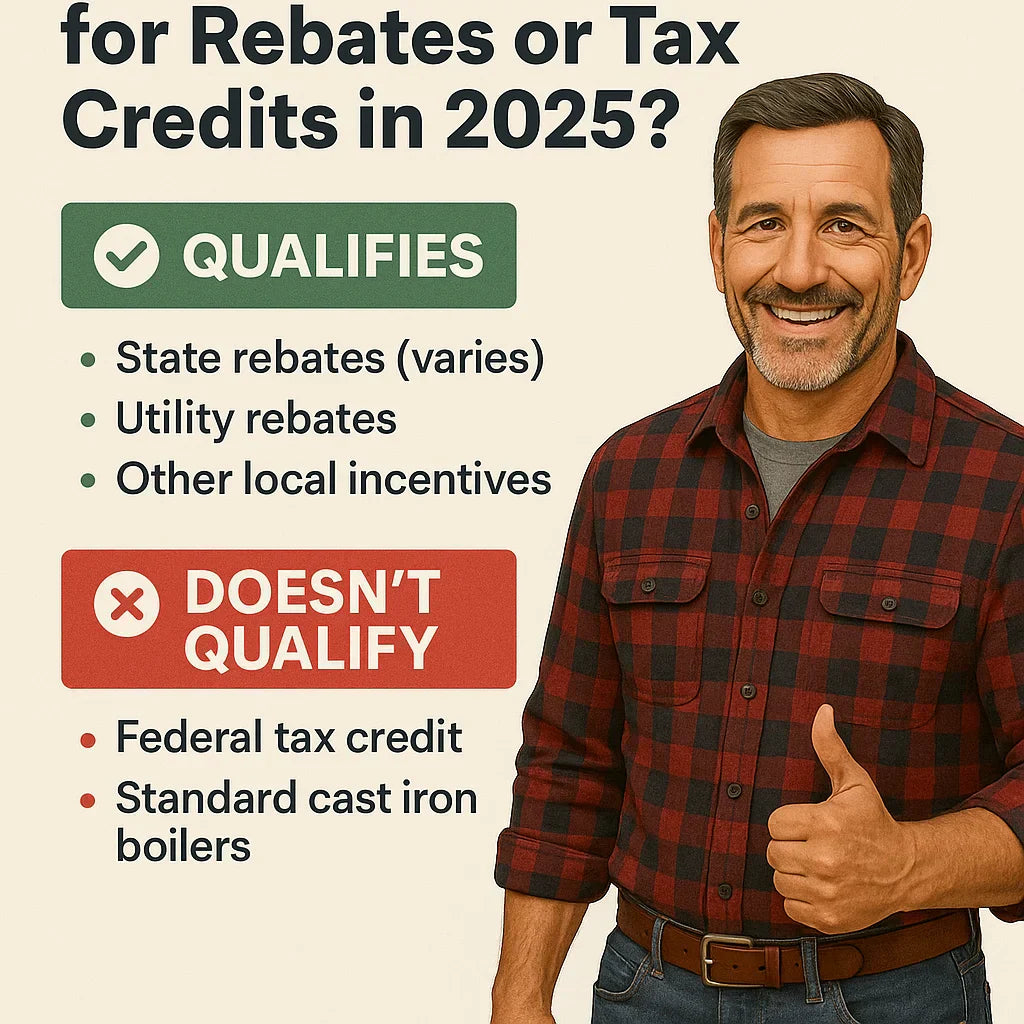

📋 What the Weil-McLain CGI-4 Actually Qualifies For

-

Federal Tax Credit: ❌ No — AFUE isn’t high enough.

-

State Rebates: ✅ Maybe — depends on your state program. Some will give smaller rebates for standard upgrades.

-

Utility Rebates: ✅ Often — many utilities offer $200–$400 just for upgrading to a newer boiler.

-

Other Incentives: ✅ Some areas offer low-interest loans for energy improvements.

⚖️ Cast Iron vs. Condensing Boilers and Incentives

Here’s the tradeoff I ran into:

-

Cast Iron (like the CGI-4):

-

Lower upfront cost ($2,500–$3,400 equipment).

-

Lifespan 20–30 years.

-

Doesn’t qualify for federal credit.

-

May still qualify for utility rebates.

-

-

Condensing Boilers (95%+ AFUE):

-

Higher upfront cost ($5,000–$7,000 equipment).

-

Lifespan 12–15 years.

-

Qualifies for federal tax credit + many state rebates.

-

🔗 U.S. DOE Boiler Efficiency Standards

💡 Mike’s Note: I chose cast iron for durability. The tax credit wasn’t worth the extra cost of condensing in my case, but every home is different.

🛠️ How to Claim Rebates and Credits

Here’s the process I followed:

-

Save all documentation

-

Contractor invoice.

-

Boiler model/serial number.

-

Installation date.

-

-

Check eligibility

-

Federal credit: use IRS Form 5695.

-

State rebate: submit online or through local energy authority.

-

Utility rebate: submit on your utility’s website.

-

-

File early

-

Rebate funds run out mid-season in many states.

-

I missed a $200 bonus rebate one year by waiting too long.

-

🔗 IRS Form 5695 for Residential Energy Credits

💲 Real-World Savings Breakdown

Here’s what incentives looked like when I priced my CGI-4 install:

-

Federal tax credit: $0 (didn’t qualify).

-

State rebate (my state): $300.

-

Utility rebate: $250.

-

Total incentives: $550.

👉 That covered almost all of my piping upgrades.

For a condensing boiler, I could’ve gotten:

-

Federal tax credit: $600.

-

State rebate: $1,000.

-

Utility rebate: $300.

-

Total incentives: $1,900.

But the upfront cost was $3,000 more. In my case, cast iron still made sense.

📝 Mike’s Final Word

Here’s the bottom line for natural gas boilers in 2025:

-

Federal Tax Credit: Only applies to 95%+ AFUE condensing boilers.

-

State Rebates: Vary widely — check DSIRE to see what’s in your state.

-

Utility Rebates: Often the best bet for cast iron models like the CGI-4.

👉 My advice: Don’t assume you won’t get anything. Even standard cast iron boilers often qualify for utility rebates and sometimes smaller state rebates.

If you’re shopping between cast iron and condensing, look at the total cost after incentives and the expected lifespan. For me, the cast iron CGI-4 was the smarter choice — rebates or not.

In the next topic we will know more about: Noise, Space & Venting: Will a 90,000 BTU Boiler Fit in Your Utility Room?