🏠 Introduction: The Cost of a New Boiler

Replacing a boiler is one of the biggest home heating expenses most families face. Depending on the model and installation, a new natural gas boiler can cost $6,000 to $12,000 or more.

The good news? In 2025, there are federal tax credits, state rebates, and utility incentives that can help soften the blow—if your boiler qualifies.

But here’s the catch: not every natural gas boiler is eligible. In fact, the kind of boiler I chose for my own home—a Weil-McLain CGA-5 cast iron unit—doesn’t qualify for federal tax credits, even though it’s a rock-solid choice for durability.

In this guide, I’ll walk you through what counts, what doesn’t, and how to make sense of the programs available in 2025.

💵 Federal Tax Credits in 2025

The biggest program on most homeowners’ radar is the Energy Efficient Home Improvement Credit, created under the Inflation Reduction Act (IRA) of 2022.

Here’s how it works in 2025:

-

Credit amount: Up to 30% of the project cost, capped at $600 for boilers.

-

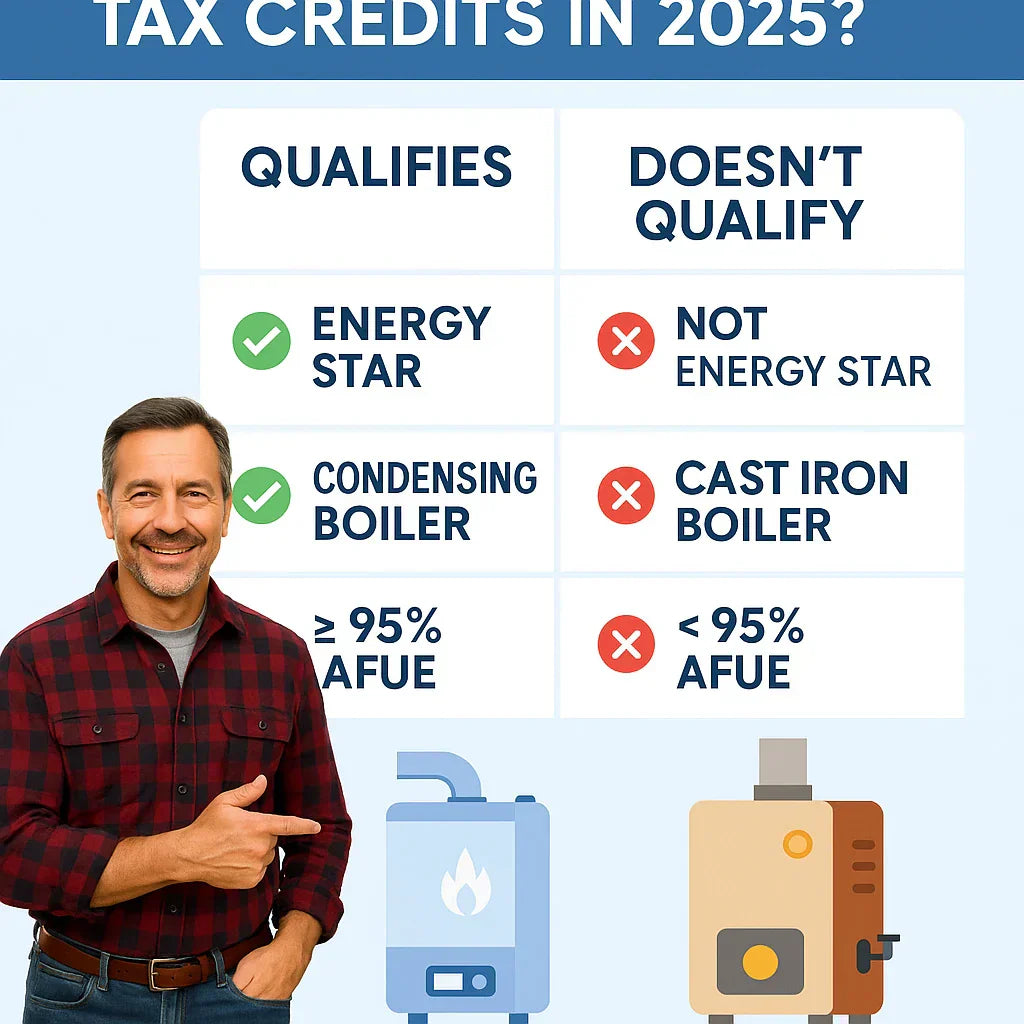

Eligibility: The boiler must be an ENERGY STAR-certified natural gas, oil, or propane boiler.

-

AFUE requirement: Typically ≥ 95% AFUE for gas boilers.

The Fine Print

-

Standard cast iron boilers (like the Weil-McLain CGA-5 at ~82–84% AFUE) don’t qualify.

-

High-efficiency condensing boilers, such as Weil-McLain’s Evergreen or Burnham’s Alpine, do qualify if they hit the 95% AFUE threshold.

-

Credit applies once per year—you can’t stack it multiple times for multiple units.

⭐ ENERGY STAR Requirements

Most rebate and tax credit programs tie directly to ENERGY STAR certification.

2025 ENERGY STAR Criteria for Gas Boilers

-

Gas-Fired Hot Water Boilers (Condensing): ≥ 95% AFUE

-

Gas-Fired Steam Boilers: No longer eligible for ENERGY STAR

-

Non-condensing models: Do not qualify

👉 Source: ENERGY STAR Gas Boilers Criteria

What This Means

-

Qualifies: Weil-McLain Ultra, Evergreen, and other condensing boilers.

-

Doesn’t Qualify: Weil-McLain CGA-5, Burnham Series 2, or Utica cast iron boilers (too low AFUE).

If your goal is to maximize tax credits, condensing is the only way to go.

📍 State & Local Rebates

In addition to federal credits, many states offer rebate programs for upgrading to high-efficiency natural gas boilers.

Examples:

-

New York: NYSERDA rebates up to $1,000 for high-efficiency boilers.

-

Massachusetts: Mass Save offers $2,750+ rebates for ENERGY STAR condensing boilers.

-

Minnesota: CenterPoint Energy rebates up to $500 for qualifying boilers.

👉 To check your local options, use the ENERGY STAR Rebate Finder.

These programs often stack with federal credits—making condensing boilers much more attractive financially.

⚡ Utility Company Incentives

Gas utility companies also run their own rebate programs, encouraging customers to cut energy use.

-

Rebates range from $300 to $1,500, depending on AFUE rating.

-

Some utilities offer extra rebates if you combine the boiler with smart thermostats or zoning controls.

-

Programs usually require professional installation by a licensed contractor.

👉 Example: National Grid Heating Rebates

Mike’s Tip

Always check with your local utility before buying. Sometimes rebates change mid-year or have limited funding—don’t assume it’s automatic.

📊 Example Cost Savings Breakdown

Here’s a realistic example of how incentives can work in 2025:

-

High-efficiency condensing boiler installation: $10,000

-

Federal tax credit: –$600

-

State rebate (Massachusetts): –$1,500

-

Utility rebate: –$500

Total savings: $2,600

Net cost: $7,400

That’s nearly a 25% savings compared to paying out of pocket with no incentives.

🧑🔧 Mike’s Real-World Take

When I replaced my boiler, I faced this exact decision:

-

Do I go with a cast iron unit like the Weil-McLain CGA-5, knowing it won’t qualify for credits?

-

Or do I spring for a condensing model that could get rebates but might not last as long?

Here’s why I chose cast iron:

-

I wanted longevity—25+ years of reliable heat.

-

I didn’t want the higher repair costs that sometimes come with condensing boilers.

-

Even without rebates, the long lifespan made sense for me.

But my neighbor went the other route:

-

Installed a condensing boiler.

-

Got $1,800 back between federal and state rebates.

-

Lower gas bills every month.

Both choices were smart—just based on different priorities.

⚠️ Fine Print to Watch For

Rebates and credits come with strings attached. Here’s what to watch out for:

-

Professional installation required. DIY installs don’t qualify.

-

Documentation: You’ll need receipts and AFUE certification proof.

-

Deadlines: Many programs expire at year’s end or when funding runs out.

-

Regional differences: What qualifies in Massachusetts may not qualify in Texas.

-

Cap limits: Federal credits max out at $600 per year for boilers.

👉 Reference: DSIRE – Database of State Incentives for Renewables & Efficiency

✅ Conclusion: Do Boilers Qualify in 2025?

So, let’s answer the big question:

Do natural gas boilers qualify for rebates or tax credits in 2025?

-

Yes—but only if they are ENERGY STAR-certified, high-efficiency condensing boilers (≥95% AFUE).

-

No—traditional cast iron boilers like the Weil-McLain CGA-5 don’t qualify.

If your goal is:

-

Long-term durability → A cast iron boiler is still a great investment, even without rebates.

-

Maximizing incentives & lowering fuel bills → A condensing ENERGY STAR boiler is your best bet.

For me, Mike, I chose peace of mind with a cast iron boiler. But for homeowners chasing rebates and lower monthly bills, condensing boilers can make a lot of sense.

Either way, the key is doing the math—rebates and credits can save you thousands in 2025 if your system qualifies.

In the next topic we will know more about: Noise, Space & Venting: Will a 133,000 BTU Boiler Fit in Your Utility Room?