When I installed my Goodman 2 Ton R-32 Compatible Wall-Mounted Air Handler with Built-In TXV and 5 kW Heater, I had one big question on my mind:

👉 “Am I eligible for any rebates or tax credits to help offset the cost?”

Like many homeowners, I didn’t want to miss out on money that might be available to me—especially with new 2025 regulations on refrigerants and efficiency.

The short answer is: Yes, Goodman R-32 compatible air handlers can qualify for incentives in 2025—but there are important conditions.

In this guide, I’ll break down everything I learned while researching and applying for credits, so you know exactly what to expect.

🏛️ The 2025 Energy Policy Landscape

The HVAC industry is in the middle of a big transition. As of 2025, the U.S. is moving away from R-410A refrigerant toward R-32 and other low-GWP alternatives.

Why does this matter?

-

✅ Lower environmental impact: R-32 has a global warming potential (GWP) of 675, compared to 2,088 for R-410A

-

✅ Higher efficiency potential: Systems designed for R-32 often achieve better SEER2 ratings.

-

✅ Policy support: Federal and state programs are encouraging adoption of next-gen refrigerants through rebates and tax credits.

👉 The bottom line: choosing an R-32 compatible Goodman air handler positions you to benefit from these incentives.

💰 Federal Tax Credits in 2025

The Inflation Reduction Act (IRA) extended and expanded federal energy efficiency tax credits through 2032.

Here’s what applies to air handlers:

Energy Efficient Home Improvement Credit (Section 25C)

-

Covers qualified HVAC equipment installed in primary residences.

-

Credit: 30% of the cost, up to $600 for air conditioners, heat pumps, or related indoor units.

-

To qualify, the system must meet CEE (Consortium for Energy Efficiency) highest efficiency tier.

👉 This means your Goodman wall-mounted air handler by itself does not qualify—but when it’s paired with a high-efficiency outdoor unit (R-32 compatible condenser or heat pump), it can be part of a qualifying system.

Residential Clean Energy Credit (Section 25D)

-

Primarily covers renewable systems (solar, geothermal).

-

Doesn’t directly apply to air handlers, but worth noting if you’re planning a larger energy upgrade.

👉 See the IRS guidance here: Energy Efficient Home Improvement Credit.

⚡ Utility Rebates

Many local utilities are offering rebates to encourage adoption of high-efficiency HVAC systems.

-

Rebates typically range from $100–$500 for installing air handlers paired with efficient outdoor units.

-

Some utilities also reward systems using low-GWP refrigerants like R-32.

-

Others provide bill credits for participating in demand-response programs.

👉 Example: My local utility in Massachusetts offered $400 back for a qualifying Goodman R-32 system under their energy savings program.

To find rebates in your area, check:

-

Your local utility’s “energy efficiency” or “rebates” page

🌎 State-Level Incentives

Rebate programs vary widely by state.

Northeast (Massachusetts, New York, Vermont)

-

Aggressive programs supporting electrification and R-32 adoption.

-

Rebates of $500+ for high-efficiency indoor/outdoor systems.

South & Southeast (Florida, Texas, Georgia)

-

Smaller rebates, often $150–$300.

-

Some tied to smart thermostat installation as well.

West Coast (California, Oregon, Washington)

-

Strongest incentives for low-GWP refrigerant adoption.

-

Some states layering additional rebates on top of federal tax credits.

👉 Check your state’s energy office site or the DOE’s Energy Saver Rebate Guide for up-to-date information.

🧾 What Qualifies (and What Doesn’t)

Here’s where homeowners often get confused (I know I did).

✅ Qualifies:

-

AHRI-matched systems (air handler + condenser/heat pump) that meet SEER2/EER2 efficiency requirements.

-

Installations in primary residences (not rentals, unless you live there part of the year).

-

Systems using R-32 or other low-GWP refrigerants.

❌ Does NOT Qualify:

-

Standalone air handler installs (must be paired with an outdoor unit).

-

Systems that don’t meet efficiency standards (low SEER2).

-

Second homes or investment properties.

👉 You can confirm if your Goodman system qualifies by checking the AHRI Directory.

👩🏫 Samantha’s Real-World Example

When I upgraded my Goodman wall-mounted air handler, here’s how I handled incentives:

-

Researched federal credits – Learned I could get up to $600 back when paired with my high-efficiency R-32 condenser.

-

Checked AHRI certificate – Verified that my Goodman system met SEER2 requirements.

-

Applied for state rebate – Massachusetts offered an additional $400 rebate.

-

Filed with IRS Form 5695 – Claimed my federal tax credit when I did my taxes.

Total savings: $1,000 back in my pocket.

👉 It took a few hours of paperwork, but it was absolutely worth it.

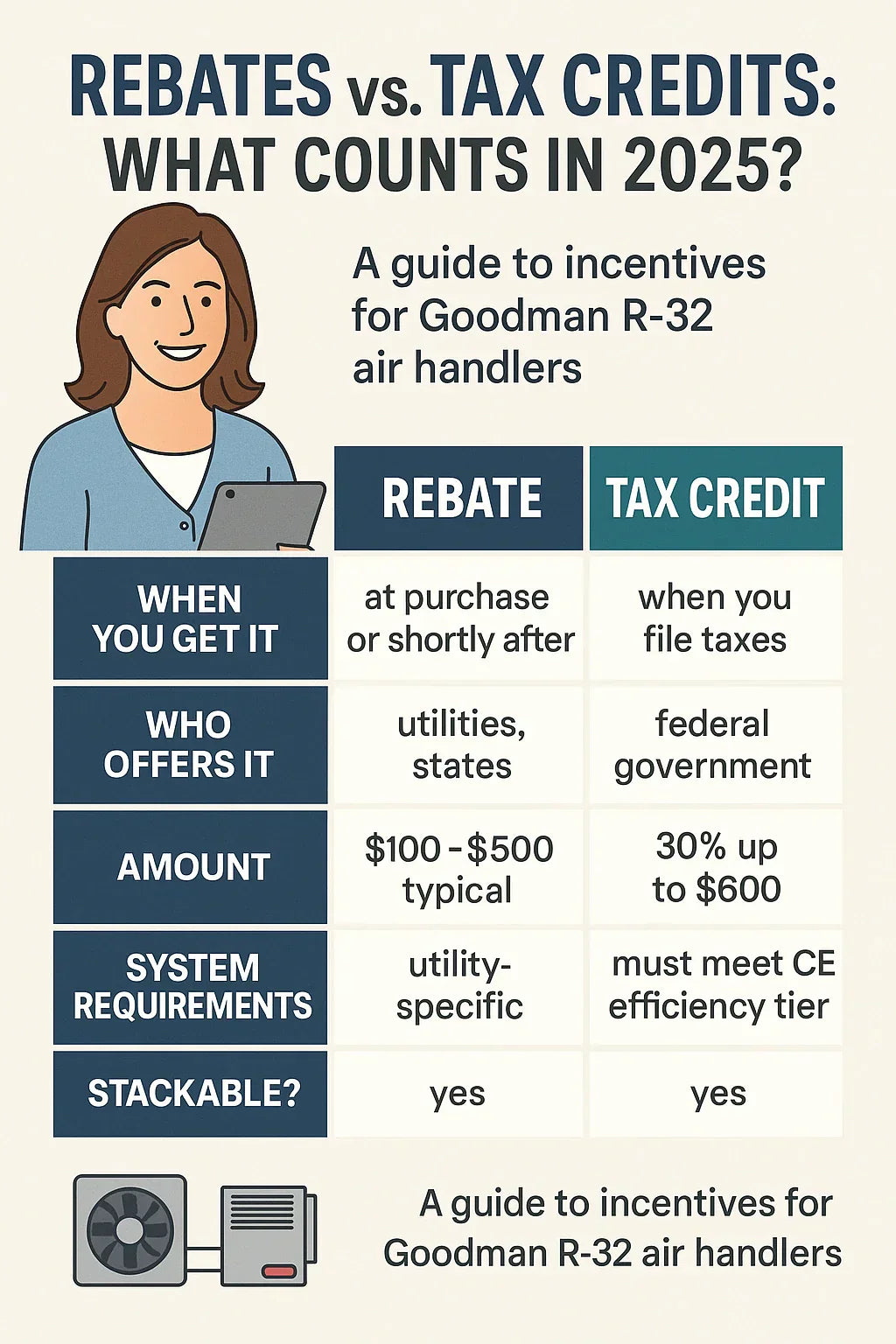

⚖️ Rebates vs. Tax Credits: Key Differences

| Feature | Rebate | Tax Credit |

|---|---|---|

| When you get it | At purchase or shortly after | When you file taxes |

| Who offers it | Utilities, states | Federal government |

| Amount | $100–$500 typical | 30% up to $600 |

| System requirements | Utility-specific | Must meet CEE efficiency tier |

| Stackable? | Yes | Yes |

👉 The best strategy is to combine both—claim your utility rebate right away, then file for your federal tax credit at year’s end.

✅ Final Takeaway

So, do Goodman R-32 compatible air handlers qualify for rebates or tax credits in 2025?

-

Yes—when installed as part of a high-efficiency system.

-

Federal tax credits cover up to $600.

-

State and utility rebates add $100–$500+.

-

Always verify with your AHRI certificate, local utility, and IRS guidance.

👉 My advice: If you’re buying a Goodman R-32 compatible air handler, don’t leave money on the table. Check your utility’s rebate page, file IRS Form 5695, and enjoy the savings.

In the next topic we will know more about: How Efficient Is a Goodman Wall-Mounted Air Handler with TXV? Real-World Performance Explained