Installing a new central AC unit is one of the biggest investments homeowners make in their comfort. But with higher efficiency standards (like SEER2) now in place, the upfront cost of top-performing systems can feel daunting.

Here’s the good news: 2025 is one of the best years yet to upgrade your cooling system. Between federal tax credits, state rebates, and utility programs, you can cut thousands of dollars off the installation cost.

This guide breaks down the rebates and tax credits available for central AC units in 2025, how much you can save, and what you need to qualify.

Federal Tax Credits for Central AC Units in 2025

The Inflation Reduction Act (IRA) and AC Upgrades

The Inflation Reduction Act continues to fund HVAC incentives in 2025, making it easier for homeowners to afford efficient cooling upgrades.

-

Federal Energy Efficiency Tax Credit: Homeowners may claim up to 30% of installation costs, capped between $600–$2,000 depending on the system.

-

To qualify, the central AC unit must meet ENERGY STAR certification and minimum SEER2 ratings set by the Department of Energy.

-

Homeowners must file IRS Form 5695 to claim the credit.

Why It Matters

This credit directly reduces your tax bill—not just your taxable income. For example, a $6,500 installation with a $2,000 tax credit effectively costs $4,500 after the credit is applied.

State and Local Rebates

State-Level Incentives

Many states have their own rebate programs on top of federal tax credits. States like California, New York, and Massachusetts often lead the way with aggressive efficiency incentives.

-

Rebates range from $500–$2,500 depending on system size and efficiency.

-

Programs may cover part of the installation cost for both the AC unit and ductwork upgrades.

How to Find State Programs

The DSIRE Database is the most comprehensive resource for state-by-state energy incentives. Simply enter your ZIP code to see available programs in your area.

Utility Company Rebates and Incentive Programs

Local utility companies also play a big role in lowering costs for homeowners.

-

Cash Rebates: Many utilities offer $200–$1,000 rebates for ENERGY STAR-certified AC systems.

-

Bill Credits: Some utilities give seasonal bill credits for enrolling in demand-response programs (where your AC adjusts slightly during peak energy hours).

-

Financing Options: Low-interest loans for HVAC upgrades may be available.

The ACEEE notes that utility incentives remain one of the fastest-growing ways to encourage residential energy efficiency.

ENERGY STAR Rebates and Promotions

The EPA’s ENERGY STAR program helps homeowners identify qualifying systems and rebates.

-

Use the ENERGY STAR rebate finder to locate promotions in your area.

-

Many manufacturers also run seasonal promotions tied to ENERGY STAR campaigns.

-

Certified units often qualify for both federal tax credits and local rebates, maximizing savings.

How Much Can Homeowners Save in 2025?

The total savings potential in 2025 is substantial:

-

Federal Tax Credit: $600–$2,000

-

State Rebates: $500–$2,500

-

Utility Rebates: $200–$1,000

-

ENERGY STAR Promotions: Seasonal discounts, typically $100–$500

Combined savings can range from $2,000 to $5,000 on a qualifying central AC upgrade.

Consumer Reports highlights that stacking rebates is one of the best ways to lower the true cost of ownership.

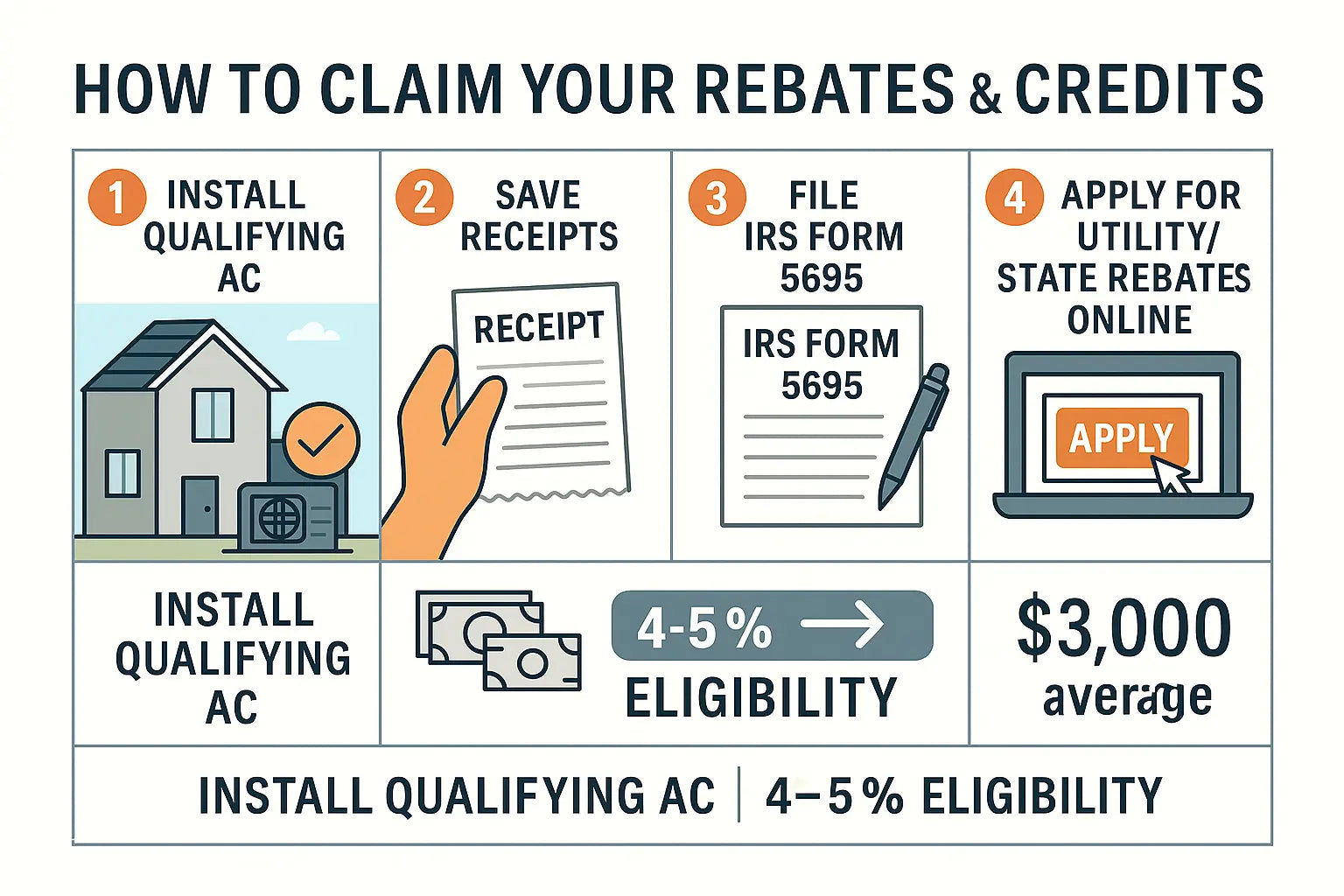

How to Qualify and Claim Rebates/Tax Credits

Step 1: Choose a Qualifying System

-

Confirm that your new AC meets ENERGY STAR certification and SEER2 minimums.

-

The EPA’s ENERGY STAR database lists certified systems.

Step 2: Work with a Licensed Contractor

-

Most rebate programs require professional installation.

-

Contractors often provide rebate paperwork and can guide you through applications.

Step 3: Keep All Documentation

-

Save receipts, model numbers, AHRI certificates, and installation forms.

-

You’ll need these when applying for rebates or filing your taxes.

Step 4: File for Credits and Rebates

-

Use IRS Form 5695 for federal tax credits.

-

Apply online through your state energy office or utility rebate portal for local incentives.

Key Takeaways for Homeowners

-

2025 is the year to upgrade: With federal, state, and utility programs in place, efficiency upgrades are more affordable than ever.

-

Stack savings: Combine federal tax credits with local rebates for maximum impact.

-

ENERGY STAR and SEER2 matter: Only certified, efficient systems qualify.

-

Paperwork is key: Save all documentation and work with contractors familiar with rebate processes.

For a breakdown of how leading brands and models compare, see our full guide to the Top 10 Central AC Units Compared.

And if you’re weighing a bigger decision, don’t miss the next article in this series: Should You Replace Your AC and Furnace at the Same Time?

Final Thoughts from Alex Lane

Upgrading your central AC doesn’t have to be a budget-busting decision. With the right incentives, you can install a high-efficiency system that lowers your monthly bills and keeps your home more comfortable—all while paying thousands less upfront.

My advice? Start by checking the DSIRE database and the ENERGY STAR rebate finder for programs in your area. Then talk with a trusted HVAC contractor who knows how to size your system properly and handle rebate paperwork.

The combination of smart planning, efficiency upgrades, and 2025’s generous rebates means you can enjoy cool comfort now while saving money for years to come.

Alex Lane

Your Home Comfort Advocate