By Alex Lane | Your Home Comfort Advocate

Replacing your furnace isn't cheap—but in 2025, it's one of the few home upgrades where the government, your utility, and even manufacturers might all chip in to help with the cost.

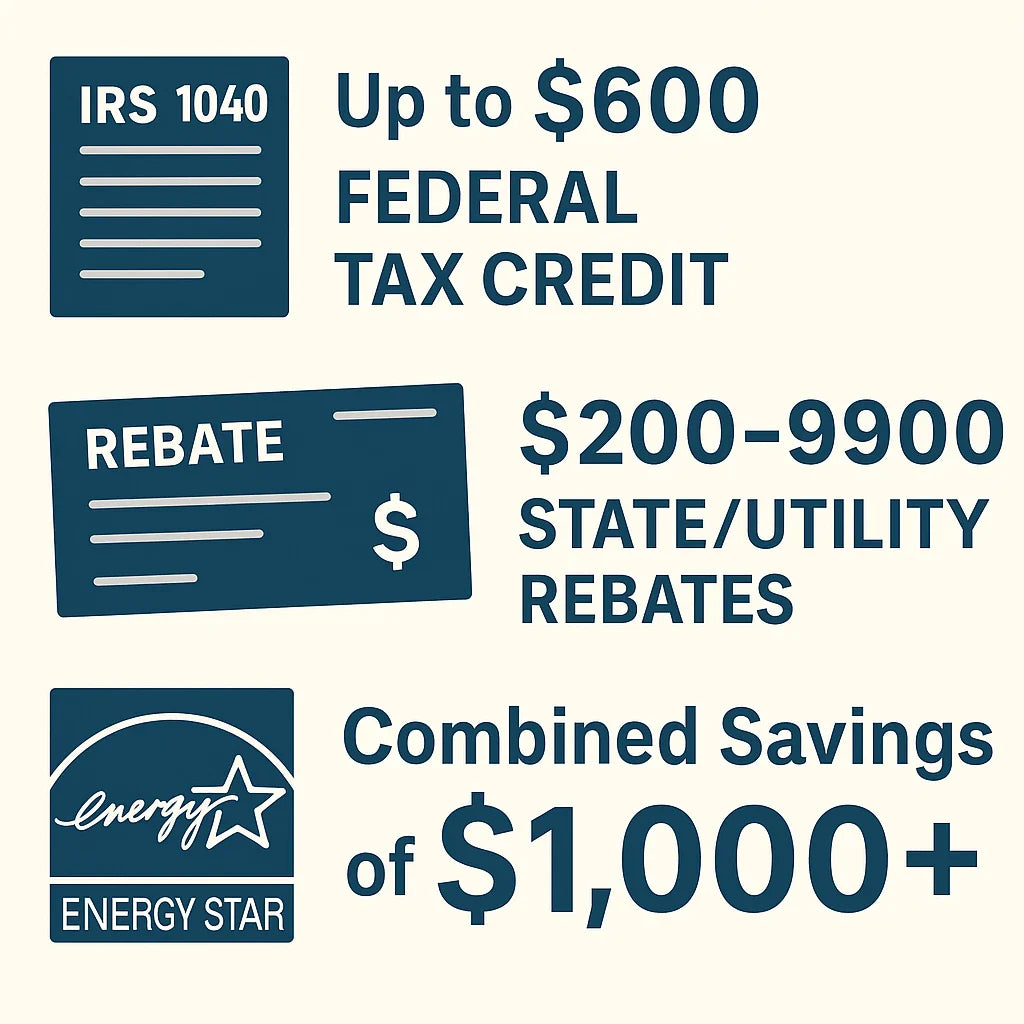

If you're considering a high-efficiency furnace, there are rebates and tax credits worth $600 to $1,500 or more—but only if you know where to look and how to qualify.

Let’s break down what’s new this year, who qualifies, and how to claim your savings without jumping through hoops.

What’s New in 2025 for HVAC Incentives?

Inflation Reduction Act (IRA) Tax Credit Extensions

The Inflation Reduction Act continues into 2025 with tax credits of up to $600 for qualified high-efficiency natural gas furnaces. To qualify, the unit must meet ENERGY STAR criteria and be professionally installed.

You can see how much you might qualify for using the IRA Savings Calculator from Rewiring America, which estimates federal rebates and credits based on your location and household details.

ENERGY STAR Requirements Tightened for 2025

To get the credit, the furnace must:

-

Be ENERGY STAR certified

-

Have an AFUE of 95% or higher

The ENERGY STAR 2025 update lists eligible high-efficiency furnaces. Not every unit on the market qualifies, so make sure you confirm model specs before you buy.

How Much Can You Save?

Tax Credits vs. Instant Rebates

There are two main types of savings:

-

Federal tax credits: Claimed when you file your taxes (via IRS Form 5695)

-

State or utility rebates: Typically applied as instant discounts or mailed checks after installation

Most homeowners can combine these for total savings in the $800–$1,500+ range.

Sample Rebate Stacks by State

Here’s how it might look for a typical homeowner:

| Location | Federal Credit | State/Utility Rebate | Total Savings |

|---|---|---|---|

| California (TECH Clean CA) | $600 | $750 | $1,350 |

| New York (NYSERDA) | $600 | $400 | $1,000 |

| Texas (CenterPoint Energy) | $600 | $200 | $800 |

To check rebates in your area, use the DSIREUSA rebate finder. You’ll just need your ZIP code to get started.

You can also explore specific programs like NYSERDA if you're in New York or TECH Clean California for Californians.

How to Qualify for Rebates and Credits

Furnace Efficiency Requirements

To qualify for most 2025 rebates and tax credits, your furnace must:

-

Have a minimum 95% AFUE

-

Be ENERGY STAR certified

-

Use sealed combustion with approved venting

These requirements are designed to reward systems that reduce both fuel waste and emissions.

Professional Installation Is a Must

DIY doesn’t cut it here. Most rebates and tax credits require professional installation by a licensed HVAC contractor.

In some cases, your installer may also need to:

-

Conduct a duct leakage test

-

Verify combustion safety

-

Submit paperwork on your behalf

Keep a copy of your itemized invoice—it’s often required for rebate and tax filings.

Income-Based Rebates May Offer More

If your household meets certain income thresholds, you may qualify for enhanced rebates through programs like the DOE’s Weatherization Assistance Program.

These programs can cover 50–100% of installation costs for qualified families.

How to Apply: Step-by-Step Guide

Claiming the Federal Tax Credit

-

Purchase and install a qualifying furnace before December 31, 2025

-

Keep documentation: model number, AFUE rating, and invoice

-

File IRS Form 5695 when you do your taxes

-

Include credit on your 2025 return (filed in 2026)

You don’t need to send in receipts, but keep them in case of audit.

Applying for Local Rebates

-

Visit your utility or state rebate portal

-

Upload your invoice and contractor info

-

Submit any required product certifications or AHRI match sheets

-

Wait for approval—some rebates take 6–8 weeks

A helpful pro tip: take photos of your installed system, including the label with the serial and model numbers. Some rebate programs require this as part of verification.

Don’t Miss These Deadlines

IRS Filing Deadlines for Tax Credits

-

Tax credits must be claimed on your 2025 return, filed by April 2026

-

No extensions offered for this credit—miss the tax year, miss the money

First-Come, First-Served Rebates

Many state and utility rebates have limited funding. When the budget runs out, the program shuts down—even mid-year.

Apply early and confirm availability with your installer or rebate program website.

💡 Not Sure If a High-Efficiency Furnace Is Worth It?

Before chasing rebates, make sure the upgrade makes sense for your home. Check out this guide for full cost-benefit analysis:

👉 High-Efficiency Furnaces: Worth the Investment?

📖 Next in the Series: Myths, Debunked

Think high-efficiency furnaces are too fragile or don’t last? Let’s clear up the confusion:

👉 Common Myths About High-Efficiency Furnaces (Debunked)

💬 Final Thoughts from Alex Lane

Rebates and tax credits are one of the few times the government and your utility company are basically offering you free money—but you’ve got to meet the criteria and act fast.

My advice?

-

Confirm eligibility before you buy

-

Work with a licensed HVAC pro who understands local rebate programs

-

Keep every receipt and product spec sheet

-

Don’t leave money on the table

If you’ve been thinking about replacing your old furnace, 2025 might be the best time in a decade to do it.

Stay smart, stay efficient,

Alex Lane

Your Home Comfort Advocate