By Alex Lane | Your Home Comfort Advocate

Upgrading your furnace isn’t just about comfort—it’s an investment. The good news? In 2025, that investment comes with some serious payback opportunities.

From federal tax credits to utility rebates and local energy programs, there are more ways than ever to save money on a new furnace—especially if you’re choosing a high-efficiency system.

In this guide, we’ll break down exactly what you can claim, how to qualify, and what steps to take to make sure you don’t leave money on the table.

💰 Why Furnace Incentives Matter More Than Ever in 2025

Furnace prices and installation costs have continued to rise due to inflation, labor shortages, and new efficiency standards. At the same time, federal and local programs are pushing for cleaner, more energy-efficient home systems—and rewarding homeowners who upgrade.

If you're thinking about replacing your system this year, this could be the perfect time to act.

Programs like the Inflation Reduction Act have made electrification and energy savings a national priority. In fact, you could qualify for up to $600 in federal tax credits, and hundreds more in state and utility rebates.

Check your eligibility using tools like the Rewiring America IRA calculator for an at-a-glance look at your potential savings.

🧾 Federal Tax Credit: The Energy Efficient Home Improvement Credit (25C)

The 25C tax credit—renewed and expanded through 2032—makes it possible to claim 30% of your furnace cost (up to $600) on your federal tax return. Here's how it works:

🔹 What's Covered?

-

Gas furnaces rated 95% AFUE or higher

-

ENERGY STAR certified equipment

-

Installed by a licensed contractor

🔹 What's Not Covered?

-

Oil furnaces

-

Gas furnaces below 95% AFUE

-

DIY installations

🔹 How to Claim It:

-

Install qualifying equipment by December 31, 2025.

-

Ask your contractor for the manufacturer’s certificate of eligibility.

-

File IRS Form 5695 with your 2025 tax return.

Need more details? The ENERGY STAR Tax Credit Guide provides a complete breakdown of eligible systems.

🌎 State and Utility Furnace Rebates You May Be Missing

While the federal government offers a solid base credit, your state and utility provider may offer even more—often stackable with federal savings.

💡 Examples of Available Utility Rebates:

-

PG&E (CA): Up to $500 for ENERGY STAR furnaces

-

Consumers Energy (MI): $600 for qualifying installations

-

National Grid (Northeast): $500–$700 for high-efficiency models

These often require:

-

Installation by a licensed contractor

-

Proof of ENERGY STAR certification

-

AHRI reference number or model info

Use the ENERGY STAR Rebate Finder to look up rebates in your ZIP code.

🛑 Heads up: Some rebates require pre-approval or application within 30 days of installation. Don’t delay!

🛠️ What Qualifies for Rebates and Credits?

Not every furnace or installer qualifies. To get money back, your system usually must meet these requirements:

✅ For Gas Furnaces:

-

AFUE rating of 95% or higher

-

ENERGY STAR or AHRI certification

-

Installed by a licensed HVAC contractor

✅ For Electric Furnaces:

-

While electric models don't use AFUE ratings, some heat pump-style furnaces may still qualify under energy savings programs.

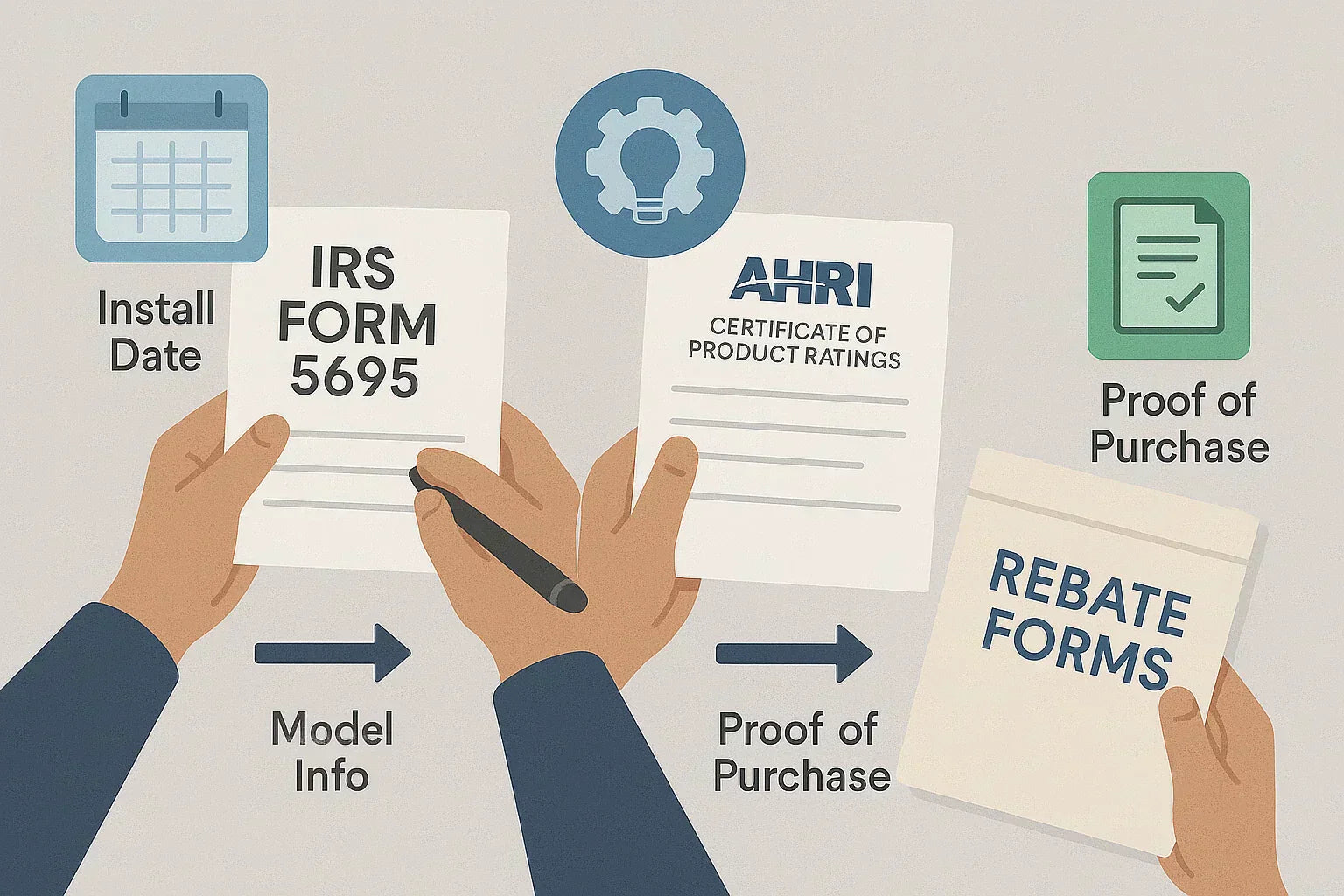

✅ Documentation You’ll Likely Need:

-

Proof of purchase (invoice/receipt)

-

Manufacturer’s certificate or AHRI certificate

-

Installation date

-

Installer’s license or permit number (if required)

State-level incentives are tracked in the DSIRE database—a helpful resource to find rebates by region, utility, and fuel type.

📋 Tips to Maximize Your Savings

Getting approved for furnace rebates or credits is easy to mess up—if you’re not organized. Follow these tips to ensure you get every dollar you’re entitled to:

🔸 Ask for Documentation Before Install

Let your installer know upfront that you're planning to claim rebates and tax credits. They’ll often be more careful to provide the right paperwork.

🔸 Save the Manufacturer’s Certificate

This verifies that your unit meets ENERGY STAR and federal credit requirements. It’s often available on the brand’s website or through your contractor.

🔸 Know What Forms to File

For federal tax credits, it’s IRS Form 5695. State and utility rebates usually have their own submission portals or paper forms.

🔸 Keep Copies of Everything

Installation date, invoice, AHRI number, permit info—save it all. You may need it for an audit or second rebate application.

🔁 Real-World Example: How the Savings Stack Up

Let’s say you install a 96% AFUE gas furnace in Michigan:

| Cost Component | Amount |

|---|---|

| Furnace + Install | $5,200 |

| Federal Tax Credit (25C) | -$600 |

| Consumers Energy Rebate | -$600 |

| Net Cost | $4,000 |

Not bad for choosing a system that saves you money every month on energy bills too.

💬 Final Thoughts from Alex Lane

Rebates and tax credits are one of the few times the government, your utility, and even the manufacturer are all offering to give you money back—for doing the right thing.

So be proactive. Ask for documentation. Compare models. And remember: higher efficiency might cost more upfront, but it usually pays you back over time—especially if you can stack the right rebates.

Curious how furnace efficiency affects your overall cost breakdown?

👉 Read next: DIY Furnace Installation vs. Hiring a Pro: Cost Breakdown and Risks

Alex Lane

Your Home Comfort Advocate