🔍 Introduction: Why Tax Credits Matter When Upgrading

Replacing your old furnace with a high-efficiency gas furnace can significantly reduce your energy bills. But many homeowners overlook another benefit: potential tax credits and rebates that lower your upfront costs.

This guide will help you understand:

-

What qualifies as a high-efficiency furnace

-

2025 federal tax credit opportunities

-

State and utility rebates

-

How to claim furnace tax credits

-

Tips to maximize your savings

♻️ What Is a High-Efficiency Furnace?

High-efficiency furnaces typically have:

-

AFUE ratings of 95% or higher

-

Advanced features like two-stage heating and variable-speed blowers

Check out Energy Star’s criteria for high-efficiency gas furnaces.

🏛️ Federal Tax Credits for High-Efficiency Furnaces

Under the Inflation Reduction Act extensions, homeowners may qualify for federal tax credits when installing eligible high-efficiency gas furnaces in 2025.

Key Points:

-

Credit of up to 30% of project cost, capped at $600 for qualifying furnaces.

-

Must meet minimum efficiency requirements (typically 95% AFUE or higher).

-

Furnace must be installed in your primary residence.

-

Credit applies to the installed cost (equipment + labor).

Learn more on Energy Star’s tax credit page.

🗺️ State and Utility Rebates

In addition to federal credits, many states and utility companies offer rebates for high-efficiency gas furnace installations.

Rebates can range from $150 to $1,200, depending on:

-

Furnace efficiency

-

Your state’s energy programs

-

Your utility company’s incentives

Use the Energy Star Rebate Finder to check your eligibility.

📄 How to Claim Furnace Tax Credits

-

Keep documentation: Save receipts for equipment, labor, and any permits.

-

Verify eligibility: Confirm the furnace meets AFUE and ENERGY STAR requirements.

-

File IRS Form 5695: Attach this to your federal tax return when filing.

-

Consult a tax professional: For complex installations or combined projects.

💡 Tips to Maximize Your Savings

✅ Combine rebates and credits: Apply for utility rebates first, then claim federal credits.

✅ Time your installation: Complete projects before year-end to claim credits for 2025.

✅ Check state-specific programs: Some states offer additional tax deductions or sales tax exemptions.

✅ Pair with other upgrades: Insulation and air sealing projects may qualify for separate credits.

🌎 Why Choosing High-Efficiency Is a Win-Win

High-efficiency gas furnaces:

-

Reduce your energy bills by up to 15-20%

-

Lower greenhouse gas emissions

-

Qualify you for rebates and credits, reducing upfront costs

🏁 Conclusion: Save Now and Later

A high-efficiency gas furnace can save you money twice:

✅ Immediate rebates and tax credits lower your upfront investment.

✅ Long-term energy savings reduce your heating bills.

If you are considering upgrading your furnace, check qualifying models, and plan your timing to maximize tax credits and rebates.

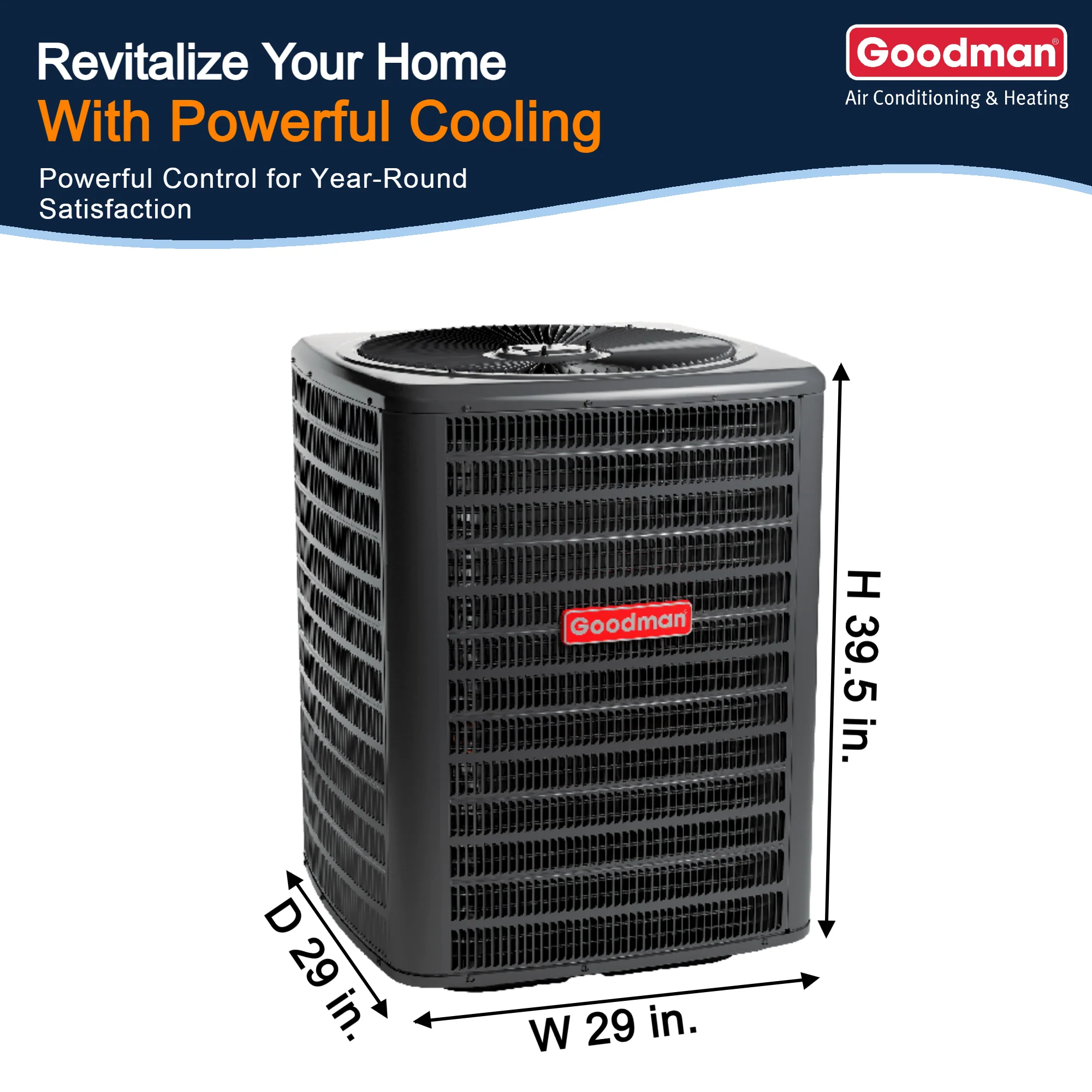

👉 Next Step: Explore eligible high-efficiency gas furnaces at The Furnace Outlet and start your energy savings journey while reducing your upfront costs.

In the next article we will know more about: How to Size a Gas Furnace for Your Home: BTUs, Climate & Layout